Are Exchange-Traded Funds Dumbing Down the Markets?

Thanks to a subscriber for this article by Edmund L. Andrews for the Stanford School of Business which may be of interest to subscribers. Here is a section:

Lee says one key difference is the unprecedented appeal of ETFs to uninformed traders. Unlike a traditional mutual fund, which can only be bought once a day, an ETF is structured so that it can be bought and sold all day long — like an individual stock. ETFs are also typically low-cost, tax-efficient, and offered in small enough units to appeal to small investors. For these reasons, they are particularly attractive to uninformed traders who would otherwise trade the underlying component securities.

Lee’s immediate concern is that ETFs will dumb down financial markets by reducing the benefits of hunting for cutting-edge information and insight. If that happens, stock prices will become less accurate barometers of corporate prospects.

Lee also has longer-term concerns. Because of the way ETFs are structured, they provide an easy way of investing in otherwise hard-to-trade assets. The downside is that investors could increasingly bet on an index without buying any actual shares at all — much the way that Wall Street firms began trading “synthetic” mortgage-backed securities that simply mirrored mortgage-market indices.

Lee doesn’t argue that individual investors should abandon ETFs. For people who don’t want to do their own research, ETFs still offer a very inexpensive way to build a diversified and customized portfolio.

The fact ETFs have become the vehicle du jour for investors to gain access to sectors that were once difficult to access represents a major innovation for regular investors. However the prevalence of these strategies and the relative position they represent in the market represents a risk particularly during times of heightened emotional tension where large numbers of investors head for the exit at the same time.

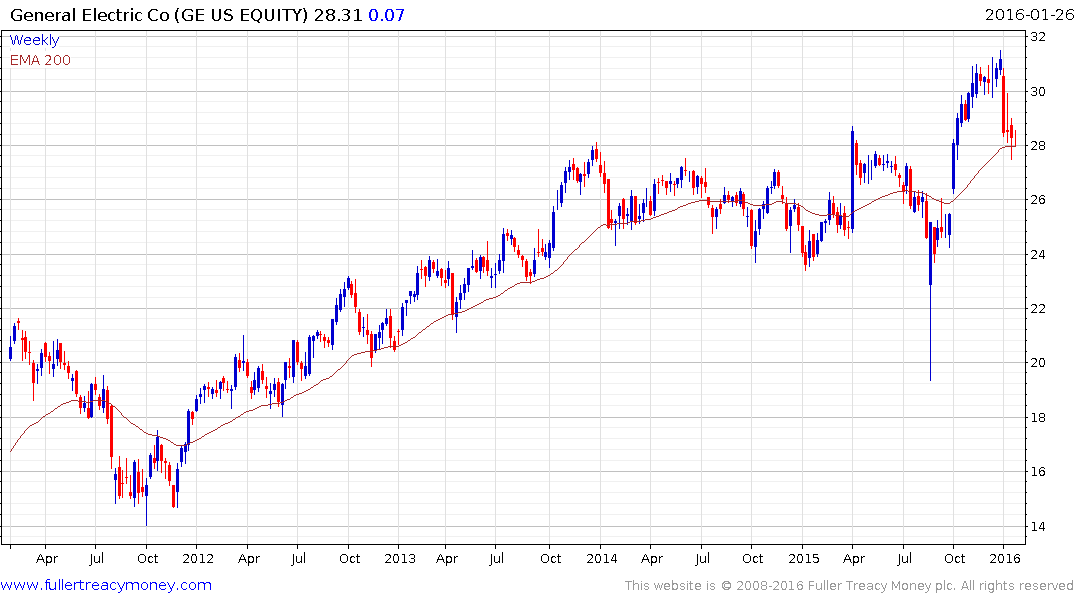

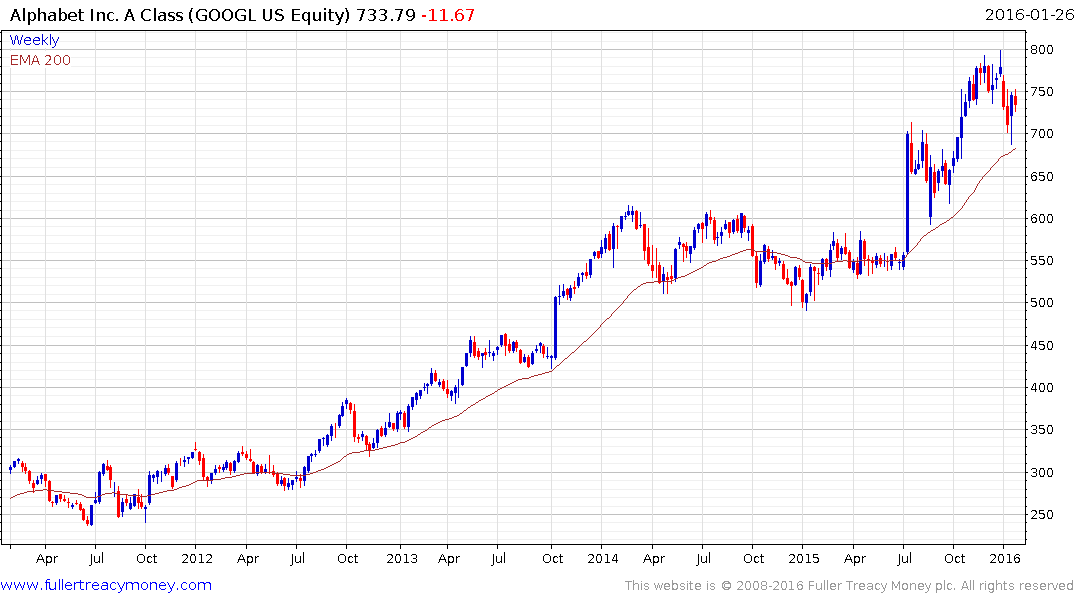

The issues that brought down BNY Mellon’s pricing engine resulted in spike in volatility and swift pullbacks across a wide swathe of the equity market in August and that had an effect on market sentiment we are still seeing today. However a question worth asking is why some shares were more affected than others. For example Google had a much smaller reaction during the panicky half hour than General Electric and this may be because it was less heavily owned by ETFs.

Considering how ETFs have been plagued with occasional bouts of volatility and the likelihood this will be repeated in future, stops are inappropriate. Having purchase orders well below the market might be advantageous on the other hand.

Back to top