Apres le vote, le deluge

I recorded an additional Audio last night to share my initial impressions following the vote to leave the EU because I wanted to have something for UK subscribers to listen to when the market opened, not least because it was a very panicky environment.

The betting couldn’t have got it more wrong in assuming people would fall into the place behind business and politicians. As an avowed libertarian I’m excited that the UK is still a democratic state where Whitehall will listen to the will of the British people to retake control of their economy and political fate.

I believe the UK will be better off in the medium to long-term but there are obviously challenges in the short-term.

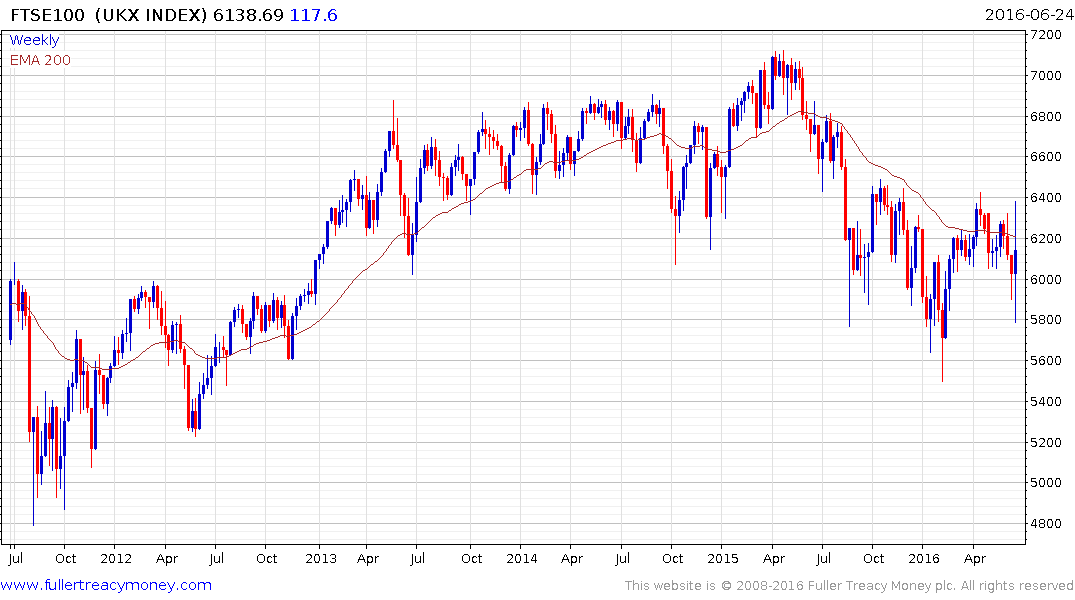

When I recorded the audio last night the FTSE-100 futures were down 8% and the Pound was down over 14¢ or more than 10%. For a foreign investor the UK market had fallen more than 15%. However the FTSE-100 is not really representative of the UK. It is loaded with companies that do business all over the world so when they redenominate their substantial foreign profits into Pounds they are going to experience a substantial windfall. Intraday rallies by globally oriented Autonomy-type companies today highlight the fact that the UK is a major corporate headquarters and one of the most internationally oriented countries in the world. That’s an important point considering how much doom and gloom is being peddled right now.

Another point that comes to mind is that the UK came through the credit crisis better than most of its European neighbours not least because it was first to devalue its currency. The weakness of the Pound during the credit crisis insulated the UK’s export sector and allowed the economy to compete effectively when everywhere else was still struggling.

The UK’s decision to quit the European Union could result in further divisions between the remaining members or it could be a catalyst for additional cohesion. In the event that it results in an additional schism, the UK could well benefit from a first mover advantage.

It has been my belief for some time that the prospect of the UK leaving the EU was a bigger problem for the Eurozone. With a recapitalisation of the banking sector being imposed on the Italian people, isn’t it only a matter of time before an enterprising politician advocates for Italians to be offered the same opportunity as the British to retake control of their political fates? Interestingly the Italian Index did not succeed in rallying off its low today.

In my view the biggest potential risk is that volatility measures move higher over the next week which will force automated trading systems to reduce positions sizes. That would put pressure on the ability of ETF pricing engines to function correctly. The problems exposed in August might have been remedied, but it definitely represents the greatest risk, so having bids well below the market continues to represent an attractive strategy.

Safe haven assets such as bonds, the Dollar, Yen and gold soared on the news. As stock markets have bounced some of the impetus behind that surge has ebbed. However with central banks standing ready to ease monetary policy even further the potential for yields to stay low and precious metals to outperform remains the base case.