Another Sign of Rough Sledding Ahead: Dividend Cuts Surpass 2008

This article by Luke Kawa for Bloomberg may be of interest to subscribers. Here is a section:

Bespoke suggested that spreads in the high-yield debt market could signal whether more companies will be under pressure to cut or eliminate their dividends.

"Based on the trends of the last decade, when the credit markets are willing to lend, companies have jumped at the opportunity to borrow and increase their payouts," the analysts wrote. "The flipside is what we are seeing now, and when the credit markets start to turn off the spigot, some companies find they don’t have the cashflows to support their payouts."

Dividends represent an important component in total return over the long term and with interest rates so low they have been a competitive source of income for yield hungry

investors over the last six years. The bond markets dwarf the equity markets in terms of the quantities of money moving around so it makes sense that widening spreads are having an effect on the balance sheets of companies as borrowing costs rise.

It is certainly true that companies have been using some of the money they borrowed to increase dividends but the impact rising borrowing costs will have on share buybacks is more important for the balance of this year. Companies have been buying back prodigious quantities of shares since 2009 and this has represented a powerful tailwind for equity markets. Supporting progressively higher prices requires the quantity of money allocated to purchases to rise in line with valuations. In order for momentum to persist increasingly large purchases are required. If borrowing costs are rising, this is unlikely to be achieved and represents a headwind for equity markets.

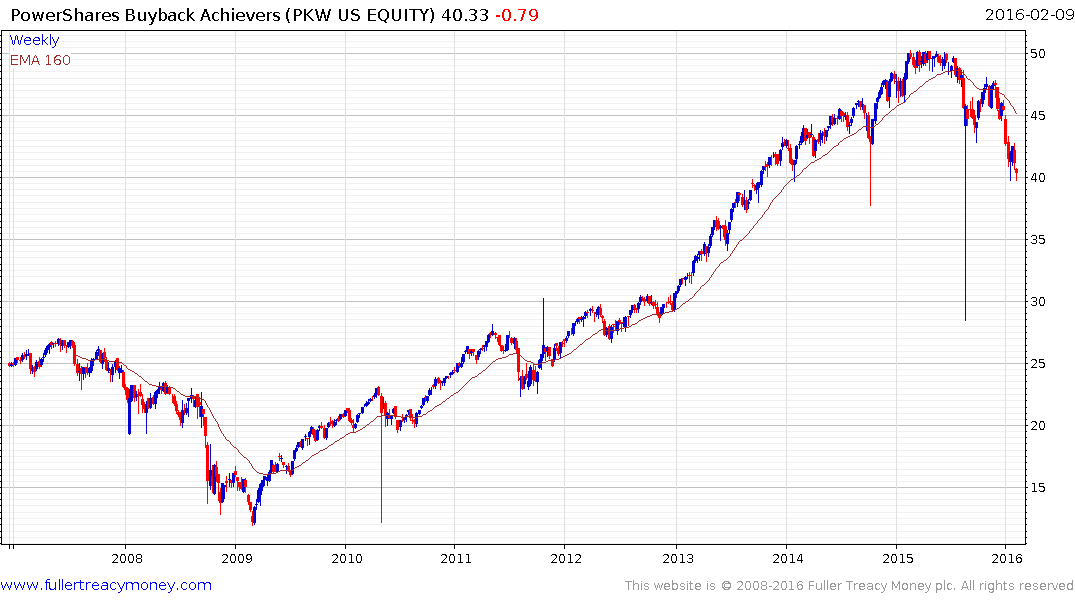

The PowerShares Buyback Achievers ETF has completed Type-3 top formation characteristics and while somewhat oversold in the short-term a sustained move above the trend mean will be required to question medium-term supply dominance.

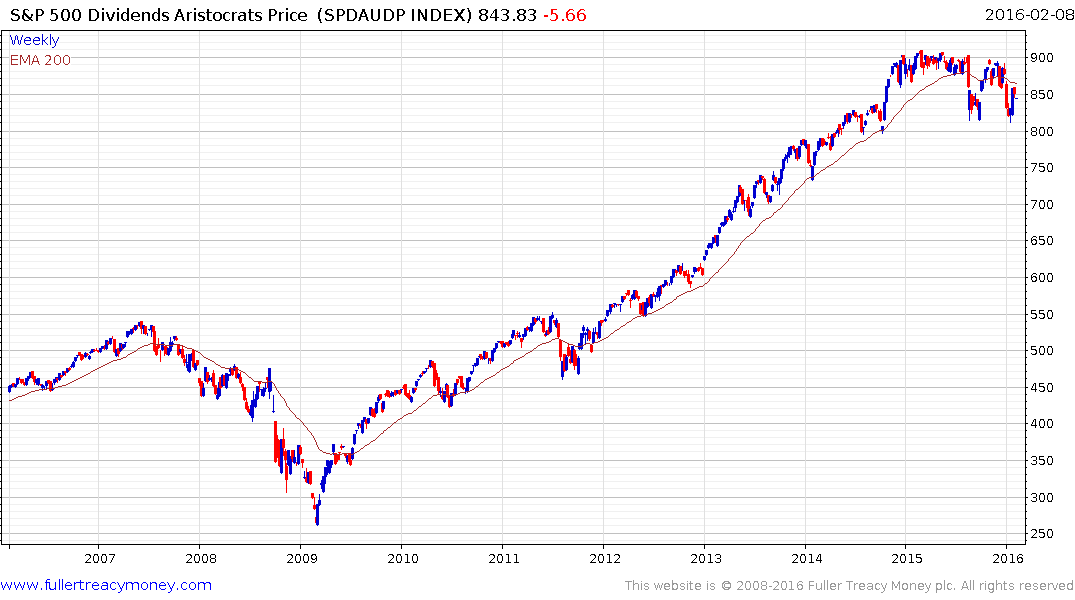

With expectations that more companies will cut their dividends, the relative strength of the S&P500 Dividend Aristocrats Index is noteworthy. It has lost momentum following what had been a consistent uptrend from the 2009 lows but has not broken down. It would be rash to expect that relative strength to persist indefinitely but there is no denying the sector has defensive characteristics.

This is a very taut environment and nerves among many people are frayed. The underperformance of global banks in particular is representative of stress in the financial sector. However we also know that every corrective phase ends and gives way to a bull market somewhere. Therefore while we do not yet have evidence that a sustainable low has been found I thought it is a good time to begin compiling something approximating a shopping list.

In order to find companies with what might be considered reasonable valuations I performed a search on Bloomberg looking for shares, globally, that have a market cap greater than $100 million, an earnings yield greater than 5%, an 1-year EPS Growth Rate of greater than 5 and an Estimated EPS Growth Rate of greater than 5 as well. The majority of results are US listed and most are in downtrends.

Airlines stand out for their low P/Es. A pilot friend described the airlines to me over the weekend as flying banks because they are generating so much cash in a low oil environment.

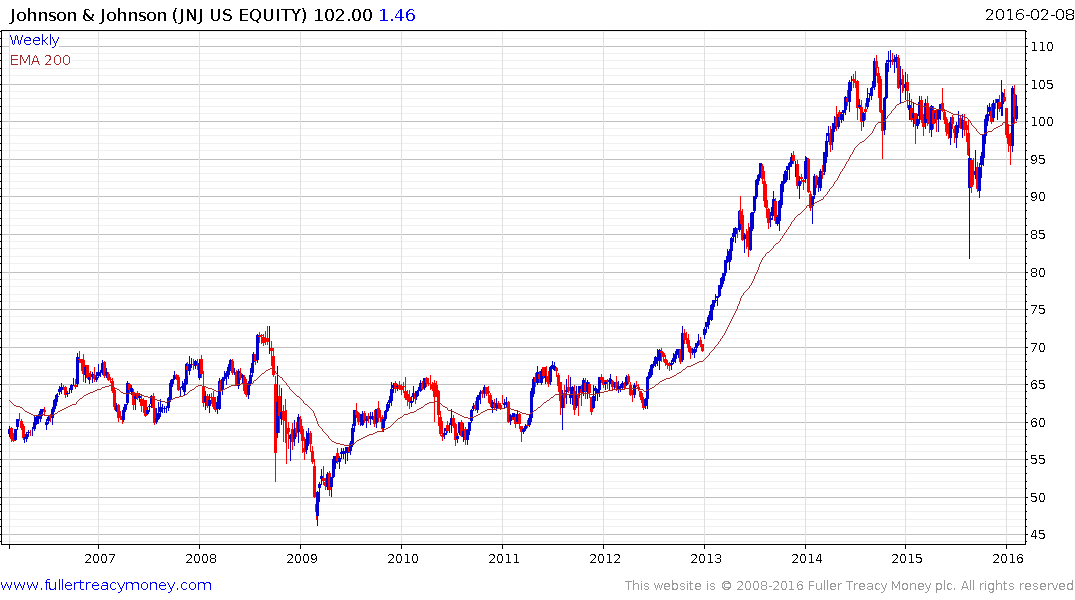

Dividend Aristocrats are reasonably well represented. Johnson & Johnson and Honeywell for example still exhibit relative strength not least because of their strong record of dividend increases.