Amazon Threat Causes Shakeout in the Health-Care Industry

This article by Robert Langreth, Jared S Hopkins, and Spencer Soper for Bloomberg may be of interest to subscribers. Here is a section:

Analysts have speculated that Amazon could soon enter the business of selling prescription drugs, threatening to disrupt retail drugstores, drug wholesalers, and the pharmacy-benefits management business. While Amazon has never publicly commented on what its plans may be, CNBC reported this month that the Internet giant could make a decision about selling drugs online by Thanksgiving. The network didn’t name its sources.

McKesson slid 5.2 percent at 4 p.m. in New York, while AmerisourceBergen shares fell 4.2 percent and Express Scripts sank 3.7 percent following the report on Amazon’s state licenses by the St. Louis Post-Dispatch.

Bloomberg News confirmed that Amazon had obtained wholesale-pharmacy licenses in at least 13 states, including Nevada, Idaho, Arizona, North Dakota, Oregon, Alabama, Louisiana, New Jersey, Michigan, Connecticut, New Hampshire, Utah and Iowa. An application is pending in Maine. Some of the licenses were obtained late last year and some this year.

Amazon doesn’t make money from shipping products in the USA and makes a loss on doing the same elsewhere which helps to explain why it can continue to grow market share at the expense of conventional companies. It depends on its webservices business to provide profits even though the online retail business accounts for the vast majority of turnover. However, it is the fact that Amazon has leeched earnings from other sectors to feed its revenue growth which is what investors are betting on which has contributed to the consistency of the advance since 2015.

In many respects Amazon is the epitome of the trend of disintermediation which has been underway since the late 1990s. The share paused in the region of $1000 since June and in that time closed the overextension relative to the trend mean. Today’s upward dynamic reasserts medium-term demand dominance and a sustained move below the MA would be required to question medium-term scope for additional upside.

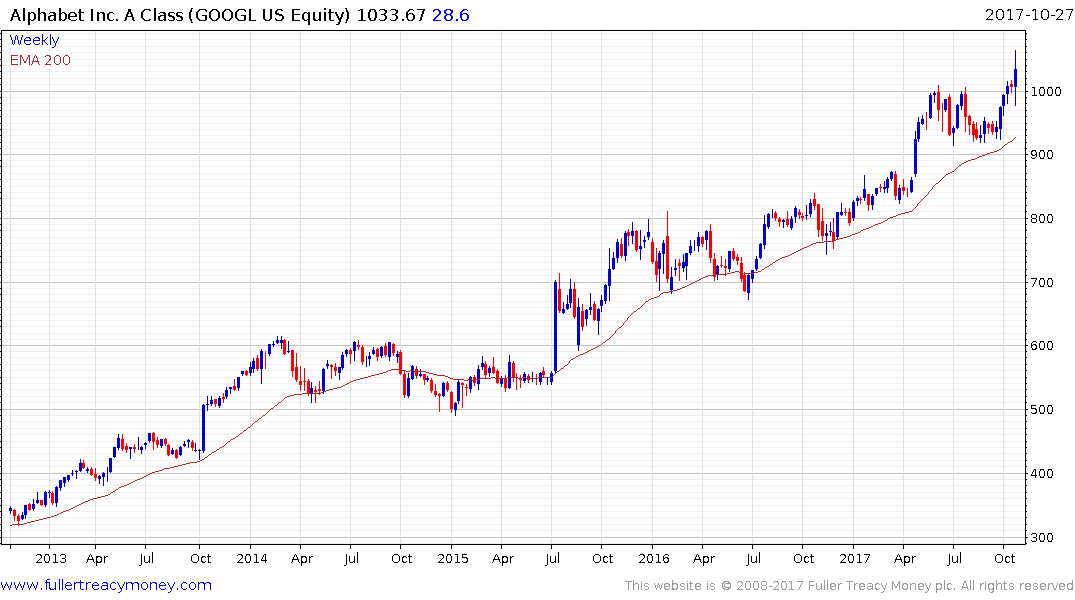

Google/Alphabet has a similar pattern, pausing near $1000 over the last few months. Today’s clear upward dynamic reasserts demand dominance; provided the breakout is sustained.

Microsoft surged to a new high in an acceleration of what was already an impressive uptrend year-to-date. It is approximately 20% overextended relative to the trend mean at present so risk of some consolidation is increasing.

Facebook remains in a consistent step sequence uptrend and rallied today to reverse the week’s earlier decline.

Quite why anyone would settle for an iPhone 8 when the gadget laden X is on the way is something of a mystery but helps to explain why Apple is seeing demand for its 10th anniversary edition surging. The share has paused in the region of $160 since May, while sustaining its upward bias and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

Personally, I’m a little reticent to buy the new iPhone because I’ve broken the screen on just about every one I’ve owned and the X has glass on both the front and back. I’m more than happy to wait and see what the customer experience is before dropping $1000 on a phone.

The Nasdaq-100 lost momentum this year but today’s emphatic break above 6000 reasserts the medium-term uptrend and increases the potential that the Index will experience an additional up-leg and potentially even accelerate higher.

The confluence of his CAPE ratios, procyclical fiscal policies, earnings agnostic passive investing and risk parity strategies and the dominance of a relatively small number of companies suggests we are entering the third psychological perception of this medium-term bull market.