Alibaba jumps ahead of Amazon with Maersk tie-up

This article by Sam Chambers for splash247 may be of interest to subscribers. Here it is in full:

Alibaba’s move to partner with Maersk Line should be seen as a game of one-upmanship with US rival Amazon, a leading name in online logistics has said.

Chinese customers will now be able to book space on Maersk ships, a first for the industry and one that potentially removes many freight forwarders as middlemen.

Dr Zvi Schreiber, CEO and founder of logistics technology Freightos, offered his perspective on the bigger picture and what this deal means for online shoppers and Alibaba’s rival, Amazon.

“Maersk is testing the waters of digital sales with one of the world’s largest ecommerce companies while threatening forwarder business. But for Alibaba, this is a direct challenge to global retailers like Amazon. Beyond drones and futuristic supermarkets, Amazon opted to get licensed as a forwarder. Alibaba one-upped them by going directly to the world’s largest ocean liner. Point, Alibaba.”

There is a great deal of speculation going on at present relating to the implications of a Trump presidency on global trade. Certainly an America first manufacturing policy would have profound implications for low cost, high population countries’ ability to compete against what would in all likelihood be a highly automated US attempt to re-shore. Nevertheless even with the most ambitious timetable that kind of initiative could take years to unfold.

Alibaba has its ambitions aimed squarely focused on developing its footprint in the US market, which is of course why Jack Ma has been so eager to develop a friendly relationship with President-elect Trump. The share bounced two weeks ago from the region of the trend mean and a sustained move back below $90 would be required to question potential for additional upside.

Maersk surged in the last couple of weeks of 2016 and some consolidation of that powerful gain is looking more likely than not. The company derives almost 60% of revenue from Maersk Line and 25% from Maersk Oil and its tankers, offshore drilling and other shipping interests.

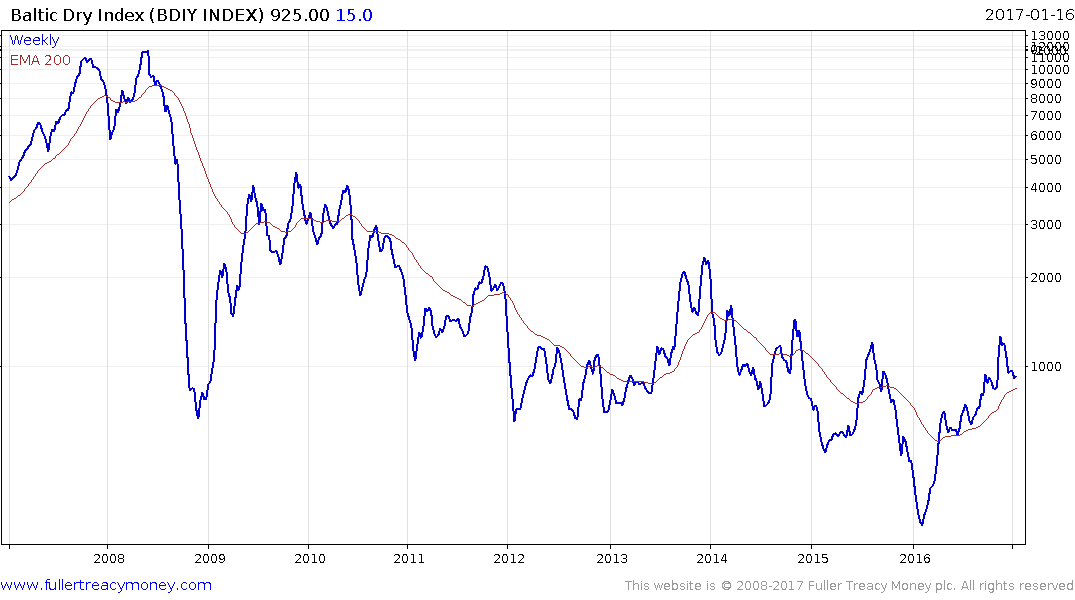

Shipping is one of the few remaining globally depressed sectors. The Baltic Dry Index trended lower until early last year as a global growth underperformed at just the same time that a large supply of new ships hit the market. Nevertheless rates have been trending steadily higher for a year; rising from a low in February of 290 to 925 today. That is still a fraction of the rate which prevailed ahead of the financial crisis.

D/S Norden focuses on dry cargo (71%) and tankers (29%) The share broke up out of a yearlong base in January and a sustained move below DKK100 would be required to question potential for additional upside.

Diana Shipping focuses on Dry Bulk Shipping and the share surged higher in November and spent most of the last six weeks consolidating that move. A sustained move above $4 would confirm a return to demand dominance beyond the short term.

Navios Maritime Holdings focuses on Logistics (52.2%) and Dry Bulk Shipping (47.8%). The share has held a progression of higher reaction low since May last year and surged higher following the Presidential Election. The share bounced from the $1.15 area in mid- December and a sustained move below that level would be required to question medium-term recovery potential.