Algorithmic Group Think

Let’s imagine we want to set up a computer based trading strategy. We could do so by telling the program to buy break outs and sell break downs, Alternatively, we could look for arbitrage opportunities across exchanges, between ordinary shares and preferreds, between equity and credit, or we could follow a trend running strategy. There are thousands of different strategies that can tell a computer what to buy and sell but very few tell the computer how much of the instrument to buy or sell.

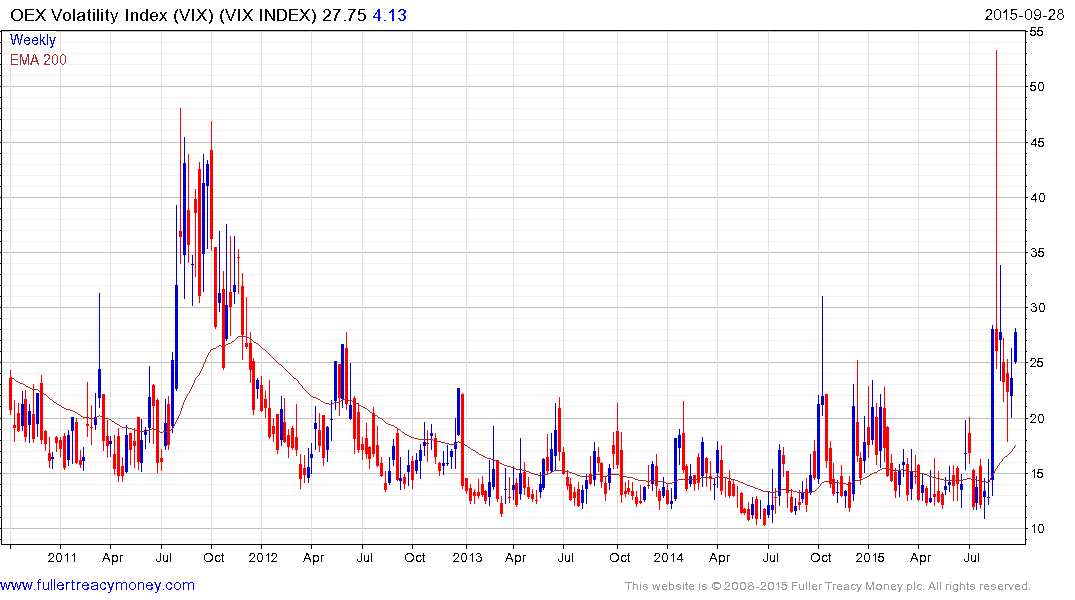

A computer needs a mathematical formula to calculate how much to buy or sell and to ensure that risk is kept within acceptable parameters. Calculating volatility is central to that decision. When volatility is low, the potential drawdown is low so positions can be larger. However, when volatility increases, the potential drawdown increases and positions have to be smaller. This works exactly the same way in reverse for short positions.

Add into this calculation the cost of borrowing which is very low, carry trades which benefit enormously from trending currencies and what you get is a situation where computer based strategies have to reduce longs and are increasing shorts. This risk-on, risk off is not something we have to deal with since 2011 but with the end of the Fed’s QE and continued intimations that rates will possibly rise this year, we are dealing with it again now.

The VIX Index has sustained higher levels than at any time since 2011 and hit an intraday peak today of 28. A clear downward dynamic will be required to signal a turn to risk-on.

.png)

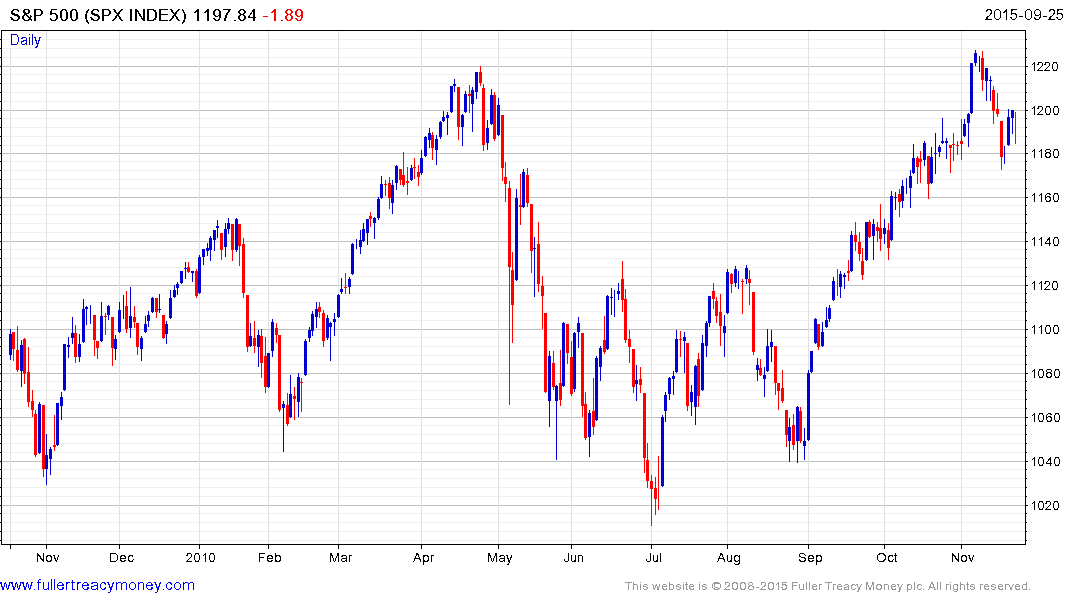

The S&P 500 is rapidly approaching the region of the August and October low so there is potential for a bounce within the next few percent. However over the medium-term this pullback represents the largest in a number of years and comes after a particularly consistent period. As a result we can conclude the imbalance between supply and demand, that drove the medium-term bull market, has changed and that it will take time for demand to be reasserted.

The damage done to sentiment by the abrupt declines and ETF pricing failures on August 24th is quite similar to what happened in May 2010 (see above chart) and the flash crash. After that event, the big question was whether it mattered and the simple answer was yes, because everyone was asking the question instead of buying. That event held up the advance, from a much lower level, for over six months. If 2010 is a benchmark then a potentially lengthy period of support building will be required before the medium-term uptrend can be reasserted.

This article from Bloomberg focusing on possible solutions proposed by HFT firms highlights the impact on sentiment this market dislocation has had and continues to exert.

Back to top