After Sudden Rout, China Stock Traders Question Beijing Put

This article from Bloomberg News may be of interest to subscribers. Here is a section:

For Sun Jianbo, president of China Vision Capital Management Co. in Beijing, valuations among large-cap shares are too expensive for state-backed funds to intervene.

The CSI 300 traded at its highest level relative to the broader Shanghai Composite Index in at least 12 years at the start of this week as investors flocked to large caps such as Moutai and Ping An Insurance (Group) Co."There’s no need to prop up the market yet," Sun said. "A lot of big caps are still expensive and it would do more harm than good to state-backed funds if they buy now."

The divergence between large-cap shares and the rest of the market may be one reason why the government took aim at Moutai. Before Xinhua warned last week that gains in the liquor maker were excessive, the stock had more than doubled this year.

Following the botched introduction of options trading in 2015 the Chinese administration introduced new rules on disclosures and selling by company principles. It also banned short selling for a time. Through steady purchases by various state-owned vehicles, they manufactured the slow and steady pace of the stock market’s advance since the low in early 2016.

The CSI 300 has outperformed the Shanghai A-Shares since June and is now susceptible to some consolidation which would allow the overextension relative to the trend mean to be unwound.

The broader question however is how long this institutional support for the market will persist. The government is getting progressively more aggressive in clamping down on unsanctioned outflows while also attempting to lean on the shadow banking sector.

This report from Gavekal Dragonomics may be of interest. Here is a section:

The joint-stock banks were established in the 1990s as nimbler competitors to the Big Five. Their share of bank assets has increased from 14% to 19% since 2007.

But this understates their growth: they are the most enthusiastic issuers of non-capital guaranteed wealth management products (WMPs), which sit off balance sheet because the issuing bank does not have to refund buyers’ capital if the product makes a loss. Joint-stock banks have issued non-guaranteed WMPs equal to a quarter of their combined balance-sheet assets.

The most explosive growth, however, has come at the 134 city commercial banks: their market share doubled to 12%, and in absolute terms their assets grew nearly seven-fold in 2007-16 to RMB28trn. Their astonishing balance-sheet growth has depended on especially aggressive use of two tactics: borrowing funds on the interbank market to supplement their meager deposit bases, and reclassifying loans as “investments,” which allows them to skirt prudential rules and lend a lot with relatively little capital, while also making low provisions for bad loans.

This reliance on non-deposit funding and shadow lending channels to disguise their loan books means that the city banks are probably the riskiest banks in China. But it is hard to know for sure because only 15 are publicly listed, and aggregating financial data for the rest of them is a cumbersome chore. Even less visible are the thousands of rural commercial banks, many of which were assembled from the older rural credit cooperatives that once dotted China’s countryside. Like the city commercial banks, they command about 13% of banking assets and have grown rapidly over the past decade. But only five are publicly listed.

As we now see with Germany, when most of a country’s banks are not publicly traded it is difficult to gain a transparent perspective of just how the credit creation mechanism is performing. Chinese government bonds have been ranging between 2.6% and 4.6% since 2006 and are currently rallying back towards the upper side of that range.

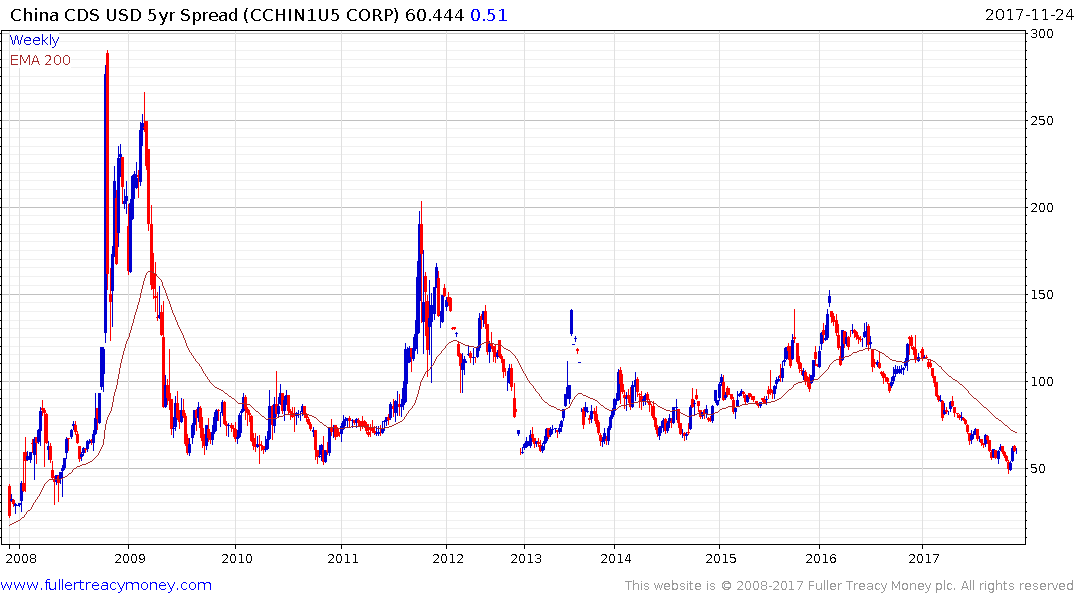

Meanwhile the country’s CDS spread is at an interesting level. It had been trending lower all year but paused near 50 basis points in October and has now rallied to challenge the medium-term progression of lower rally highs. A sustained move above the trend mean would signal more than temporary appetite for China hedges.

From an international investor’s perspective, if China moves from a roughly balanced monetary and fiscal policy to tightening that would represent another major central bank that is no longer adding liquidity to the market.

I can’t think of another country more exposed to Chinese tightening than Australia. This article highlights how the Australian housing market is finally beginning to cool. Here is a section:

After five years of surging prices, the market value of the nation’s homes has ballooned to A$7.3 trillion ($5.6 trillion) -- or more than four times gross domestic product. Not even the U.S. and U.K. markets achieved such heights at their peaks a decade ago before prices spiraled lower and dragged their economies with them.

And

“Australia’s world-record housing boom is officially over,” UBS Group AG economists declared at the start of this month. “The cooling may be happening a bit more quickly than even we expected.”

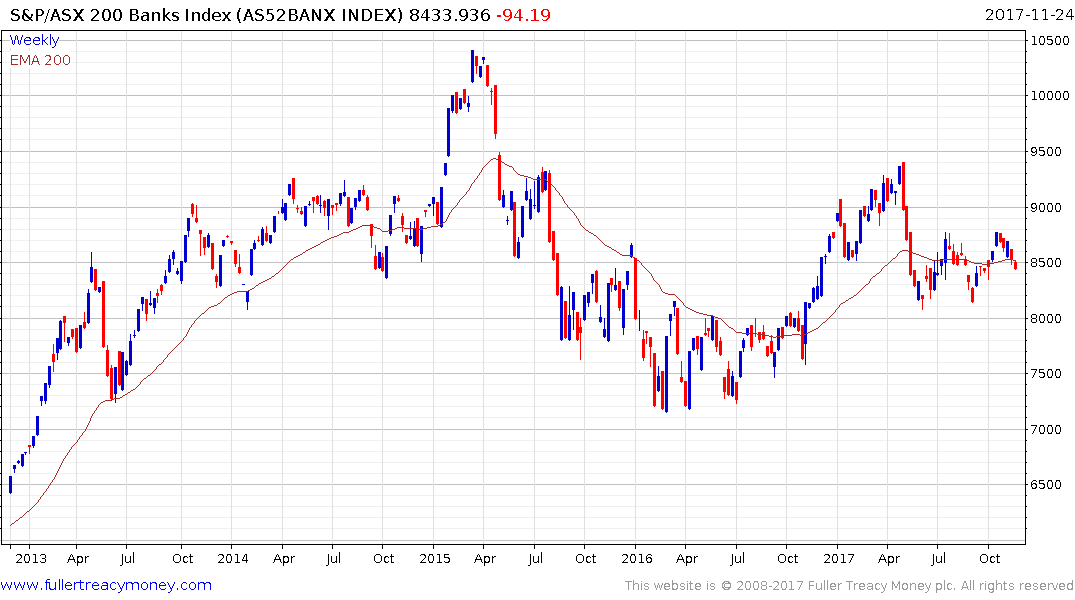

The S&P/ASX 300 Banks Index experienced a sharp pullback in May and has been ranging in the region of the trend mean since. A sustained move above 8750 will be required to signal a return to demand dominance and to check potential for a further test of underlying trading.

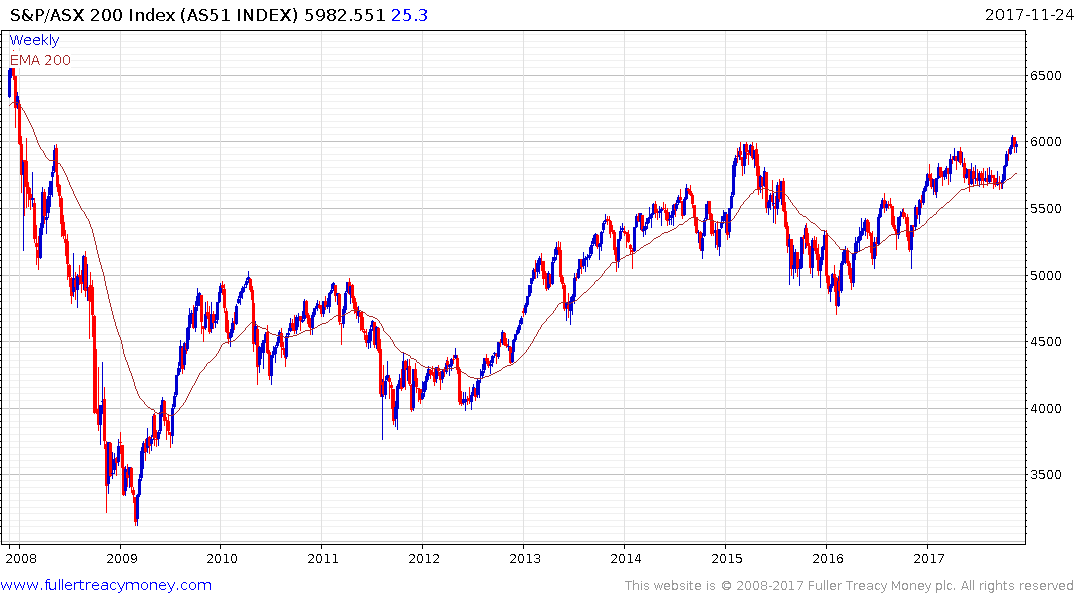

Meanwhile the resources sector has lent the broader S&P/ASX 200 some impetus of late. It continues to pause in the 6000 area, and a sustained move below the trend mean would be required to question near-term scope for additional upside.

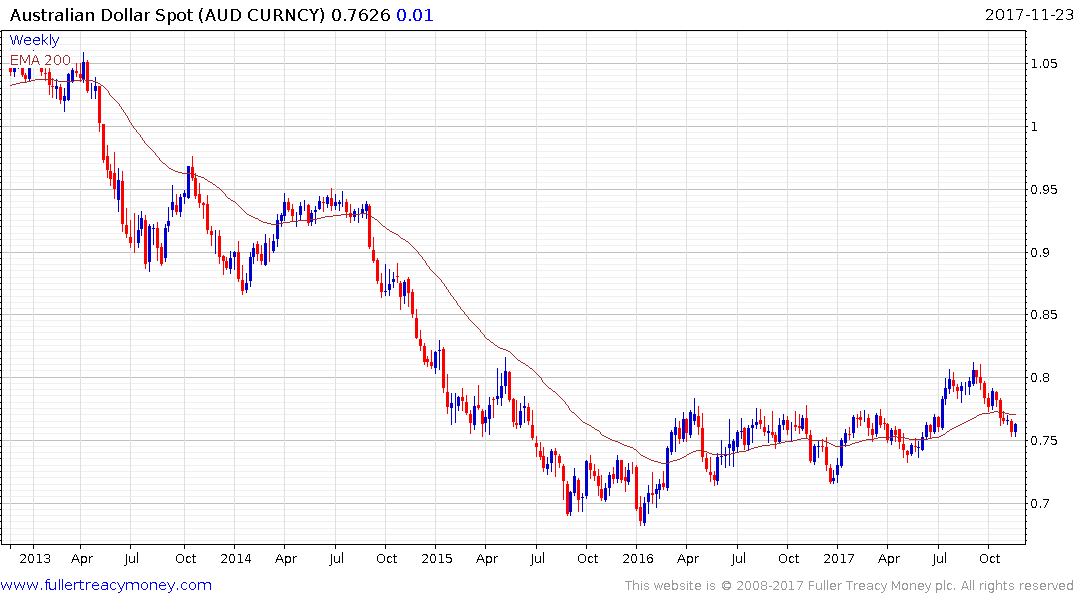

The Australian Dollar is back testing its progression of higher reaction lows against the US Dollar and will need to continue to demonstrate support in the region of 75¢ if medium-term support building is to be given the benefit of the doubt.

None of these charts signal alarm right now and the resources sector continues to represent a tailwind for Australia. However, while Australia’s politics are making international headlines, how serious the Xi administration is about tightening is likely to be a more significant determinant of how well the economy continues to expand.

Back to top