Adani Debts Enter Spotlight as Dollar Bond Coupon Deadlines Loom

This article from Bloomberg may be of interest to subscribers. Here is a section:

There has been no suggestion that the Adani entities would struggle to make these payments, and Adani has flagged interest coverage ratios that show it has the wherewithal to meet such obligations.

But Hindenburg’s report last week alleging “accounting fraud” along with its short position in Adani’s US-traded bonds and non-Indian-traded derivatives has put the debt in the spotlight. Some of the notes have fallen to distressed levels below 70 cents on the dollar that generally show mounting concern about creditworthiness. The securities extended declines Monday after a rebuttal by the Indian conglomerate and as Hindenburg followed with its own response.

Tightening global liquidity causes liquidity issues. We’ve seen several examples of that in the last 12 months. The UK pension crisis, South Korean perpetuals, frontier country sovereign defaults, REIT withdrawal issues are all symptoms of that theme. The issues currently being explored with Adani are part of the same trend. The longer rates stay high and as liquidity tightens the more these issues will appear. Eventually we will see solvency issues arise.

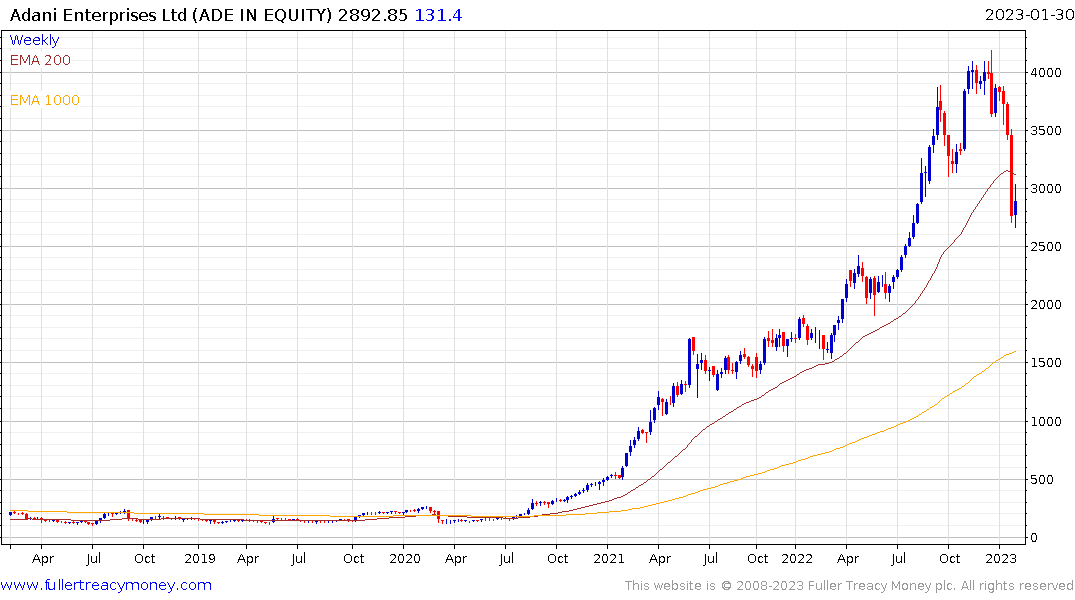

Adani Enterprises has experienced a massive reaction against the accelerated two-year trend. While the price was steadier today, the trend has clear type-2 top formation characteristics. The only question is whether a period of right-hand extension (first step below the top) will occur.

Adani Power extended its decline today and looks more like a crash scenario.

Adani Enterprises and Adani Ports & Special Economic Zones are both constituents of the Nifty Index occupying about 3% of the total market cap. As a result the Nifty has held up reasonably well but these kinds of issues will contribute to reticence to favour India over China.

This quote from Barry Sternlicht of Starwood Capital on CNBC last week clearly demonstrates the higher rates and tighter liquidity trend pressuring heavily leveraged companies is a global phenomenon. "If Powell keeps hiking rates, you have the Weimar Republic," says Barry Sternlicht. "He has to keep printing dollars to pay interest on the deficit. That will really slow the economy. He risks the entire financial stability of the [global economic] system."

Back to top