A year of disruption in the private markets

This report from McKinsey may be of interest to subscribers. Here is a section:

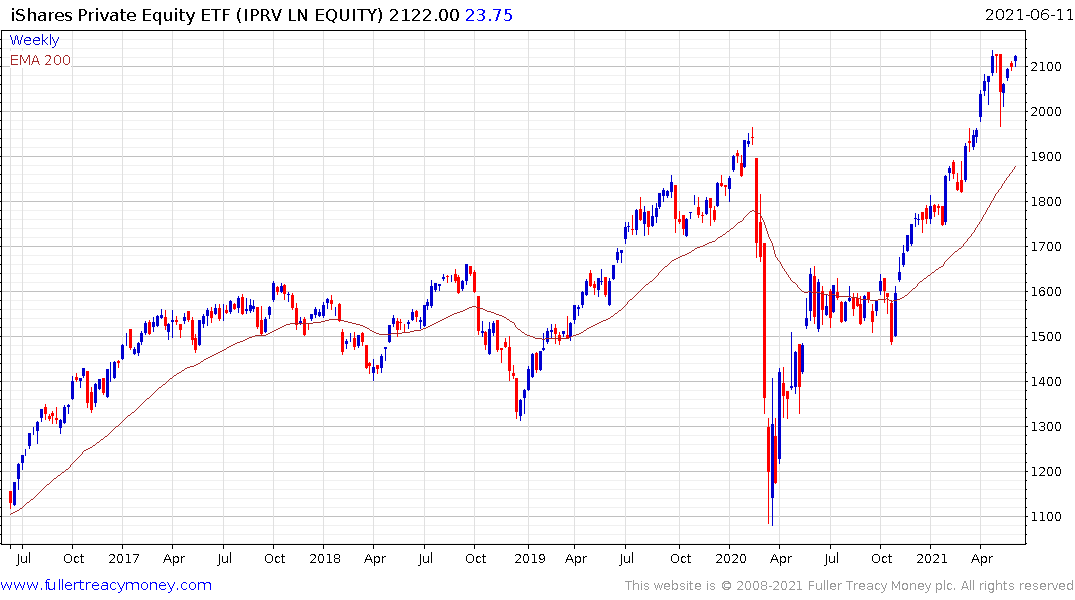

Dry powder Private equity dry powder stands at $1.4 trillion (60 percent of the private markets total) and has grown 16.6 percent annually since 2015. Dry powder stocks are best viewed in the context of deal volume, and as a multiple of average annual equity investments over the prior three years, PE buyout dry powder inventories have crept higher, growing 11.9 percent since 2017. However, normalizing for abnormally high deal volatility in 2020, PE dry powder as a multiple of deal volume remained largely in line with historical averages (Exhibit 21). Dry powder growth reflects fundraising in excess of capital deployment. Its continued growth in 2020 highlights a common misperception among industry participants and pundits: the belief that stocks of dry powder can be deployed quickly in a market correction. While fundraising fell sharply in the first half of 2020 (–22.8 percent relative to the first half of 2019), so too did deal volume (–22.5 percent). Despite the sharp (and short-lived) decline in mark-to-market valuations in the first half of 2020, PE investors were largely unable to take advantage, as private owners exercised a key feature of PE—the right to hold. Without willing sellers, dry powder stocks rose once again, piling pressure on deal multiples, which once again reached all-time highs in 2020.

Here is a link to the full report.

Private Equity is one of the primary destinations for liquidity and the fact that dry powder stands at $1.4 trillion with no easily accessible opportunities or willing sellers is a testament to just how high valuations are.

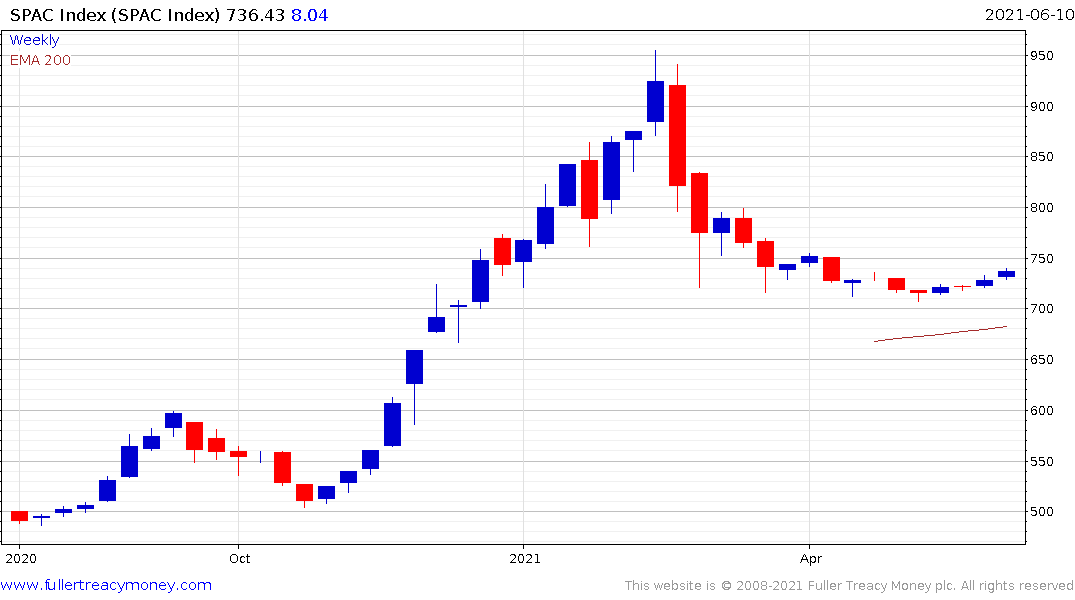

The evolution of the SPAC market, where $170 billion has been raised to date this year only adds fuel to the feeding frenzy. The challenge of special purpose acquisition companies is they have a time limit on investing or they have to give the money back. That greatly increases the potential they will end up overpaying.

The iShares Listed Private Equity UCITS ETF is currently firming above the early 2020 peak.

The SPAC Index is currently firming from the region of the trend mean.

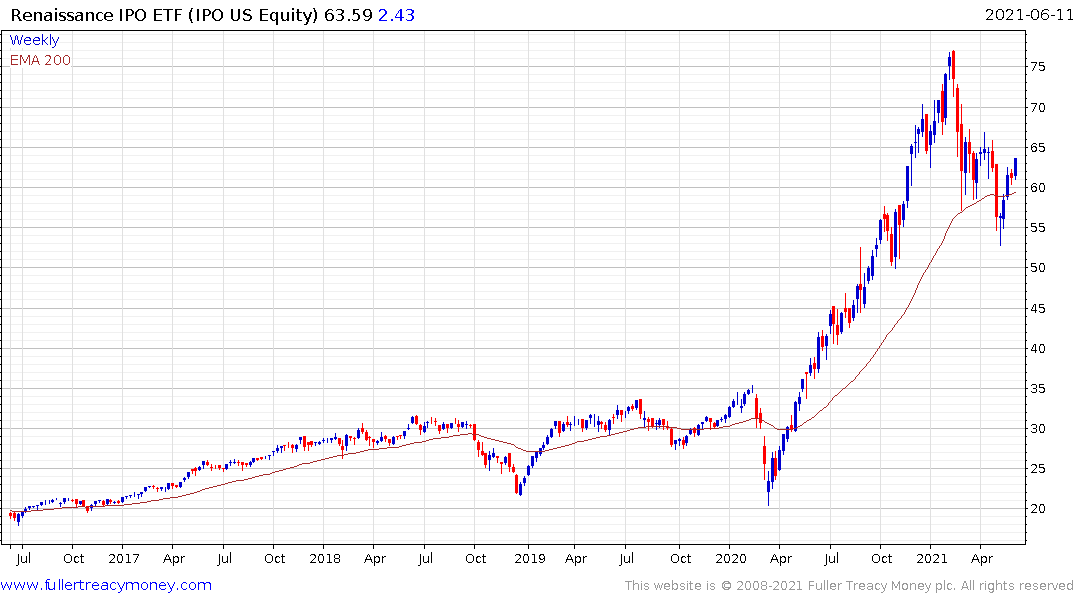

The Renaissance IPO ETF has rebounded over the last month to test the sequence of lower highs and trade back above the 200-day MA.