A Slow Slog Back

Thanks to a subscriber for this report from Morgan Stanley looking at the outlook for the global economy next year. Here is a section on emerging markets:

(2) Commodity exporters (top three EM in this group are Brazil, Russia and Indonesia): While USD appreciation was already resulting in an exogenous monetary tightening in these countries, a simultaneous downward trend in commodity prices and weakness in non-commodity exports hit these economies hard. Domestic demand in these economies has been impacted adversely since 2Q15, as reflected in the trend for real imports.

(3) Commodity importers (top three EM in this group are India, Korea and Turkey): Commodity importers in EM have also seen a slowdown in exports but their domestic demand has seen a positive offset in the form of the terms of trade, which has also helped to improve their current account balance. Lower inflation has encouraged the central banks to ease monetary policy even as the dollar has been rising.

Advanced Stage of Adjustment, EM Drag to Decline

While we think the EM adjustment is not yet complete, we expect the EM drag on global growth to reduce as all three factors – terms of trade, real rates needed in response to the rise of the dollar and unwinding of domestic misallocation – will become less onerous. Particularly on the issue of real interest rates, the top ten EM excluding China have now lifted their real interest rates about 270bp higher than US real rates. With real rates remaining high as EM continues on the adjustment path, a number of them, though not all, are likely to see improvement in macro stability indicators including their current account balances and inflation. Indeed, we expect more EM central banks to cut policy rates, though still on a selective basis, in 2016.

Here is a link to the full report.

2015 has already seen some major declines in emerging market currencies with a number of Asian currencies testing their Asian Financial Crisis lows while commodity related currencies are also testing historic lows. A crisis needs to be seen to be getting worse for it to continue to have such a marked effect on prices. Rather than focus on the extent of the problem, the better question at this stage is to ask how much worse is it likely to get?

Commodity price declines are already mature and while there is little evidence yet that the declines in industrial metals are over, the potential for reversionary rallies is increasing every day. One would have to be very bearish indeed to propose prices will fall in 2016 like they have fallen in 2015. Additionally oil prices are back to an area of previous support and producers are under pressure. There is still potential that prices might break below $40 but an even bigger question would be for how long?

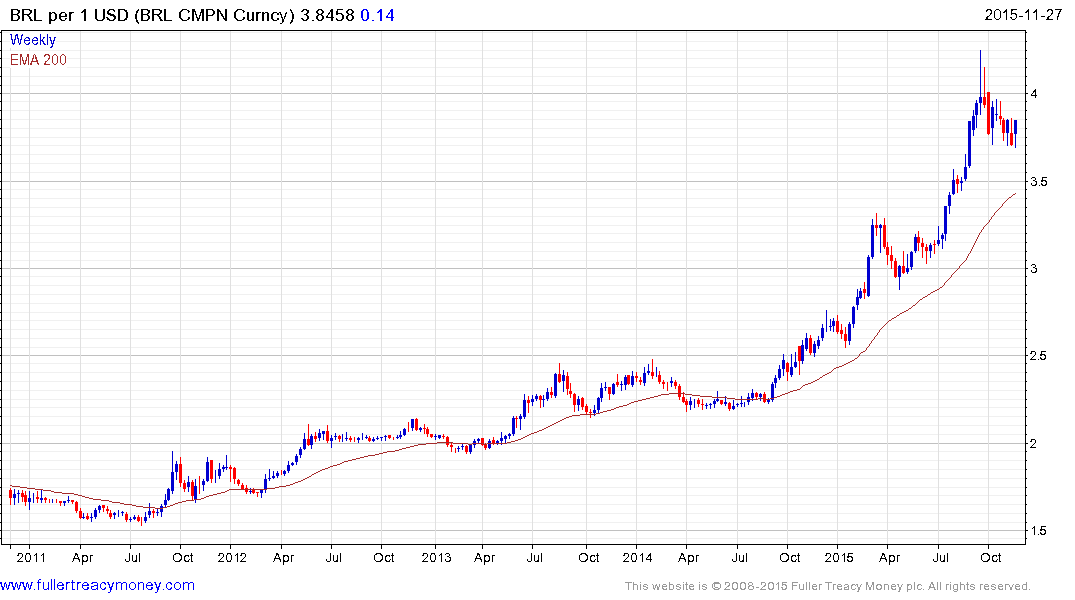

As exporters Brazil, Indonesia and Russia will be very sensitive to commodity price movements. The US Dollar hit a near-term peak against the Brazilian Real in late September and the reaction to date has been limited to a relatively similar move to that posted in March. It will need to encounter resistance in the region of BRL4.25 to indicate more than a temporary pause in the region of 2002 peak.

The iBovespa Index fell today to break the short-term progression of higher reaction lows evident since late September and a clear upward dynamic will be required to signal demand returning to dominance.

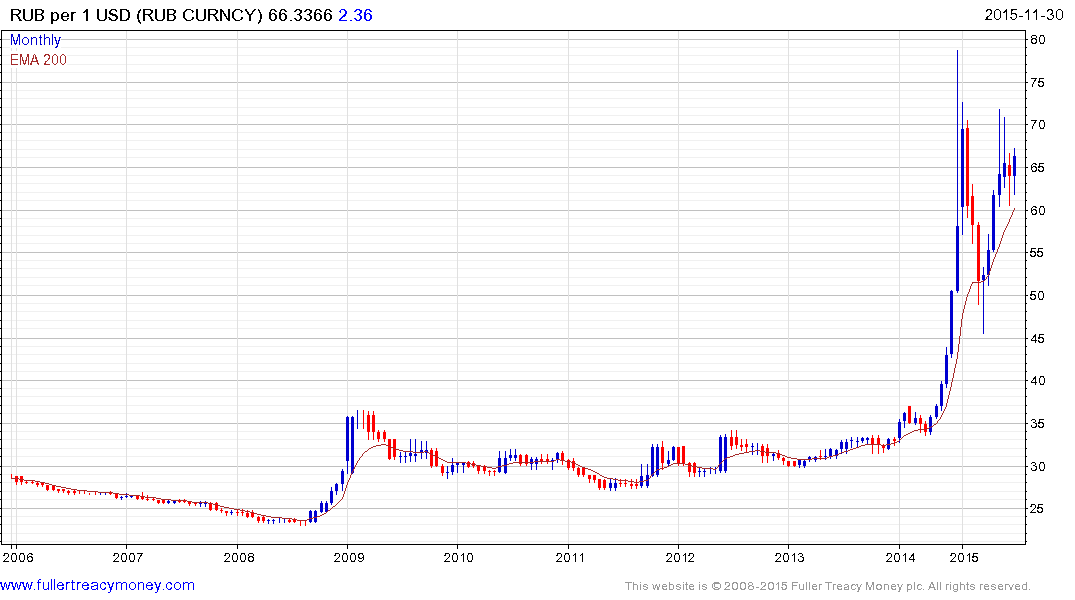

While the Real’s decline has been in evidence for a number of years already, the Russian Ruble had been reasonably stable, ranging around RUB 30 between 2000 and 2013. It experienced a swift devaluation in 2014 and has tested the RUB 70 area twice this year. A sustained move below RUB60 would be required to question the Dollar’s dominance over the medium term.

The US Dollar denominated Russian Traded Index has been ranging mostly above 1000 this year but will need to sustain a move above the trend mean to begin to suggest a return to demand dominance beyond the short term.

The Indonesian Rupiah experienced one of the most abrupt rallies of any currency from the September retest of the 1998 nadir. However, the Dollar found support in the region of the 200-day MA and a sustained move below it will be required to confirm a return to Rupiah dominance.

The Jakarta Composite has paused following a reversionary rally back up towards the trend mean and will need to demonstrate support above, or in the region of 4000, if support building is to be given the benefit of the doubt.

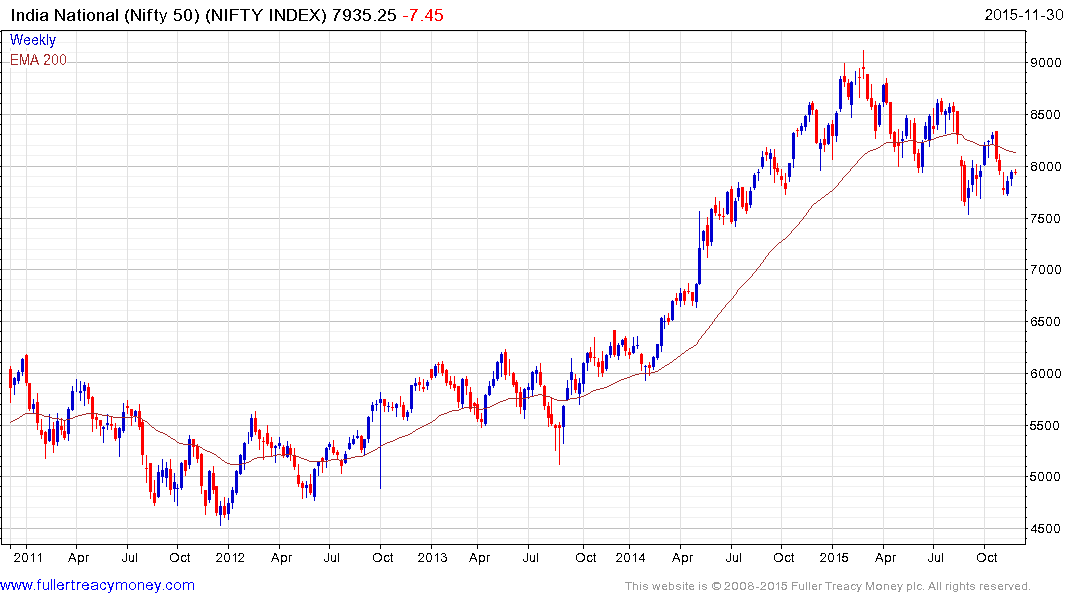

Among commodity importers, the Dollar continues to hold a progression of higher reaction lows against the Indian Rupee. A sustained move below INR 64 would be required to question the Dollar’s potential for additional higher to lateral ranging.

The Nifty Index has held a progression of lower rally highs since hitting a medium-term peak in March. It will need to sustain a move above 8350 to confirm a return to demand dominance beyond short-term steadying.

The South Korean Won has been among the firmest currencies in the region but the Dollar is now demonstrating a rounding characteristic against it consistent with accumulation. A sustained move below KRW1130 would be required to question medium-term scope for additional upside.

The Kospi has been ranging for nearly four years, but a weaker Won would be a major benefit to companies like Samsung Electronics and Kia which have been suffering relative to international competitors.

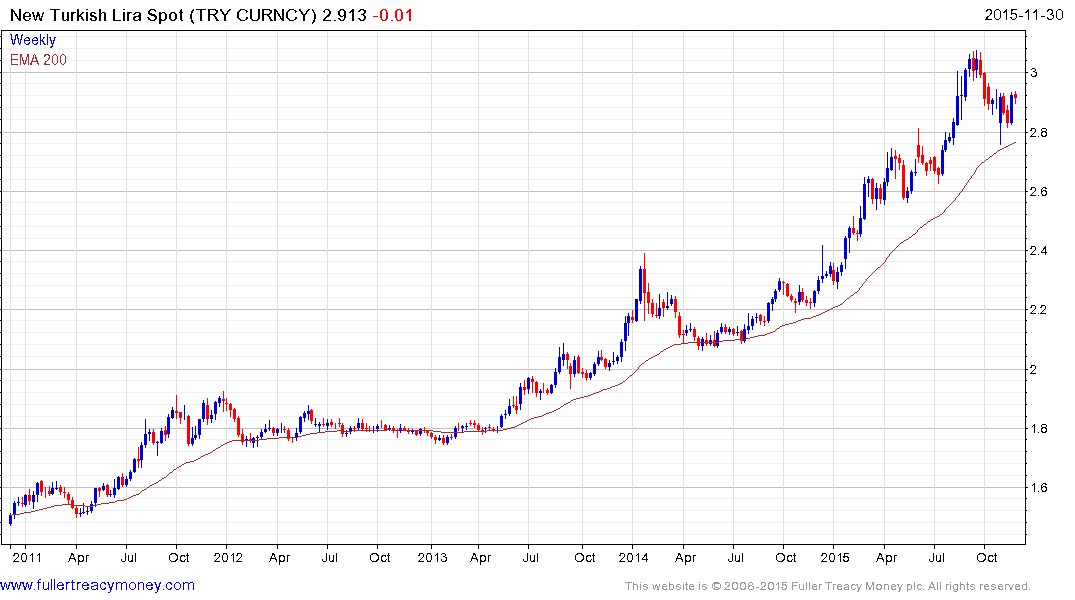

The US Dollar remains in a consistent medium-term uptrend against the Turkish Lira and a sustained move below the trend mean would be the minimum required to question its dominance. Open warfare on the country’s doorstep, floundering demand in its primary export markets and deteriorating relations with Russia are all weighing on the economy.

The National 100 Index has been ranging below 90,000 since 2013 and will need to demonstrate support above 70,000 if Type-3 top formation characteristics are to be avoided.

If we consider the outlook for the above stock markets none have been immune to the pullback in commodity prices or the slowdown in major markets like China. The ability of their respective currencies to hold above their lows will be a bellwether for their stock markets next year.