A Powell-Backed Yield Curve Gives Fed Cover to Go Max Hawkish

This article from Bloomberg may be of interest to subscribers. Here is a section:

The near-term forward spread measures the difference between bets on where the three-month rate will be in 18 months’ time and that same rate today. That curve, along with the more traditional three-month, 10-year spread, has steepened to multi-year highs, spurred by expectations that a hawkish Fed may frontload interest-rate increases, taking the federal funds rate to about 2.8% at the end of 2023.

A 2018 Fed research paper highlighted that the shorter-term yield curve eliminates complicating factors like the so-called term premium, and thus gives a cleaner read on market expectations for future monetary policy. In effect, the gauge would only invert when a large cohort of investors expected rate cuts on the basis of slowing growth. Previous Fed research has found it has a better predictive power than other parts of the curve -- a conclusion the chair endorsed Monday.

History has shown that when the force of a Fed tightening cycle causes a yield-curve inversion, it foreshadows a pending recession as consumer spending and business activity increasingly buckles under the weight of policy tightening.

Campbell Harvey was one of the first to historically show the link, with his work on the three-month, 10-year spread -- which has inverted before each of the past eight U.S. recessions. These days, the professor at Duke University’s Fuqua School of Business is concerned about growing threats to the U.S. recovery, even though his beloved spread is not yet flashing “code red.”

High inflation and “geopolitical risk -- which we haven’t even felt the economic outcome of yet, besides at the gas pump -- is all acting like a tax,” Harvey said. “It all indicates slower economic growth.”

Cherry picking the one part of the yield curve that is not at danger of inverting seems to be intellectually dishonest to this observer. Instead, we should be attempting to answer the question why 3-month yields are so depressed.

It seems like every day we get a new aggressive forecast for how quickly interest rates are going to rise. Just this morning, I saw one predicting four 50 basis point hike by December. Yet, the 3-month yield is locked steady exactly in line with the upper bound of the Fed Funds rate.

Everyone knows long-dated bonds are allergic to inflation and rising rates. Investors can’t sell them fast enough. It seems likely that the Fed’s use of the implied forwards on 3-month yields only take account of the disinflationary environment of the last forty years.

This also begs the question what are they doing with the proceeds of these sales? Some are undoubtedly holding cash. Those with the ability, have been hedging rising yields by buying stocks. Those who must hold fixed income have been buying the shortest duration instruments they can.

That has artificially depressed the short-end of the curve and inflated the Fed’s measure as well as the 10-year – 3-month spread.

.png) Meanwhile, the 10-2 year hit another low today. At this rate it will be inverted by the end of April.

Meanwhile, the 10-2 year hit another low today. At this rate it will be inverted by the end of April.

The 10-2 year Swap yield curve spread is at less than 1 basis point as of today.

The 10-2 year Swap yield curve spread is at less than 1 basis point as of today.

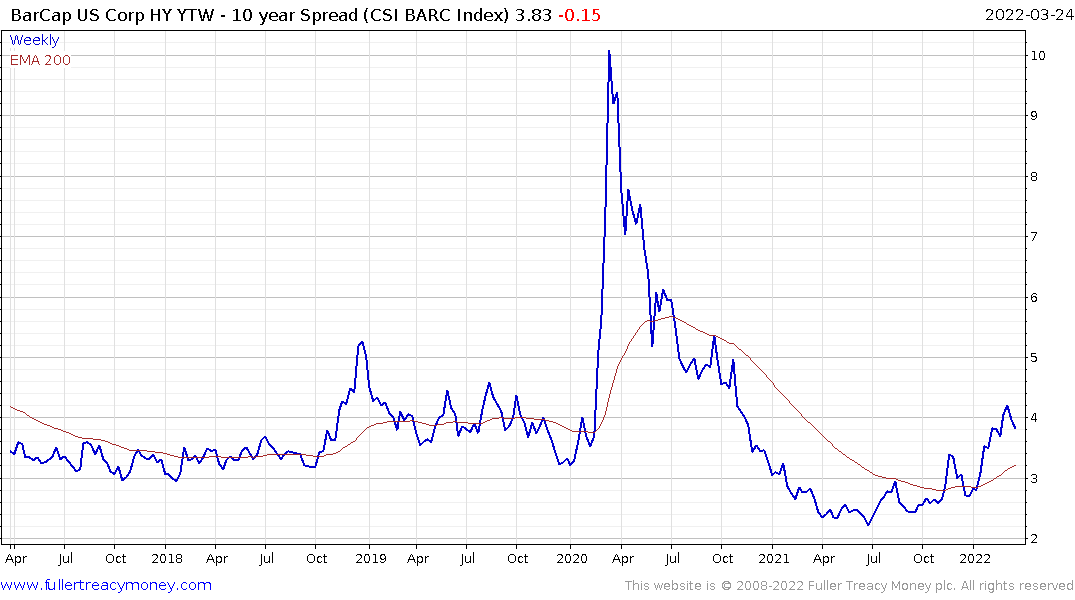

The high yield 10-2 yield curve spread is also trending lower at an accelerated pace.

High yield spreads and the Ted spread have both paused following jumps earlier this month.

High yield spreads and the Ted spread have both paused following jumps earlier this month.

I believe the Federal Reserve is underestimating how sensitive the economy is to interest rates. We are likely to see a market slowdown in growth figures well before they have reached even a fraction of the interest rate hikes already being priced in.

Back to top