A Patent Decision on Crispr Gene Editing Favors MIT

This article from Wired.com may be of interest to subscribers. Here is a section:

Someone is going to make a lot of money licensing Crispr. And someone is going to make lot of money on therapies based on Crispr. That’s why, the day before the decision, the National Academy of Sciences released a long document laying out what kind of Crispr-based human therapies were kosher—so no one goes the full Gattaca.

In fact, the moneymaking part has already begun. Startups are getting funding based on Crispr-based business plans. Editas Medicine, which licenses the Broad patents to work on treatments for genetic disorders in human beings, had a 30 percent stock bump on word of the patent decision. “It certainly caused some concerns, because depending on how the courts were going to rule on the two claims, if you went with one, you could lose, right?” says Edison Liu, CEO of the Jackson Laboratory, a major source of genetically modified mice used in research. Jackson Labs has licenses from both sides, and since it aims at academic uses, gets better terms than a Silicon Valley biotech startup might.

The acrimonious patent battle over exactly who controls the intellectual property relating to CRISPR-Cas9 DNA editing has been dragging on for a year. Since the three main protagonists are well funded there is ample scope for additional suits and counter suits since the potential rewards are so large.

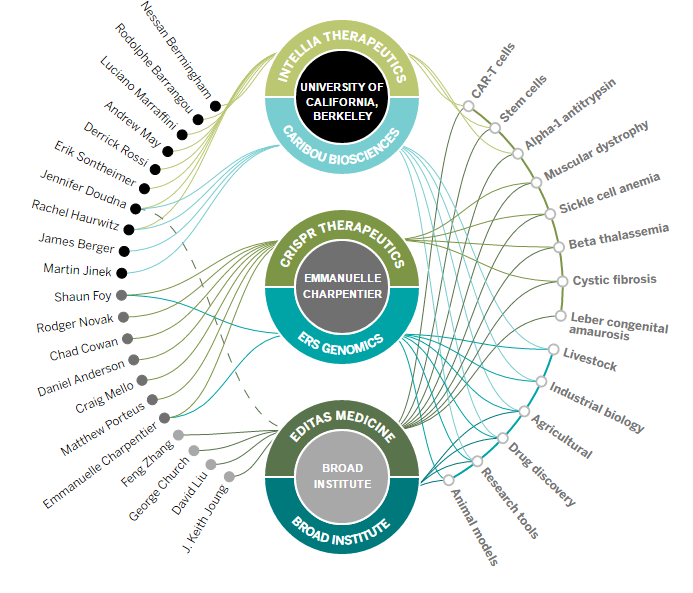

This article from Science contains a very useful graphic which links the companies, the academic institutions behind them and the main people involved. As you can see Editas and the Broad Institute has the greatest exposure to potential healthcare and animal care applications while CRISPR Therapeutics and Intellia Therapeutics appear to now own less access to the available intellectual property.

Editas surged higher ahead of the USPTO decision but pulled back last week as some debate erupted on just ambiguous the statement was. It bounced impressively yesterday and a sustained move below $20 would be required to question medium-term scope for additional upside.

CRISPR Therapeutics has already doubled from its mid-February low and is now testing the region of the December peak. Some consolidation in this area is likely but a sustained move below $20 would be required to question potential for additional upside.

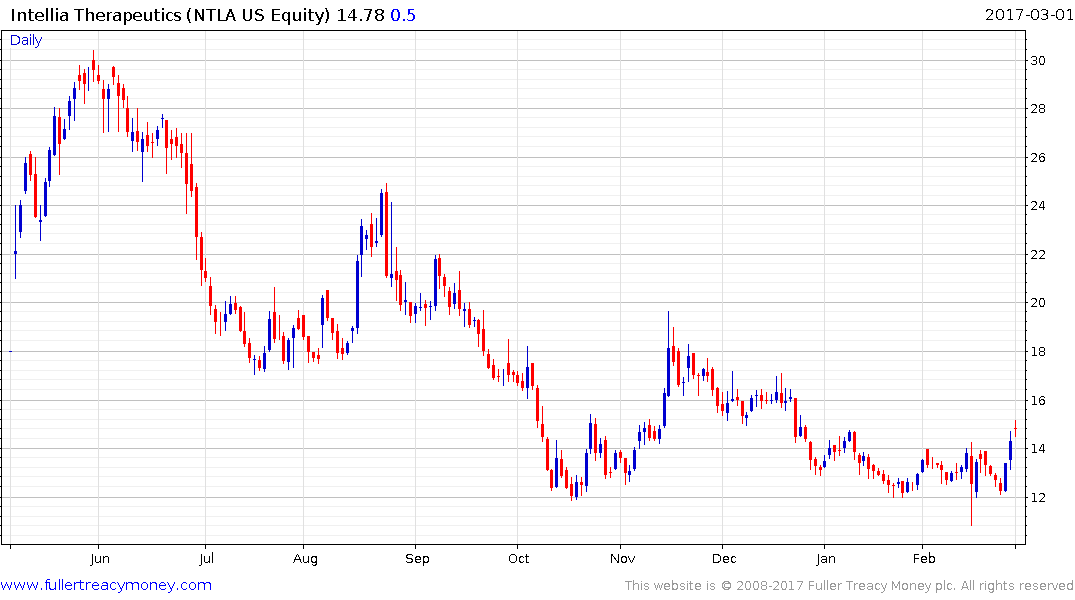

Intellia Therapeutics rallied this week to break a progression of lower rally highs, evident since November, but needs to sustain a move above the trend mean to challenge the medium-term downward bias.