A Fed Cut This Year Is Now Being Priced In as a Near Certainty

This article by Alexandra Harris for Bloomberg may be of interest to subscribers. Here is a section:

The rate on the January fed funds futures contract implies that the central bank’s benchmark will fall to 2.075% by the end of 2019. This is more than 25 basis points below where the effective fed funds rate stood Friday, showing traders are fully pricing in a quarter-point reduction. The implied rate on the contract ended last week at 2.15%.

This is happening as China threatens retaliatory tariffs on some American imports, an escalation in the trade war with U.S. President Donald Trump. The clash is fueling concern about economic growth, prompting a key part of the U.S. yield curve to invert again -- a sign to many that the risk of a recession has increased.

While “China/U.S. trade ripple effects certainly affect the Fed’s outlook, I think this is more of a macro move,” said Todd Colvin, senior vice president at futures and options broker Ambrosino Brothers in Chicago. “It’s not about whether or not the Fed sees policy shifts, that is, as much as it’s looking at

global growth woes, or increased market volatility.”

Jay Powell probably didn’t bargain for the environment he has been presented with since taking the helm of the Federal Reserve. Reducing the size of the balance sheet was supposed to be part of the re-arming of monetary policy to provide for the next crisis. It turned out to be the primary cause of the volatility last year and offered graphic evidence of just how addicted to liquidity the market is.

So far, the trade war has been reasonably targeted but the potential for tariffs to be imposed on all Chinese imports represents a significant challenge. In Mrs. Treacy’s various online businesses we can already observe evidence of inflation picking up. Amazon has been raising the cost of doing business both by raising fees and inventing new fees. The US Postal Service went from a pan-continental pricing structure to a regional structure which has led to a material increase in shipping costs.

The tariffs represent an additional force to compress margins. The answer has been simple. Increase prices. There has been little to no resistance to higher prices because the economic expansion is still underway and sales volumes are on average 30% ahead of last year. The other reason is because all other sellers are in the same boat but sales are nonetheless dependent on demand.

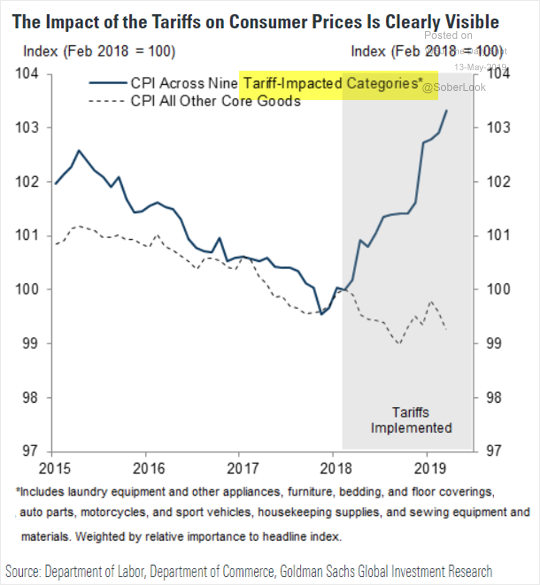

This graphic from Goldman Sachs highlights how much CPI inflation has increased for goods subject to tariffs. If targeting of tariffs is abandoned and fees imposed on all Chinese imports there is inevitably going to be a significant uptick in inflation at least until alternative sources of supply, from tariff-free jurisdictions can be found.

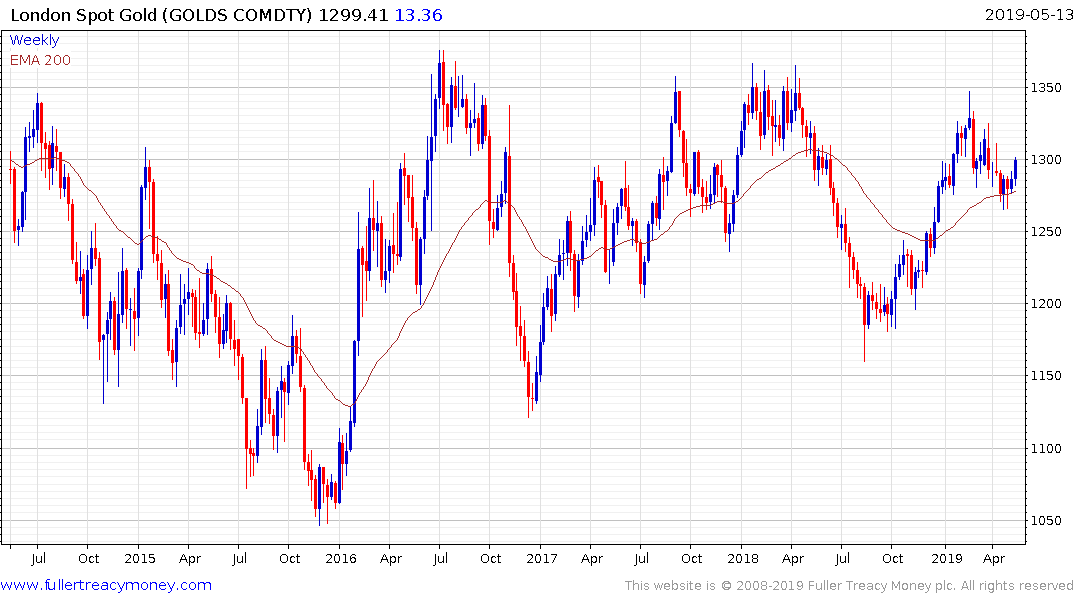

Meanwhile Treasury prices continue to rally, on safe haven buying and the conclusion that the Fed will be constrained from raising rates against a background of heightened geopolitical tension which is likely to have an effect on the economy. This raises the potential of stagflation which is positive for gold.

The price is back testing the $1300 level and a sustained move above that level would break the 10-week sequence of lower rally highs and confirm support in the region of the trend mean.

We can be sure that both sides of these negotiations are aware of what is at stake but investors are now in a “show me” mood following last week’s disappointment at the failure to reach an amicable solution.

Back to top