A Deeply Inverted Yield Curve Means Credit Is Set to Dry Up Next

This article from Bloomberg may be of interest to subscribers. Here is a section:

The other constraint is the so-called ‘spot real rate’, which measures the Fed’s target rate minus current headline inflation. The premise is that the Fed cannot tighten financial conditions sufficiently to wring out inflation if it ends rate hikes with the spot real rate still negative.

Putting this together, if the Fed gets to, say, a 4.5% target rate with inflation in 2Q 2023 at the same level, maybe it can call it a day. That’s a very high inflation level but also a restrictive level of policy which will mean significant economic pain. If, for example, the US economy lapses into recession and inflation falls to 4%, the Fed might feel confident that inflation was headed down to its 2% target even if the fed funds rate is only 3.0% when this occurs.

The scenarios above are more akin to the early 1970s when the Federal Reserve allowed real yields to remain negative in the face of double digit inflation. It’s not the crushing blows that Paul Volcker administered to the US economy.

Even so, inflation is so high that there are almost no scenarios where the fed funds rate doesn’t get to at least 3 or 3.5%. More likely we go higher than that.

That’s when banks will likely face problems with defaults and net interest margins.

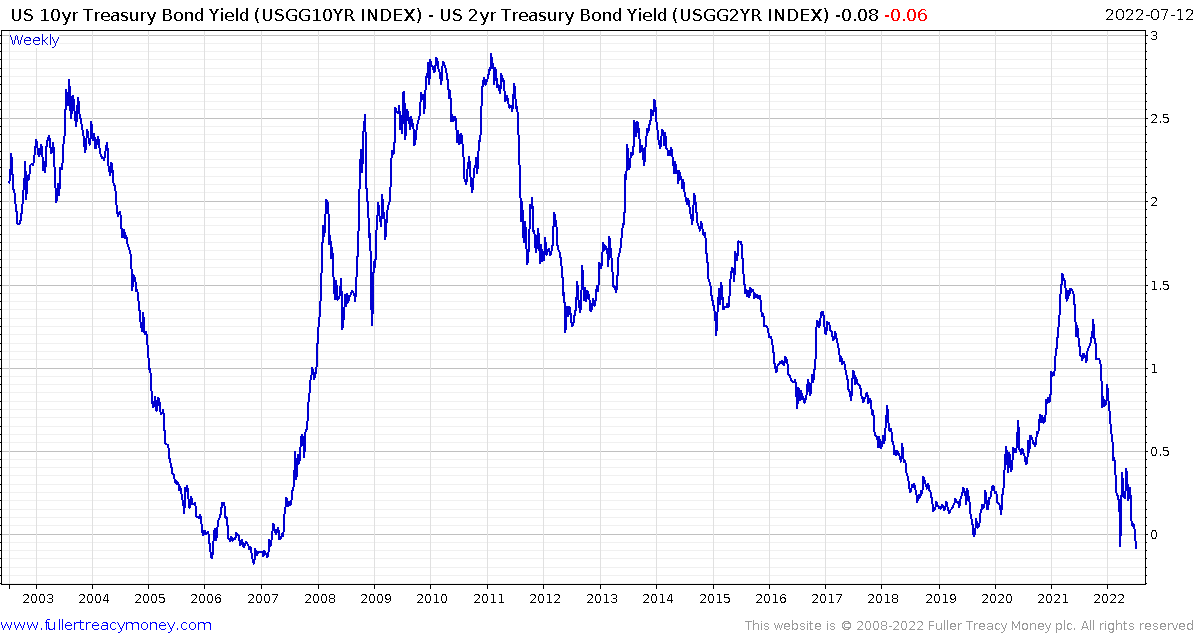

The 10-2-year yield curve spread is currently at negative 9 basis points. That’s the most inverted the spread has been since 2007. Jay Powell dismissed this indicator as useful and prefers to look at the 10-year – 3-month spread. That measure has contracted by 40 basis points since Friday. In early May it was at 230 basis points. Today it is at 80.

.png)

That’s an exceptionally swift pace of tightening and it is not over. The balance of probabilities is the Fed will raise rates by 75 basis points this month and at least another 50 in September.

The basic business model of banks is to borrow short-term and lend long-term. That doesn’t work with an inverted yield curve. The high nominal mortgage rate means any demand for refinancing has also dried up. So they are being squeezed on the revenue raising side but will also have to make greater loan loss provisions because the economy is slowing down.

That suggests the weakest banks are likely to continue lower. The Financial SPDR ETF is barely steady in the region of the 1000-day MA.

Inverted yield curves, weak banks and high energy prices all suggest a recession is more likely than not.

It is also normal to see a very strong labour market before a recession. That’s why it is worth paying attention to news of firings. Many tech companies have been rescinding job offers and others are actively reducing head count. It’s like a switch went off, in the space of a quarter companies have lurched from expansion to contraction. That’s a clear sign tight financial conditions are having an effect.

Bitcoin’s inability to rally is a further sign of tight financial conditions.