A capital constraint

Thanks to a subscriber for this thought provoking report from James Paulsen at Wells Fargo Asset Management. Here is a section:

As shown in Chart 1, the U.S. KL ratio has been declining since 2009. However, the primary impact of this decline on the pace of economic growth, corporate profit performance, and the stock market might just be beginning. Indeed, as suggested by Charts 2, 3 and 4, this recovery may suffer from a lack of capital investment during the next four years!

The fact the U.S. KL ratio has declined in the last five years does not imply the impact of that decline is now over. Nor does it necessarily suggest an imminent recession, a collapse in corporate profits, or a looming bear market. Rather, the significant decline in the KL ratio since 2009 may just now become more noticeable in terms of its impact in slowing economic growth, reducing profitability, and lowering future stock market returns.

While we expect the economic recovery to most likely last several more years, investors should realize the best of this cycle is probably past. The pace of economic growth, corporate profit performance, and stock market returns will likely be less satisfactory during the balance of this recovery as it increasingly struggles with the lagged impact of a prolonged “capital constraint.”

Here is a link to the full report.

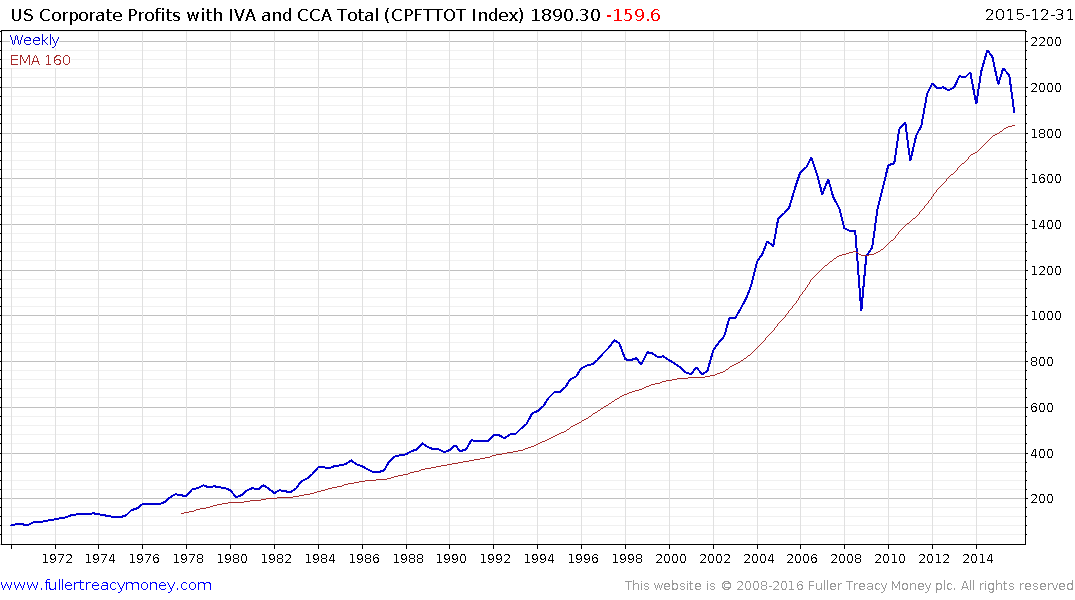

As we enter earnings season it’s not a bad time to contemplate what the outlook for corporate profits is. The Index of US Corporate Profits runs up to the end of December and is next expected to be updated on April 28th. A marked loss of momentum is evident on the chart following the gradual removal of QE so as interest rates rise they are likely to act as an additional headwind to profit growth.

The US Capital / Labor Ratio James Paulsen writes about in the above report offers a noteworthy correlation. The question, of course, is to what extent it will be relevant in this cycle.

The five-year period of underperformance looks unlikely to be overturned, not least when the regulatory environment and modest pace of recovery represents a hostile environment for corporations to make investments. However the deflationary forces of technological innovation.is something that was perhaps less of an influence in past cycles is very much relevant today. It means that even though capital might be invested less will be needed to achieve the same results.

We will continue to be guided by the charts. The S&P 500 continues to rebound but is drawing increasingly close to a potential area of resistance near 2100 which marked the November peak. A sustained break above that level will be required to confirm a return to demand dominance beyond what has been an impressive two-month rebound.

.png)

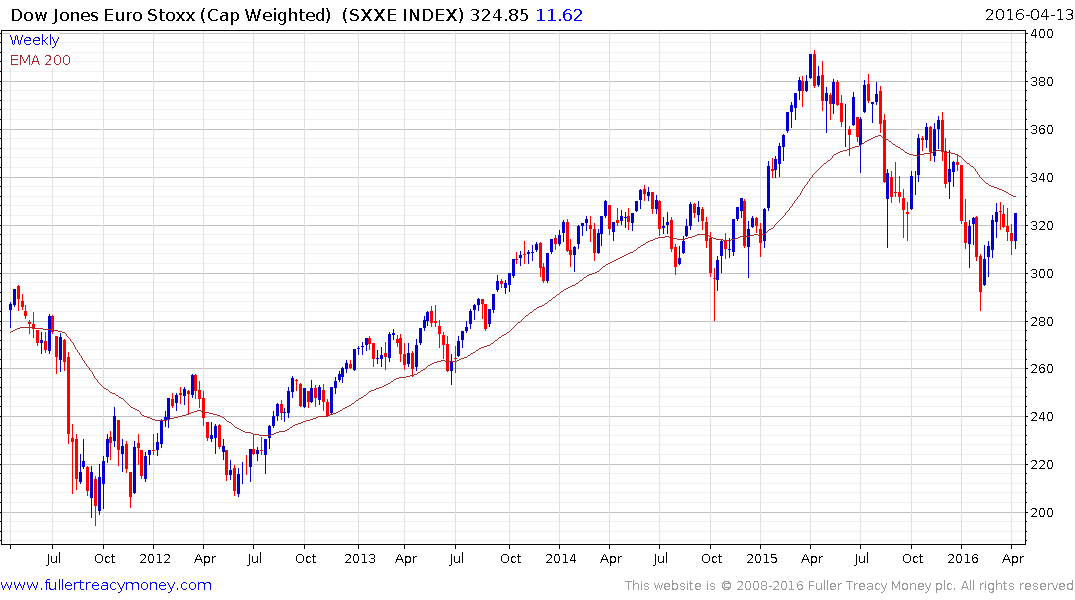

The Dollar’s relative weakness over the last eight weeks and rebound today flattered the market when redenominated into Euro. This also helps emphasise that while the Eurozone’s stock markets respond to Euro weakness, the USA’s markets tend to benefit from Dollar strength not least because they have greater safe haven status

The Euro Stoxx Index firmed today to confirm a higher reaction low and a clear downward dynamic would be required to question current scope for additional upside.

The extent to which the Euro continues to pull back from the upper side of its range is likely to have a strong influence on how much Eurozone stock markets rally.