A Bull Case Is Forming Around Bearishness at Hedge Funds, Quants

This article from Bloomberg may be of interest to subscribers. Here is a section:

The violent selloff has forced many systematic macro strategies, including trend followers and volatility-targeted funds, to slash equity holdings. Last week, their exposure fell to the bottom of a five-year range that even if stocks resume selling, their unwinding would be relatively subdued, according to Morgan Stanley.

For instance, should the S&P 500 drop 5% in one day, the cohort would need to offload less than $20 billion of stocks in the follow week, analysts including Christopher Metli estimated. That’s down from an expected disposal of over $100 billion at the start of the year.

Goldman’s long/short hedge fund clients saw their gross leverage falling 12 percentage points during the week through Wednesday, the largest reduction over comparable periods sine at least 2016, according to data compiled by analysts including Vincent Lin.

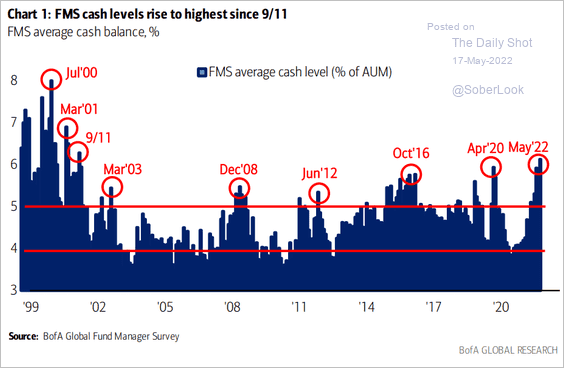

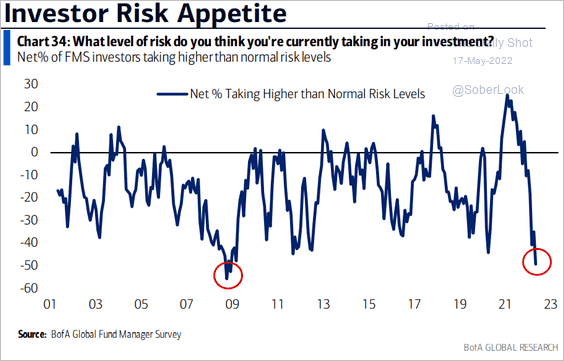

Light positioning by hedge funds and quants is among indicators watched by Goldman’s Scott Rubner to determine whether investors have capitulated. With cash holdings elevated in mutual funds and day traders retreating, one missing ingredient to call the all-clear is a reduction of stocks in US household holdings and retirement accounts, he says.

“Tracking this cohort is my single and most important focus from the lows here,” he wrote in a note last week. “We have not capitulated, it is very slow on the way out.”

There is still a great deal of uncertainty about the trajectory of monetary policy and the continuing impact of the war in Ukraine. The challenge for investors is to determine if this has been adequately priced in by the pullback to date.

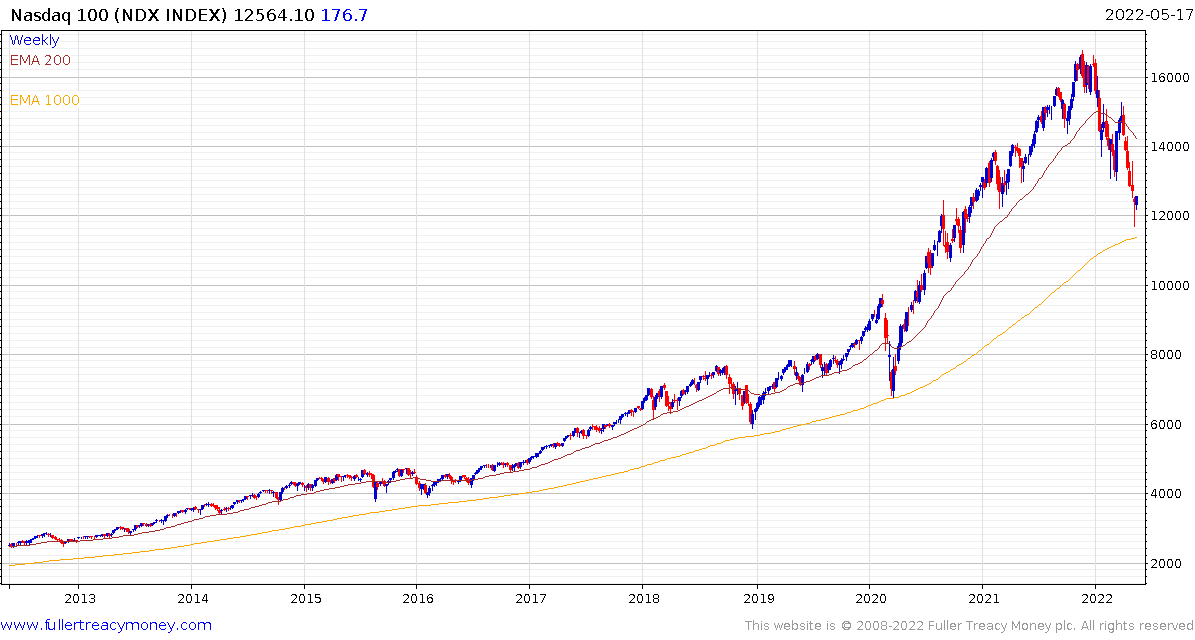

A significant number of indices are testing their respective 1000-day MAs which is the secular trend mean. This is the point where demand should return to dominance if the secular trend is still intact. Therefore, it is not all that surprising to see the buy-the-dip mentality reasserted itself at this point.

A significant number of indices are testing their respective 1000-day MAs which is the secular trend mean. This is the point where demand should return to dominance if the secular trend is still intact. Therefore, it is not all that surprising to see the buy-the-dip mentality reasserted itself at this point.

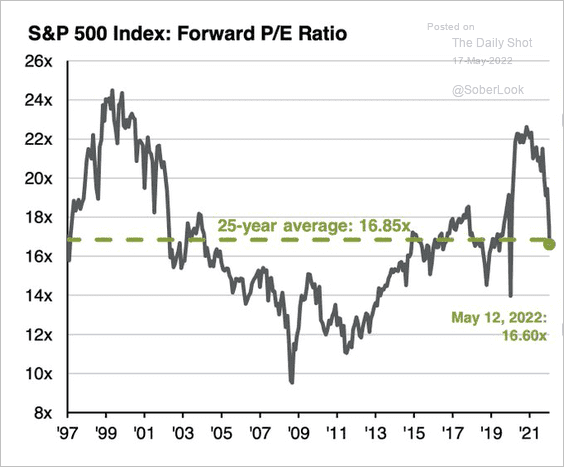

Additionally, the S&P500’s forward P/E is back at the historical norm, cash holdings are high and risk appetite is low. That’s a recipe for at least a reversionary rally which appears to be unfolding.

Nevertheless, the primary challenge remains unchanged. The Federal Reserve wishes to snuff out excess demand and get rates back to the “neutral” level which they surmise to be somewhere between 2 and 2.5%.

High yield spreads continue to trend higher so that is a clear sign financial conditions are tightening.

![]() The biggest source of support for the buy the dip mentality is inventory cycles tend to be cyclical. Companies bought more than they needed during the pandemic and will find themselves with excess inventory before long. Taiwan Semiconductor announcing price increases yesterday suggests that point may still be a while away. The continued underperformance of supermarket stocks suggests they have not yet seen the end of price pressures.

The biggest source of support for the buy the dip mentality is inventory cycles tend to be cyclical. Companies bought more than they needed during the pandemic and will find themselves with excess inventory before long. Taiwan Semiconductor announcing price increases yesterday suggests that point may still be a while away. The continued underperformance of supermarket stocks suggests they have not yet seen the end of price pressures.

Against this background, a reversionary rally appears likely, at least to unwind some short positions but it is too early to sound the all clear. That will not be possible until monetary conditions are more accommodating and we have clear evidence of a higher reaction low.

Back to top