A Battle of Inflation Versus Recession: Views on US Yield Curve

This article from Bloomberg may be of interest to subscribers. Here is a section:

“The 10-year yield may have been depressed for a large part of the past 15 years or so because global central banks have increased their balance sheets substantially and have reduced the term premium at the long end of the curve. And so you can get around these possible distortions by focusing more closely on how the market is pricing central bank policy.”

“What you will see is, three to six months from now, most if not all of these recession-probability metrics that we get from the yield curve will begin to start flashing at least orange, if not red.”

No Sense

“The Fed is telling us that they want to go to 3.8% sometime in early 2023; the two-year yield is over 100 basis points below that level right now,” noted Jim Caron, chief fixed-income strategist at Morgan Stanley Investment Management.“This doesn’t make any sense whatsoever -- unless one of two things: one, the market just doesn’t believe that the Fed is actually going to be able to hike in the way that they’re saying they will, or, something’s going to happen along the way.”

More broadly, “the markets are right now are surrendering to the fact that we’re likely to have a hard landing or a recession,” he said.

Long-dated yields have generally tended to rise during periods of quantitative easing because the Fed crowds out other investors and reduces the risk in other asset classes. Therefore, there is less inclination to hoard bonds and more incentive to buy risk assets; both public and private. That suggests the argument QE depresses long-dated yields is wrong.

Instead long-dated yields were low because of inflation metrics are gamed to keep inflation low, technological innovation has provided savings, low energy prices removed pressure and demographics means there is no swell of new demand from masses of young people. That allowed debt volumes to trend higher for decades so now the challenge is in figuring out how can yields be allowed to rise when the economy is already so leveraged. That implies valuations would need to correct, a lot.

The short end of the curve is depressed because bond investors have been fleeing duration because they fear inflation. That means the 3-month is below the prevailing Fed Funds rate not to mind the 2-year being below the expected rate in 2023. Flight to near-cash items has depressed yields at the short end of the curve and created the illusion of liquidity.

.png)

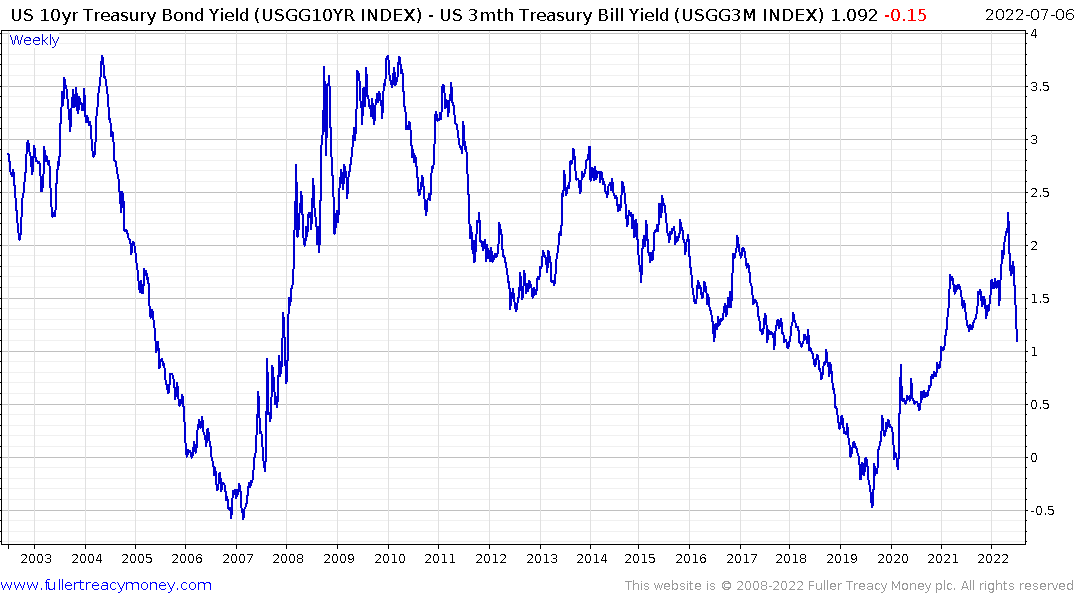

The 10-year – 3-month is now contracting in a hurry. By the time a recession is confirmed, the entire yield curve will be inverted. That could happen a lot sooner than most investors are willing to give credence to.

The consensus is a recession is to be expected in 2023. The stock market is behaving as if we are already in a recession. That also implies the ultimate low is probably closer than many anticipate. The Fed’s Minutes imply they are still committed to raising rates. That will accelerate the squeezing of liquidity from the market and hasten an economic contraction. By extension that also hastens the timeline for interest rate cuts and recovery. The recipe still points towards short, sharp cycles for the next decade rather than decade-long trends.

Back to top