2023 Outlook: Bear with it

Thanks to a subscriber for this report from Goldman Sachs which may be of interest. Here is a section:

Here is a link to the full report. Here is a section:

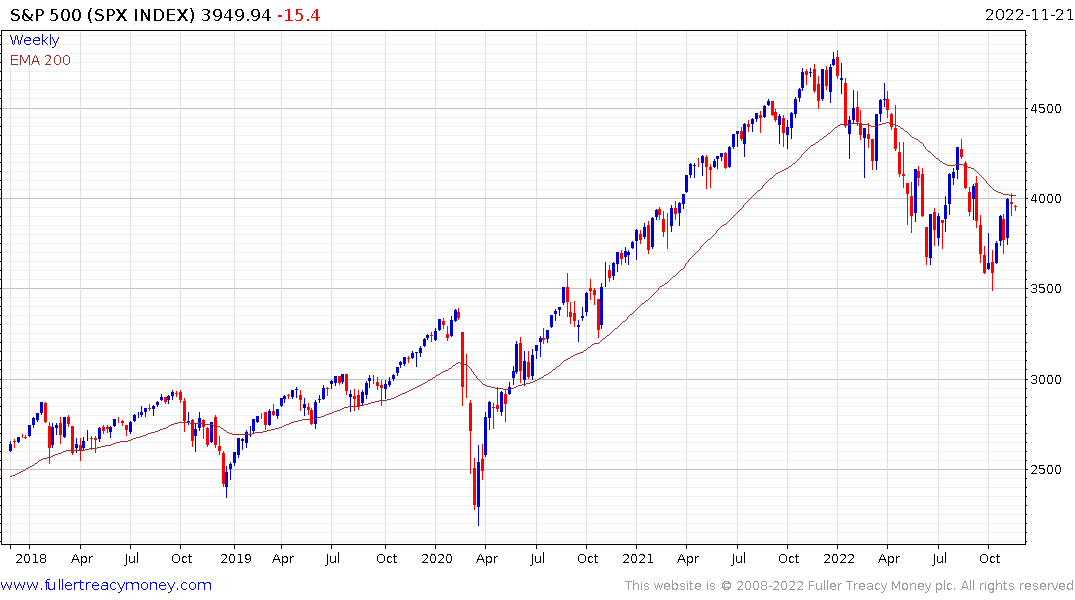

We would characterise the current bear market as ‘cyclical’. Cyclical bear markets are those that are driven predominately by the economic cycle and by rising interest rates, driving fears of economic and profit recession. These types of bear market typically experience falls of around 30%, last for 26 months and take 50 months to recover. This is milder than the 60% average falls in ‘structural’ bear markets, which are largely associated with major asset bubbles and private-sector leverage, and similar in magnitude to ‘event-driven’ bear markets (those triggered by exogenous shocks). That said, event-driven bear markets tend to be over more quickly, whereas cyclical ones tend to go on for longer and are interspersed with rallies before they reach a final trough. In common with other cyclical bear markets, these falls have also come in phases interrupted by several sharp rallies. The first, in March, drove global equities up by 10% and lasted 21 days. The second was triggered by optimism of a ‘Fed pivot’ in July and pushed equities up around 13% over 30 days, and the current one has, so far, triggered a 13% rally. However, so far at least, these rallies have not lasted; more persistent inflation and hawkish central bank rhetoric, particularly in the aftermath of the Jackson Hole meetings in August, heralded another setback.

The big question for investors is whether this is a cyclical or structural bear market. The exogenous shocks that come to mind are COVID, the response to it, and the Russian invasion of Ukraine. The private sector leverage is not focused in the consumer sector, but there has been extensive use of leverage in private investment, crypto and institutional investment areas not least in pensions and endowments.

I am not yet willing to concede this is merely a cyclical bear market. The big take away from The Chart Seminar today was how many of the best performers in the secular technology trend have returned to test the region of their respective trend means represented by the 200-day MA. If they sustain moves above those levels, the potential for a Santa Claus rally to take us into the beginning of next year will be bolstered. A failure at this level would disappoint a large number of institutional investors who are praying for a redemption rally to close out a dismal year.