"Taxes Again"

Thanks to a subscriber for this report by Andrew Adams for Raymond James which may be of interest to subscribers. Here is a section:

Yet, if we happen to get a repeat of the reaction after the 2003 Bush tax cuts, higher longer-term interest rates and an uptick in GDP next year would be the expectation, according to Strategas Research Partners, and it appears investors may already be starting to factor something similar into their analysis. We have largely refrained from trying to pick the ultimate winners and losers of the tax bill, which is a reflection of both the inherent complexity involved and the fact that we think investment decisions should be based on more than just the amount of tax paid; however, when reviewing the S&P 500 companies that have had the highest effective tax rates over the last ten years, energy, retail, health care, and financials are disproportionately represented at the top of the list. The financials, especially, seem to set up quite nicely, with a potential combination of tax relief, higher interest rates, less regulation, and a growing economy contributing to their attractiveness

“If 2003 is any guide, we don’t believe investors should overthink the short-term impact of tax cuts in 2018. The 10year rose from 3.1% to 4.6% in six weeks after the 2003 tax cut was passed, GDP surged in 2004, and those companies with vast amounts of cash overseas outperformed.”

Here is a link to the full report.

Fiscal stimulus at a time of almost full employment and close to record low corporate spreads is a recipe for a boom. That is what the vast majority of people are focused on right now especially with the fact that corporations are likely to be the largest beneficiaries. For consumers the final text of the bill that is approved by the House and Senate will be a mix of the data in the below table but the net effect is a tax cut for many people which is likely to boost sentiment.

.png)

This video by John Hussman, kindly forwarded by a subscriber, on the logic behind the formula for tax cuts is instructive and points out the reality that tax cuts at this stage in the cycle are likely to contribute to rather deter valuation expansion.

Corporate profits are close to record highs and the tax cuts should help that measure to break out which is bullish for stocks and could contribute to a further uptick in demand and potentially the intensification of a third psychological perception stage of the medium-term bull market.

.png)

In the meantime, the Fed is likely to continue to raise rates and that will eventually contribute a headwind for both the stock market and the economy not least because the quantity of debt that needs to be refinanced in the next couple of years dwarfs that which was outstanding in 2003.

Right now, the S&P500 Banks Index is extending the breakout from this year’s range and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

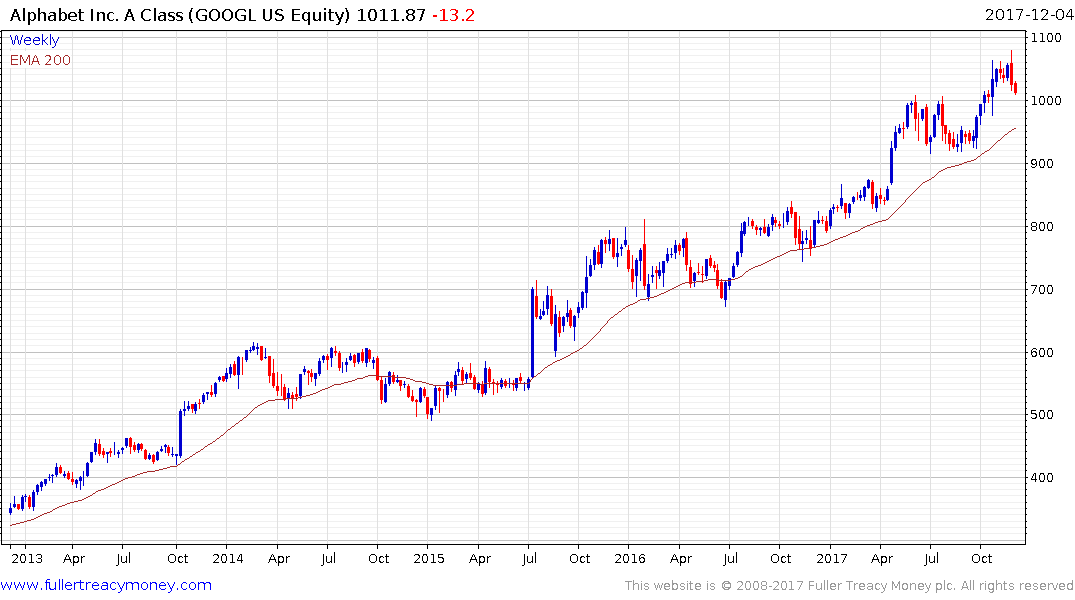

The mega-cap technology sector initially bounced back strongly today with Alphabet, Facebook and Amazon holding important short-term support areas but they were unable to hold the gains and upside follow through tomorrow will be needed to confirm a return to demand dominance.

The domestic sector represented by companies that pay the majority of their taxes inside the USA has the potential to outperform next year not least because it represents a catch-up play. In the meantime, a lot of good news has already been priced in over the last year and some pause and consolidation appears likely as the full ramifications of the myriad tax changes are more fully examined.