'Strikingly Tight' Copper Market Belies Price Drop, Miner Says

This article from Bloomberg may be of interest to subscribers. Here is a section:

It’s “striking how negative financial markets feel about this market and yet the physical market is so tight,” said Richard Adkerson, chief executive officer of Freeport-McMoRan Inc.

“We’re not seeing customers scaling back orders. Customers are really fighting to get products,” Adkerson said Thursday during a conference call with analysts after the miner reported adjusted third-quarter per-share profit that exceeded estimates.

The decline in copper prices this year reflects investor concerns about the global economy, weak economic data from top consumer China, the European energy crisis and a strong dollar, he added.

Such a pricing environment will defer new copper projects and mine expansions just when the world’s epic shift to electrification requires a massive amount of the metal, according to Adkerson.

The mining sector is expecting demand from the electrification sector to explode over the coming decade with the result that copper demand will double. That goal is impossible to achieve with investment in new mining infrastructure on a massive scale.

Unfortunately, there is no appetite for building on that scale in most countries. Therefore, we can expect a messy supply and demand relationship. Demand will be mitigated by access issues and supply will be inhibited by an inability to expand enough to meet demand.

How China’s economy performs is likely to be the deciding factor in how well copper demand projections actually play out. The continuesd downtrend in US Dollar denominated Chinese high yield debt suggests domestic copper demand will continue to moderate since most of that debt is tied to property developers.

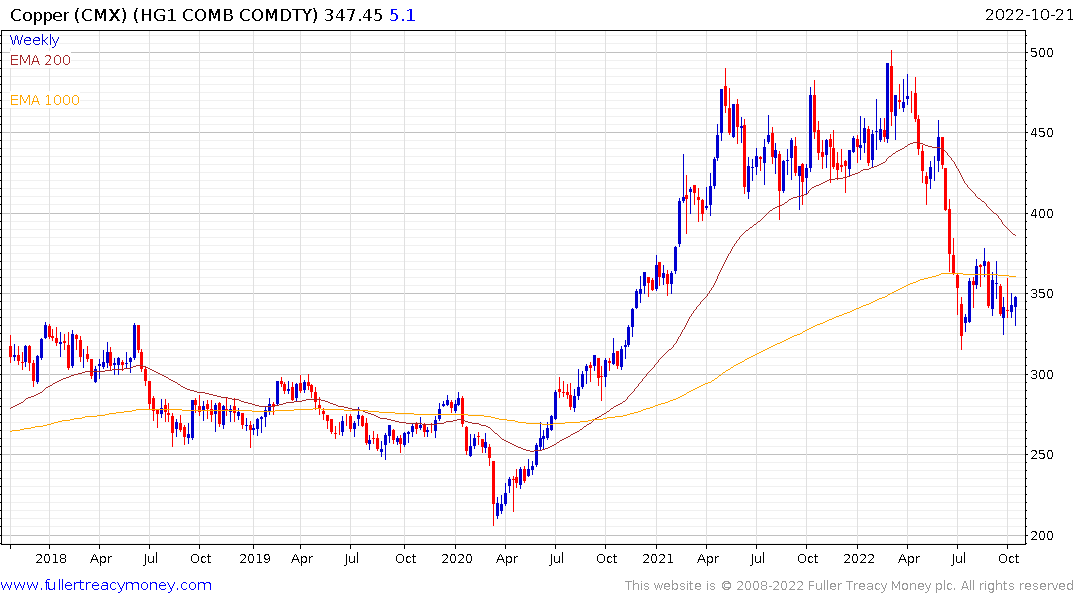

Copper continues to firm within its range but will need to sustain a move above the 1000-day MA to confirm a return to demand dominance beyond short-term steadying.

Copper continues to firm within its range but will need to sustain a move above the 1000-day MA to confirm a return to demand dominance beyond short-term steadying.

Freeport McMoRan was up in a dynamic manner today as it ranges above its 1000-day MA. That’s certainly more encouraging action and a sustained move above 200-day MA would confirm the change of trend.

Freeport McMoRan was up in a dynamic manner today as it ranges above its 1000-day MA. That’s certainly more encouraging action and a sustained move above 200-day MA would confirm the change of trend.

The company reported an increase in gold production of about 10% and a realized price of $1683 versus an estimate of $1715.

Gold posted another upside key day reversal today to confirm near-term support in the region of the September low above $1600.

Gold posted another upside key day reversal today to confirm near-term support in the region of the September low above $1600.

Silver also rebounded to confirm near-term support at the lower side of its range near $18.

Silver also rebounded to confirm near-term support at the lower side of its range near $18.