'Irrational Exuberance' Driving India Mid-Caps, Strategist Says

This article from Bloomberg may be of interest. Here is a section:

Prasad said he is dropping his recommended mid-cap portfolio as he has “largely run out of options” in trying to pick stocks that offer further upside potential. His view echoes sentiment from JPMorgan Chase & Co., whose India strategist Sanjay Mookim told Bloomberg earlier this month that the outperformance of smaller companies is in “extreme territory”.

In contrast, HSBC Securities Strategist Amit Sachdeva last week said that the rally in Indian mid-cap stocks had only progressed about half way, based on past cycles. And Goldman Sachs Group Inc. notes that mid-caps are becoming more popular with investors in Indian stocks, showing confidence in the market even despite concerns over high valuations.

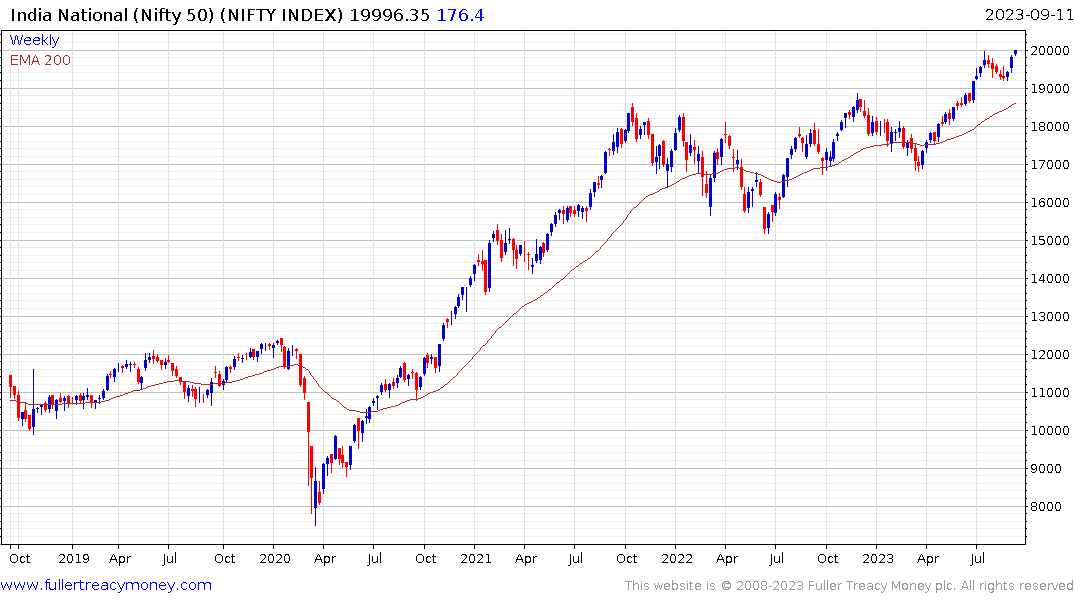

The Nifty Index touched the big psychological 20,000 level for the first time today. Renewed enthusiasm about India’s growth prospects and its ability to attract inward investment following the G-20 meeting are the likely catalyst for the rebound over the last two weeks.

India’s credit cycle runs to a different beat compared to most other countries. The deleveraging from the last property bear market probably troughed in 2018. The RBI estimates the medium-term credit cycle is about eight years so that suggests the peak of this cycle will be around 2026.

Generally speaking, mid-caps tend to be high beta plays on the expansion of valuations. The BSE Midcaps Index is very overextended following a persistent rally over the last six months. The first clear downward dynamic is likely to mark a peak of medium-term significance.

Generally speaking, mid-caps tend to be high beta plays on the expansion of valuations. The BSE Midcaps Index is very overextended following a persistent rally over the last six months. The first clear downward dynamic is likely to mark a peak of medium-term significance.

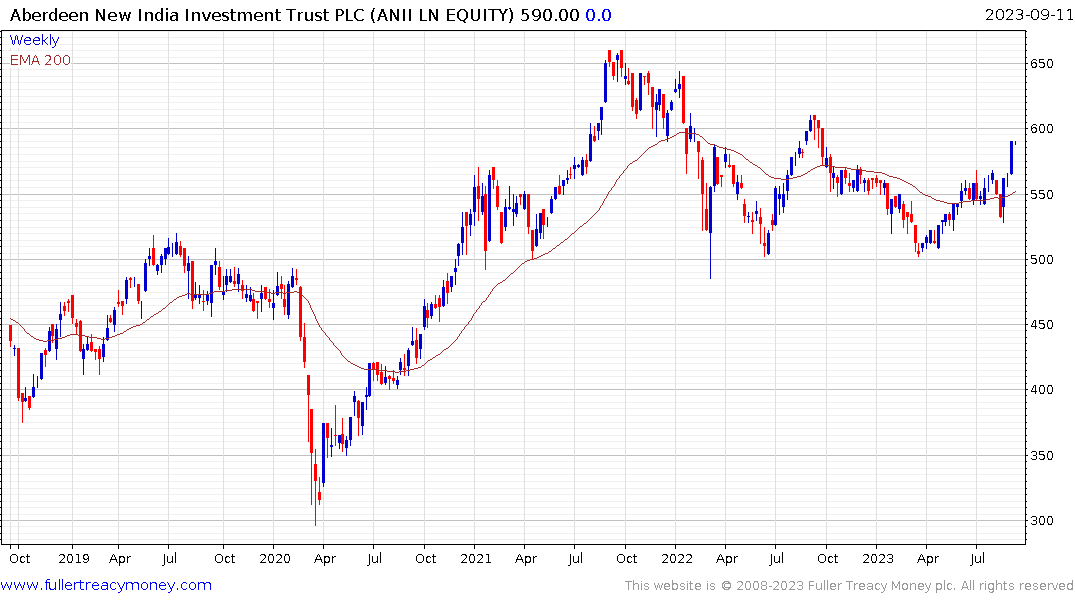

The Abrdn New India Investment Trust broke out to new recovery highs last week and held the move today. The Rupee has been a significant factor in detracting performance from foreign investors in India and it has not yet demonstrated a meaningful has been found.

The Abrdn New India Investment Trust broke out to new recovery highs last week and held the move today. The Rupee has been a significant factor in detracting performance from foreign investors in India and it has not yet demonstrated a meaningful has been found.