'Fed Is in Denial': How a $4 Trillion Dilemma Could Get Ugly

This article from Bloomberg may be of interest to subscribers. Here is a section:

The trouble is, post-crisis rules enacted to curb risk-taking, like Dodd-Frank and Basel III, have prompted banks to use much of those same reserves -- upwards of $2 trillion worth -- to meet the more stringent requirements. It’s those forces that are, in effect, creating the scarcity of reserves that has banks -- mainly the smaller ones at this point -- scrambling for short-term dollar funding. Since the Fed started shrinking its assets, reserves have fallen by more than a half-trillion dollars, according to Fed data from Barclays.

“The current backdrop is one that is dominated by the regulatory landscape,” said Jonathan Cohn, the head of interest-rate trading strategy at Credit Suisse. He estimates excess high-quality liquid assets (which include reserves) at the eight U.S. globally systemically important banks have fallen by more than 15 percent since the Fed began its unwind. “Banks are in a decent position right now, but over time this will begin to weigh” on them.

The pace of the Fed’s balance sheet unwind is picking up and that is beginning to make considerations of what that means for related markets more urgent. A balance of $900 billion before the credit crisis is the base line but if we add the $2 trillion of bank reserves to that figure, we get close to $3 trillion. The Fed’s balance sheet is now $4.13 trillion and trending lower. That is not a particularly large buffer particularly when a good proportion of the remaining part of the balance sheet is comprised of mortgage bonds with questionable liquidity.

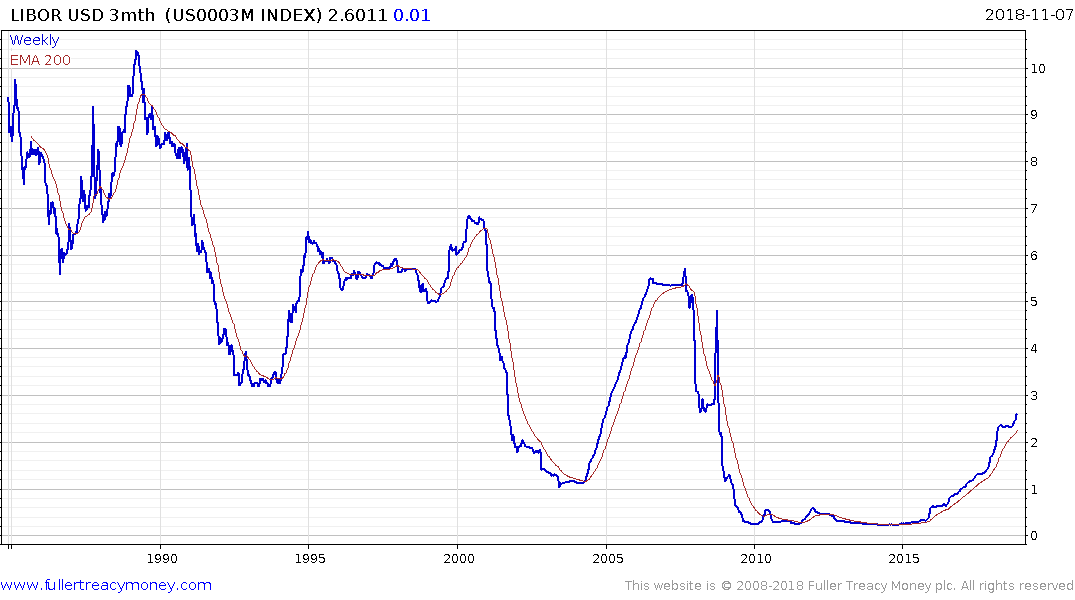

3-month LIBOR remains on an upward trajectory. It will not escape the attention of bond bulls that each successive major peak is lower than the last. That is part of the rationale many pundits rely on for their assumption that the terminal value for this Fed hiking cycle will be around 4%.

.png)

The spread of LIBOR over the Fed Fund rate highlights how much the relationship between the two benchmarks has changed since 2000. Before the TMT bust, and lower for longer monetary policy, the spread regularly moved out to 100 basis points. Since 2000 the only time the spread has traded above 50 basis points was in 2008 for obvious reasons.

The more relevant point right now is the spread is trending higher, suggesting the outlook for liquidity in the financial sector is definitely skewed towards tightening.

The S&P500 Banks Index remains the best performing of the global banking sectors but it needs to sustain a move back above the trend mean to signal a failed downside break.