(Don't Fear) The Yield Curve, Reprise

Thanks to a subscriber for this article from the Federal Reserve which may be of interest. Here is a section:

It is not valid to interpret inverted term spreads as independent measures of impending recession. They largely reflect the expectations of market participants. Among various terms spreads to consider, the 2-10 spread offers a particularly muddled view. Especially in the present circumstances when the 2-10 spread is very much out of step with the near-term forward spread, which offers a much more precise view of market expectations over the next year and a half, it is difficult to concoct a reason to be concerned about the flattening of the 2-10 spread. In contrast, if and when the near-term spread does contract, we know that investors will then be expecting a cessation in monetary policy tightening. While such a shift in expectations could well be precipitated by future concerns about a recession, that need not be the case. A more benign cause would be a marked easing in inflation and inflation expectations that allow for a cessation of policy firming.

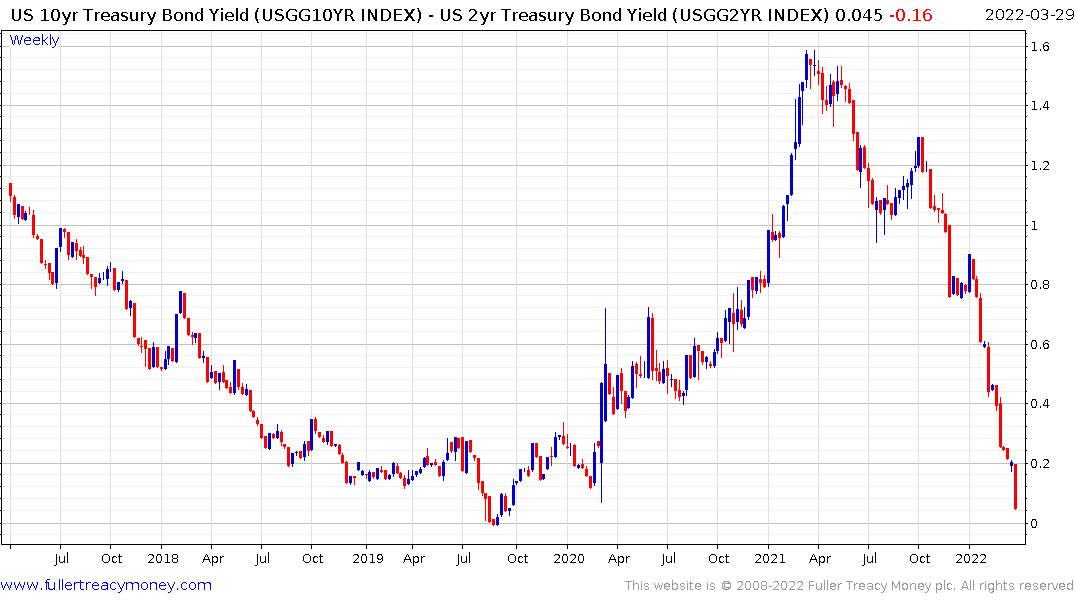

The benign outcome is more often referred to as a soft landing. The 10-2 year spread closed at 1 basis point and was inverted for a brief period intraday. The 10-year-3-month is at 189 basis points which is an historically wide diversion.

.png)

Most commentary has focused on what it means and less on what caused it. Long dated yields have been rising aggressively because inflation is at multi-decade highs. There has been an investor exodus from the long end. Anyone who can sell has sold, and those who must hold bonds were forced into ultra-short durations.

Fed Fund futures price in eight 25-basis point rate hikes within the year. The 3-month is still close to 0.50% which suggests no hike before the end of June. Those signals are incompatible.

Massive demand for near cash items has depressed short-term yields. That’s a symptom of inflation fear, rather than a signal the economy is surging.

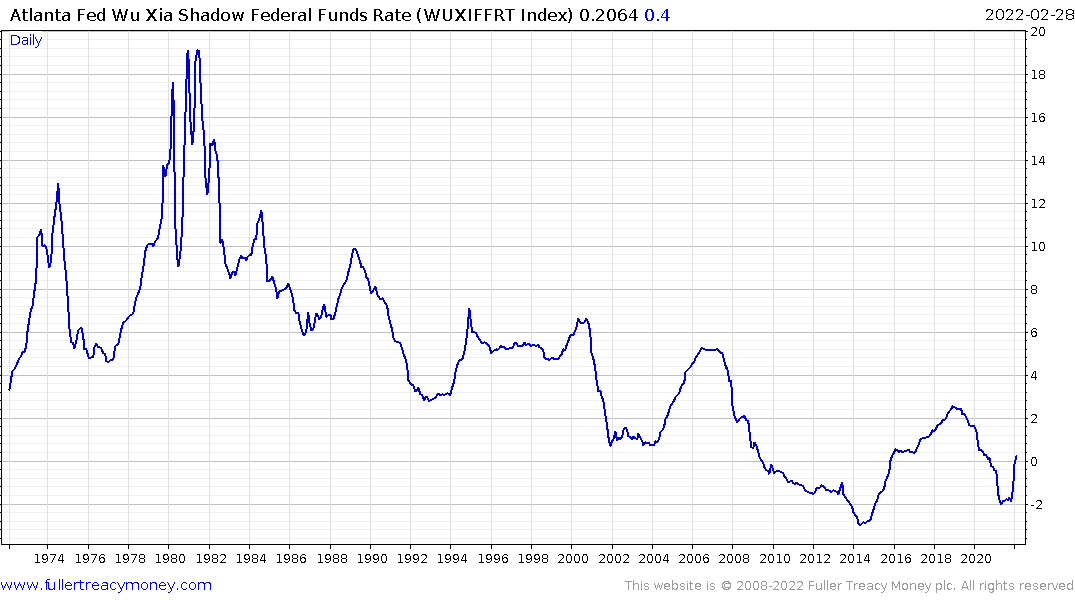

This time is different or at least we have not had an inflation scare of this magnitude in the last forty years. If a soft landing is to be achieved, inflation will have to come down of its own accord. If central banks are forced into acting to depress demand in a big way, a hard landing is much more likely.

Year over year money supply growth is down to 11%. That is still high by historic standards, but the downtrend is clear. If the Federal Reserve follows through with quantitative tightening that will further emphasise the loss of money supply growth.

The Swap curve also inverted this week, the high yield curve, high yield spreads and TED spread have all paused of late but have so far sustained breakouts.

At a minimum all this suggests we are already late in this economic cycle. That supports the view this cycle is going to be much shorter than the last, which was the longest in history.

Consumer sentiment is already deteriorating as housing affordability, the return to student loan repayments, food and energy costs sap demand. The volume of debt outstanding suggests the economy is in no position to tolerate an aggressive hiking schedule.

The Wu Xia Shadow rate has tightened by 200 basis points since November and is still rising. To my eye, it looks like growth is already peaking and will shock the Fed into inactivity.

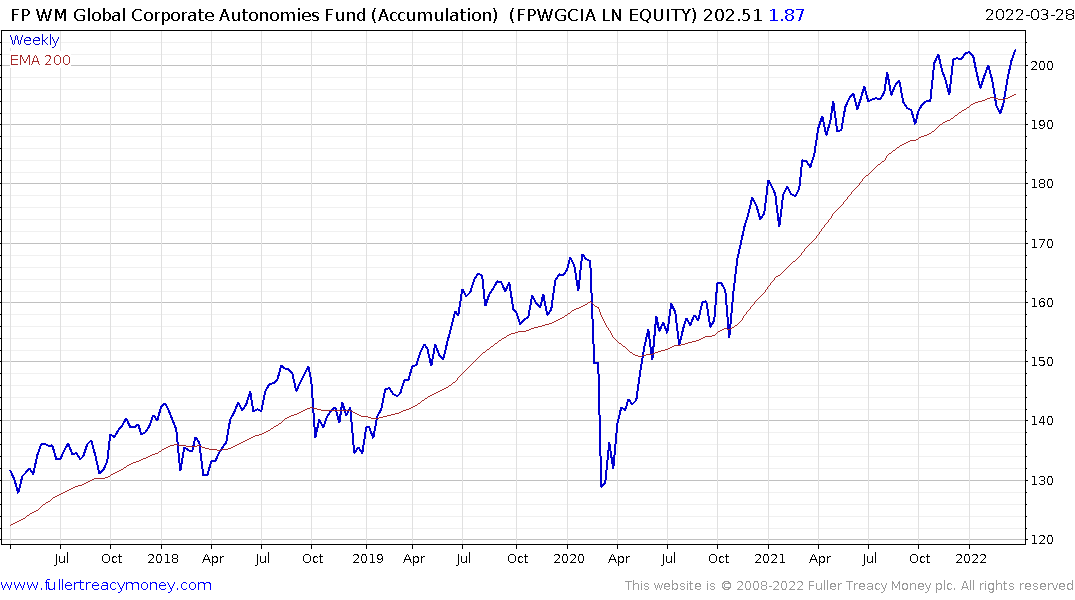

The Invesco Defensive ETF, the S&P500 Dividend Aristocrats and the Autonomies continue to bounce from their respective the trend means.

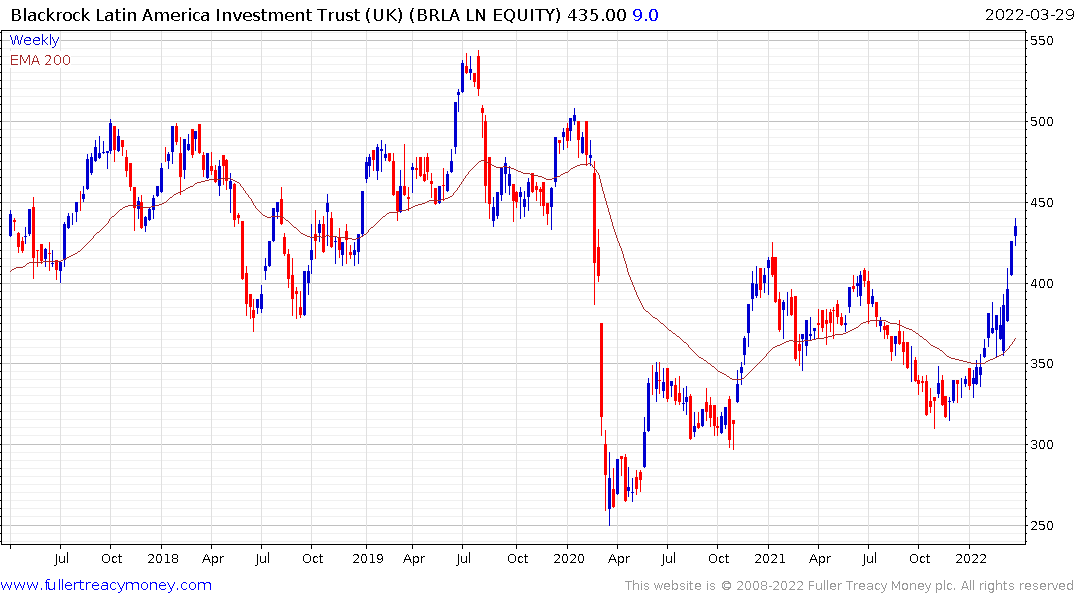

The Blackrock Latin America Trust broke out to new recovery highs this week.

Mega-caps continue to benefit from a heady combination of defensive characteristics from their cash piles and financial engineering.

Speculative sectors continue to rebound from short-term oversold conditions but as most likely to form lengthy base formations once short covering has run its course.

The stock market generally puts in a last leg higher following an inversion with commodities and defensives peaking last.

Banks tend to be sensitive to liquidity and remains quite steady.