Variants and Volatility but Fundamentals Intact

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

Here is a link to the full report and here is section from it:

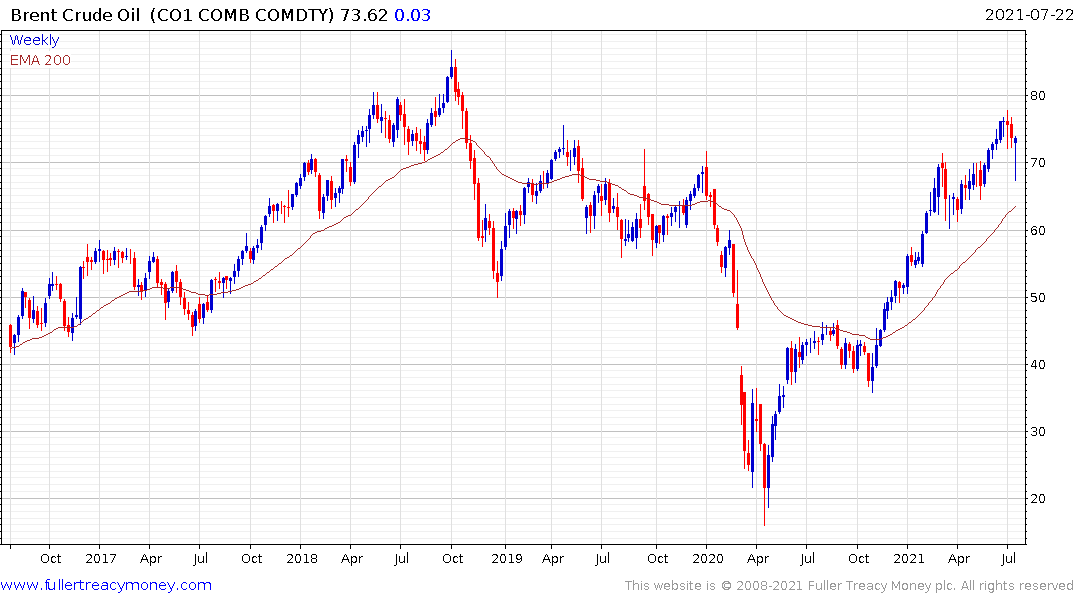

Still, this does not represent a fundamental change: There are two possible pathways in years ahead. In one scenario, a peak in demand and competition for market share drive prices to the marginal cost of supply, probably around $50/bbl. In another scenario, the lack of upstream investment, driven by shareholder pressure on listed oil companies, creates market tightness that causes oil prices to bounce up to levels where demand erosion kicks in, probably around $75-80/bbl. We would still argue that the oil market remains in that latter regime, which still means prices in the mid-to-high $70s.

First, the GDP recovery likely remains on track: Our economics colleagues still argue for a transitory impact of the Delta variant. Rising vaccinations and a weakened link with hospitalisations mean policy makers can avoid aggressive lockdowns. As a result, the global economic recovery likely continues and the Delta variant ends up having only a muted impact on oil demand.

Two, inventory data continues to be encouraging: Notwithstanding some demand soft spots, aggregate inventories continue to trend down. Since the start of the year, we can identify inventory draws of a steady ~1.64 mb/d.

Three, a sizeable deficit remains in 2H21: Our supply/demand estimates incorporate OPEC's decision to add 400 kb/d to supply every month, as well as a likely increase in US production of ~400 kb/d between 2Q and 4Q. Yet, we still see the market in a stronger deficit in 2H even than in 1H21.

Four, OPEC market management will likely remain in 2022: The supply/demand balance looks weaker in 2022than in 2021, but there is still room for those in OPEC+ with spare capacity to ramp up production substantially. Also,2022and 2023are likely to be transition years to a period that is much more favourable to OPEC. With that prospect, we suspect OPEC will remain cohesive and keep the market in a modest deficit in 2022.

If the marginal cost of production is now around $50, prices cannot fall below that level for a sustained period. In a volatile market like oil, there will inevitably be occasions when prices test the lower bound and rise enough to encourage marginal production in off the side lines.

The trend remains higher and the impressive rebound over the last two days confirms another higher reaction low. A sustained move below $67 will now be required to question potential for additional upside.

The higher prices go, the greater the incentive for OPEC+ to release more supply and for shale producers to increase drilling. A significant supply shock will be required support prices anywhere near the $100 bound so a lot of good news has already been priced in, despite the upward trend overall.

The rising price of oil and related products is one of the primary factors contributing to the perception of higher inflation. That’s where demands for higher wages are based. When consumers see they are paying more for food, fuel and shelter they have no option but to ask for more money to help pay for it all. That’s the basis for non-transitory inflation.