Uranium Climbs to Highest Since January 2013 Amid Utility Demand

This article by Ben Sharples for Bloomberg may be of interest to subscribers. Here is a section:

Demand from utilities is driving prices higher after uranium entered a bull market in September amid a labor strike at Cameco Corp.’s McArthur River operation in Canada, the world’s biggest mine for the fuel. Kyushu Electric Power Co. this month received local approval for reactors at its Sendai power station to resume operations, clearing the way for the first nuclear plants in Japan to restart as soon as early 2015.

While uranium for immediate delivery is in demand through January, there’s also been a rise in buying interest for distribution of supplies later in 2015, Ux said. It has recorded 22 transactions for 3.8 million pounds this month.

Uranium and nuclear energy is on a “more positive trajectory with a lot of upside to come,” John Borshoff, the chief executive officer of Paladin Energy Ltd., said on a conference call Nov. 13. Global production cuts of 6 million to 8 million pounds are starting to take effect, he said.

Increasing tensions with Russia have reduced supplies from that country while the restarting of at least some of Japan’s reactors represents some good news from the demand side of the equation.

Uranium prices rallied in August to break the almost four-year progression of lower rally highs and continue to extend the rebound. Until recently the majority of related shares have been slow to respond but as metal prices extend the breakout investor interest in the sector is increasing once more.

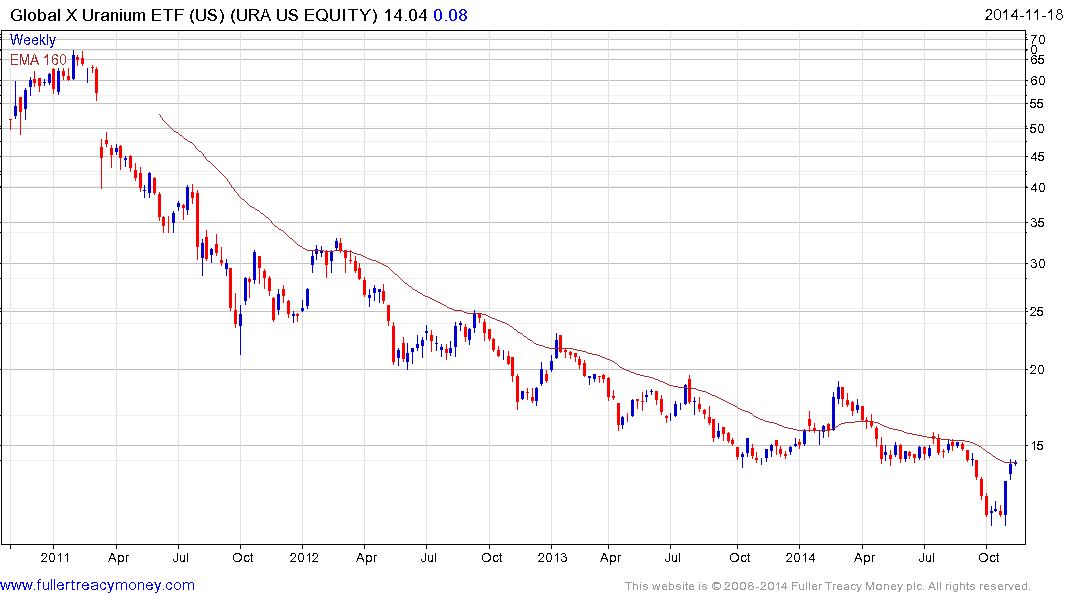

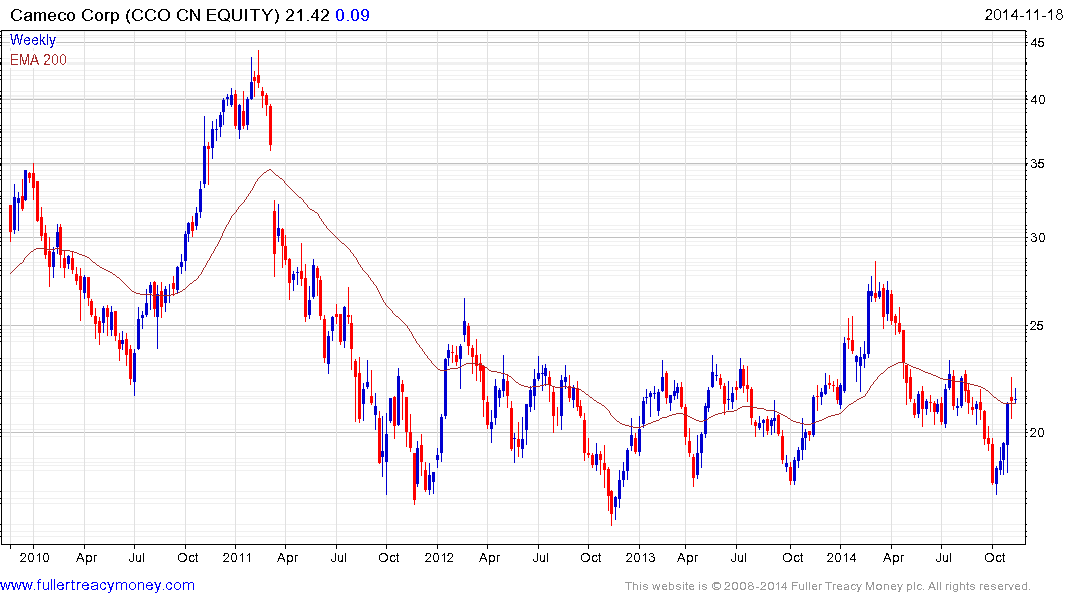

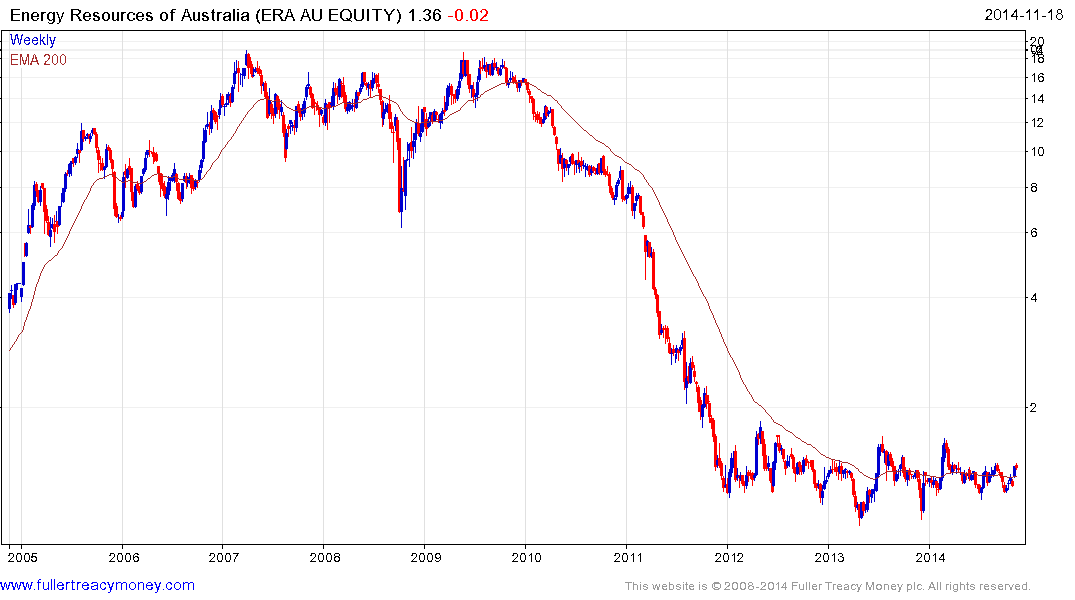

The following charts are in log scale in order to highlight the base formation characteristics without focusing on the depth of the prior declines.

Global X Uranium ETF has a market cap of approximately $250 million and has rallied over the last three weeks to unwind the oversold condition relative to the 200-day MA.

Among some of the larger companies, Cameco, Denison Mines and Energy Resources of Australia are rallying from the lower side of their respective base formations.

An important consideration for many investors is that the market cap of most uranium shares has declined to such an extent that liquidity is an issue.

Bannerman Resources (AU) has lost downward momentum and rallied over the last two weeks to post its first higher reaction low of any consequence in years.

Mega Uranium (CN) appears to be forming a first step above its Type-2 bottom as taught at The Chart Seminar.