U.S. shale is now cash flow neutral

This article from Mining.com may be of interest to subscribers. Here is a section:

Oil prices are probably already high enough to spark a rebound in shale production.

The IEA says that in the third quarter of 2016, the U.S. shale industry became cash flow neutral for the first time ever. That isn’t a typo. For years, the drilling boom was done with a lot of debt, and the revenues earned from steadily higher levels of output were not enough to cover the cost of drilling, even when oil prices traded above $100 per barrel in the go-go drilling days between 2011 and 2014. Even when U.S. oil production hit a peak at 9.7 million barrels per day in the second quarter of 2015, the industry did not break even. Indeed, shale companies were coming off of one of their worst quarters in terms of cash flow in recent history.

That all changed around the middle of 2015 when the most indebted and high-cost producers went out of business and consolidation began to take hold. E&P companies began cutting costs, laying off workers, squeezing their suppliers and deferring projects that no longer made sense.

By 2016, oil companies large and small had shed a lot of that extra fat, running leaner than at any point in the last few years. By the third quarter, oil prices had climbed back to above $40 and traded at around $50 per barrel for some time, replenishing some lost revenue. That was enough to make the industry cash flow neutral for the first time in its history.

The price of anything is heavily influenced by the marginal cost of production. If US onshore domestic unconventional oil plays are cash flow neutral at $50 it is reasonable to expect they will invest any free cash flow in expanding production at prices above that level.

That represents a challenge for OPEC which has been squabbling about the impact of Iran returning to reclaim its position in the oil market. The decision to cut supply was probably agreed because of the role US production, and indeed exports, now have in shaping global prices.

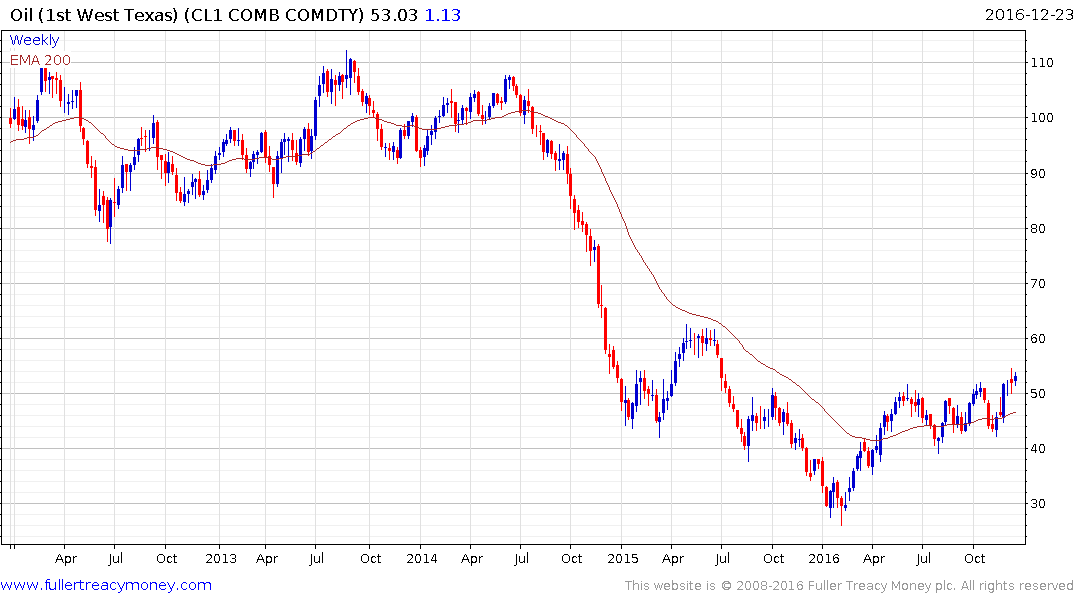

West Texas Intermediate Crude Oil spent much of the latter half of the year ranging in a consolidation of its rebound from its bear market lows. The breakout to new highs has so far held but is predicated on the assumption demand will improve with US economic growth; soaking up the available supply at these levels. A sustained move below the trend mean would be required to question medium-term scope for additional higher to lateral ranging.

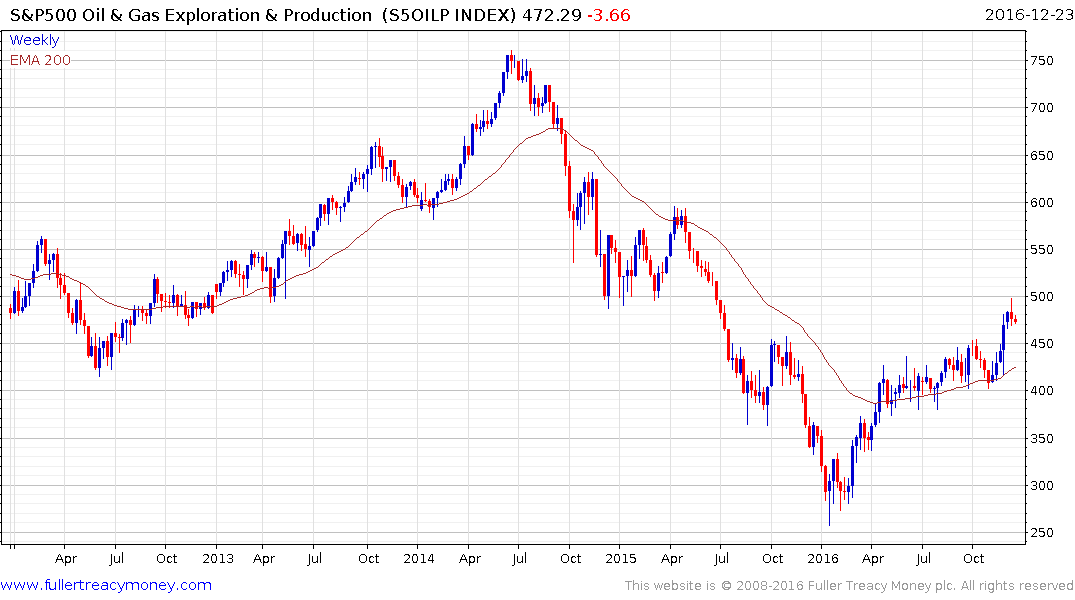

This development also suggests the leverage of oil producers to oil prices will persist. The S&P500 Oil and Gas E&P Index and the FTSE-350 Oil and Gas Producers Index continue to hold progressions of higher reaction lows but are somewhat overbought in the short term.