Trouble Brews for OPEC as Expensive Deep-Sea Oil Turns Cheap

This article by Serene Cheong, Sharon Cho and Dan Murtaugh for Bloomberg may be of interest to subscribers. Here is a section:

The falling costs make it more likely that investors will approve pumping crude from such large deep-water projects, the process for which is more complex and risky than drilling traditional fields on land. That may compete with OPEC’s oil to meet future supply gaps that the group sees forming as demand increases and output from existing wells naturally declines.

Saudi Arabia’s Al-Naimi left his post shortly after his speech targeting high-cost producers, and his successor Khalid Al-Falih organized production cuts by OPEC and some other nations that are set to run through March 2018. In a speech in Malaysia this month, Al-Falih bemoaned the lack of investment in higher-cost projects and said he fears the lack of them could cause demand to spike above supply in the future.

Warnings from OPEC of a looming shortage are “overstated and misleading,” Citigroup Inc. said in a report earlier this month. The revolution in unconventional supplies like shale is “unstoppable” unless prices fall below $40 a barrel, and deep- water output could grow by more than 1 million barrels a day by 2022, according to the bank.

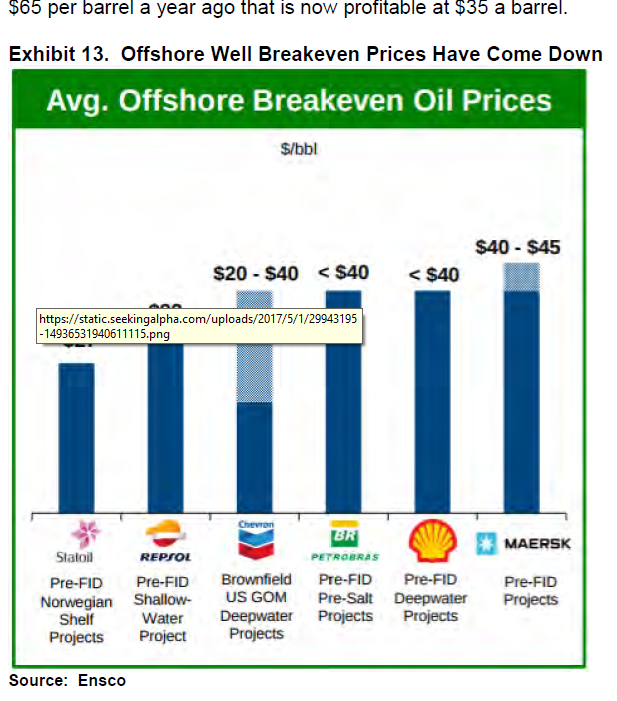

Royal Dutch Shell Plc in February approved its Kaikias deep-water project in the U.S. Gulf of Mexico, saying it would break even with prices below $40 a barrel. That followed BP Plc’s decision in December to move forward with its Mad Dog Phase 2 project in the Gulf, with costs estimated at $9 billion compared to $20 billion as originally planned.

Over the next three years, eight offshore projects may be approved with break-even prices below $50, according to a Transocean Ltd. presentation at the Scotia Howard Weil Energy Conference in New Orleans in March. Eni SpA could reach a final investment decision on a $10 billion Nigeria deep-water project by October.

Oil producers spent a decade investing in additional supply and while they went right on investing until prices declined, the reality is that a lot of that investment was in new technology which is now being used to drive prices down while exploration has been abandoned.

This graphic from the Musings from the Oil Patch report in the above piece may be of interest. It tells a compelling picture of profitability for major offshore projects at prices well below $50.

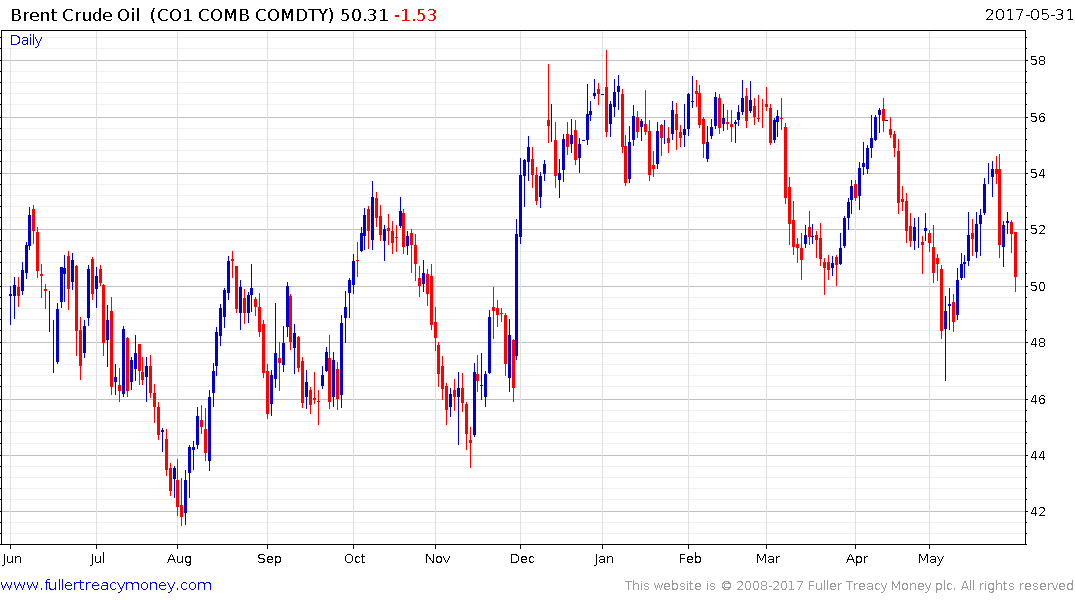

Much of the discussion about the oil market has focused on the speculation we may be entering a period of peak demand. However the reality is there is ample supply at today’s levels and the marginal cost of production has fallen to below $50. That still represents a higher marginal cost than before the commodity boom but is substantially below peak levels and suggests the most likely trajectory for oil prices is volatile ranging in a manner similar to natural gas’ pattern following its crash in 2008.

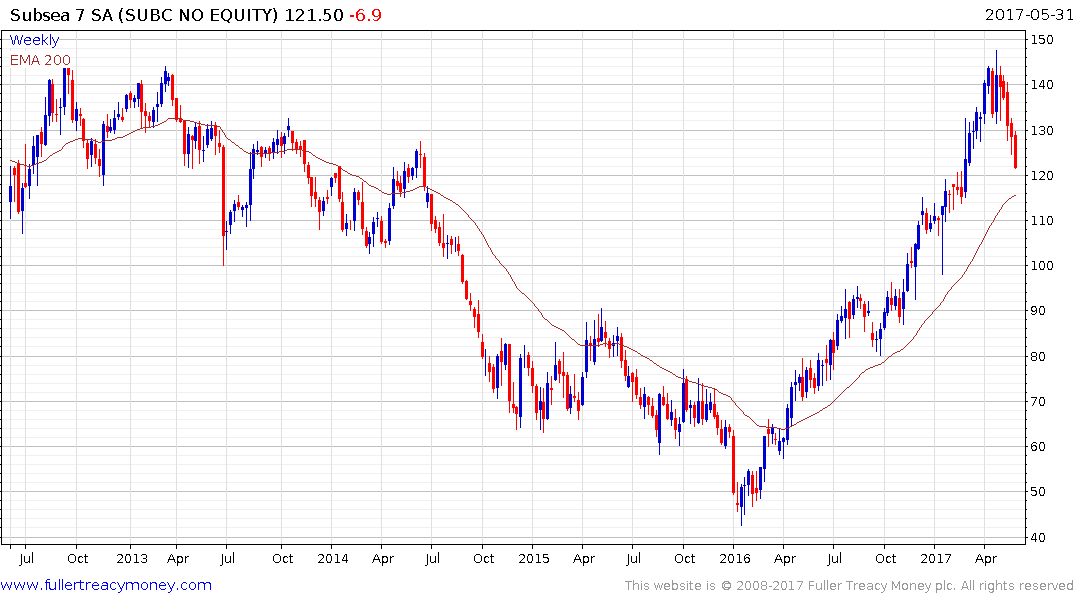

Subsea 7 have been among the most successful in cutting costs, and rallied impressively over the last 18-months; in contrast to the rest of the offshore sector. It encountered resistance in the region of the 2007 peak near NOK140 at the beginning of May and is now rapidly unwinding its short-term overbought condition. It will need to find support in the region of the trend mean if medium-term potential for additional upside is to be given the benefit of the doubt.