Top Oil Traders Say Emissions Market Could Challenge Crude

This article for Bloomberg may be of interest to subscribers. Here is a section:

Oil traders including Vitol and Trafigura, as well as a host of hedge funds have been building up trading desks to profit from one of the hottest commodities trades of the year. Traders are bracing for tighter supplies as the European Union is preparing for the markets biggest reform to date to align emissions trading with a stricter climate goal for the next decade.

“Carbon is already the largest commodity in the world, with the potential to be 10 times the size of the global crude markets,” Hauman said the FT Commodities Global Summit on Wednesday. “We see a massive potential here.”

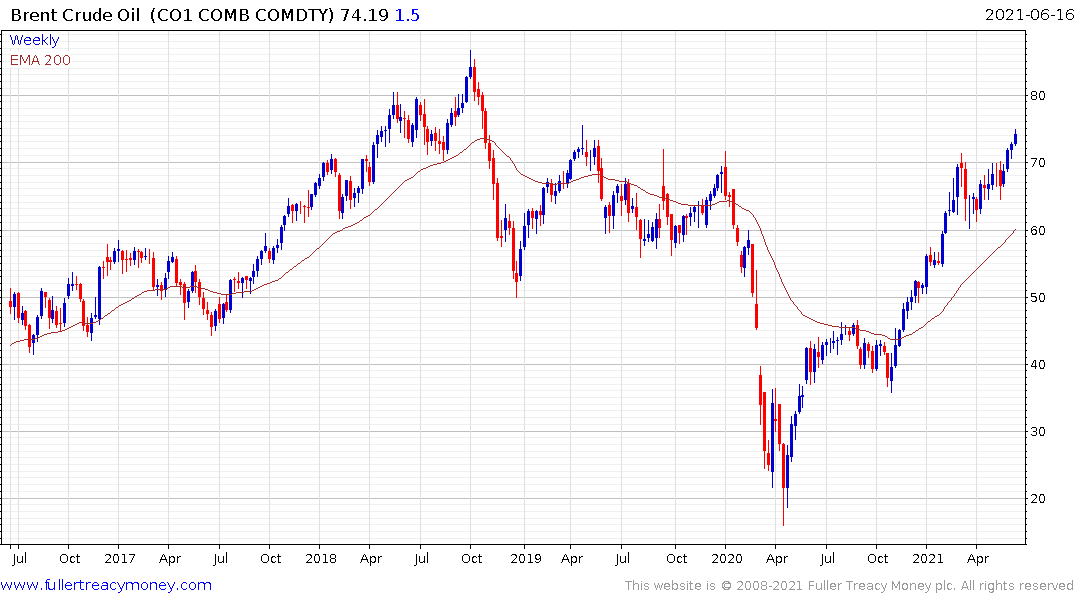

Carbon emissions are a growing market as the willingness to enact legislation to tax fossil fuel usage goes global. That is limiting the supply response of large companies because they are unwilling to make the investments necessary to replace reserves. The global economic recovery and OPEC+’s supply discipline continue to support oil prices as a result.

As we look at the history of carbon credits, the supply situation is dependent on how many governing bodies are willing issue on any given year. When there is are too many prices can collapse. When there are too few, the price can explode on the upside, like we have seen over the last 12 months.

The stated European position to see the price at €100. That suggests they will limit supply of emissions contracts in order to support the market over the medium-term. Explicit political support for the trading mechanism means carbon pricing is an additional premium on the cost of production for companies subject to the market.

That’s the primary reason European oil companies are underperforming US companies by such a wide margin.

Back to top