This is how much copper, nickel, cobalt an electric vehicle world needs

This article by Frik Els for Mining.com may be of interest to subscribers. Here is a section:

The London-based research company modelled metal requirements across the supply chain – from generation and grid infrastructure through to storage, charging and vehicles – based on relatively modest penetration of EVs in the total global vehicle market out to 2030.

According to the study as early as 2020, when EVs would still make up only 2% of new vehicle sales, related metal demand already becomes significant, requiring an additional 390,000 tonnes of copper, 85,000 tonnes of nickel and 24,000 tonnes of cobalt.

Based on an EV market share of less than 32% in 2030, forecast metal requirements are roughly 4.1m tonnes of additional copper (18% of 2016 supply). The move away from gasoline and diesel-powered vehicles would need 56% more nickel production or 1.1m tonnes compared to 2016 and 314,000 tonnes of cobalt, a fourfold increase from 2016 supply.

Miners went through a decade of investing in supply and then prices collapsed. They were forced to cancel exploration and to focus on free cash flow. Appetite for investing in additional new supply is low but there are obvious demand drivers coming from the electric car market.

The supply inelasticity meets rising demand argument that propelled iron-ore and coal in the last cycle might equally now be applied to the copper, nickel, cobalt and lithium markets.

Copper bounced over the last couple of weeks from the region of the trend mean.

Nickel is still divided between the dominance of the stainless-steel market, compared to the growth of the battery market, but bounced this week from the region of the trend mean.

Cobalt prices have accelerated of late but a sustained move below the trend mean, currently near $60,000, would be required to question medium-term scope for continued upside.

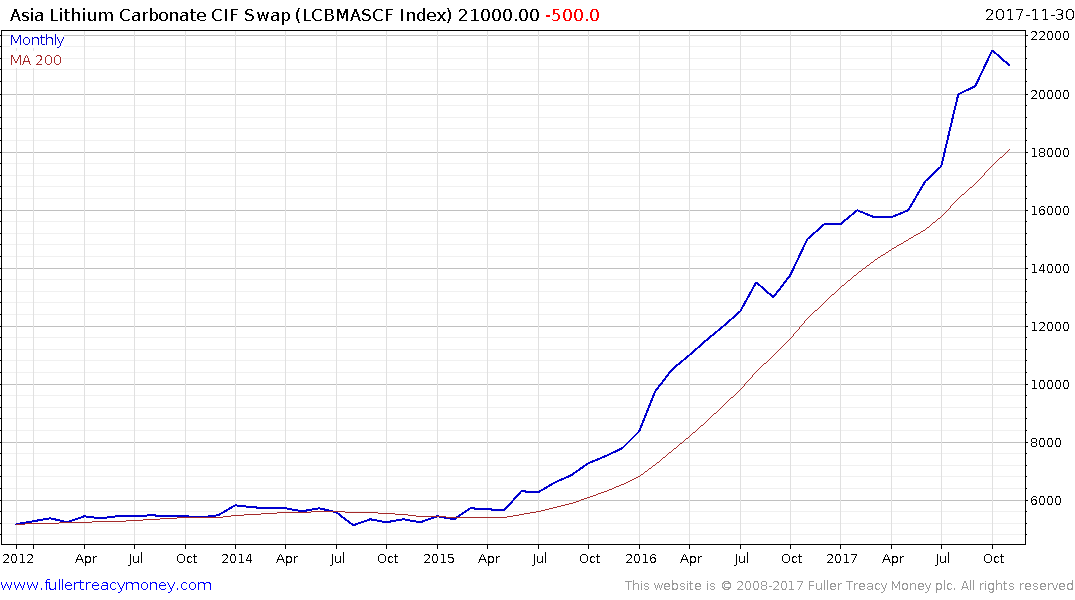

Lithium prices have gone from $5,000 to over $20,000 since early 2015 and while a pause is currently underway, a sustained move below $20,000 would be required to check the advance.

Glencore is well positioned as a producer of three of the four metals integral to the growth of the battery sector. The share bounced over the last two weeks from the region of the trend mean and a sustained move below it would be required to question medium-term scope for continued upside.