The Weak Spot in the Oil Market That Traders Are Missing

This article by Stephanie Ying for the Wall Street Journal may be of interest to subscribers. Here is a section:

Faltering demand in Germany has preceded weak industrial data, which raised fears of a continued slowdown in Europe’s largest economy. Industrial production dropped for the fourth straight month in December, and Germany’s economy contracted in the third quarter of 2018 for the first time since 2015.

Standard Chartered analysts warn that the weakness could spread to other parts of Europe, further undermining demand for oil.

German demand makes up a minor fraction of the world’s oil consumption; the country was the 10th largest oil consumer in 2016, accounting for 2% of the global total, according to the U.S. Energy Information Administration. Since China made up 13% of oil consumption as of 2016, a drop in Chinese demand growth would likely have a comparatively larger impact.

Additionally, signs of slowing demand in other parts of Europe haven’t materialized, Mr. Horsnell noted.

Saudi Arabia continues to cut back on supply which buoyed the market today. However, the reasons for this move are not only to support prices but also in response to the slowdown in the global economy which is being led by Europe and China.

Germany’s exports primary go to the Eurozone and China and both of these destinations are experiencing slowdowns at present. The country squeaked by with positive growth in the 4th quarter to avoid a recession but that does nothing to defray the risk from Italy’s contraction, France’s slowdown and the impending collapse of the Spanish government. All of these factors are representative of the region’s continued inability to grow its way out of trouble.

Crude oil is testing the upper side of its short range following the Saudi announcement this morning.

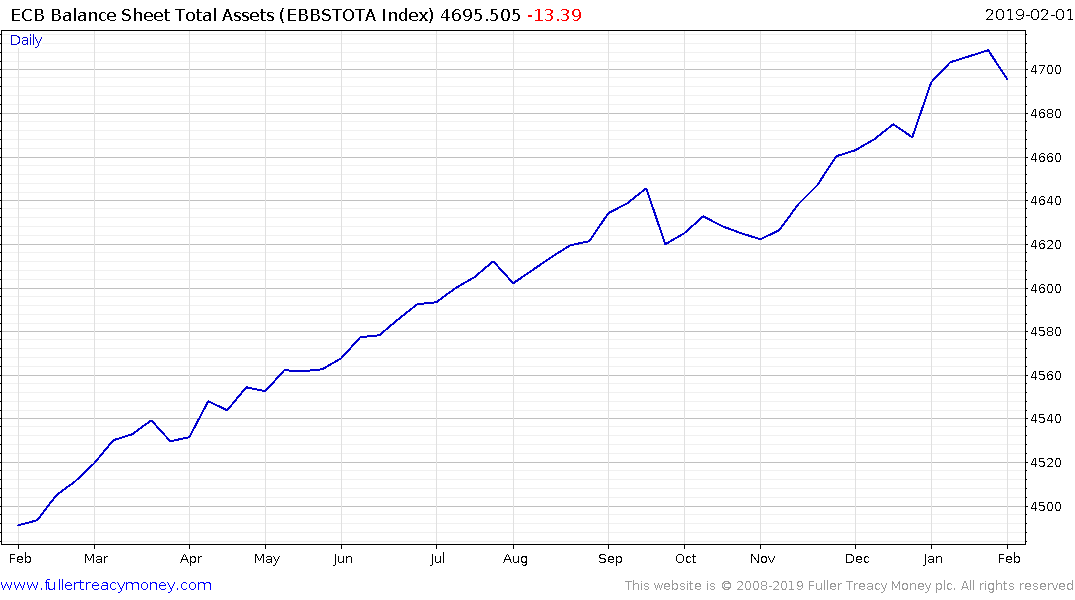

Meanwhile the ECB publicly stated its QE program is over but the continued uptrend in its balance sheet does not corroborate that claim. Considering the pressure coming to bear on the bloc’s economy there is no prospect of the ECB raising interest rates and it is increasingly likely it will have to embark on further stimulus.

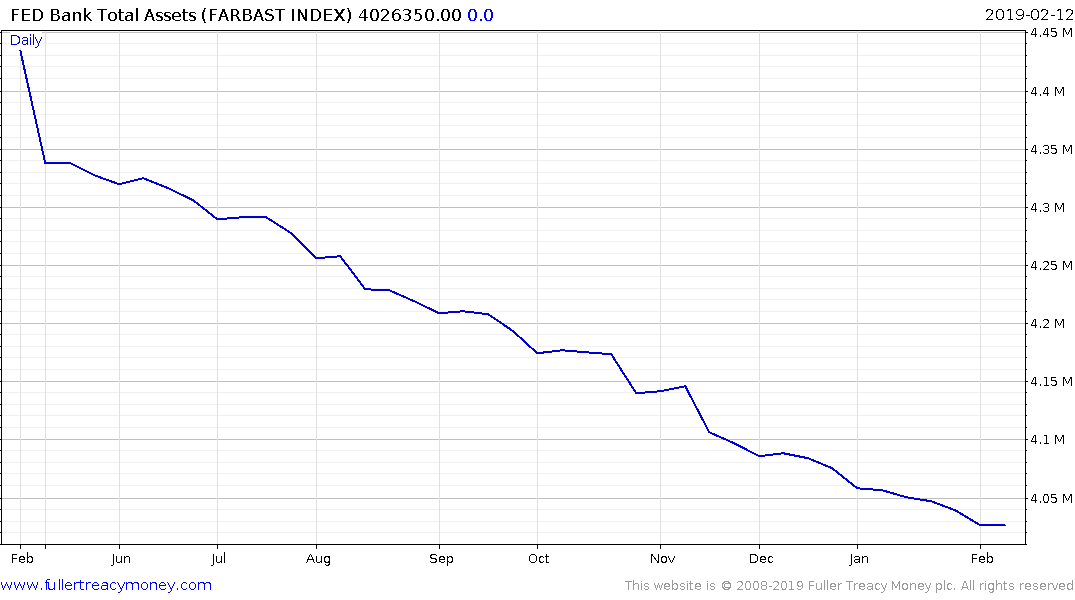

At the other end of the scale the Federal Reserve stated they are open to moderating the pace of the balance sheet run-off but there is no evidence they have changed anything, at least not yet.

The Euro broke its sequence of consecutive declines today by posting an outside day. Upside follow through tomorrow would bolster the view it is still ranging. However, the bigger picture is the Eurozone needs a weaker currency more than the USA right now suggesting the ECB will keep printing.

European equities tend to bound when the currency is week so today’s bounce today was noteworthy. The DAX Index, however, needs to break its eight-month progression of lower rally highs to signal more than temporary steadying.