The Oil Crisis is Unfolding in Slow Motion

This article from Goehring & Rozencwajg which may be of interest to subscribers. Here is a section:

If an EROEI of 10:1 resulted in de minimis economic growth, what can we use this 10:1 number to infer about how high oil prices can go today? An EROEI of 10:1 means that 10% of all energy goes to sustain the energy supply. If energy is a good proxy for general economic activity, then an economy should stagnate once 10% of its GDP goes towards producing (and by extension consuming) energy. Evidence backs this up. Many academic studies suggest an economy will fall into recession once energy takes up 10% of total GDP – an empirical result that agrees with our theory.

In 2008, energy prices were approximately 10% of GDP right before the global financial crisis. If oil represents about half of all energy consumed, this means an economy will stall when oil represent about 5% of GDP. In 2008, the US consumed 18.8 m b/d. At $120 per barrel that equated to $823 bn or 5.6% of the $14.7 tr US GDP. The economy fell into recession shortly thereafter. In 2012-14, oil consumption never exceeded 3.5% of US GDP and prices stayed between $90 and $100 per barrel with no impact on either demand or economic activity.

Today, oil represents less than 3.3% of US GDP and would have to rise to $140 per barrel before approaching the critical 5% threshold. Why do we focus only on the US? Demand is the most elastic in wealthy countries with high energy intensities and the least elastic in developing countries that need energy to fuel their ongoing development. In 2008, prices spiked as high as $145 per barrel albeit temporarily. In this cycle, we believe oil prices will at some point reach, and potentially significantly exceed the previous $145 per barrel peak before we begin to see evidence of demand destruction.

How high do prices have to go to limit demand might not be the correct question. It’s well understood that oil spikes are one of the leading causes of recessions, because energy is a tax on consumption. That suggests the speed of the price rise is at least as important as the headline rate.

Consumers are alarmed at the speed of the recent advance. It’s easy to make the academic argument that oil is less important to developed economies today than it was in 2007 or that prices are still contained when adjusted for the loss of purchasing power of that time. The challenge is these arguments ignore the pressure the poorer half of society experience when oil prices rise. Spending an extra $30-$50 a week is not an option for many families.

We are at a critical point at present. The price rise has raised alarm. If it were to reaccelerate that would spell significant trouble for the global economy. At present it looks like people are about to get some relief.

The backwardation between the front and second month contracts has moderated over the last month. It is still at $3.50 which would have been a record level below last month but it is coming back down. The fact the backwardation is no longer accelerating higher suggests we should expect more ranging than trending for oil prices.

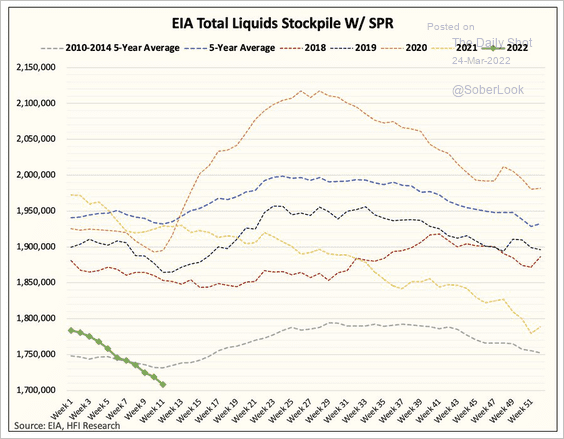

Inventories are at historically low levels and producers are looking to extract meaningful concessions before committing to spending on additional supply. That is likely to mean either credit guarantees, permits for drilling on federal land, and/or relaxation of emissions regulations like bans on flaring gas. Until there is a meaningful uptick in drilling activity, that will act to support prices.

Inventories are at historically low levels and producers are looking to extract meaningful concessions before committing to spending on additional supply. That is likely to mean either credit guarantees, permits for drilling on federal land, and/or relaxation of emissions regulations like bans on flaring gas. Until there is a meaningful uptick in drilling activity, that will act to support prices.

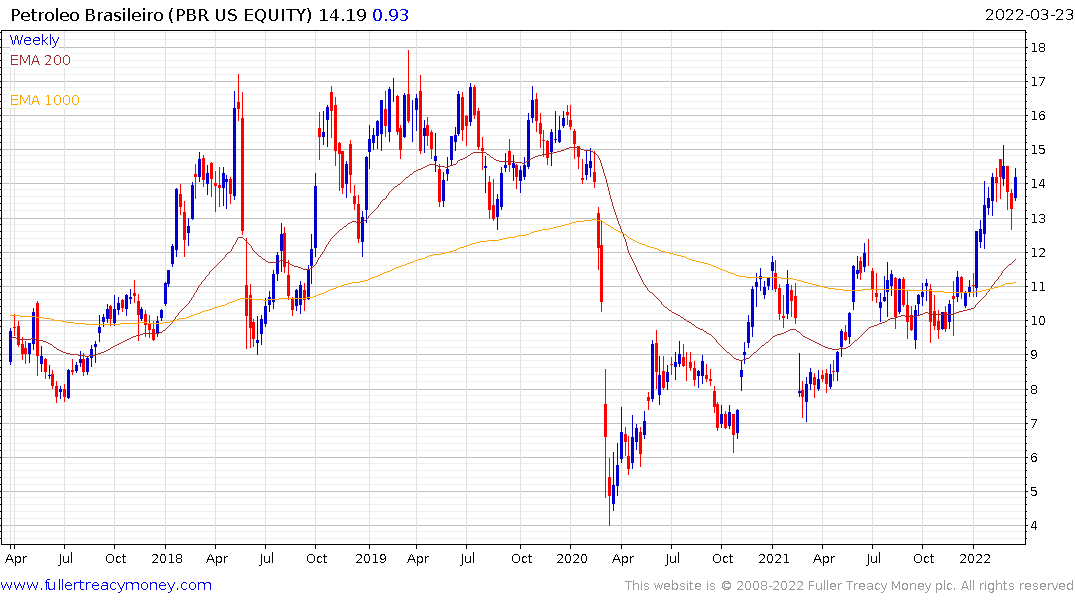

The big caveat is the market is uniquely susceptible to volatility because of the low inventory figures and lack of a quickly available supply source.Higher cost producers like Petroleo Brasileiro continue to recover.

The oil services sector also continues to extend its breakout from its base formation.