The Invasion of Ukraine Is a Tragic Sin

This article by Leonid Bershidsky for Bloomberg may be of interest to subscribers. Here is a section:

I have met Putin, and I have watched him as a journalist since before he became president. My analysis of his actions was always based on the assumption of his rationality. There was always something to gain, a manageable risk of losing. Perhaps I was wrong from the start. Perhaps Putin has changed in recent years as his close circle narrowed and negative selection expelled people with a broader vision from the ranks of his advisors. Quite likely, Ukraine has long constituted an exception from Putin’s rationality, as most of its people time and time again chose the Western path, away from Putin’s vision of the Russian World.

I left Russia after the Crimea annexation because I couldn’t accept it and felt it was a great historical wrong — both for Ukraine and for Russia. But I ended up returning to that assumption of rationality. I analyzed Putin’s moves from a cost and benefit perspective. I have a lot of rethinking to do.

The invasion is an irrational move. It makes any further negotiations with Putin and his clique pointless: There is, quite clearly, nothing he won't do, no line he won’t cross, no matter what he says or what deal he makes. From this point on, autarky is the only feasible economic choice for Russia, and a retreat into isolation is the only remaining cultural and political choice. At the same time, Russia's dependence on China, which has grown in recent years, is no longer a matter of choice. Any security benefits from turning Ukraine — and neighboring Belarus, from whose territory Putin also attacked — into a buffer state are illusory since Russia also borders actual NATO member states, which now will arm themselves as heavily as possible.

I was not expecting a full-scale invasion, but my positions benefitted anyway. I agree we are now in a new environment and it will be years before Russia’s relationship with most of its biggest trading partners is repaired.

Russia’s invasion appears irrational but there is also a cool predatory calculus in play. By removing itself from dependence on the US Dollar, Russia has already preemptively acted to insulate itself from sanctions.

They obviously believe now is the most opportune time to act on their long-held aspirations. They believe NATO and the EU have been weakened and disillusioned by the pandemic, political polarization is at record highs, and much of Europe is actively dismantling energy infrastructure. That is only increasing near-term reliance on Russian imports.

The US population is also weary from two decades of war. Russia’s belief they have no appetite for opening a new front against a well-supplied, sophisticated enemy in Europe was confirmed late last year when President Biden stated he has no intention of sending troops into Ukraine. Russia’s administration saw an opportunity and they are taking it. This kind of action is reprehensible, but it is the reality of the world we live in.

Ukraine is not in the EU or NATO but the trend of closer ties was clear. That was also part of the Russian decision to invade. They believed that if they do not move now, they would never have another opportunity.

It appears Putin’s cabal have concluded the reality of mutually assured destruction from nuclear weapons means you can ratchet up tensions with little risk of overt counteraction. The options available to your adversary are limited because of the ultimate threat of total-destruction.

So, now the big question is what will the EU and NATO do about it? North Korea-style sanctions would send a clear message but it would come at a deep cost to the global economy. Russia is betting Ukraine is not worth the sacrifice for the EU and NATO.

The sanctions announced by the USA today freeze Russian financial assets and not much more. Commodity markets have been subject to volatility but the initial rallies were not sustained. Investors are betting the Western reaction to Russian aggression will be muted and that the status quo of international trade will remain unchanged.

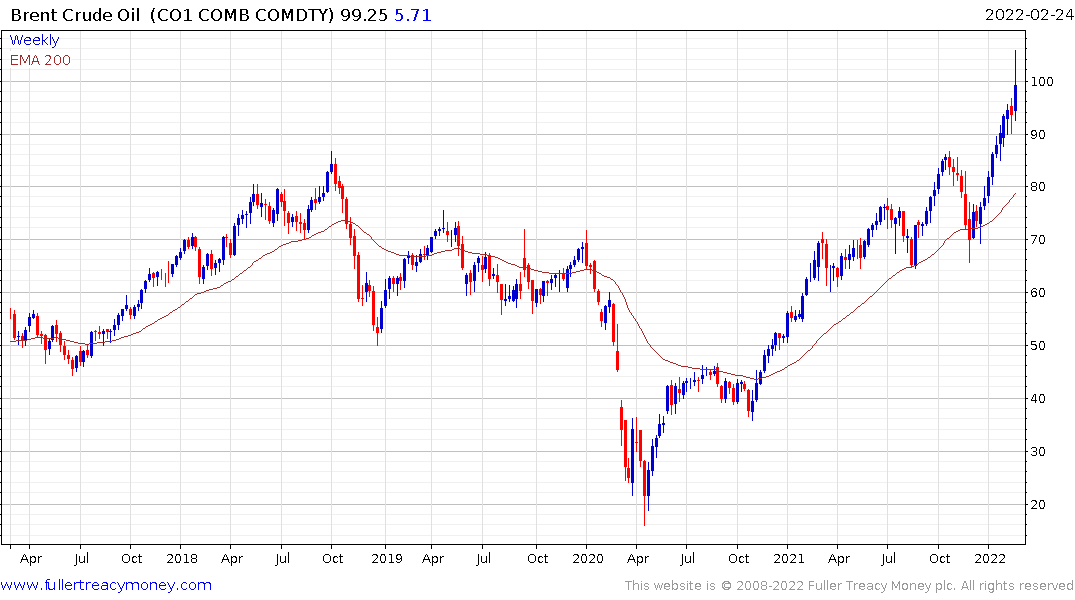

With the release of oil from the strategic reserve, oil prices are likely to experience at least a reversion towards the mean.

With the release of oil from the strategic reserve, oil prices are likely to experience at least a reversion towards the mean.

Gold posted a large downside key reversal to close below $1900. That also suggests an unwinding of the short-term overbought condition.

At a minimum, this episode suggests the path of policy normalization is likely to be lengthier than investors were pricing in only a week ago. That should lend support to the growth sector of the market. The Nasdaq-100 rebounded from the intraday low to finish up on the day.

At a minimum, this episode suggests the path of policy normalization is likely to be lengthier than investors were pricing in only a week ago. That should lend support to the growth sector of the market. The Nasdaq-100 rebounded from the intraday low to finish up on the day.