The Future of Copper

Thanks to a subscriber for this report from S&P Global which may be of interest. Here is a section from the conclusion:

Notably, neither scenario assumes that the growth in new capacity—expansions and new mines—speeds up. Absent a major policy shift, however, regulatory, permitting, and legal challenges, combined with long timelines for new mines to come onstream, will continue to dampen the pace of supply increases. This supply-demand gap for copper will pose a significant challenge to the energy transition timeline targeting Net-Zero Emissions by 2050. The challenge will be compounded by increasingly complex geopolitical and country-level operating environments. These include

The strategic rivalry between the United States and China—over a projected period in which China will remain the dominant global supplier of refined copper, while the United States depends on imports for well over half its copper.

Russia’s invasion of Ukraine and its cascading effects on the commodities markets and energy security, which have highlighted the vulnerability of supply chains. “Supply chain resilience” policies aiming to secure reliable supplies of the materials needed for energy transition—and economies in general—are likely to be a central feature of the emerging geopolitics.

A growing tension between energy transition, social license, and ESG objectives that dramatically increase the need for minerals like copper on one hand, while raising the compliance, legal, and operational costs of mining those minerals on the other.

The risk of a significant, structural increase in copper prices as the supply-demand gap increases, with a potentially destabilizing impact on global markets and industry. While structurally higher prices incentivize international investment in new capacity, governments in sourcing countries are likely to seek to capture domestically a rising share of revenues.

The fragmenting of globalization and a resurgence of resource nationalism. The resulting challenge for all actors involved with the energy transition will be to manage often competing and seemingly contradictory priorities. It is clear that technology and policy innovation will both be critical to reducing the supply-demand gap for copper in order to help enable the net-zero goals

Here is a link to the full report.

Every major bull market which climaxes in a mania exhibits contradictory arguments. We are fully aware of the earnings don’t matter claims from the 1990s or house prices only go up ahead of the GFC. The difficulties with fulfilment of the renewable energy idealistic dream are a fresh contradiction. It is impossible to double copper production within 13 years. Therefore, there is no possible way the zero carbon ambitions of the green lobby can be realized.

The price continues to distribute mostly below the 1000-day MA and with a global recession looming, there is clear scope for additional downside. The only possible way sufficient copper will be available to meet the demands of a renewable energy buildout will be if Chinese demand evaporates.

If that were only an infrastructure/housing issue it might be partially realizable but much of the copper China’s consumption goes into export products. This tight supply and price sensitive condition is a recipe for extremely volatile trading. Significant drops in copper prices will fuel demand from EVs and renewables but surges will kill off demand.

China’s CATL has posted a lower rally high and is falling back towards the lows. This is no longer a consistent trend and it will at least need to hold the CNY350 area if the benefit of the doubt is to be given to the upside.

Meanwhile there is solid commonality in the performance of US listed battery companies. Evonix has first step above the base characteristics.

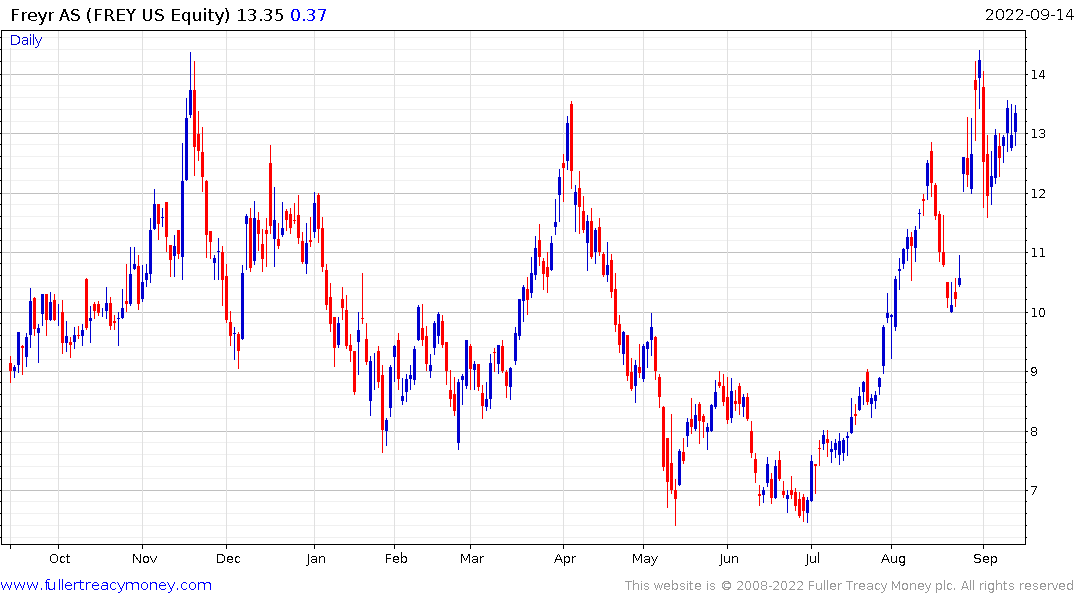

Freyr Battery is testing the upper side of a six-month range.

Freyr Battery is testing the upper side of a six-month range.

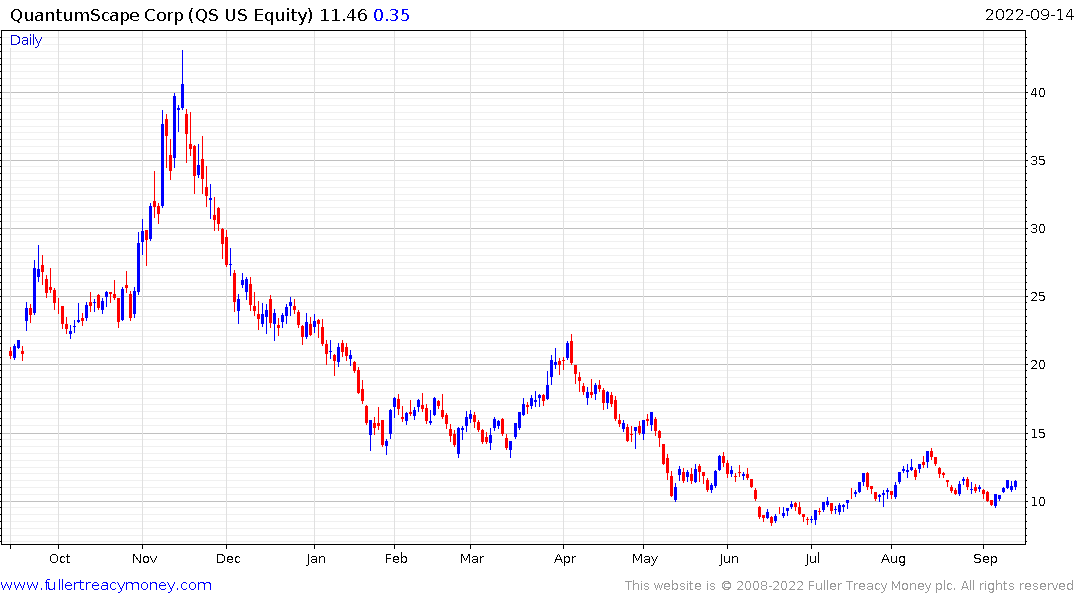

ESS Tech, QuantumScape and Solid Power appear to be building base formations.