The Freeport LNG Paradox

This article from Goehring & Rozencwajg may be of interest to subscribers. Here is the conclusion:

With the announcement that Freeport will likely resume exports in October, much sooner than originally planned, combined with low inventories and a gas supply that has shown little in the way of growth, we believe the risk of a Q4 price spike in North American natural gas is once again high.

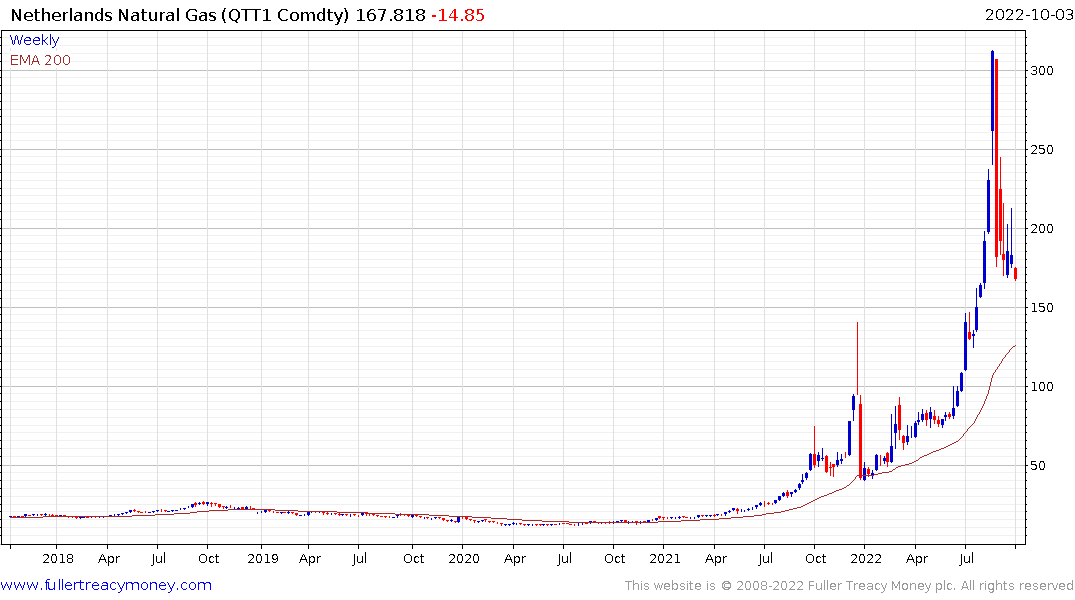

Natural gas has quickly gone from relative obscurity to geopolitical lynchpin. In the summer of 2020, seaborn LNG reached a low of $1.90 per mmcf while oil prices turned negative. Together, this represented the lowest energy costs in human history. Two short years later, LNG has risen 30-fold to $58 per mmcf, representing the highest energy costs in human history. Such is the result of a decade of underinvestment. Given the fragility of the world’s energy supply, it is no wonder tyrants and despots are moving to weaponize fuel sources. We do not expect this trend to stop and recommend investors position themselves accordingly. We remain extremely bullish on North American natural gas and recommend investors continue holding their natural gas related equities.

Some of information quoted in this report is not accurate. For example, Rhine river levels could approach normal depths this week, and France changed the rules on nuclear power heating of river water in August. European coal prices peaked in March and continue to unwind an overbought condition.

There is a clear temptation to think Europe’s economic demise is completely unavoidable. However, it is also one of the most hotly anticipated crises I have encountered. That’s not generally how markets work. The usual process is investors price in the crisis ahead of time and it would then need to be even worse than feared to sustain a higher plateau for prices.

The explosion at the Freeport LNG plant reduced the pass through of higher European prices to the US market because supply was impossible to export in sufficient volumes. There are also physical limits to how much gas Europe can import because there are only so many floating regasification units and new import terminals will not be built before the end of this winter.

The team at G&R have been adamant in their claims that falling rig counts are coincident with peak production growth levels. However, rising interest rates, tight liquidity conditions, unavailability of investment capital because of the ESG movement and technological innovation all also major considerations in accounting for less drilling activity.

In fact, both horizontal and rotary rig counts are approaching 2016 levels.

Henry Hub gas is back in the region of the 200-day MA. If the trend is to remain reasonably consistent it will need to find support in this area.

The run-up from the $4 to $10 was the only significant advance that was not associated with hurricane damage. Meanwhile new sources of demand have appeared that did not exist a decade ago. Natural gas has taken over from coal in new power plants and LNG is creating a globally fungible market. Those two factors suggest somewhat higher prices for US gas than has been the norm over the last decade.

Restarting exports from the Freeport LNG facility is particularly beneficial for both EOG Resources and Devon Energy since they supply the plant with gas.

The one thing that no one seems to talk about is what the US government would do if natural gas prices were to surge higher. With the stroke of a pen exports could be stopped or curtailed. That would sever the fungibility argument so unmitigated bullishness should be tempered. Too much of a good thing is not always positive.

Back to top