The Age of Energy Insecurity

Thanks to a subscriber for this article from Foreign Affairs. Here is a section:

Even with redoubled efforts to produce more clean energy at home, the United States and others will still depend on China for critical minerals and other clean energy components and technologies for years to come, creating vulnerabilities to Chinese-induced shocks. For instance, in recent months, China has suggested that it may restrict the export of solar energy technologies, materials, and know-how as a response to restrictions that Washington imposed last year on the export of high-end semiconductors and machinery to China. If Beijing were to follow through on this threat or curtail the export of critical minerals or advanced batteries to major economies (just as it cut off rare earth supplies to Japan in the early 2010s), large segments of the clean energy economy could suffer setbacks.

Traditional energy heavyweights are also recalibrating their positions in response to the changing geopolitical landscape in ways that increase energy security risks. Saudi Arabia, for instance, now sees its global stance differently than it did in the decades that followed the famous “oil for security” bargain struck by U.S. President Franklin Roosevelt and Saudi King Abdulaziz ibn Saud on Valentine’s Day in 1945. Riyadh is now far less concerned with accommodating Washington’s requests, overt or implied, to supply oil markets in ways consistent with U.S. interests. In the face of a perceived or real decrease in U.S. strategic commitment to the Middle East, Riyadh has concluded it must tend to other relationships—especially its links to China, the single largest customer for its oil. The kingdom’s acceptance of China as a guarantor of the recent Iranian-Saudi rapprochement bolsters Beijing’s role in the region and its global status. Relations with Moscow have also become particularly important to Saudi Arabia. Regardless of the invasion of Ukraine, the Saudi government believes that Russia remains an essential economic partner and collaborator in managing oil-market volatility. It will therefore be extremely reluctant to take positions that pit the Saudi leadership against Putin.

Here is a PDF of the full article.

A war is underway in the energy markets. Suppliers are intent on sustaining high prices and eco-warriors fervently hope high prices will wean the world from its addiction. Consumers are caught in the middle and have little in the way of choice as they face increasing regulatory and infrastructure costs.

The contradiction of relying on weather dependent energy when you are worried about a changing climate has not yet featured into the decision making of governments. That is doubly puzzling when Europeans are some of the world’s largest energy importers and are choosing to pay more.

Christine Lagarde this week was talking about how successful the EU has been in avoiding an energy crisis and even had positive growth to boot. She did not mention the €800 billion required to achieve that success or how growth will be when it stops. Most particularly she did not draw any connection between rampant money printing and how sticky inflation remains.

Meanwhile, China invested heavily and aggressively in building manufacturing capacity for rare earth metals, batteries, solar and wind. Substituting reliance on OPEC+ for reliance on China is not something anyone is particularly happy about. China is also burning more coal than ever.

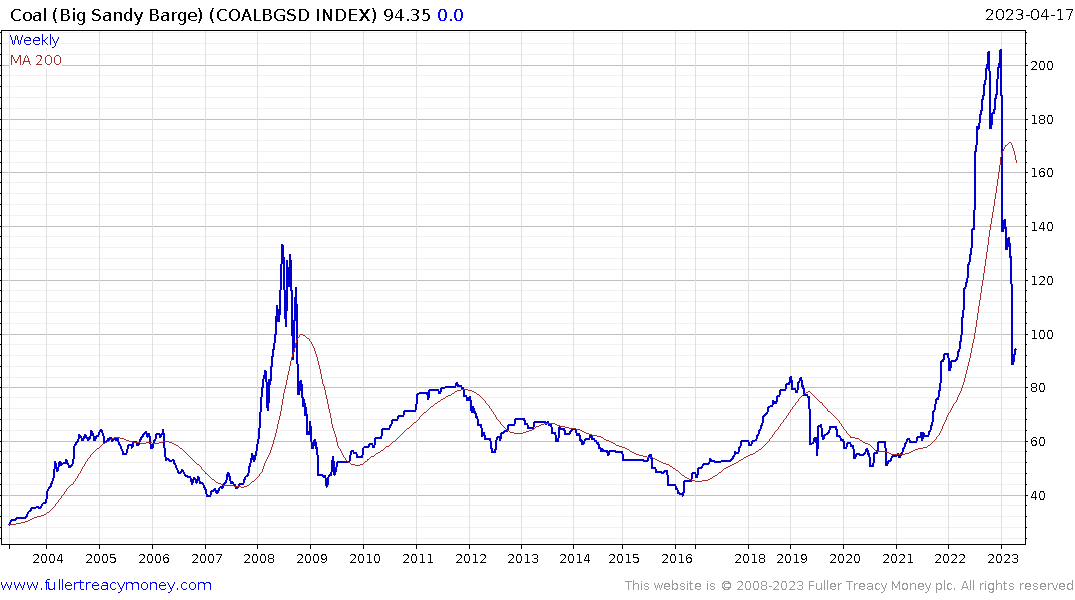

US natural gas prices are still testing the $2 lows. Low sulfur coal spot prices have almost made the round trip to retest the peaks from 2019. West Texas Intermediate is now also included in the calculation of the Brent benchmark which suggests the USA has a part in the global price setting mechanism.

Tesla has spent significant capital building manufacturing capacity. They have now realized $80,000 is not a mass market vehicle price. The price cuts announced year to date suggest the margin strength of the automotive sector will be under significant pressure for at least the next couple of years. I wonder how long it will be before the airlines learn the same lesson. Ryanair is talking about double digit price increases this year for example.

When we think about where energy insecurity is most relevant, it appears neither China nor the USA should be the focus of attention. I expect to see a great deal of volatility in prices over the coming years as environmental regulations make carbon emissions more expensive but that is still going to be a bigger challenge for consumers than suppliers. It’s one of the biggest headwinds to Europe sustaining its stock market outperformance.

Back to top