Summers Says Fed 'Let Us Down Quite Badly' and Still Unrealistic

This article from Bloomberg may be of interest to subscribers. Here it is in full:

Former Treasury Secretary Lawrence Summers issued one of his harshest criticisms yet of the Federal Reserve’s slowness in moving to raise interest rates, and warned that policy makers are still presenting forecasts that are unrealistic.

“In 2021, our central bank let us down quite badly,” hurting policy makers’ credibility, Summers said on Bloomberg Television’s “Wall Street Week.” “It made mistakes in the core functioning of a central bank,” including in its failure to lean in against fiscal stimulus last year, he said.

Among the errors has been a “repeated poor forecasting record -- and I have to say that it’s not something that’s been fully fixed,” Summers said. The June median Fed official predictions showed inflation coming back toward the 2% target but unemployment only reaching a high of 4.1% by 2024 -- a “highly implausible” result, he said.

“Frankly I think in 2021 our central bank lost its way. It was talking about the environment, talking about social justice in a range of things,” Summers, a Harvard University professor and paid contributor to Bloomberg TV, said. “It was confidently dismissing concerns about inflation as transitory.”

Turning to Japan, which has seen its currency tumble to the weakest since 1998 as the Bank of Japan declines to join its peers in tightening policy, Summers said it’s likely to be a challenge to exit the current zero-yield targeting regime.

Dollar’s Impact

“Sooner or later they’re going to leave the yield curve control strategy and I’m not entirely sure what’s going to happen when they do,” Summers said. “In the meantime, the pressures are likely to build,” with the potential for “an even weaker yen,” he said.While some emerging markets are also suffering from a strengthening dollar, Summers said that he didn’t see a “systemic” crisis along the lines of 1998. Still, countries with “particularly unsound policies” including Turkey and Argentina are a concern, he said.

The world as it is, the reactions of traders to evolving stimuli, and the world as we would like it to be, are three very different places.

The reality of massive money supply growth in 2020/21, and the subsequent decline in supply growth represent the background for market. The absence of clear sources of new liquidity suggest it is unproductive to expect sharp rebounds on par with those seen in 2021.

The very real possibility Russia will not restart the Nord Stream 1 pipeline on schedule on July 21st is an additional challenge and virtually ensures Europe is going to experience a deep recession.

We have ample evidence to support the view that restricting money supply growth and central bank balance sheet contraction contribute to deflationary forces. The sheet volume of outstanding debt means markets are more sensitive to these factors than in the past.

Traders look at these factors and weigh the potential for additional tightening. By definition, the frontloading of interest rate hikes brings forward the peak of the cycle. That also suggests pricing in the low in the stock market can also be brought forward.

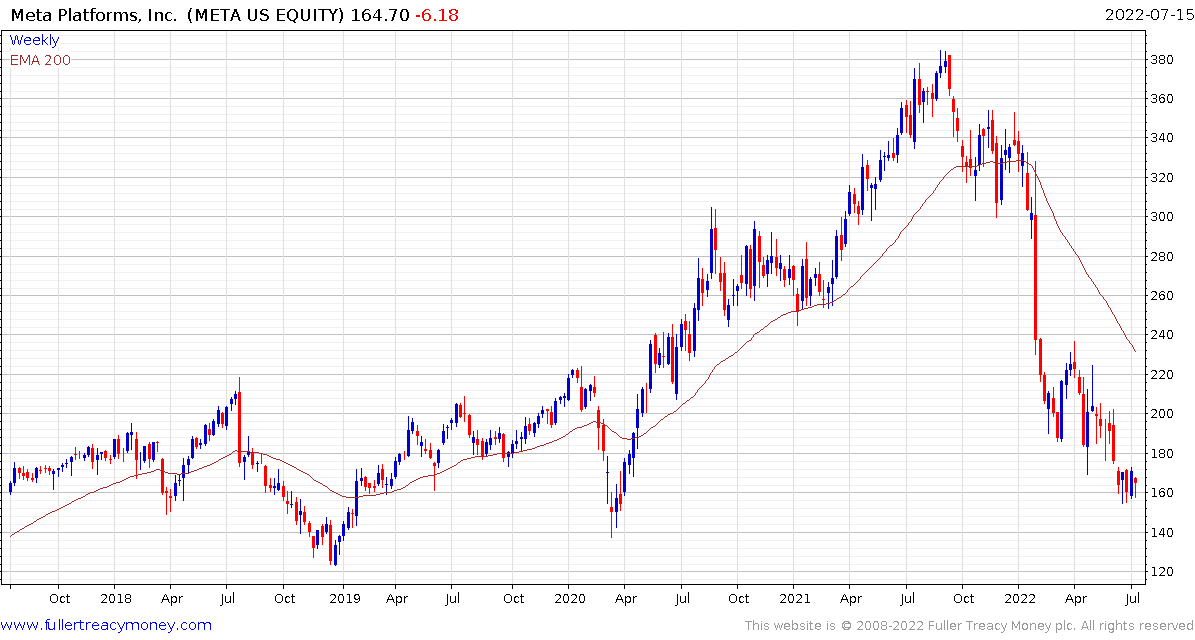

I closed out the most expensively purchased portion of my Nasdaq-100 short last two weeks ago because I was expecting a short covering rally to unwind the oversold condition. That now appears to be unfolding. A surprisingly positive earnings report from Citi and the significant recalibration of valuations for companies like Netflix (Est P/E 17) and Meta Platforms (Est P/E 14) are supporting bargain hunting.

We would like to believe a repeat of the swift rebound from the correction lows and a surge to new fresh new all-time highs is inevitable. We’ve been conditioned to believe that is the most likely scenario because of successive rounds of liquidity provision. The base case for bulls is the Fed will return to the pattern of supplying ample liquidity in the face of a deflationary threat so frontloading of interest hikes brings that day closer.

The big challenge to that conclusion is the deteriorating geopolitical situation where Russia and China are overtly attempting to challenge the Dollar’s hegemony. Debasing the currency is not well aligned with attempting to ensure the Dollar remains the reserve currency so we are heading into a more uncertain period.

In the absence of clear liquidity stimuli, accelerated declines end with sharp rebounds followed by lengthy ranging; type-3 bottoming characteristics.

Meanwhile Japan continues to defend the yield on the 10-year while allowing the rest of the yield curve do whatever it will. The Yen is very oversold and even in a supply dominated environment is susceptible to some steadier action.

Meanwhile Japan continues to defend the yield on the 10-year while allowing the rest of the yield curve do whatever it will. The Yen is very oversold and even in a supply dominated environment is susceptible to some steadier action.