Stuart Kirk tells FT investors need not worry about climate risk

This presentation by Stuart Kirk at a Financial Times conference in May is a notable discussion on subject of ESG and climate.

Kirk was afforded the opportunity to share his frank views and resigned from his position at HSBC less than a month later.

That helps to highlight how polarized the discussion on climate is. There is no room for a dissenting public voice. That’s despite the fact he did not deny climate change but instead suggested we need to adapt.

He highlights the fact much of the Netherlands, one of the most densely populated countries in the world, is below sea level. The rationale is why worry about the outlook for Miami?

Instead, if you increase the population of a city by several million people and build a commensurate number of dwelling, work, commerce and transportation units, it implies a great deal of additional mass. If the city is already sitting on a flood plain, then flood barriers are going to be necessary one way or another. You don’t need climate change for that.

It’s an important point because no one knows for certain if the efforts underway to curtail emissions will successfully correct climate volatility. Governments are willing to spent hundreds of billions, if not trillions on the bet they are correct. It’s the basis for the secular bull market in commodity argument.

This talk from Michael Shellenberger in defense of nuclear energy may also be of interest. There is a brewing battle between environmentalists and ecologists.

When I was at the Future Minerals Summit in January, miners were salivating at the opportunity presented by renewable energy and the drive to take over a small fraction of oil’s dominance. To even come close to achieving the goals for wind and solar, supply of copper and other metals would need to double. It’s questionable whether that is even possible.

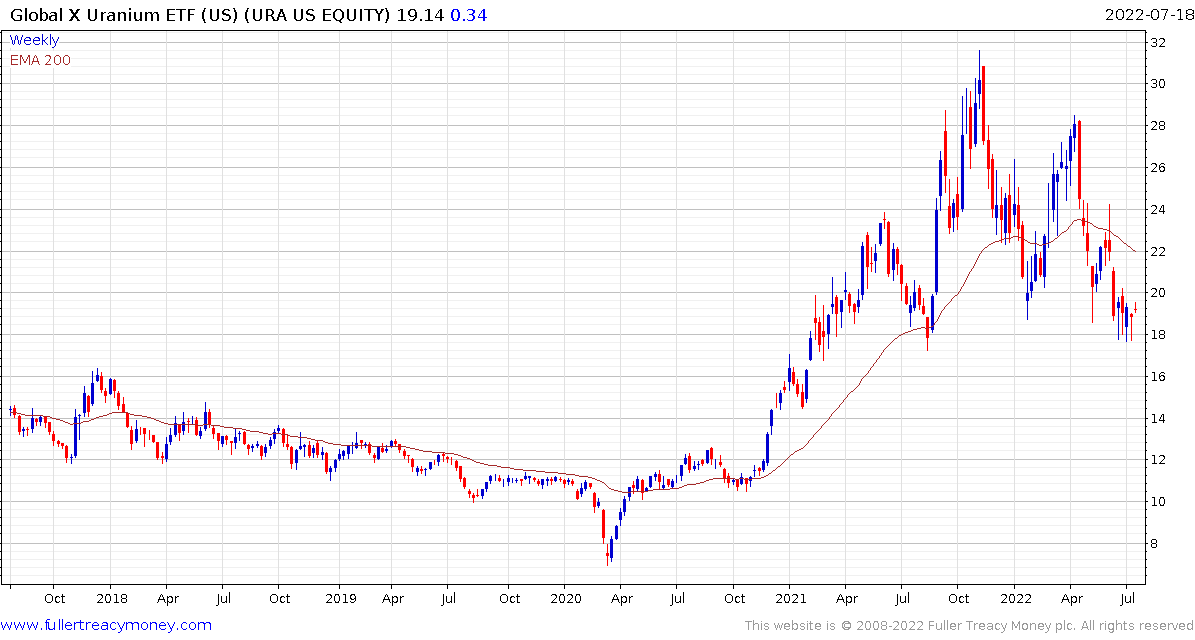

The Global X Uranium ETF is beginning to firm from the region of the 1000-day MA.

Korea’s Doosan Enerbiliity is furthest along in building small modular reactors.

Korea’s Doosan Enerbiliity is furthest along in building small modular reactors.

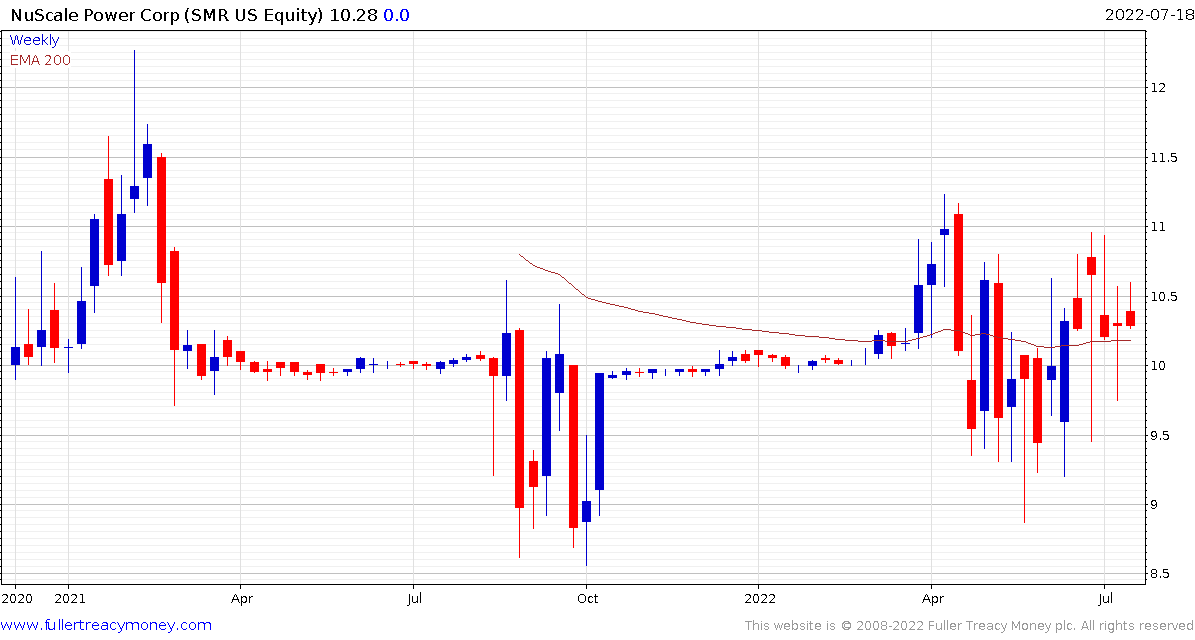

NuScale has contracted with the company to build its designs. The share is firming in the region of the SPAC listing level.

There is also a geopolitical element to this discussion. China has spent a great deal of capital and energy dominating the manufacturing process for solar, wind and batteries as well as for the materials required. The world needs an alternative in the event relations with China deteriorate to the level of those with Russia.

Back to top