Started from the Bottom Now We're Here

Thanks to a subscriber for this report from Clarus Securities. Here is a section:

POSITIONING FOR BETTER PRICES: We are of the opinion that we have seen the worst of both the crude oil and natural gas markets and that prices should further improve as we enter 2017. We are currently forecasting ~US$50/bbl WTI for H2/16, which is a level where most producers fail to grow on a per share basis. In our updated growth tracker, we now expect average production per share to decline by 8% (-12% growth on a median basis); this compares to our estimates of -3% (median -8%) and 5% (median -3%) during Q2/16 and Q1/16, respectively. The decline in per share growth has been a result of dispositions to reduce debt, equity financings without concurrent M&A, or some combination thereof. Ultimately, only a few select companies are able to generate consistent per share growth. Most are natural gas operators but some oil-weighted names, chiefly RRX and SPE, continue to grow on a per share basis.

IMPLIED OIL PRICES: Despite the ~US$5/bbl pullback in WTI prices, there has not been panic selling of the equities. This benign response is attributed to the belief that the worst is behind us and that any weakness in oil prices will be short lived. However, with equities not pulling back, it is important to estimate the implied oil price by name. We looked at each company’s historical multiple relative to its current trading level in order to back out the oil price needed. Based on our analysis, very few names are pricing in US$50/bbl oil, with most between US$55/bbl and US$65/bbl. Companies with cheaper implied pricing generally possessed higher than average debt, which weighed on valuation.

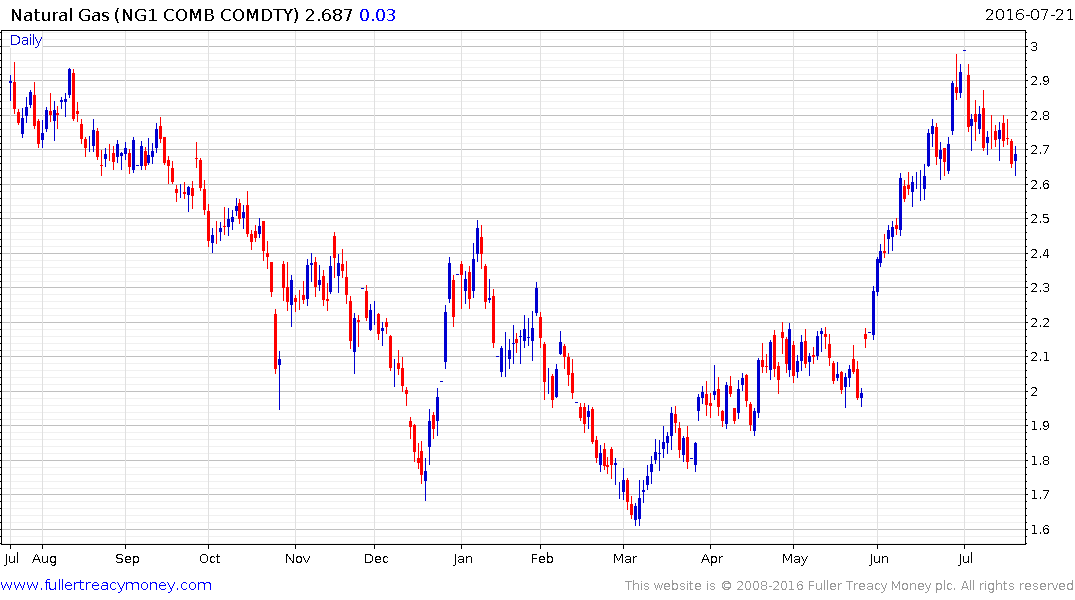

IMPLIED GAS PRICES: Using the same methodology with the gas weighted names results in implied prices mostly ranging between $2.25/mcf to $3.50/mcf. The valuation for the gas names is generally a bit more difficult to assess because some producers are promising very high rates of growth which may be difficult to achieve (versus oil producers, where growth profiles are much lower and more manageable). Regardless, we see some opportunities for investors who are bullish on natural gas going into H2/16.

Optimism about a recovery in oil prices has improved following an almost 100% rally since January. This is despite the fact higher prices ensure a great deal of marginal production is now approaching economic viability. At the lows it was difficult to impress upon anyone that a rally was possible. Now that marginal supply can once more be produced economically many analysts anticipate additional upside.

What is perhaps most interesting is that increasingly bullish predictions are being posted in the face of an oil price which has pulled back $8 since early June. A sustained move below the trend mean would confirm more than temporary resistance in this area.

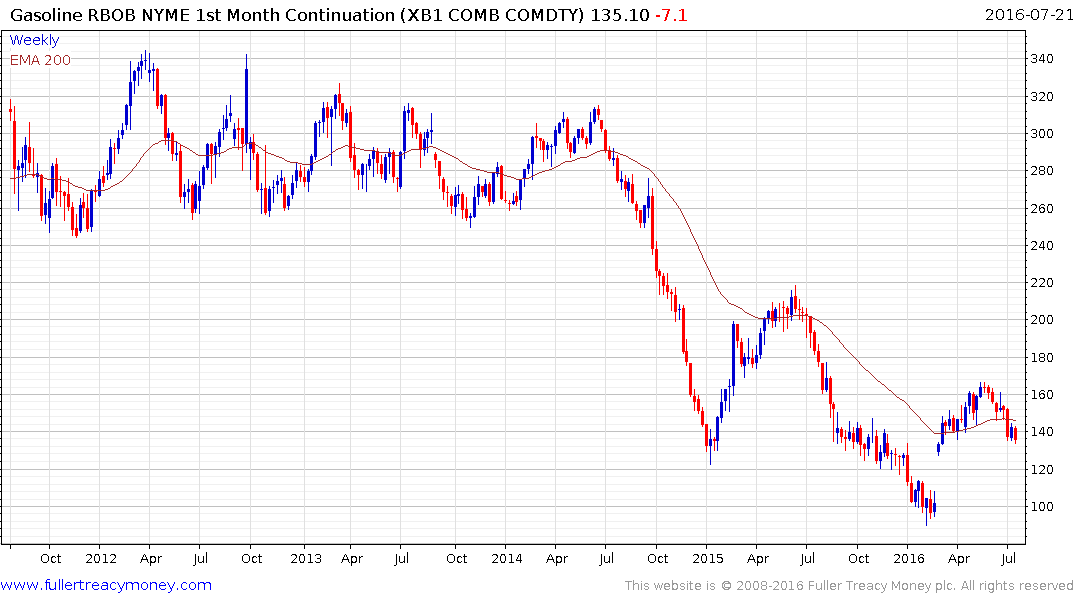

Gasoline prices have been leading on the downside and continue to sustain the break below the trend mean.

Natural gas prices have also completed a reversion towards the mean and will need to hold the $2.60 if potential for higher to lateral ranging is to be given the benefit of the doubt.