Shell Isn't Looking for Big Deals as Debt Shrinks, Profits Soar

This article from Bloomberg may be of interest to subscribers. Here it is in full:

Shell Plc isn’t planning to use its growing cash pile to pursue big acquisitions, aiming instead to deliver greater value for shareholders.

That was the message delivered by new Chief Executive Officer Wael Sawan and Chief Financial Officer Sinead Gorman at a meeting with analysts on Friday morning, following their announcement the day before of record profits of nearly $40 billion in 2022 and the lowest level of indebtedness since 2015.

The company’s management is trying to boost Shell’s value, which has lagged American peers that stuck more closely to their fossil-fuel core instead of diversifying into cleaner energy.

Shell’s shrinking debt could give investors “some nervousness around the potential for large-scale M&A,” Biraj Borkhataria, an analyst at RBC Capital Markets, wrote in a note on Friday about the meeting earlier in the day. “Wael clearly stated this was not on the agenda, with focus more on performance of the asset base and driving higher returns.”

Shell said at the meeting that big acquisitions of around $10 billion are unlikely in low-carbon energy because there aren’t good opportunities, according to analysts at Barclays Plc led by Lydia Rainforth.

There could be smaller-scale investments in that area, particularly in hydrogen. Last year Shell spent $2 billion to buy Danish company Nature Energy Biogas A/S and reached final investment decision on Europe’s largest green hydrogen production site.

Berkshire purchased a chunk of Occidental Petroleum in December 2022 for $10 billion. That reflected a conscious decision to boost exposure to the conventional energy sector. Meanwhile, energy majors have been shy about increasing exposure and have instead become much more conservative. The majority of the US company spending has been either been in onshore domestic US production. Shell continues to focus on high probability international plays like Australia and it Brunei/Malaysia production.

Shell has $40 billion in cash, expects $35 billion in free cash flow this year and $83.7 billion in debt. That’s not a heavy debt burden and it begs the question what they will do with the extra money.

The biggest challenge is major oil companies come under excessive scrutiny when they talk about boosting supply. That has discouraged M&A activity and was also why Chevron returned so much to investors via buybacks. Those concerns are doubly important for European producers.

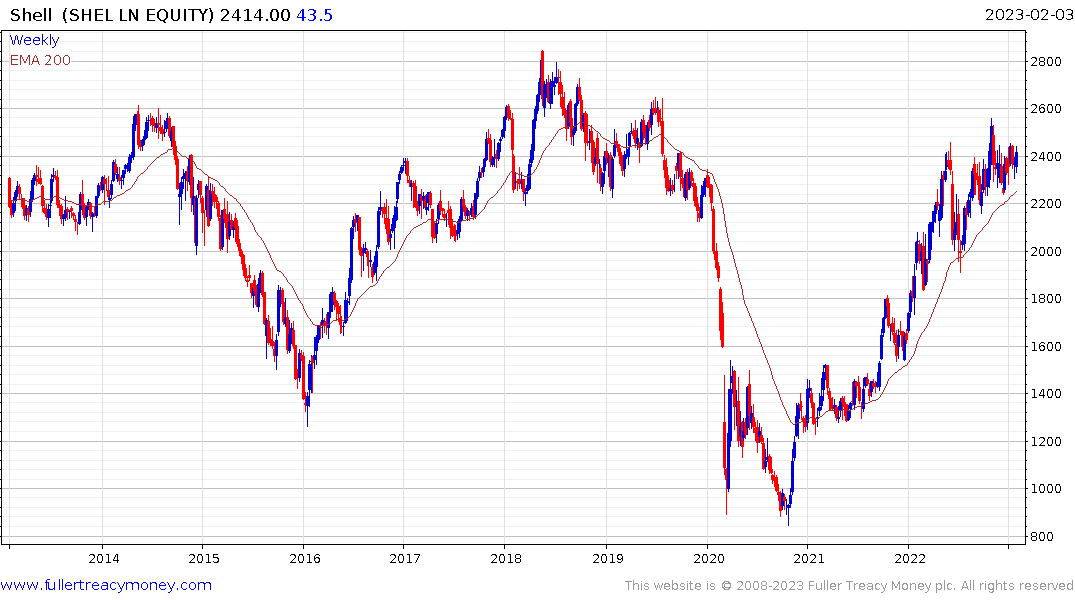

The difficulty Shell has had in sustaining production from its large offshore Australian assets suggest it will also be reticent to make big splashy new technology plays. That trend of less investment in new supply is positive for energy company share prices provided prices remains steady. That’s where the biggest uncertainty is right now.

The difficulty Shell has had in sustaining production from its large offshore Australian assets suggest it will also be reticent to make big splashy new technology plays. That trend of less investment in new supply is positive for energy company share prices provided prices remains steady. That’s where the biggest uncertainty is right now.

At present natural gas is plumbing new depths. The price insensitive inventory build pushed prices in Europe to previously unimaginable heights in the summer and spurred a significant run-up in US demand too. Now that the inventory build is over, prices have collapsed. When Europe starts buying again in the spring, prices will begin to recover.

At present natural gas is plumbing new depths. The price insensitive inventory build pushed prices in Europe to previously unimaginable heights in the summer and spurred a significant run-up in US demand too. Now that the inventory build is over, prices have collapsed. When Europe starts buying again in the spring, prices will begin to recover.

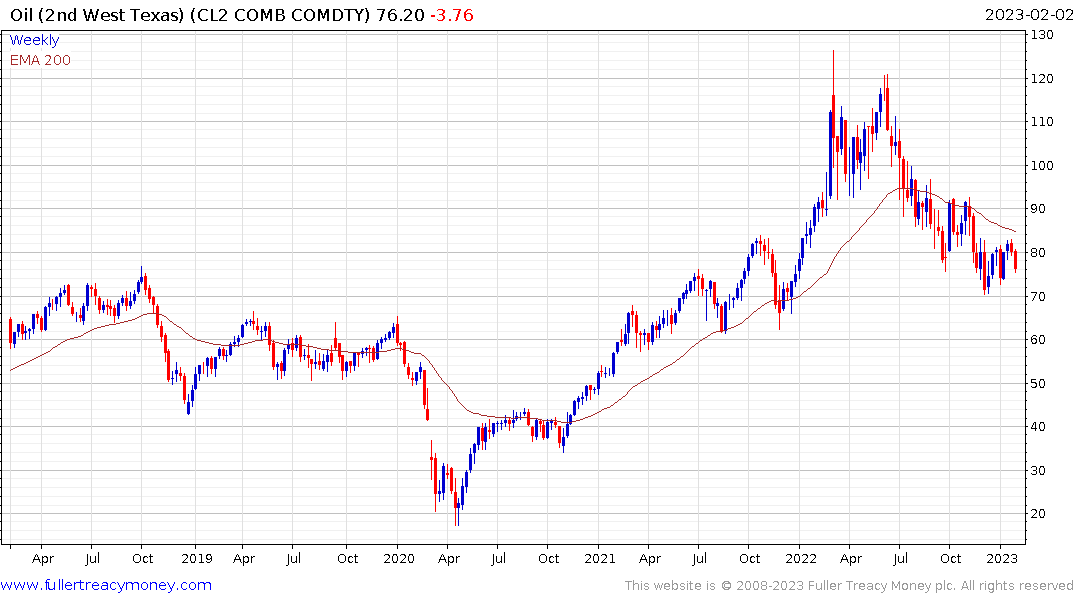

Crude oil has been supported by the assumption the US government will buy at between $67.50 and $72.50 for the Strategic Reserve. It looks likely the market will test the wishy washy resolve of the Biden administration to support energy prices. West Texas Intermediate reversed a rebound today to close below $75. The debt ceiling impasse also raises the question of where the cash will come from to make the investment in new oil assets at such high levels?

Crude oil has been supported by the assumption the US government will buy at between $67.50 and $72.50 for the Strategic Reserve. It looks likely the market will test the wishy washy resolve of the Biden administration to support energy prices. West Texas Intermediate reversed a rebound today to close below $75. The debt ceiling impasse also raises the question of where the cash will come from to make the investment in new oil assets at such high levels?

The Energy SPDR has lost momentum in the region of its previous peaks. The risk of a deeper consolidation is rising.

The Energy SPDR has lost momentum in the region of its previous peaks. The risk of a deeper consolidation is rising.