Shanghai Copper Stockpiles at Lowest in a Decade, Nickel Jumps

This note from Bloomberg may be of interest to subscribers. Here is a section:

Copper inventories extend a drop to the lowest level in almost 10 years, while aluminum holdings also fell and nickel inventories climbed, according to weekly data from Shanghai Futures Exchanges.

Copper -11% to 61,838 tons, lowest since Dec. 2011

Aluminum -1.6% to 228,529 tons, lowest since Dec.

Lead +3.3% to record 204,008 tons

Nickel +45% to 8,608 tons, following a more than 30% gain the previous week

The realisation that contagion risk in the property sector could bring down the whole economy has refocused the attention of the Chinese administration on easing up on liquidity tightening measures. That has helped to stabilise the high yield sector and is also helping to improve the outlook for industrial resources.

Copper continues to extend its rebound from the psychological $4 area and a sustained move below that level would be required to question medium-term scope for continued upside.

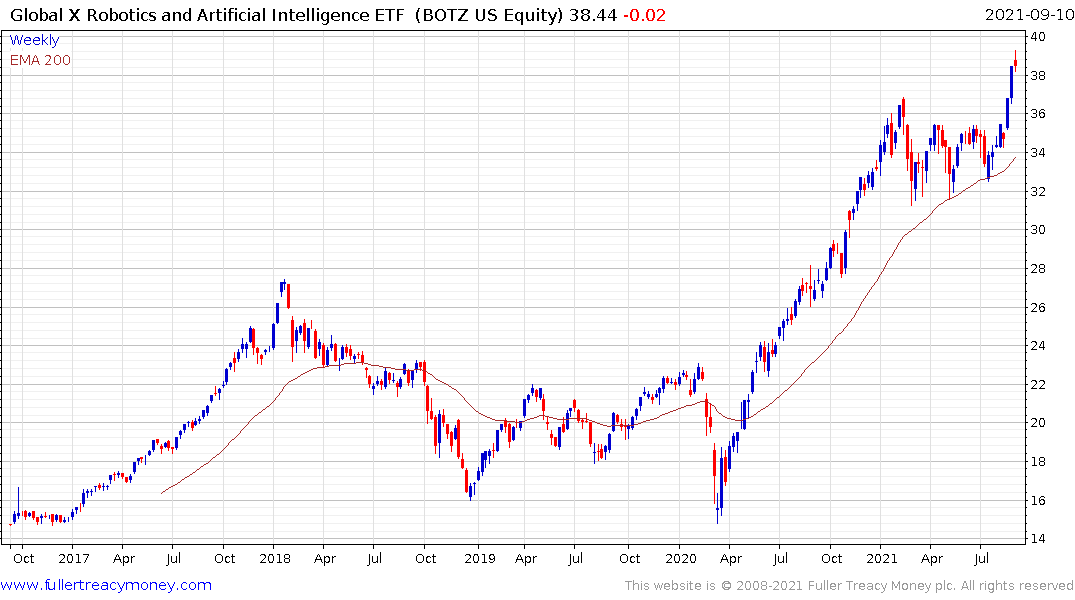

The political tailwinds continuing to support renewable energy infrastructure and electric vehicles. We can argue about the wisdom, or indeed the effectiveness, of this gambit but the political will to fund recalibration of the energy sector with carbon credits is unlikely to change any time soon. That’s positive for copper, nickel, lithium and cobalt.

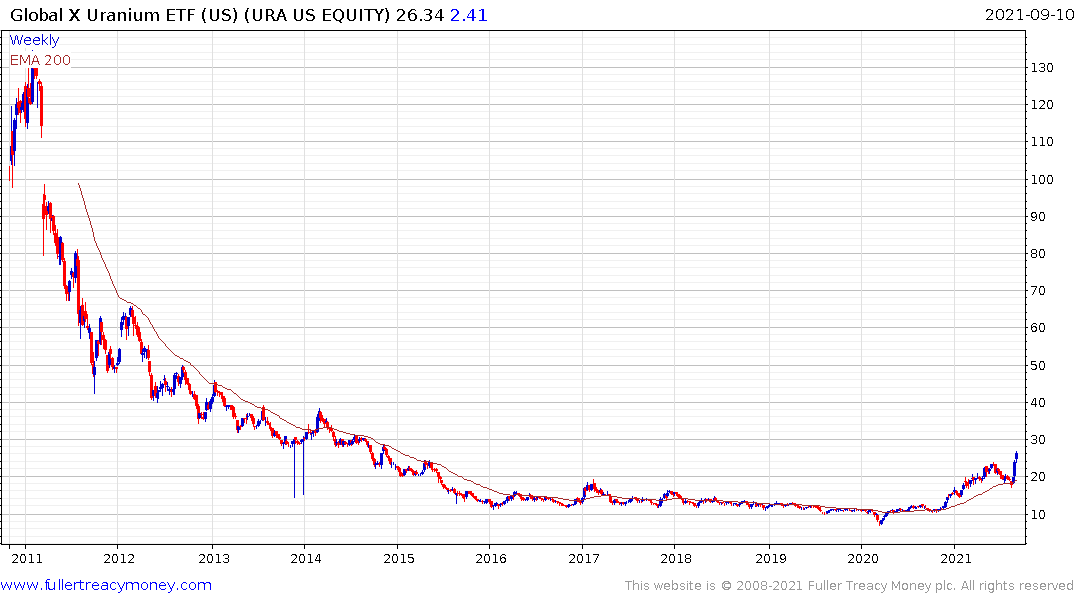

This promotional video from Goehring and Rozencwajg makes the solid argument that renewables are much less energy intensive and inefficient than fossil fuels but no one in government is listening. However, investors are beginning to express greater interest in nuclear.

Nickel continues to extend its break above the psychological $20,000 as it completes is lengthy base formation.

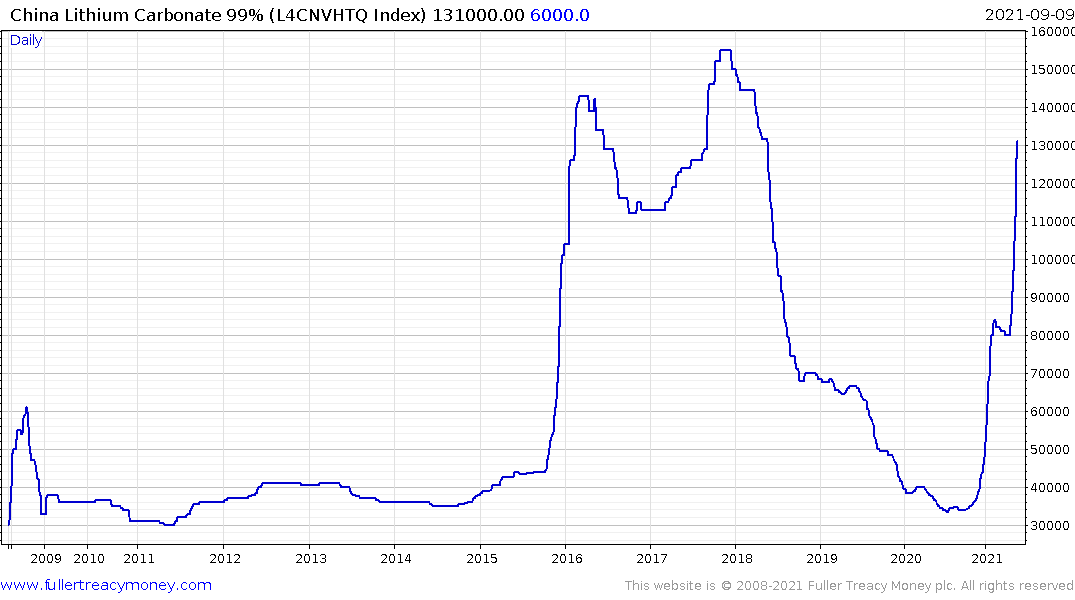

Lithium continues to accelerate higher and is now approaching the peaks put in between 2016 and 2018.

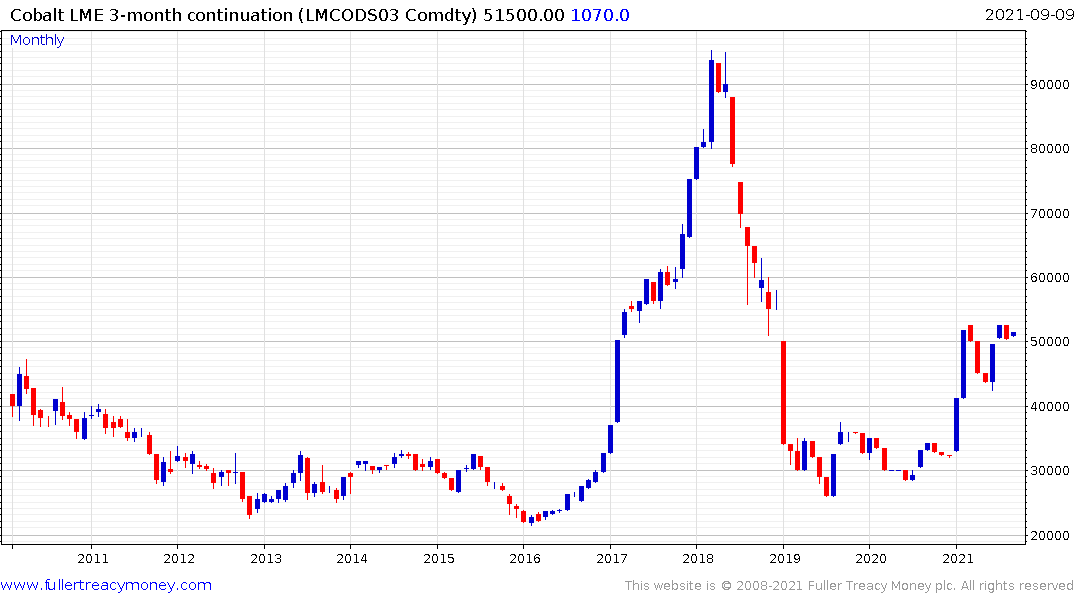

Cobalt also remains on a recovery trajectory.

The Global X Lithium & Battery Tech ETF remains in a reasonably consistent uptrend.