Shale Oil Firms Hedge 2017 Prices in 'Droves' After OPEC

This article by Alex Longley and Javier Blas for Bloomberg may be of interest to subscribers. Here is a section:

Harry Tchilinguirian, head of commodity research at BNP Paribas SA in London, said on Friday that OPEC had thrown a “lifeline” to U.S. shale firms, prompting them to hedge “in droves.” The bank has “seen many queries coming through” from producers, he said.

The West Texas Intermediate 2017 calendar strip -- an average of future prices next year that’s often used as a reference for hedging activity -- rose above $50 a barrel to its highest since August on Monday. “When calendar 2017 pricing rises into the low-to-mid $50s, as it is doing now, producer hedging rises materially,” Longson said.

U.S. shale producers used a similar rally to hedge their prices in May, when the WTI 2017 calendar strip also rose above $50 a barrel. The current activity comes after industry executives told investors in July and August they planned to use any window of higher prices to lock-in cash flows for next year.

"We would like to be a little bit further hedged than we are today," Pioneer Natural Resources Co. Chief Executive Officer Tim Dove said back in July, noting his company has locked in prices for up to 55 percent of its 2017 exposure. “I’d like to see us get that number up as we go towards at the end of this year.”

US unconventional onshore supply represents an important marginal producer that functions independently of the OPEC/Russia cartel. The level at which US producers are willing to hedge supply into next year tells us more about at what level they deem to be economic for their operations than probably any other factor. It is now possible to hedge December 2017 supply at over $53 so we can reasonably conclude that level represents where the incentive to drill and produce even more really becomes inviting.

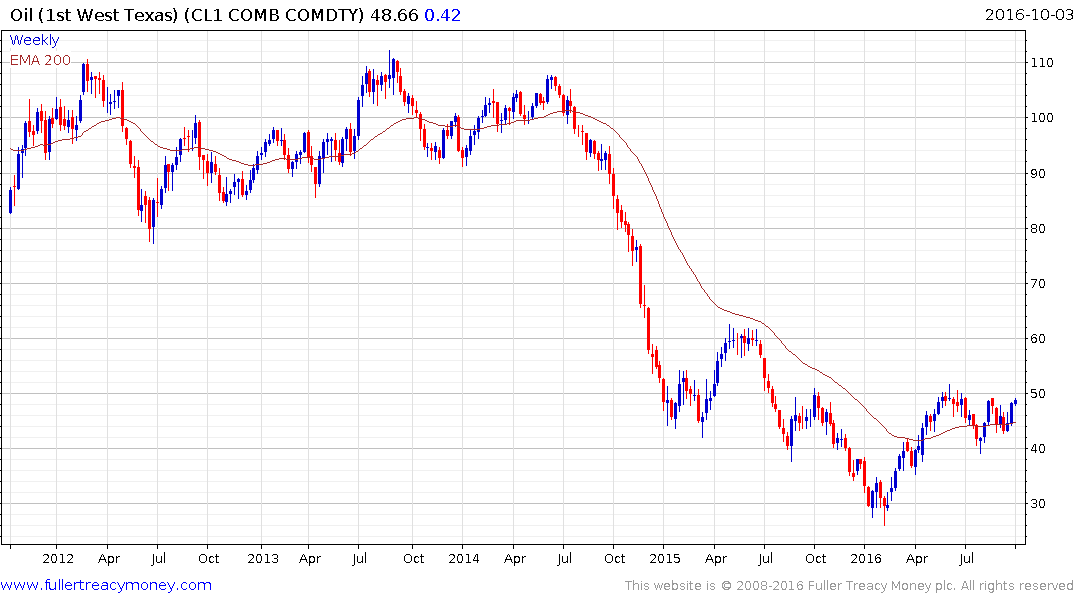

West Texas Intermediate Crude Oil continues to rally back up towards the upper side of the evolving three-month range but a sustained move to new recovery highs would be required to signal a return to demand dominance beyond short-term steadying.

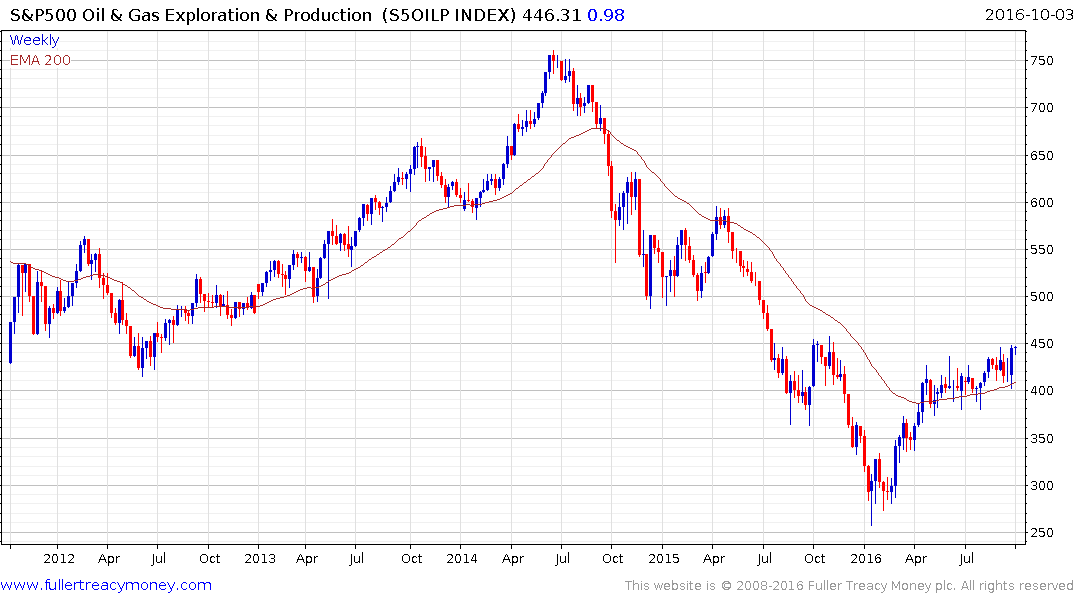

The S&P Oil & Gas Exploration and Producers Index continues to offer leverage to the oil price and moved to a new recovery high last week.