Secular Themes Review May 7th 2021

On November 24th I began a series of reviews of longer-term themes which will be updated on the first Friday of every month going forward. The last was on March 5th. These reviews can be found via the search bar using the term “Secular Themes Review”.

After a crash everyone is wary. We all seek to learn lessons from our most recent experience because it is the only way to help us emotionally move past the trauma. Coming out of the pandemic most investors wished they had sold everything at the first sight of virus news in early 2020 and bought everything back again following the crash. Today they are worried that there is another big shock waiting around the corner that will cause a repeat of pandemic panic.

The challenge for investors is less to learn from the most recent mistake but rather to know when to deploy the lessons learned. The best time to be wary about a massive decline is when no one is worried about it. The time to take precautionary action is when it seems like a waste of time and when you are most afraid of giving up on the potential for even better gains. That’s the best time to remember the experience of the crash but the interval of time and the positive reinforcement of experience in an uptrend make it difficult.

.png)

The Wu Xia Shadow Fed Funds Rate was not updated for years but has since been infilled with the intervening data. It offers a valuable insight into the effects of central bank easing on the availability of credit to financial markets. There are a couple of conclusions. The first is the current easing cycle is not over and may yet reach significant new levels of easing. The second is easing cycles last years and economic problems do not generally arise until tightening has been underway for years.

The Goldman Sachs Financial Conditions Index remains at historically accommodative levels and there is no evidence of tightening.

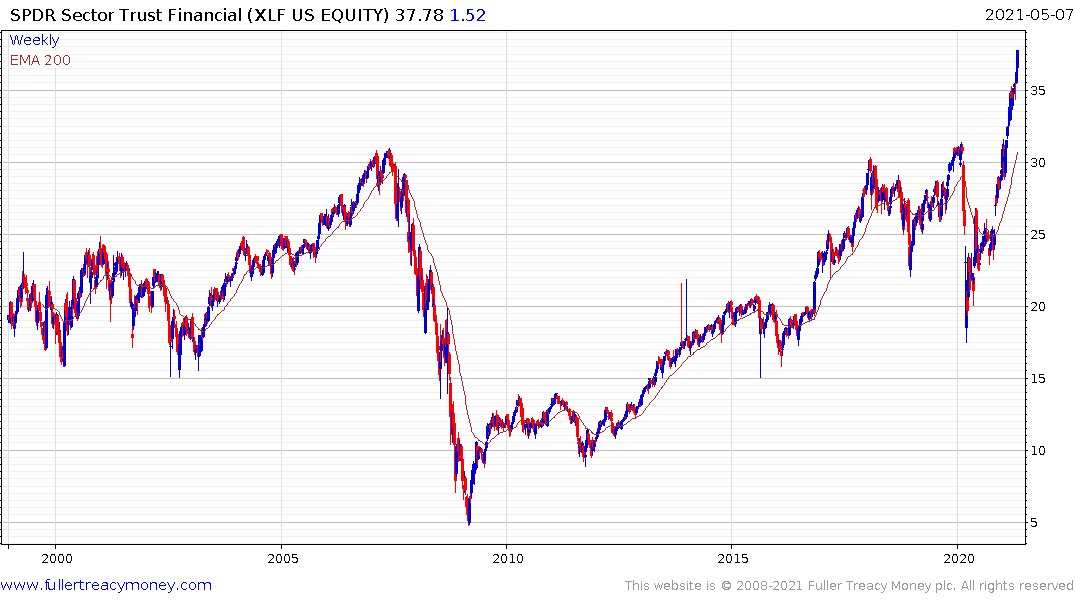

The Financial Sector ETF (XLF) remains in a clear but short-term overextended uptrend. That strength in banks shares a high degree of commonality globally. European, UK, Taiwanese, South Korean, Australian and Canadian banking indices have all rebounded impressively. Even Japan’s sector which took the brunt of the Archegos collapse is now trading back above its trend mean.

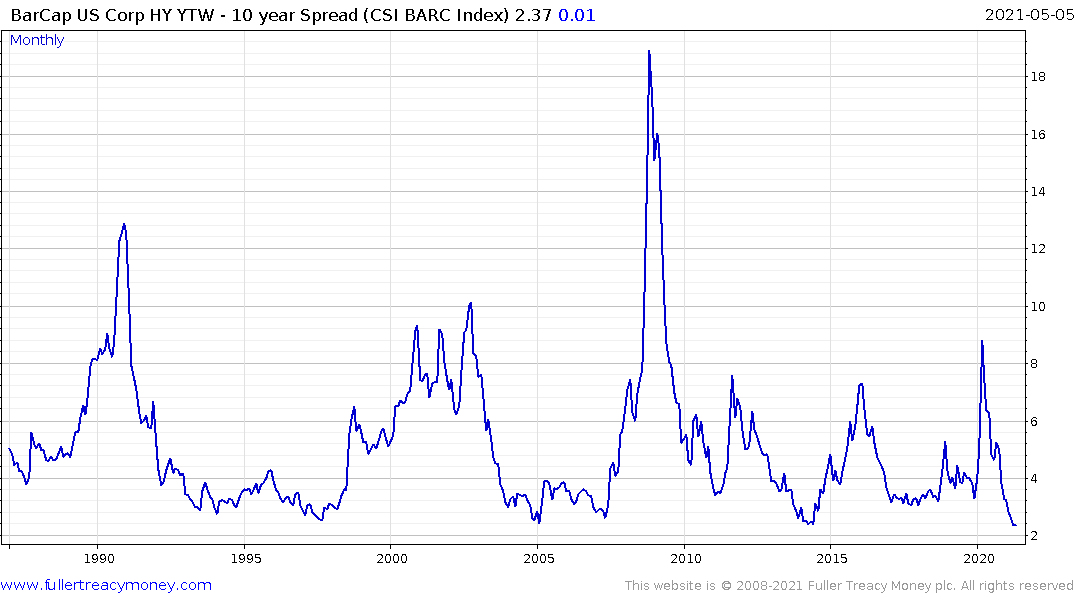

High yield spreads mirror the trend of financial conditions. Any company who could issued debt in 2020 to avail of low rates and abundant credit. Back in early 2019 the years 2020 through 2022 were being highlighted as challenging years for the corporate bond markets because $2 trillion needed to be refinanced. A lot of that refinancing was achieved in 2020 so the debt maturity cliff has been pushed further out into the future. That’s great news for investment and high yield issuers. It gives them more time to restructure. It also implies the debt problem will represent an even bigger issue about five years from now.

That’s why the Fed’s warning yesterday that corporate debt levels are high rings hollow. The reason debt is high is because of the Fed’s continued support for the financial markets. Without it there would not be a bull market. The mass downgrading of investment grade paper to high yield has not happened because of this support and that continues to represent a tailwind for speculative portions of the market.

While the corporate sector has largely avoided a maturity cliff, governments have increased the quantity of debt outstanding and have ongoing funding requirements to the tune of $2.3 trillion annually. That represents a massive headwind to tightening policy. The challenge for all central banks is this stimulus is fanning inflationary fears. They argue that the inflation will be transitory because that is what has happened after every other recession in the last few decades.

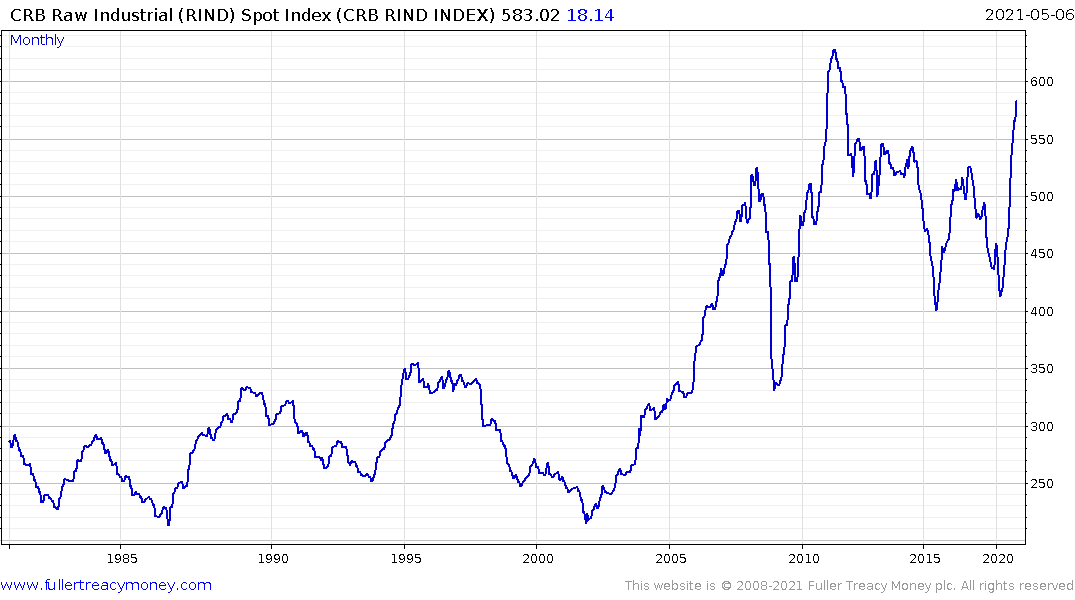

The CRB Raw Industrial Commodity Spot Index tends to bottom soon after a market panic and surges higher as monetary policy is eased and economic recovery begins. That’s what happened in 2001 and 2008 and against in 2020. Since recessions cause businesses to close supply chains are impacted. As a recovery takes hold demand for everything increases and bottlenecks appear. Those take time to iron out so commodity prices rally for as long as it takes supply to respond.

Industrial Resources of all kinds are breaking out. Copper has been making headlines because of the secular demand trend from the electric vehicle and wind turbine markets. However, iron-ore, lead, tin, aluminium and zinc are also breaking out. That is fanning inflationary fears and is the foundation of the belief that this recovery in commodities prices can persist, albeit with bumps along the way.

The Blackrock World Mining Trust continues to recovery and is now trading at a premium. The biggest thing to remember is commodities are very volatility and best bought following reactions.

The lag in hiring in the logging sector continues to stimulate demand in the illiquid lumber futures market. This falls into the short to medium-term trend category since the world is not running out of trees, merely lacks enough people to process them into products.

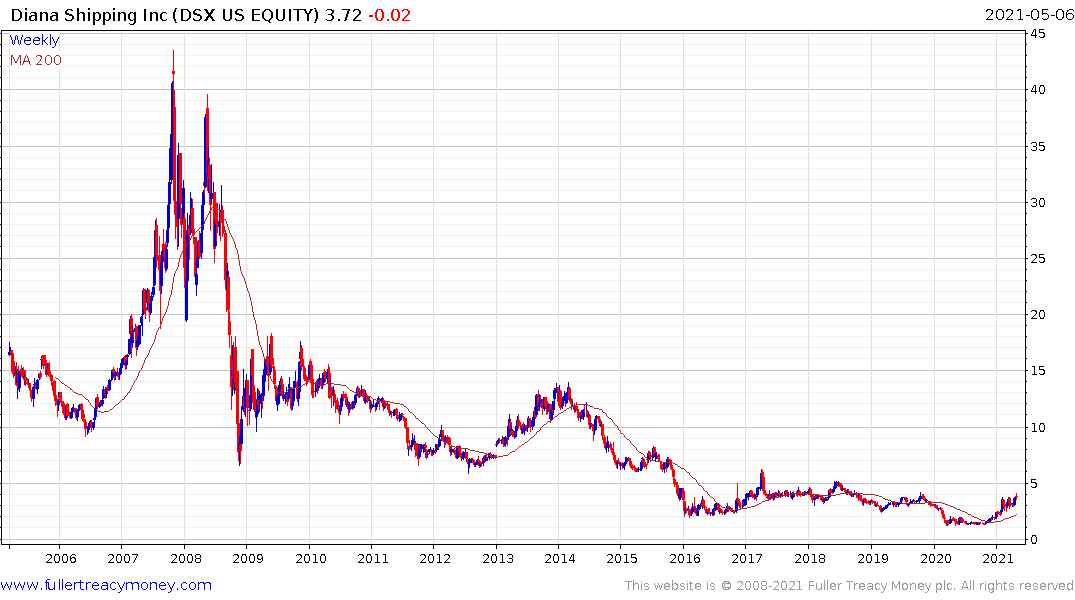

The pandemic took an outsized toll on the shipping industry. Many brokers went bust and many ships have been decommissioned because of the expense of complying with the IMO2020 emissions regulations. That has resulted in the Baltic Dry Index breaking out of new highs.

Maersk continues to extend its breakout to new highs while Diana Shipping is only beginning to now push back above its trend mean.

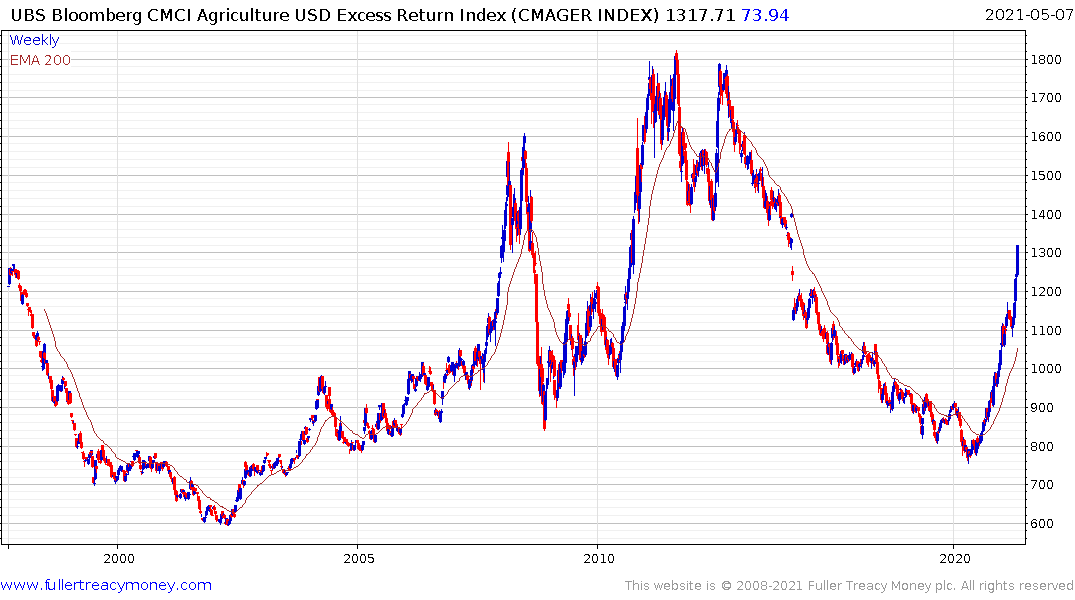

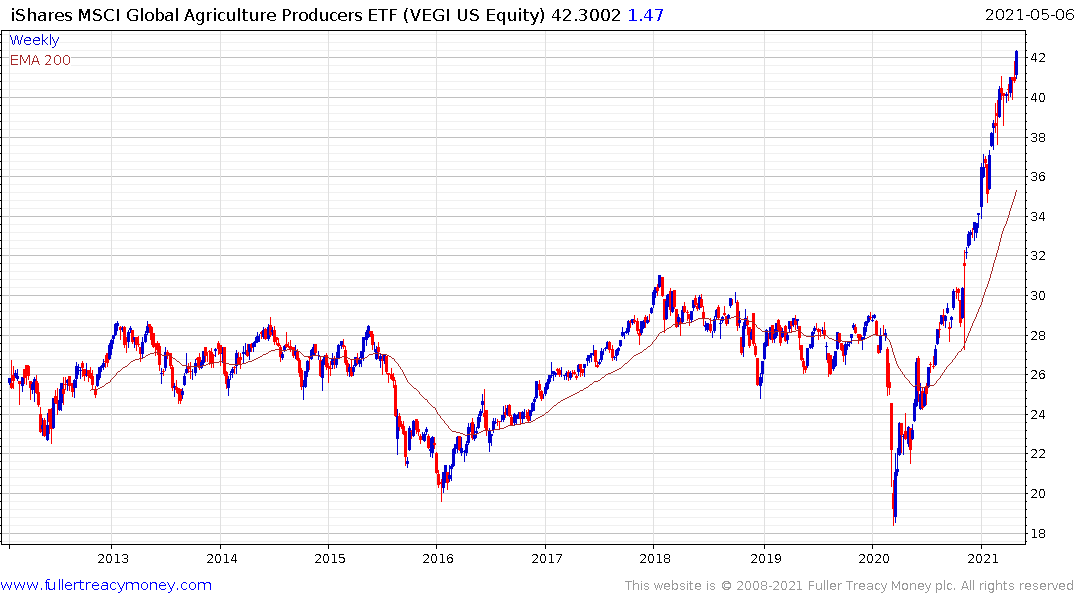

Agriculture supply chains have also been impacted and grain and bean prices are almost universally rallying.

The iShares Global Agriculture Producers ETF has been resurgent over the last year and is now accelerating higher. The food processors sector is now playing catch up and a large number of related shares completed base formations this week. (Please see Thursday’s Comment of the Day for charts) The return to performance of the Dividend Aristocrats and Autonomies is a handy proxy for this trend.

Meanwhile Mosaic is on the cusp of breaking out to new five-year highs.

The outsized demand for consumer electronics resulted in a one-time bump to demand for semiconductors in 2020. The longer-term theme is that the automotive sector is now a substantial buyer of chips for the first time and demand is likely to trend higher over the next decade as cars become mobile entertainment hubs.

![]()

The Philadelphia Semiconductors Index has been ranging since January but continues to hold the upward bias overall. News today that IBM has developed a 2nm chip which runs 45% faster or on 75% less power is a testament to the ability of the technology sector to continue to achieve what was once thought impossible. https://www.youtube.com/watch?v=HD5KbeR5mtc These kinds of chips will help data centres run more efficiently and will eventually find their way into cars, phones and everything else. A lot more computing power is required to deliver on the promise of artificial intelligence and autonomy and this is a step towards achieving those objectives.

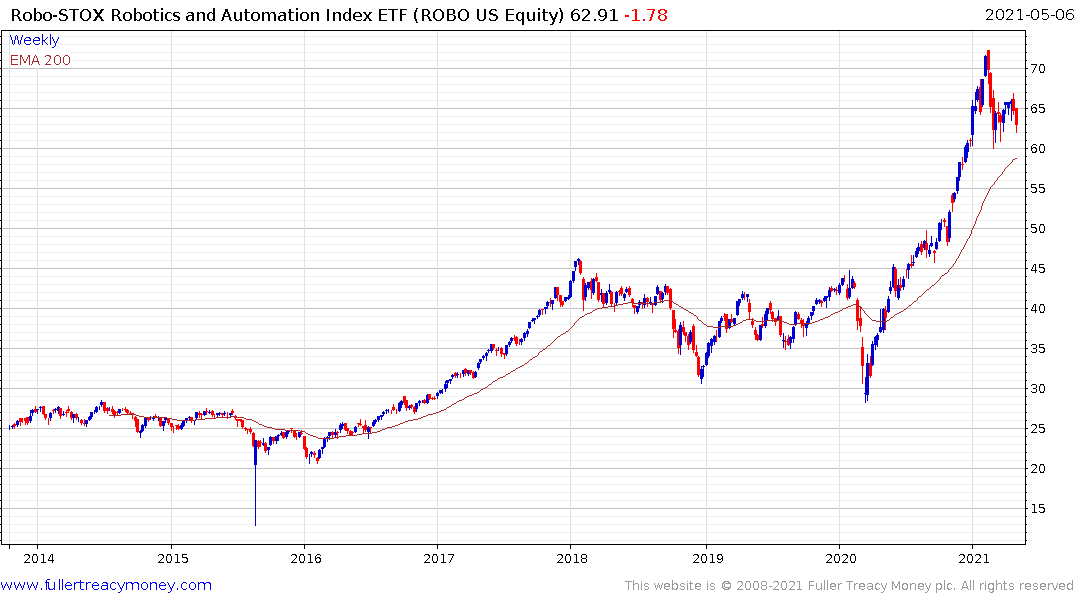

The Global Robotics and Automation ETF continues to firm above the trend mean.

Following a shock like a global pandemic behaviour changes. More people now want to work from home and seek to spend more time enjoying life. Anyone who was thinking of retiring has brought forwards plans to do so. Anyone thinking of moving home is doing the same thing. Anyone thinking of moving jobs is actively searching. That’s creating a lot of lumpy economic data and it is dangerous to reach firm conclusions on the back of it. That’s particularly true because the year over year comparisons are going to be loopy for least the next couple of quarters.

Perhaps the most important thing to consider is the pandemic has now superseded the credit crisis in the minds of most consumers as the most traumatic economic event they have witnessed. The conclusion everyone has drawn is there are no negative consequences to governments increasing their debt to GDP ratios by 50% in a year. The rebound in economic activity from the debris of the lockdowns is going to be lumpy but investors fully expect central banks and governments to ride to the rescue at the first sign of trouble. That encourages risk taking behaviour but the time to be risk tolerant is following weakness.

The big unanswered question amid resounding bullishness about the pace and size of economic recovery is what is to be done about forbearance on mortgages and moratoriums on evictions. No politician wishes to grasp that particular nettle and it has the potential to represent a significant uptick in delinquencies. In the USA, the expiry of outsized unemployment benefits is September, legal challenges to eviction bans are increasingly successful and together than is likely to represent at least a moderating effect on the economic expansion.

That suggests the provision of liquidity in the USA is going to last longer than many people anticipate and that a tapering is a topic of conversation for 2022. Concurrently, the UK is already talking seriously about tapering, Canada is the cusp of beginning to taper, the jump in commodity prices is boosting the currencies of producers and Asia’s currencies are also firming not least because they are more fiscally responsible than so-called developed economies. That is adding up to a downtrend for the US Dollar. It is now one of the world’s weakest currencies.

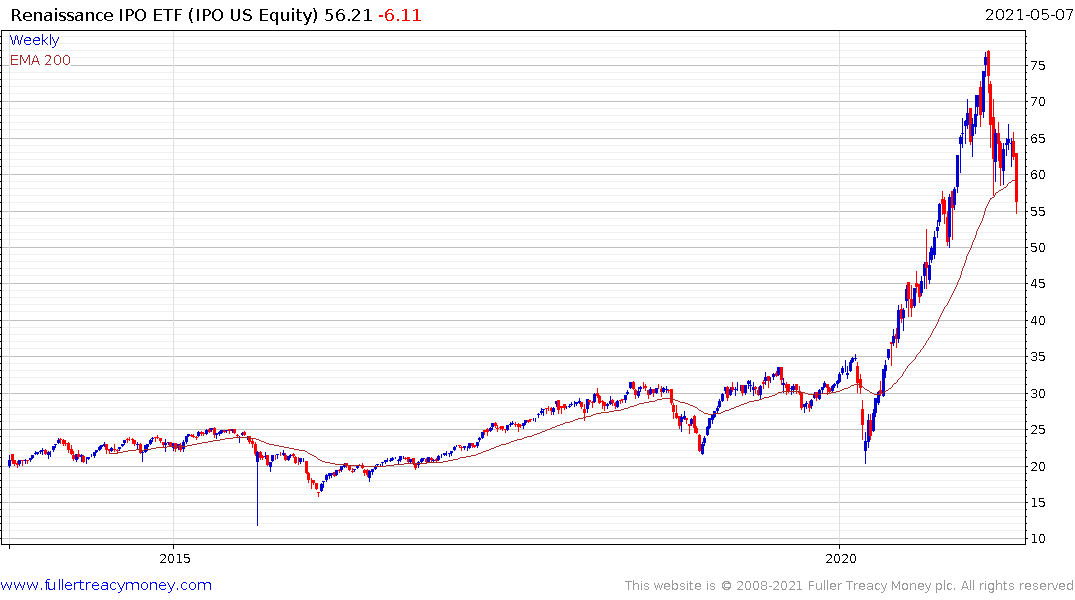

The flood of new money entering the market over the last year has been of particular benefit to new companies where investors favoured novelty and growth potential over profits. The Renaissance IPO ETF accelerated (type-1) to its February peak and climaxed with downside weekly key reversal. It then posted a massive reaction against the prevailing trend and ranged below the peak and in the region of the trend mean (type-2 with right hand extension) It broke lower again this week. This is a completed top formation. If interest in innovation, IPOs and SPAC is to be reasserted a lot of technical damage will need to be unwound. At a minimum that will require time.

The Bloomberg Dollar Index is dropping back to retest the January and 2018 lows. A clear and sustained move above 1150 will be required to begin to question medium-term scope for continued downside. Considering the long-term cycle in the Dollar Index of 7-year downtrends from the peak with a couple of years of ranging around the lows, it is unlikely we are going to see a significant low in the Dollar until at least the middle of this decade and potentially later.

Gold is the ultimate zero-coupon bond because it cannot default. It rises in value as investors fear the implications of governments spending with no plans for repayment. The price has been in a corrective phase for the last nine months but it back above the 200-day MA this week and a recovery appears to be underway.

.png)

Longer-term, I believe it is reasonable to conclude we will see gold trading out to significant new highs on a purchasing power parity basis.

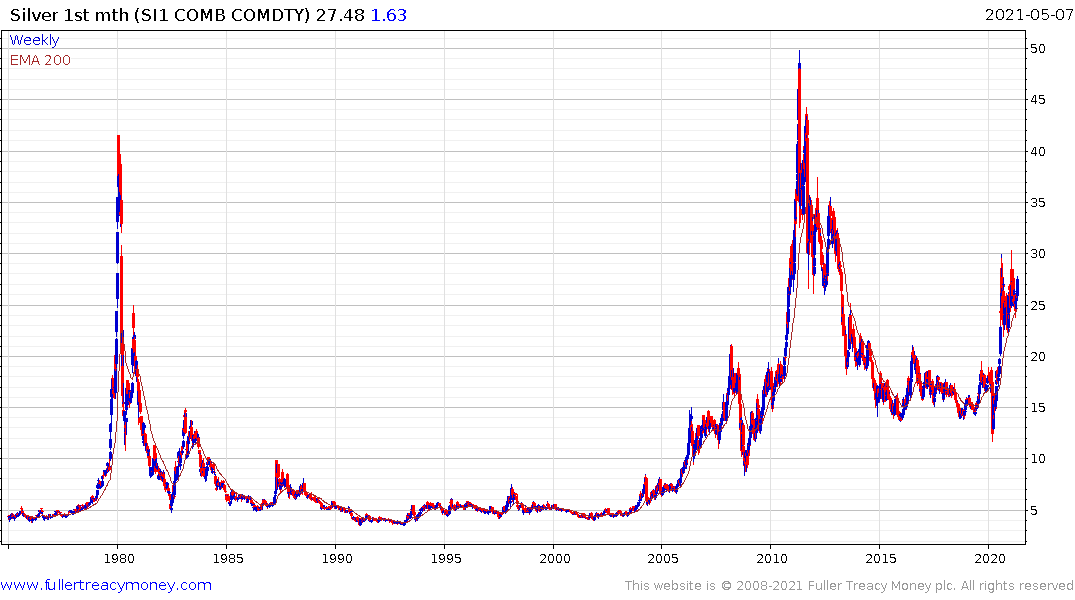

Silver as high beta gold and with major new industrial demand is leading on the upside.

Gold miners remain constrained from borrowing and spending on new supply. Instead, they are increasingly protective of their strong balance sheets. That puts them in a strong position to offer leverage to the gold price. The VanEck Vectors Gold Miners ETF continues to rebound from the region of the trend mean and the upper side of the base formation.

Demand for hard assets is not limited to precious metals. Many billionaires are displaying outsized interest in acquiring productive land and trophy properties. Brookfield Asset Management deploys a private equity model to acquiring income producing properties. The share remains in a clear uptrend.

If gold is the ultimate safe haven insurance policy, bitcoin is the ultimate risk asset. The spectacular returns possible in the cryptocurrency market mean it is increasingly difficult to avoid for institutional investors. That’s particularly true at a time when the wonders of modern portfolio theory are being revisited following David Swensen’s death. Here is a section from an article by John Authers:

Such strategies are now commonplace. Hedge funds and private equity make up a huge share of large university endowments’ investments, and pension funds have followed them. Such vehicles were still esoteric opportunities when Swensen first started to put Yale’s money into them. They have now become institutionalized asset classes in their own right.

And

The close-knit team of young investors who worked with him in New Haven spread his influence, with former Swensen employees now running the endowments of top-tier schools from the Massachusetts Institute of Technology to the University of Pennsylvania, Stanford and Princeton.

The biggest bulls believe that bitcoin will change the world. In many respects it already has. Central bank digital currencies are increasingly being tested and played with. The biggest attraction for investors is cryptocurrencies tend to be less correlated with equities and therefore lend diversification to a portfolio. The reality is that most endowments and an increasingly large number of pensions are managed using the strategies developed by David Swenson. That suggests a heavy reliance of returns from illiquid and unlisted entities as well as highly speculative ventures.

Bitcoin is unlikely to be the panacea many believe because of its inherent limitations even as the promise of digital currencies pushes further into the mainstream. At present Ethereum is outperforming bitcoin in a robust manner in a trend similar to that seen in 2017. The price of bitcoin is at a critical juncture. The trend is no longer consistent and risks of a deeper correction have increased substantially. In order to reassert the medium-term trend, it will need to sustain a move to new highs.

The enduring challenge of Heisenberg’s Uncertainty Principle, as it applies to markets, is the less we know about a given the strategy, the better it works. A popularity rises, the once uncorrelated asset becomes highly correlated. That was true of illiquid assets in 2008 and it is equally true today and particularly so for bitcoin. In other words, assets are uncorrelated because they are less well known. As soon as everyone knows they are uncorrelated that statement is no longer true.

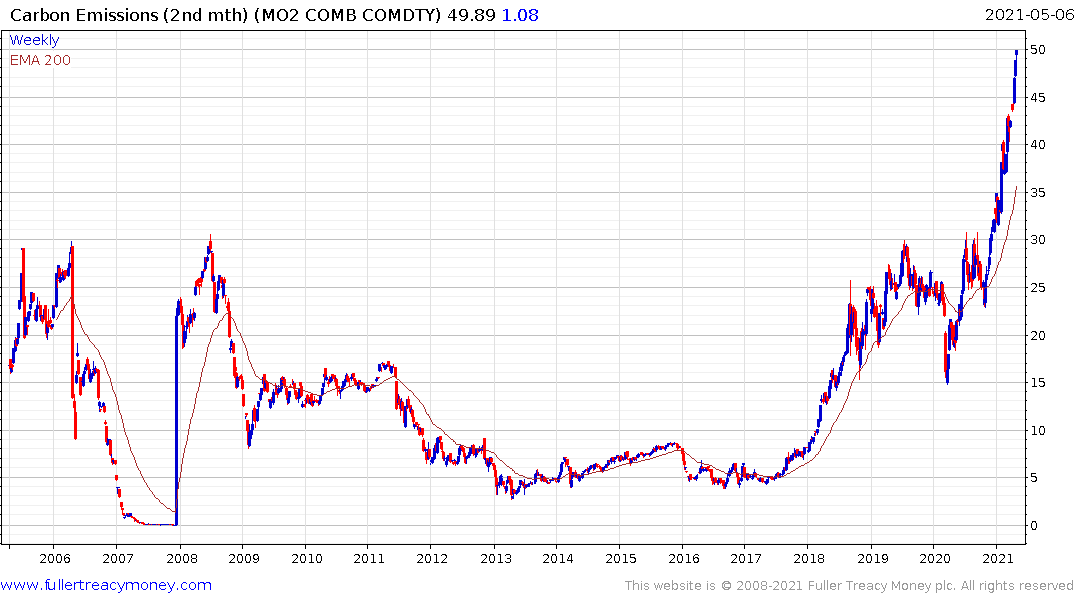

The big question for all investors over the long term is how far with the trend of carbon emission taxes go. I am very much reminded of Ronald Reagan’s quip If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.” Any government that needs to raise revenue starts with the biggest targets. The official response to the credit crisis resulted in a populist backlash which is still being felt today. Populations are in no mood to accept additional taxes or cuts to services. In fact, we are instead seeing loud and vocal calls for even more social assistance. The money has to come from somewhere.

Policies to tax the wealthy and cash-rich corporations are increasingly popular. The problem is the wealthy can leave and corporations will decamp to friendlier locations if they feel overly burdened. The easiest way to raise taxes is to stay local. That leaves property, carbon and transaction taxes.

Europe is already committed to greatly increasing the cost of carbon. The burden will inevitably fall hardest on lower and middle-income families but authorities believe the effect will be like a stealth tax. Carbon premia are being added to prices for everything in real time and the trend is likely to persist for years to come since green policies now approach quasi-religious adherence.

To raise income from the population tracking transactions and cash flow of individuals is the primary rationale for governments experimenting with central bank digital currencies. Any other argument does not have a sufficiently large game-changing effect to necessitate the efforts currently underway to foster this state-backed sector. A central bank digital currency creates a ledger of all transactions. It gives the sovereign full control over money creation and velocity of money. It also allows for full visibility on what consumers are doing and they will be introduced to “make sure the rich pay their fair share”. They would also enable central banks to put time limits on stimulus money which would ensure it is spent and they would have added ability of dictating what people can and cannot spend their money on. The makeup of China’s two-tier digital currency experiment is the equivalent of creating ration books for domestic transactions while allowed normal currency transactions to continued internationally. That represents the laying of the foundation to debase domestic debt burdens.

Against that background the relative attraction of bitcoin and the other cryptocurrencies is obvious. However, they are not immune from carbon taxes, other special tax treatment and onerous regulation. The more compelling the case for central bank digital currencies the greater the risk they represent to the unregulated market for cryptos.

If carbon taxes weigh on the fossil fuel and industrial sectors, they are a tailwind for the renewable energy sector. The sector’s correlation with oil broke down over two-years ago. Today it is much more influenced by interest rates since the payback horizon for intermittent supply stretches maturities. As bond yields have backed up the sector has reverted towards the mean.

That is equally true of the hydrogen sector. The L&G Hydrogen Economy ETF was listed in February and has been ranging for two months. However, the problem with the fund is it does not appear to hold many of the pureplays on hydrogen I have identified over the last two years which is rather disappointing.

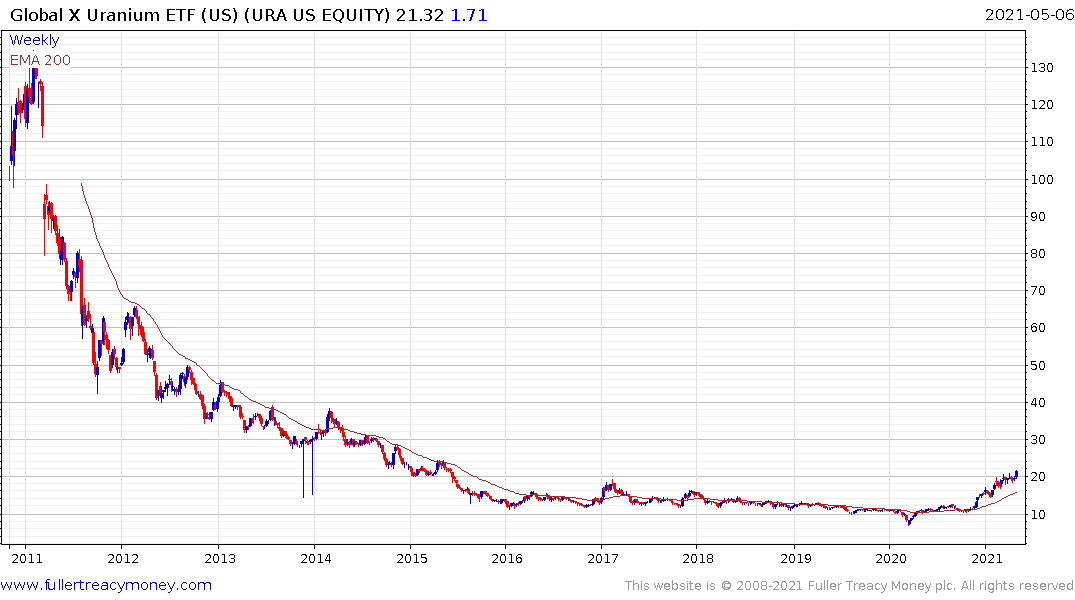

Cameco may have missed on its earnings today but the company believes additional demand for nuclear energy is realisable. The Global X Uranium ETF continues to extend its breakout. This article covering the fact that mined uranium is still more expensive than spot contracts suggest investors betting on the supply glut finally ending.

The cannabis sector remains on a secular growth trajectory and the pandemic will only have bolstered the trend of licentiousness. The Alternative Harvest ETF continues to pause in the region of the trend mean.

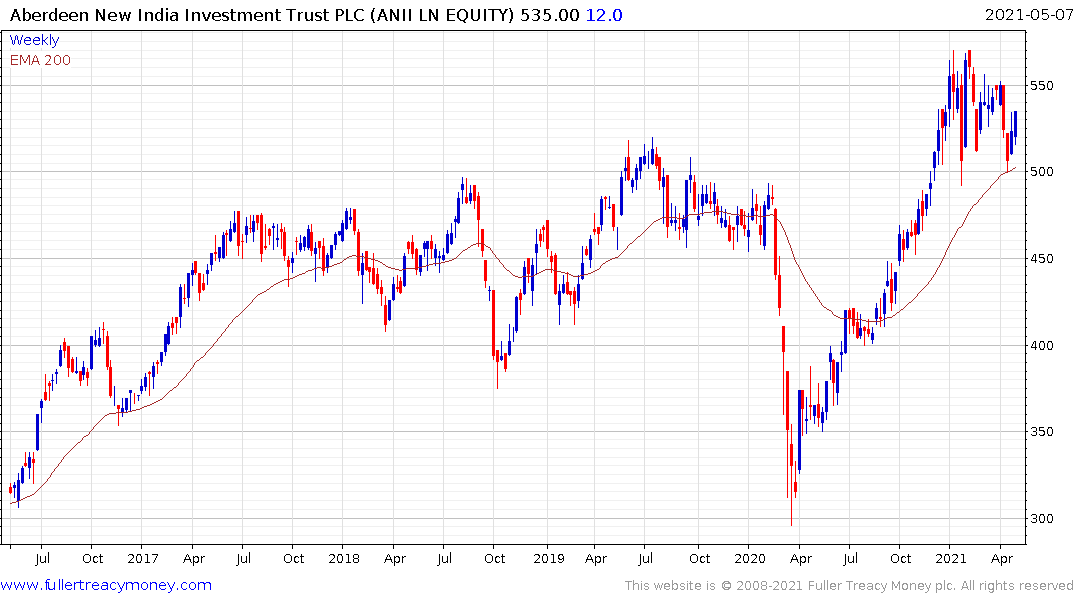

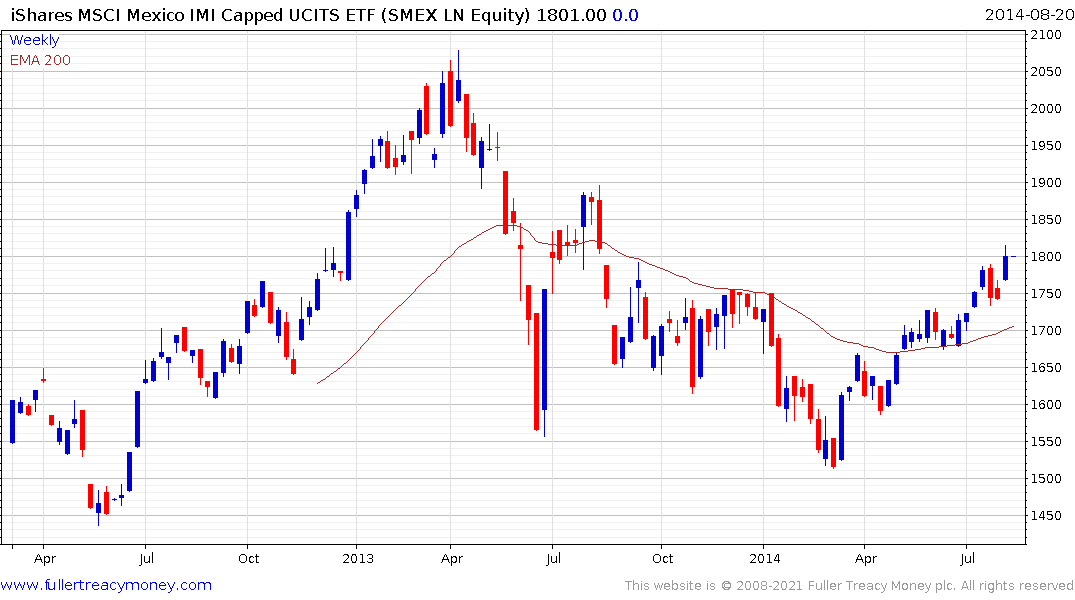

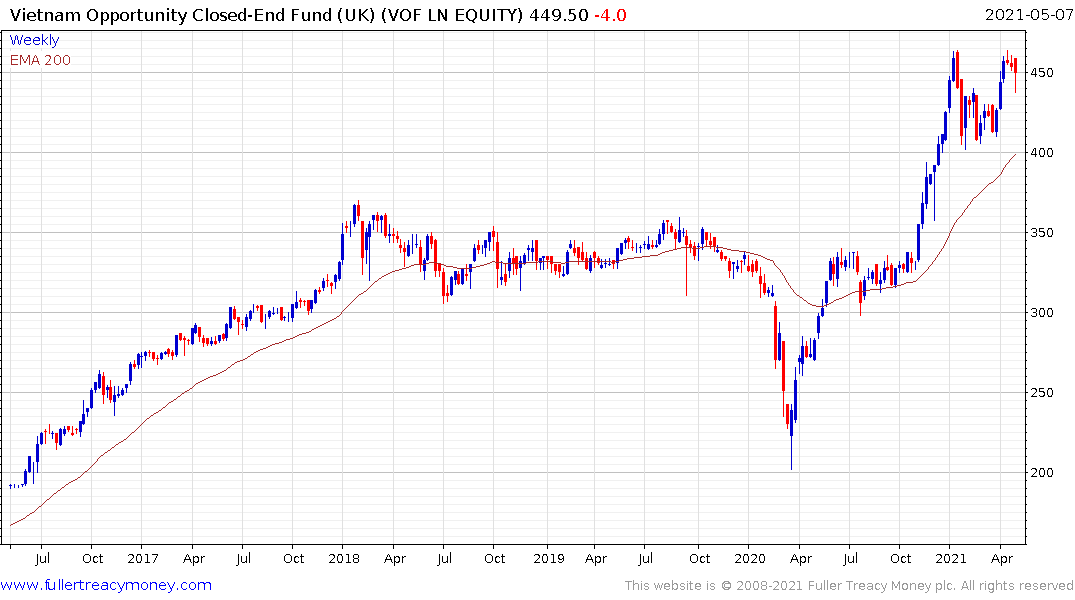

The demise of the Dollar bolsters the relative attraction of emerging markets. On the one hand, the worries about funding Dollar debt decline in importance while the growth rate, trade surpluses and performance of markets attract investors. Geopolitical challenges arising from China’s global ambitions are only going to become more contentious. That’s a primary benefit for countries like India, Vietnam and Mexico. They are likely to pick up the migration of manufacturing as China’s wages rise and regulations/sanctions make it less attractive for foreign direct investment.

The big takeaways from the above trends are the bull market is still intact and none of the lead indicators for recessions are worrying. There are patches of over exuberance but the broader global economic recovery is more about rotation than a commonality driven decline.

There are a lot of parallels with the recovery from the TMT bust and the credit crisis. Liquidity remains abundant and is likely to remain so until well after it is strictly required. Even then, the policy of normalisation will take years and, in the meantime, there is ample scope for asset prices to increase. The purchasing power of fiat currencies is the casualty of this asset price inflation.

Back to top