Secular Themes Review February 4th 2022

In 2020 I began a series of reviews of longer-term themes which will be updated going forward on the first Friday of every month. These reviews can be found via the search bar using the term “Secular Themes Review”.

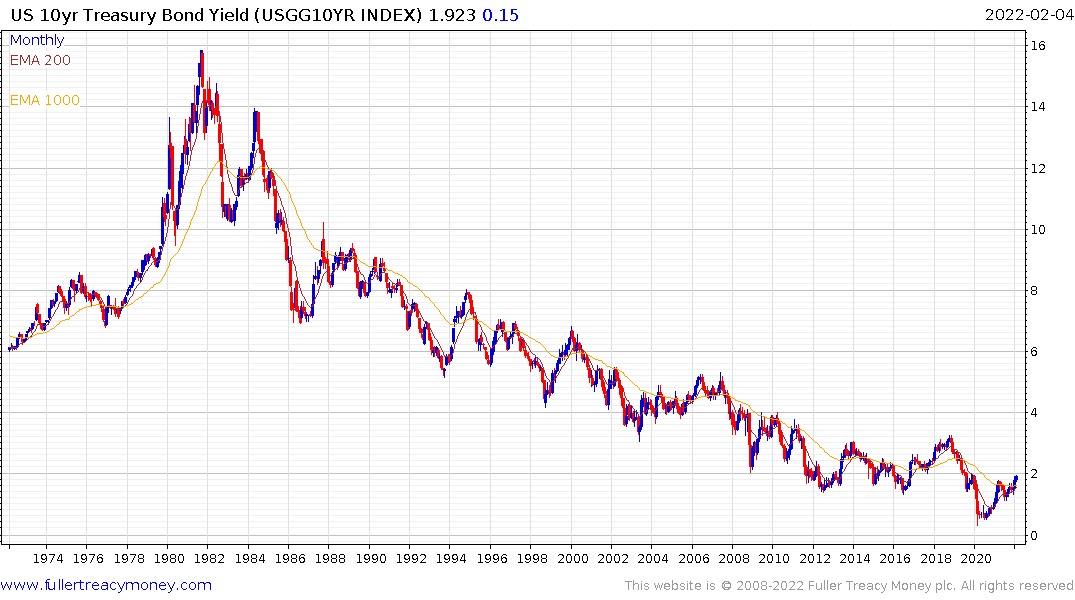

The biggest trend in the world isn’t bitcoin or the FANGMAN stocks. It’s bonds. Yields peaked in 1980 and the cost of borrowing has done nothing but decline since.

That’s enabled the steady rise of leverage, debt accumulation, asset price appreciation, speculation in all manner of public and private assets and every other bull market too.

The exact mix of where the debts have accumulated most is different in each country. For the USA, fiscal excess and unfunded liabilities are the biggest debt issue. The large number of companies surviving with no profits is the second biggest debt issue.

In Australia, Canada and the UK, consumer debt ratios, household debt and property debt are the pain points. The Reserve Bank of Australia’s reluctance to raise rates, despite inflation, is a symptom of the economy’s reliance on property prices.

For China, the accumulation of debt in the property sector has been epic. The sector represents 30% of GDP. At least in Japan, the massive quantity of debt is held domestically but it is a significant hurdle to raising rates.

Debt is only relevant when it needs to be repaid. Most of the time coupon payments are not challenging. Corporations used the opportunity presented by the pandemic to refinance their outstanding debt. The majority are not going to have to worry about paying more to borrow for at least another couple of years. That’s the primary reason high yield spreads have been reasonably well contained despite stress in the stock market.

Governments massively increased their outstanding debt during the pandemic; many by 25%. They also have ongoing funding requirements. Debt sustainability metrics have not been a topic of conversation for a long time. That’s going to change as yields rise.

This represents a significant change since December when yields had fallen aggressively to test the region of the trend mean. Only a couple of months ago it was still possible to make a deflationary argument. It is still possible for many inflationary pressures to ease later this year but markets are now in a “show me” mood.

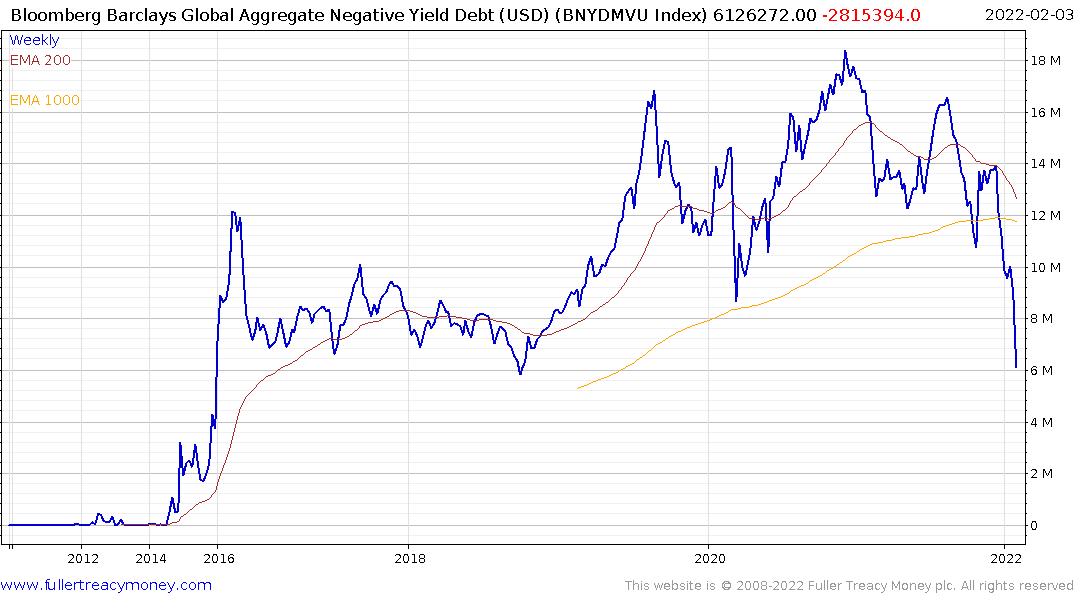

The total value of bonds with negative yields peaked at $18 trillion in December 2020 and is now $6 trillion. With German bunds and other European sovereign yields breaking out this week it represented $4 trillion in debt moving to a positive yield.

The total value of bonds with negative yields peaked at $18 trillion in December 2020 and is now $6 trillion. With German bunds and other European sovereign yields breaking out this week it represented $4 trillion in debt moving to a positive yield.

Many investors spoke about the illogical trend of investment in negative yielding debt as the first upswing took place in 2016. However, as negative yields persisted, and became more negative, investors had little choice but to buy the bonds. Everyone who bought in the last couple of years is now sitting on losses.

Since the sovereign bond portion of the portfolio is supposed to be “risk free” this is a significant issue for portfolio managers. The majority of 60/40 portfolios are now faced with a painful choice. They will need to buy very short duration bonds/floaters to back out the interest rate risk. That implies selling longer-dated issues which explains the dynamic moves in yields this week.

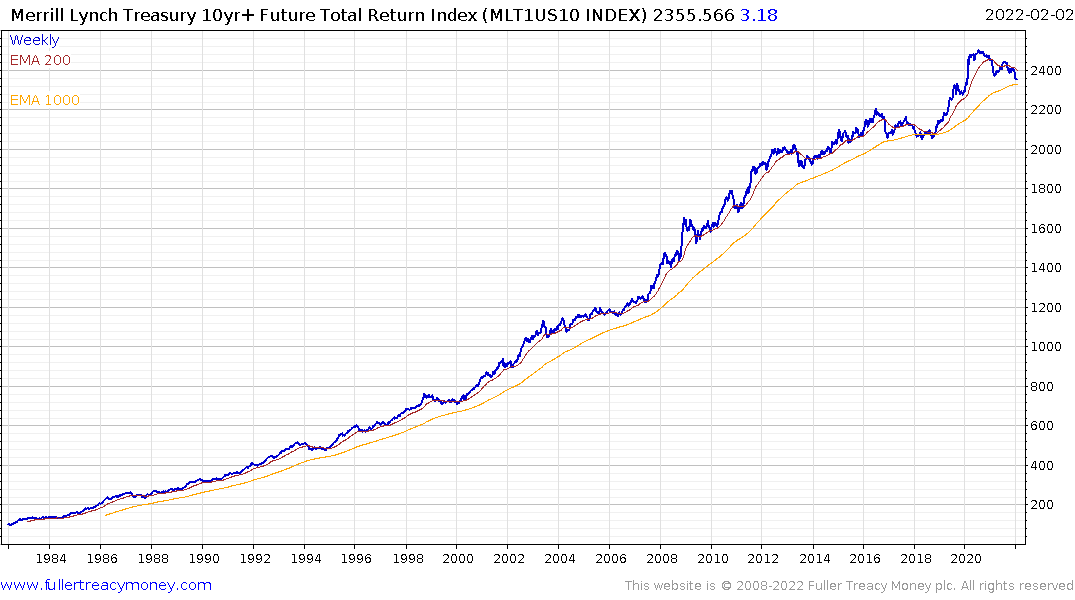

The Merrill Lynch 10yr+ Futures Total Return Index is testing the region of the 1000-day MA. This is only the second time in 42 years this has happened. The last time was in 2018 and the move was not sustained.

If a rebound is to take place, it will be accompanied by a significant announcement that interest rate hikes are going to be delayed and central banks are going to re-engage with yield curve control. Just how sticky inflationary pressures are is going to play a significant role in dictating whether those polices are likely.

.png)

One of the primary reasons the stock market has been so volatile over the last month is because the US Treasury was rebuilding its cash balance. It sucked $600 billion out of circulation over the last six weeks which represented a significant form of quantitative tightening. That process is now almost complete so that drag on asset prices will abate.

This helps to explain why the stock market is now rebounding from the recent lows. The most speculative portion of the market like recent IPOs and the ARK Innovation ETFs have all found near-term lows in the region of their respective 1000-day MAs. They have potential to unwind short-term oversold conditions. How well they can ultimately recover will be heavily influenced by the outlook for yields.

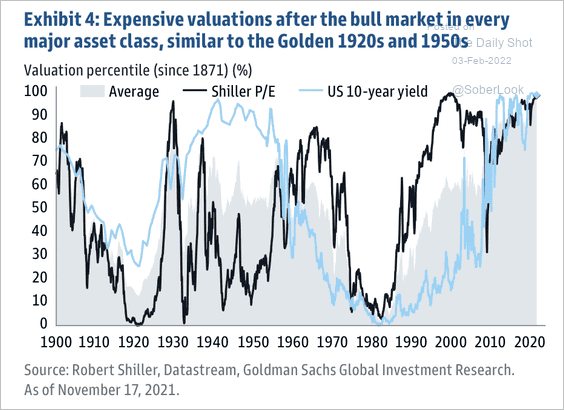

Valautions are historcially high so that means assets are much more interest rate sensitive than they would be in a normal cycle.

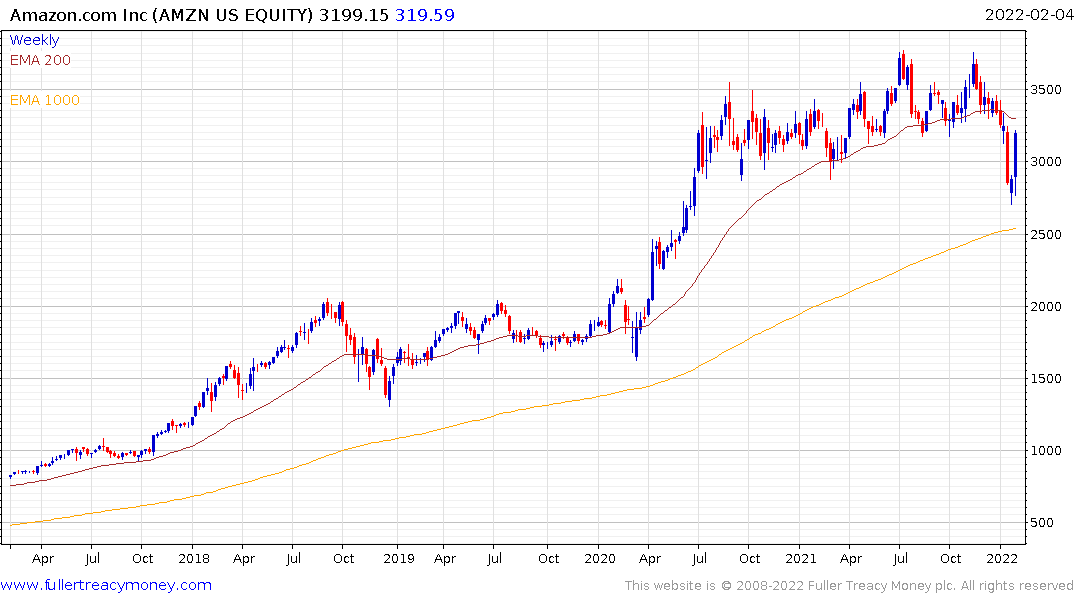

Meanwhile the FANGMANT shares (Meta Platforms/Facebook, Apple, Netflix, Alphabet/Google, Microsoft, Amazon, NVidia, and Tesla are struggling to sustain their outperformance. Investors celebrated outstanding Q4 results for Apple, Alphabet, Microsoft, and Amazon and had no qualms about shooting down Meta Platforms and Netflix on disappointing results. In just the last week, we’ve seen both record total declines and advances in single stocks (Facebook & Amazon respectively).

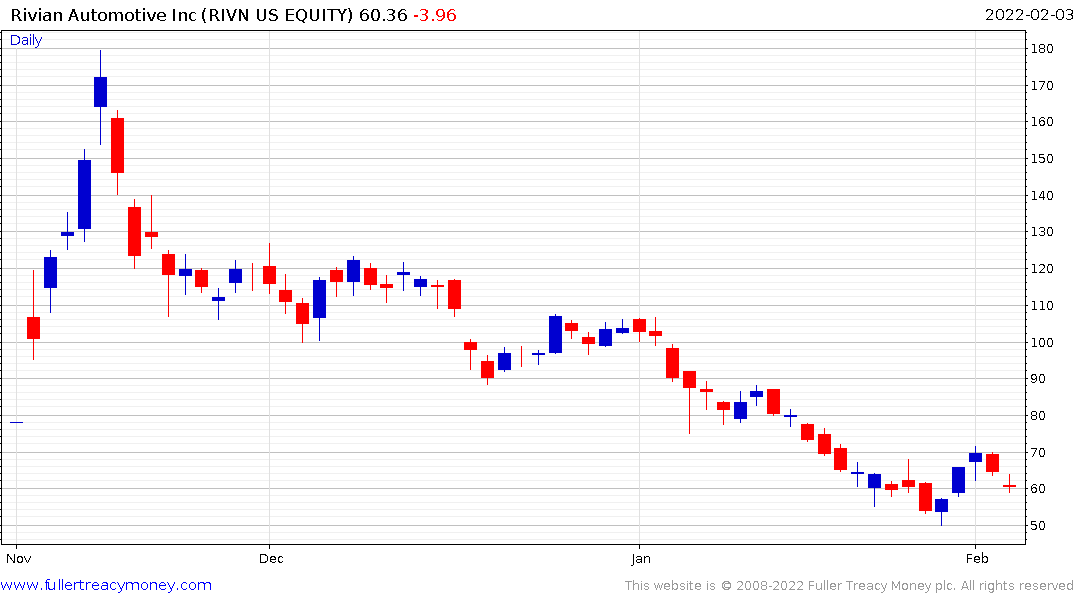

At present investors seem to be willing to ignore less than ambitious guidance. The gain from Rivian contributed most of Amazon’s earnings jump, even as cloud surprised on the upside. It is still a giant low margin business. The loss in Rivian shares (down from $100 to $60) will need to be booked at the end of the first quarter assuming there is no recovery.

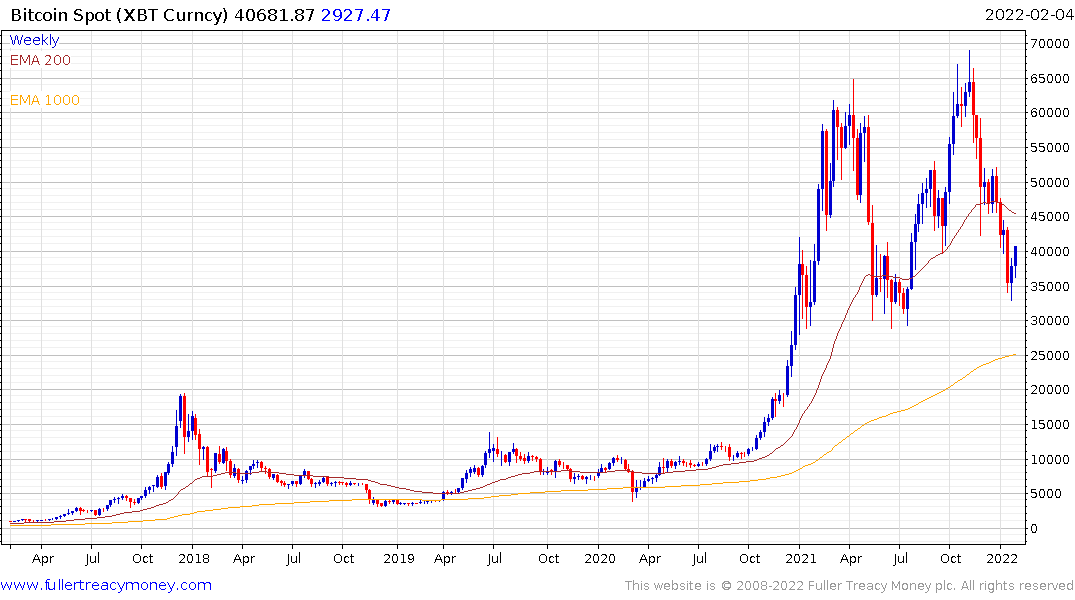

Bitcoin is the most significant barometer of risk-taking behaviour. It popped back above the psychological $40,000 today to push back up into the overhead trading range. Provided that gain is held and improved upon it supports the near-term rebound hypothesis for risk assets.

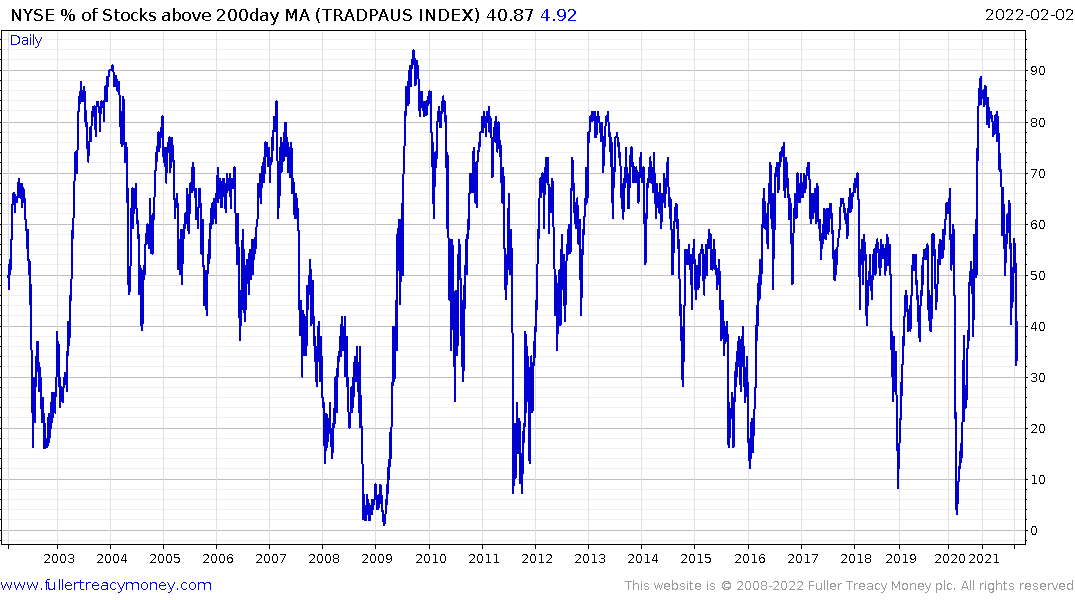

The Number of shares trading above their 200-day MA on the NYSE is also back at the 2010 lows. That was where stocks found support when they corrected after the initial bounce from the 2009 lows.

These are two competing themes. The risk-taking behaviour in the stock market and continued willingness to buy the dip stands in contrast to the significant and continued advance in yields. The Bloomberg Dollar Index pulled back sharply this week. A declining currency would support the view for higher yields and nominal price appreciation in the stock market. A break below the trend means would confirm the change of trend.

From a broader perspective, the S&P500 has lost uptrend consistency. The best-case scenario is this is a medium-term correction like late 2018. Back then, the confirmation of the Powell Put, following a 20% pullback, helped install a floor under prices. At present, investors are pricing in scope for a 50-basis point hike in March. Despite the rebounds mentioned above, this remains a dangerous environment.

The fact the USA’s DoJ is investigating short sellers, rather than Reddit users for market manipulation tells us all we need to know about how sensitive politicians are to stock prices.

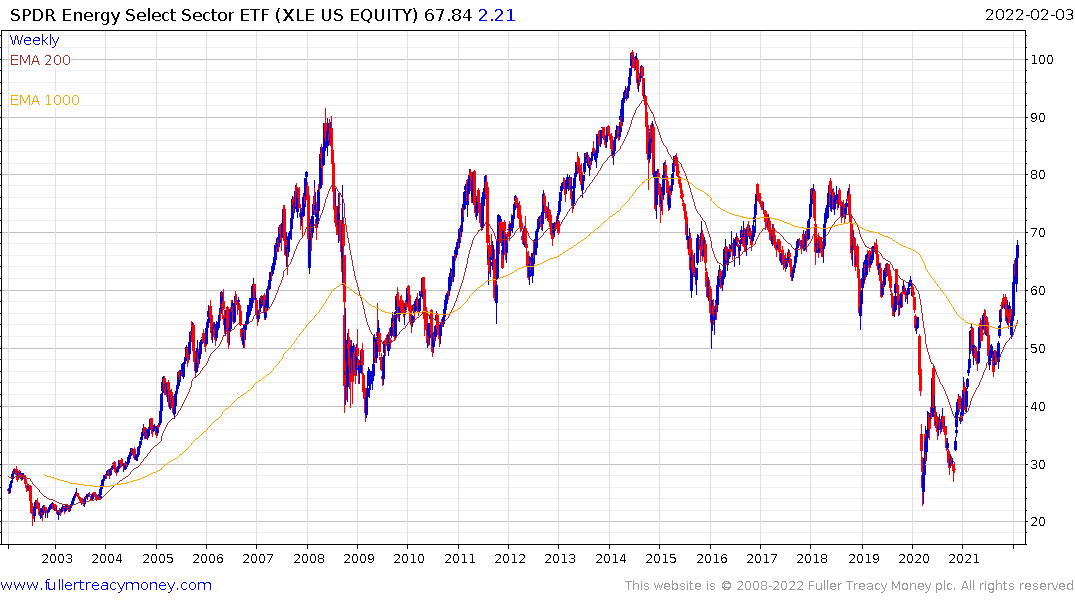

Oil prices continue to trend higher and look likely to test the psychological $100 level. OPEC+ remains disciplined with supply increases and the major oil companies are reluctant/unable to increase spending on new production.

The price has been ranging for 14 years and the price is currently only marginally higher than mid-range. Spikes in energy prices are a tax on consumption. They cut off spending from consumers and reorient investment into the energy sector which withdraws capital from other areas.

Europe is already experiencing an energy crisis, with significant pressure coming to bear on consumers. Subsidies are inevitable to curtail the inflationary push from this crisis and all the while carbon credits continue to march higher.

The region’s crisis is political in nature and will require a political solution. All higher interest rates will do is support the currency which should help to mitigate the pressure on imported energy prices.

The Energy SPDR ETF (XLE) is following the price of oil higher.

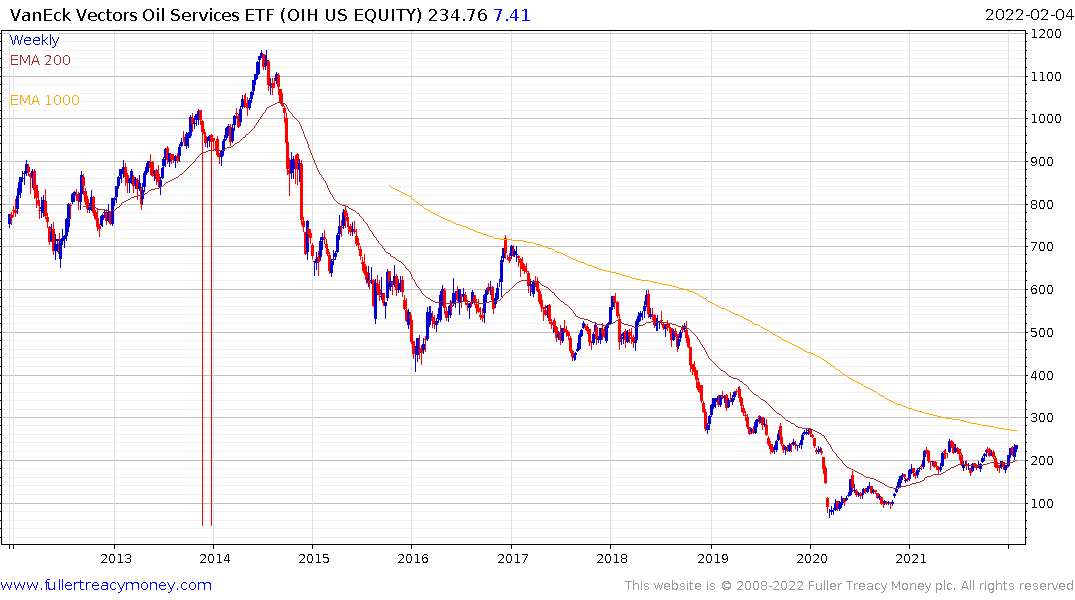

The Oil Services sector has base formation completion characteristics.

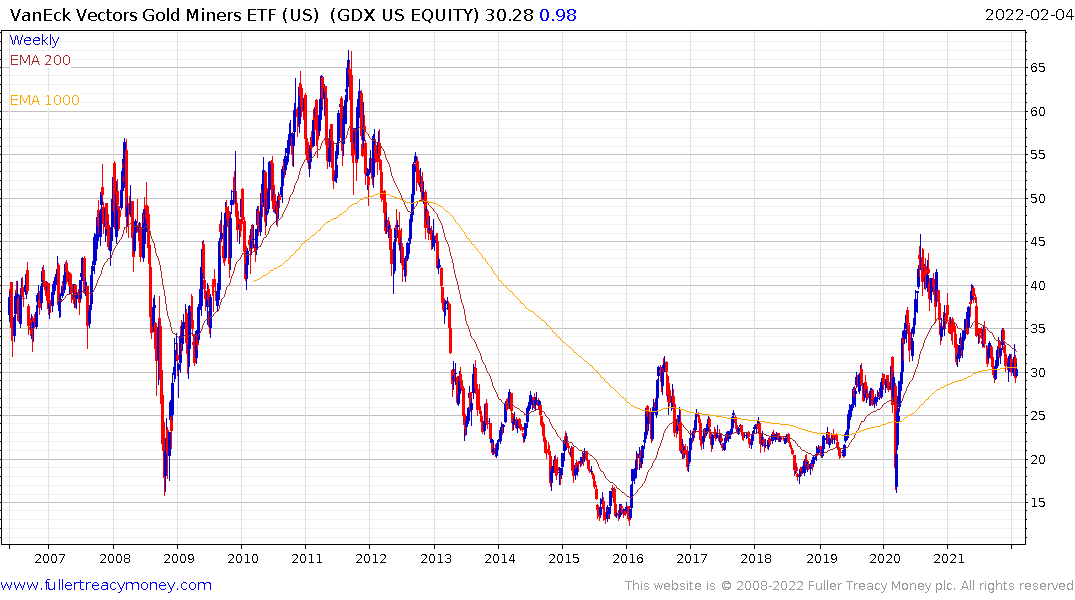

Meanwhile gold remains in a lengthy medium-term range. The price has repeatedly failed to sustain drops below $1800 and rallied above $1850. That reflects a war between supply and demand. The breakout when it comes will be powerful and will surprise many people who have been lured into the false sense of security that volatility can only contract.

In the just the same way that oil shares have staged an impressive rebound, gold shares will perform in a similar manner when gold breaks on the upside.

There might be a global movement towards renewable energy underway but the big question is where is the money going to come from to build the necessary infrastructure. Saudi Arabia announced today they are considering another $50 billion stake in Saudi Aramco. Those funds will likely be used to further the country’s ambitions of achieving its Vision 2030 goals of downstream development and industrialisation.

The S&P/Oil ratio peaked in 2020 when oil prices when negative and is trending lower. The last time it peaked was in 1998. That was a lead indicator for the eventual demise of the tech boom and the beginning on a massive commodity boom. The sustainability of the rebound on Wall Street needs to monitored very carefully.

Even as the world migrates towards spending on renewable infrastructure and hydrogen production capacity, there will still be a chronic need for more fossil fuels and metals.

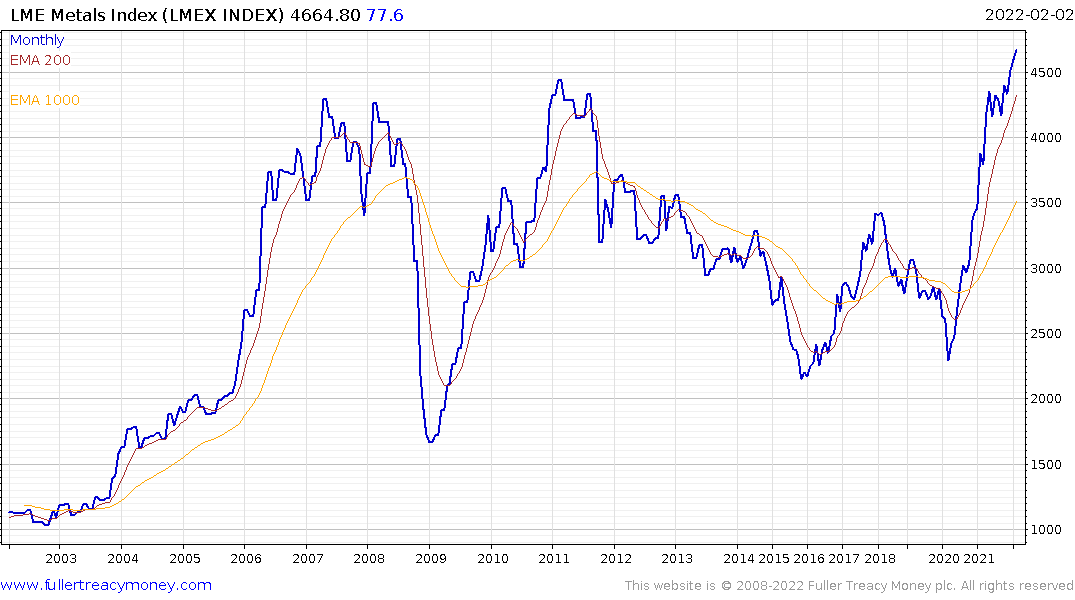

The LME Metals Index continues to march higher. Copper continues to have the clearest secular bull market fundamentals of any of the major industrial metals whereas lithium has the most compelling supply inelasticity argument in the near term.

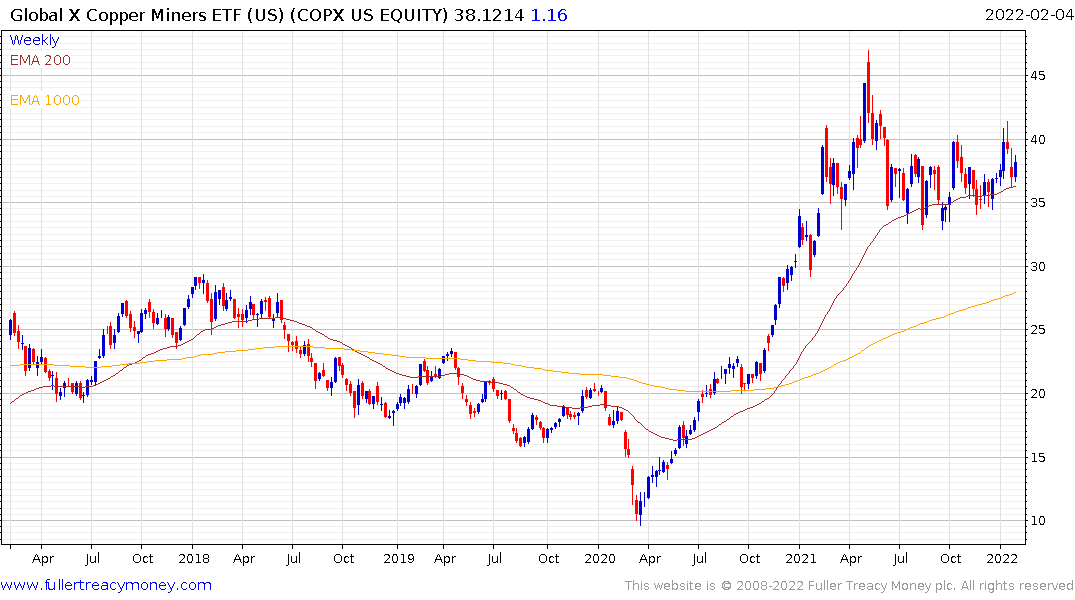

The Global X Copper Miners ETF continues to exhibit first step above the base characteristics.

The Baltic Dry index has collapsed over the last couple of months. With strong commodity prices, this is an anomaly. The only rationale I can think of its that China has massively curtailed imports of coal, iron-ore, and other commodities in the run-up to the Winter Olympics. They have engineered clear skies over Beijing, in the middle of winter, by shutting down polluting industries. It is reasonable to expect that bulk shipping will pick back up in March, once the cameras leave.

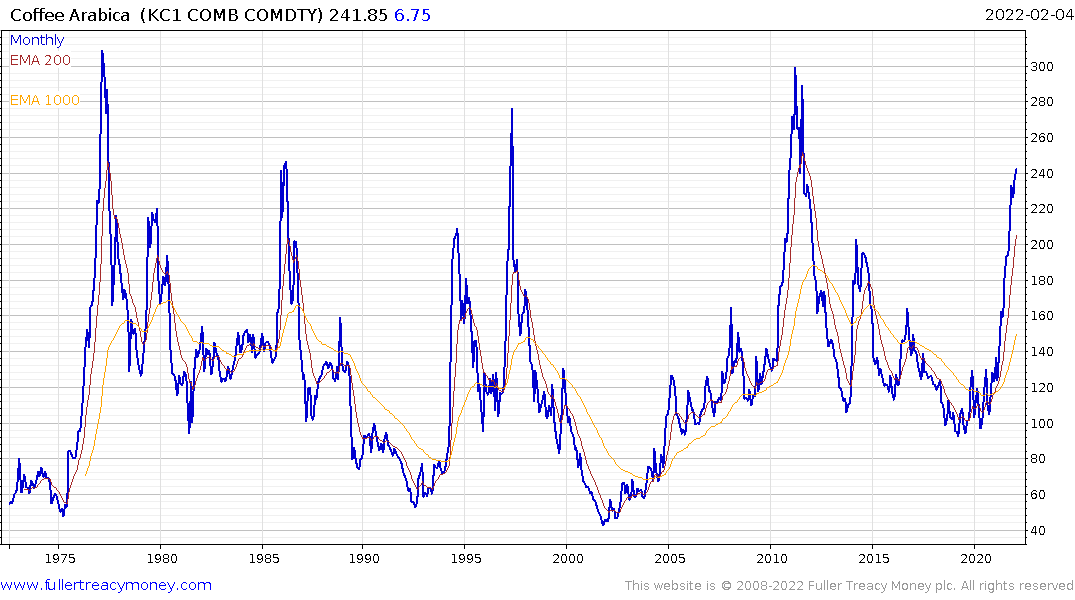

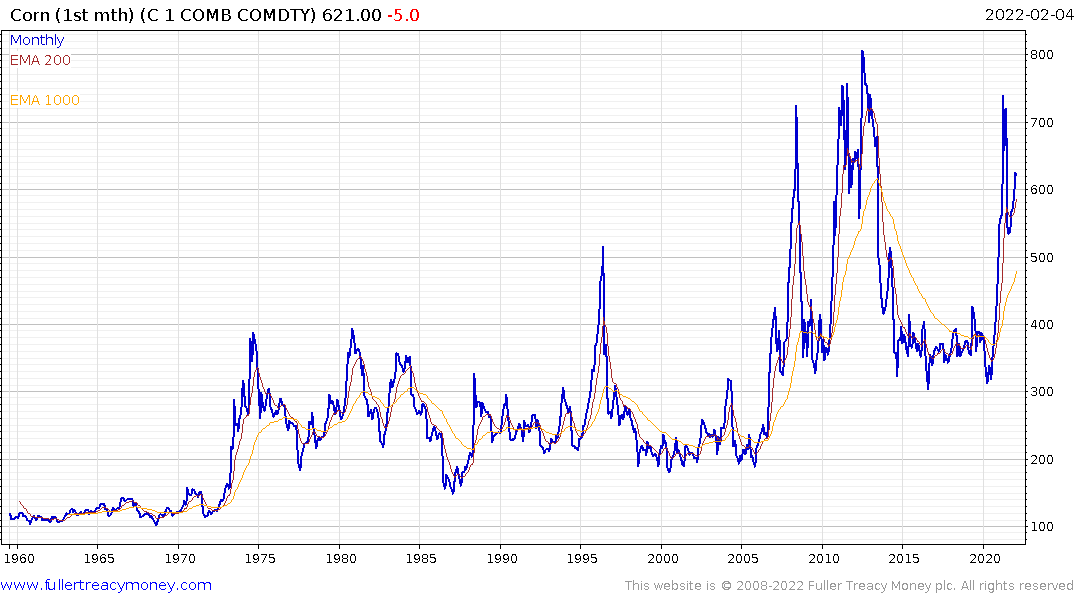

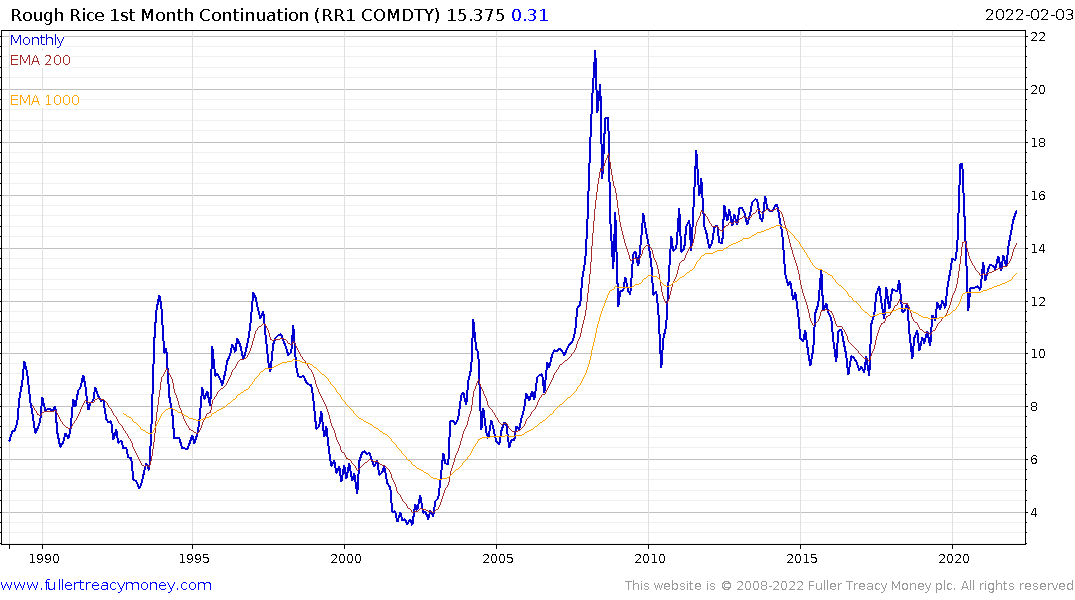

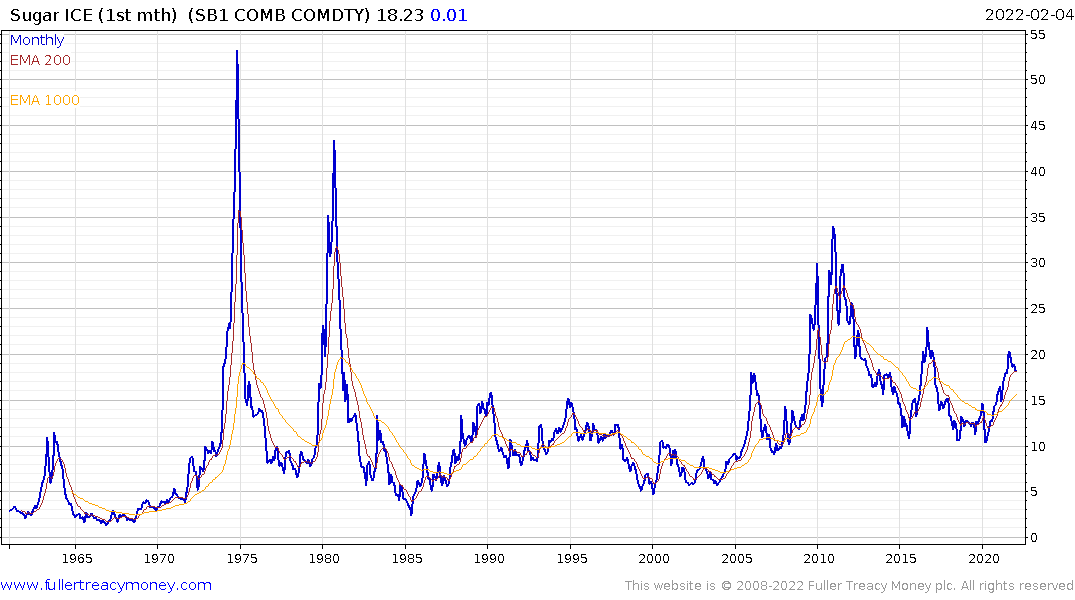

The Bloomberg Agriculture Subindex peaked in 1980 following a phenomenal bull market in the 1970s. Since then, there have been multi-year periods when prices rose aggressively but they were always followed by declines to new lows.

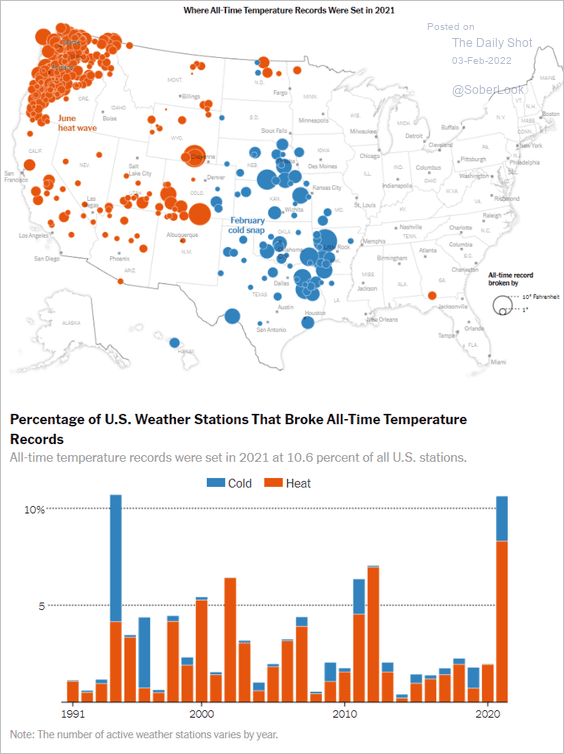

If we are at the end of the bond bull market and at the beginning of a new inflationary trend, agriculture prices will trend higher in a significant manner. Frosts in Brazil, droughts in Latin America, floods in the US Midwest, massive rain events associated with hurricanes, record heat in Europe, the Middle East and Australia might be individually worrisome but combined point towards greater climate volatility.

Coral bleaching, ocean acidification, microplastics everywhere, bumblebees on the endangered species list, vineyards migrating north in France and new agricultural areas opening in Russia and Canada point towards the need for significant flexibility in agricultural production. That does not come cheap.

If the agriculture futures complete secular base formations, that will be the catalyst needed to spend the money required to build out a carbon-free energy infrastructure. There will be no choice. The “nature is failing” narrative will go into overdrive.

I thought the above graphic was particularly relevant. We all experience weather locally. Record low temperatures in the centre of the USA and record highs on the coast go a long way towards explaining the arguments about climate.

Nutrien remains in a consistent uptrend. Mosaic posted new recovery highs this week. Even Bayer is firming within its base formation.

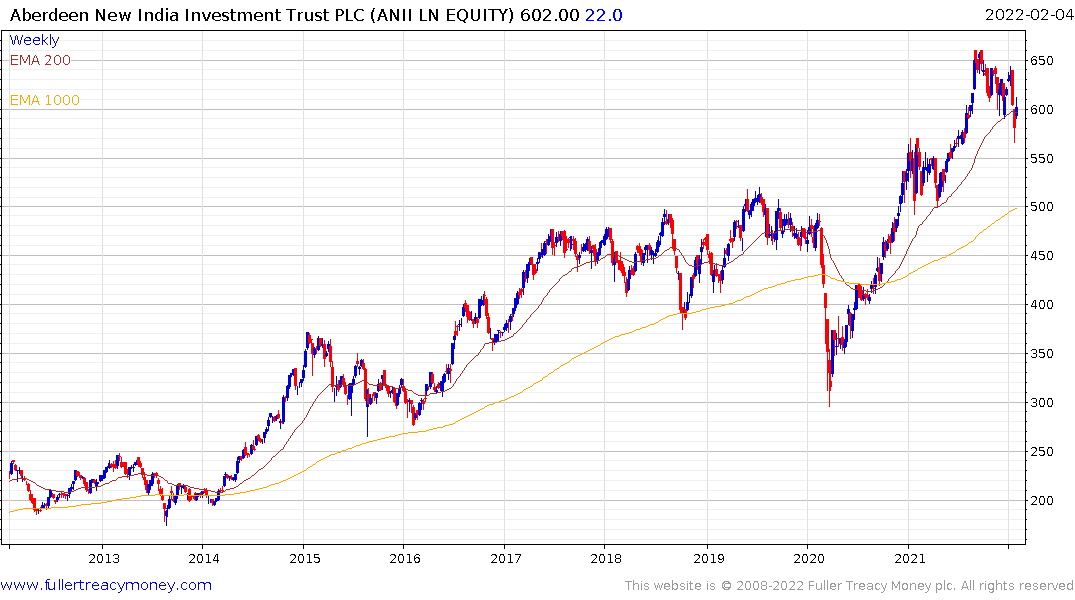

This article from Bloomberg discusses Chris Woods contention the Indian Sensex will surpass 100,000 in five years.

India has a large young population and a government elected with a mandate to find jobs for them. Over the next decade India’s growth is likely to surprise on the upside because it will reap maximum benefit from this demographic dividend. India is one of the few places with potential for strong organic growth potential. That’s something investors are likely to prize over the next decade.

Many countries have a vested interest in seeing India succeed. They want a regional counterbalance to China. India is the best bet. That suggests India will find more doors open to trade and support than previously.

The Sensex currently trades at 58,000 so a 5-year target of 100,000 implies a CAGR of 11.26%. Over the last 20 years, the Sensex has returned 13.2% per annum on average so this target is conservative.

Nothing has happened to change the volatility of India’s markets. They are capable of wild swings so investors are best served by expressing a willingness to buy during medium-term corrections. The Index is currently holding the region of the trend mean and received a boost from the fiscal pop announced in the budget.

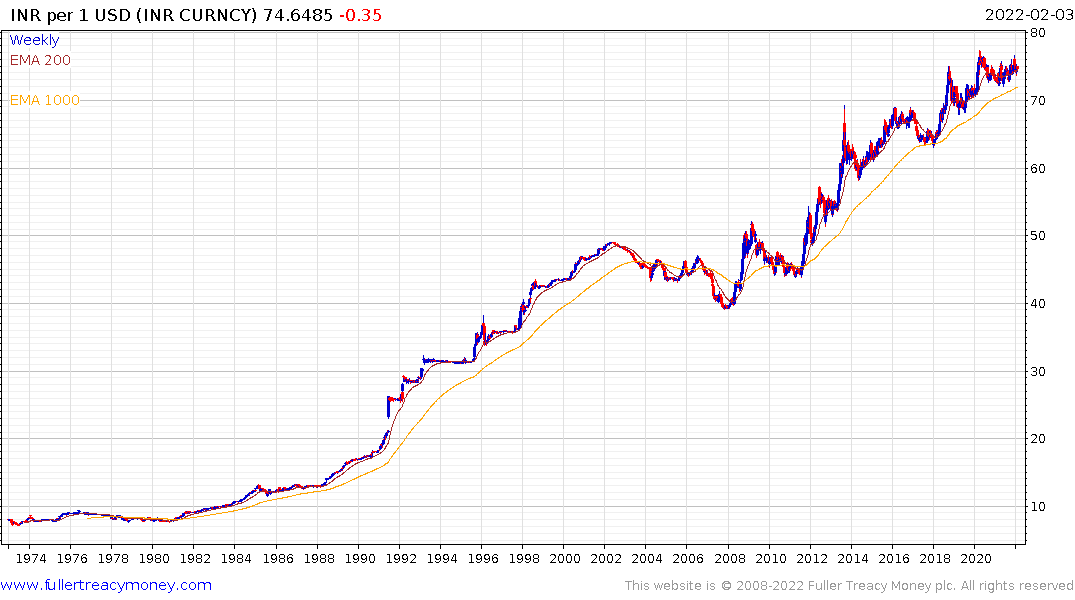

While oil prices are a challenge for a big importer like India, it is also worth considering that the only time the Rupee trended higher was during periods of strong oil prices. The RBI’s primary tool for mitigating some of the pressure from commodity imports is to support the currency. That has generally represented a green light for foreign investors to migrate to India markets. It also forces innovation to reduce dependence.

The Rupee is currently holding steady in the region of INR75 versus the Dollar. It would need to at least sustain a move through INR73.75 to signal a return to demand dominance.

Brookfields, India listed, Real Estate Trust broke out to new highs this week.

The Aberdeen New India Trust is currently pausing in the region of the trend mean.

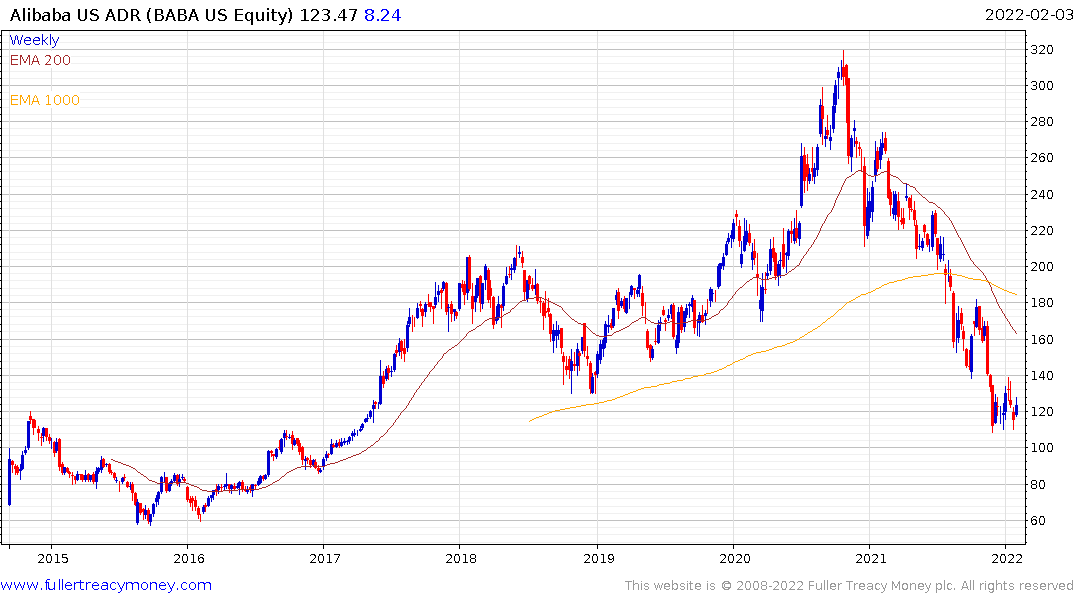

China's credit impulse is turning. That suggests there will be more money made available following the end of the New Year holiday to support the economy and particularly the property sector. Inflation has been much less of an issue in China than elsewhere because they ran tight money policies during the pandemic. That also implies they have more room to stimulate now that the economy is under stress.

The high yield Index has experienced a deep decline and continues to struggle to put in a low.

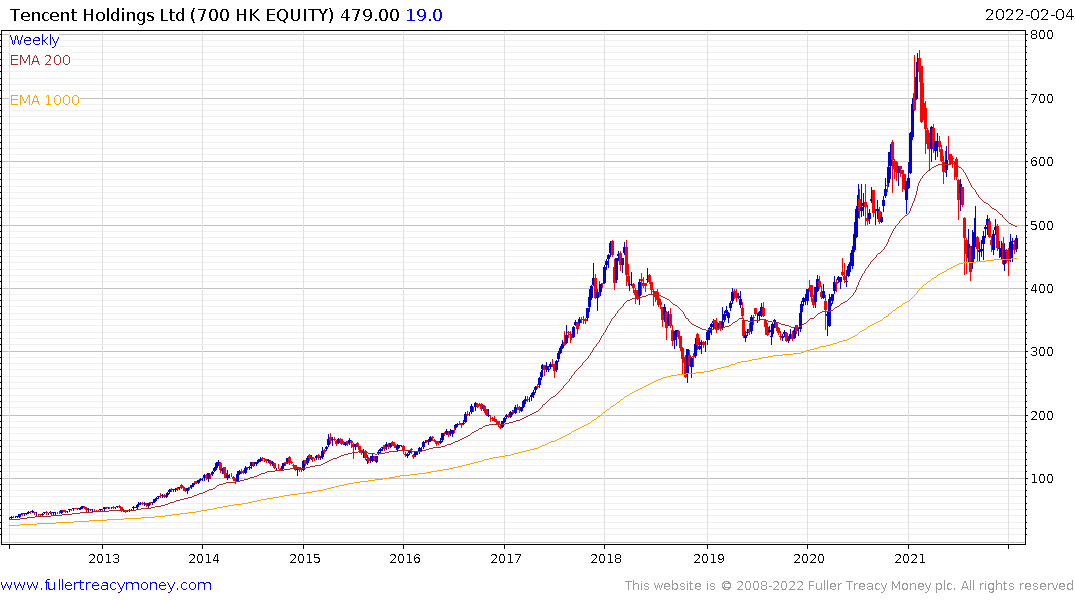

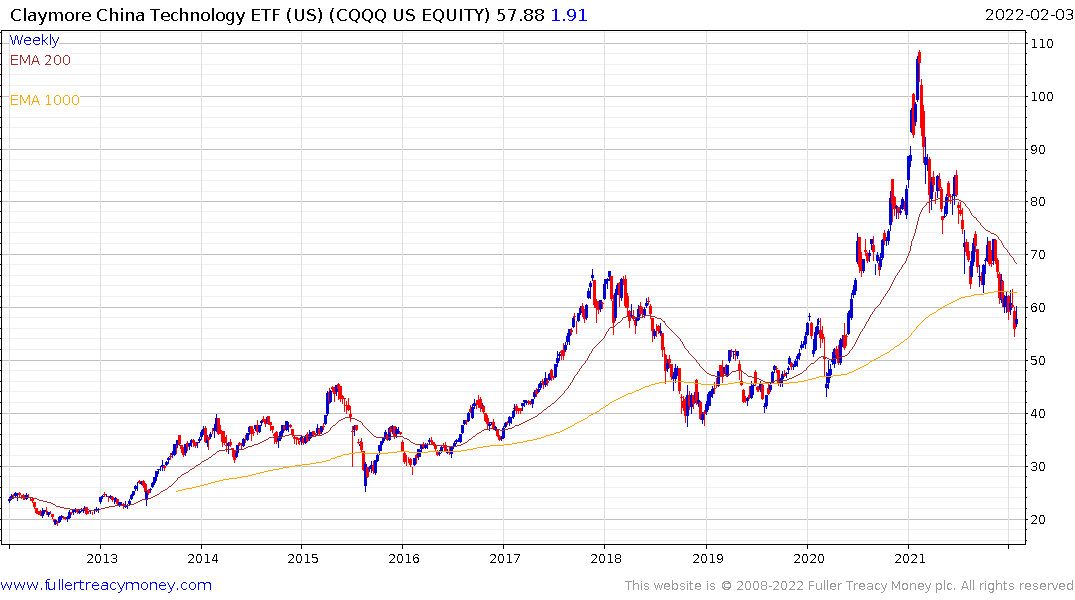

Meanwhile the tech sector is showing initial signs of building support. Alibaba is steadying. Tencent is firming from the region of the 1000-day MA and the Invesco China Technology ETF is beginning to firm as well.

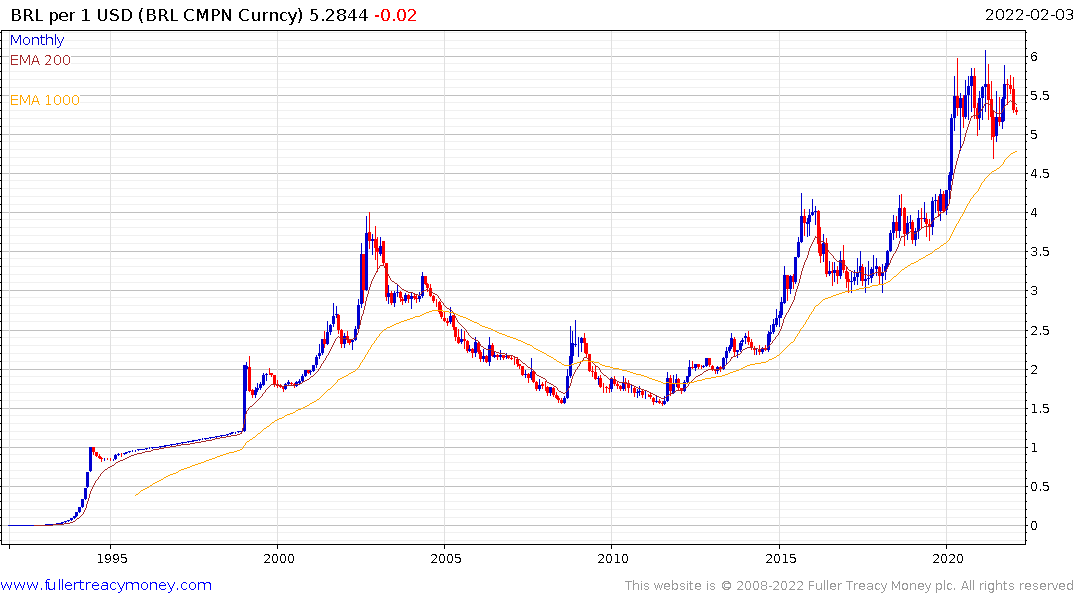

Brazil has some of the highest interest rates in the world and is actively working to curtail inflation. The currency strengthened through the 200-day MA this week. If we are at the beginning of a new commodity-led bull market, as appears likely, Brazil’s oil will become competitive again and demand for metal exports will be even more intense.

Brazil has some of the highest interest rates in the world and is actively working to curtail inflation. The currency strengthened through the 200-day MA this week. If we are at the beginning of a new commodity-led bull market, as appears likely, Brazil’s oil will become competitive again and demand for metal exports will be even more intense.

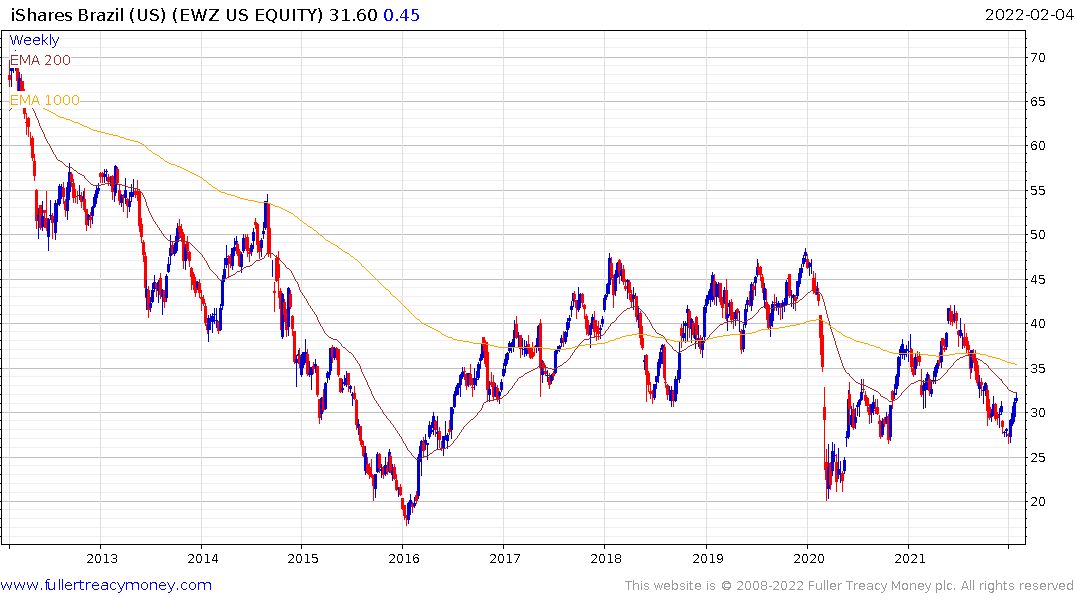

The iShares MSCI Brazil ETF continues to firm within its base formation.

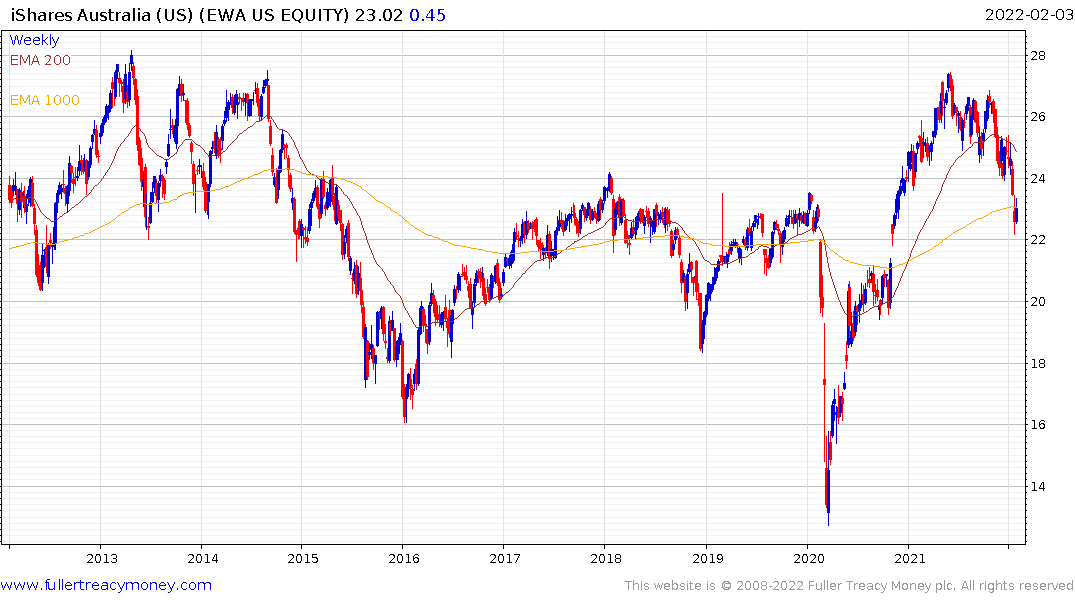

The iShares MSCI Australia ETF is firming following a steep decline over the last month.

As we look around the world, there is still a big argument about whether we are in a new secular bull market for commodities like the early 2000s or a cyclical bull market like between 2008 and 2011. If oil prices remain firm and both copper and gold breakout the argument will be resolved clearly in favour of a new secular bull trend. That would also suggest the bond bull market is over, inflation is going to be a long-term problem and the speculative tech bull market is over.

On the other hand, if commodity prices break lower and bond yields contract, that will signal renewed Dollar strength and continued support for the pre-eminence of Wall Street.

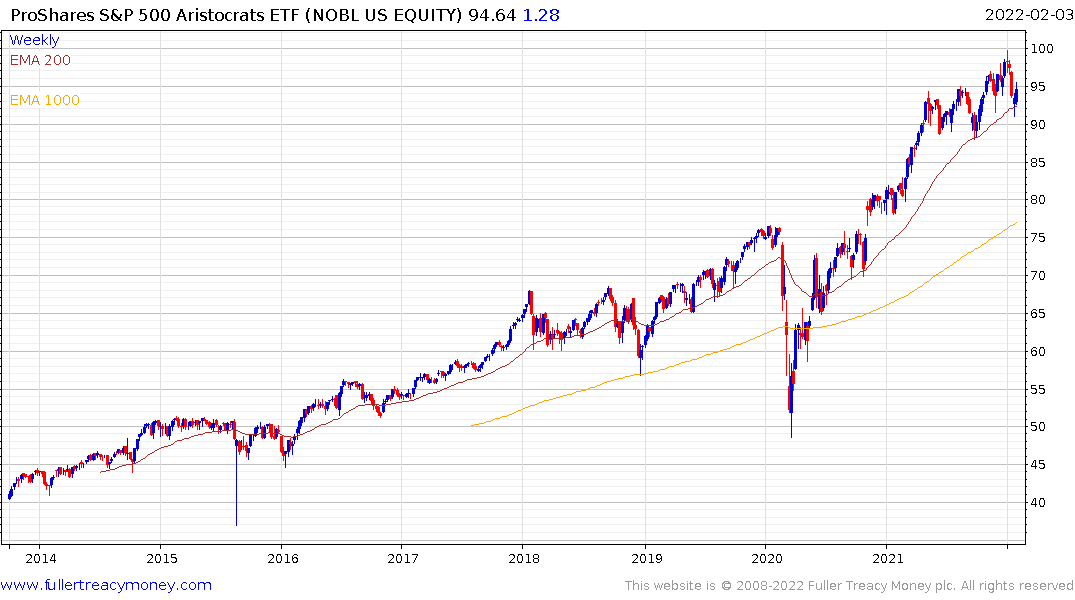

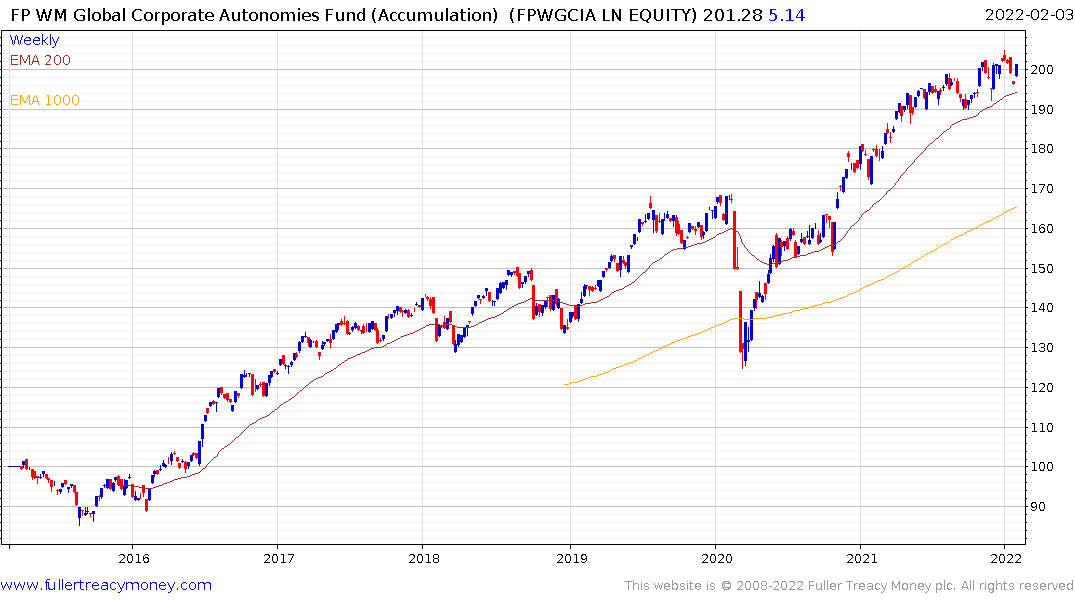

Value has exhibited clear relative strength over the last month with dividend aristocrats and autonomies sustaining their uptrends. That supports the former view, even if there is scope for some short-term unwinding of oversold conditions in the speculative sector.