Secular Bull Market Investment Candidates Review March 2021

On November 24th I began a series of reviews of longer-term themes which will be updated on the first Friday of every month going forward. The last was on January 8th. These reviews can be found via the search bar using the term “Secular Themes Review”.

The rollout of vaccines to COVID-19 continues to accelerate and that will continue through the balance of the year and 2022. There is encouraging news about the number of different vaccines which have been approved and their success against variants. By the end of the year, the world will be inundated with doses which will provide at least some protection from the virus for anyone who wants it. That’s all the rationale any government needs for reopening the economy.

On Valentine’s Day 2020 Mrs Treacy and I went out for dinner with another couple. We talked about the news of a virus threat from China and how it could potentially cause ructions further afield. We told them we had stocked up on rice, meat, protein bars and batteries just in case. They thought we were crazy crackpots jumping at shadows.

It was hard to imagine then just how disruptive the decision to lockdown was going to be. A similar condition exists today. After a year of being confined to our immediate vicinity it is tempting to think this is how it will always be. The reality, however, is we are going to see a surge back to normalcy much quicker than most believe possible.

Humans are social animals and we yearn for social contact. We’ve been starved of that basic need for a year and we’ll overdose on it when we are able. That suggests we are looking at a boom in consumer activity over the coming couple of years.

Stock and bond market investors have been pricing in this conclusion for the last few months. The rise in government bond yields, everywhere, is a testament to improving expectations for growth and the clear signalling from central banks that they are going to aggressively pursue inflationary policies.

Fed officials admitting they are no good at forecasting inflation is the biggest change in the macroeconomic environment for decades. They want to see inflation rise, hold the gain and accelerate on a sustained basis before raising rates. There is a lot of discussion about whether they are serious and whether they will be able to follow through on that ambition.

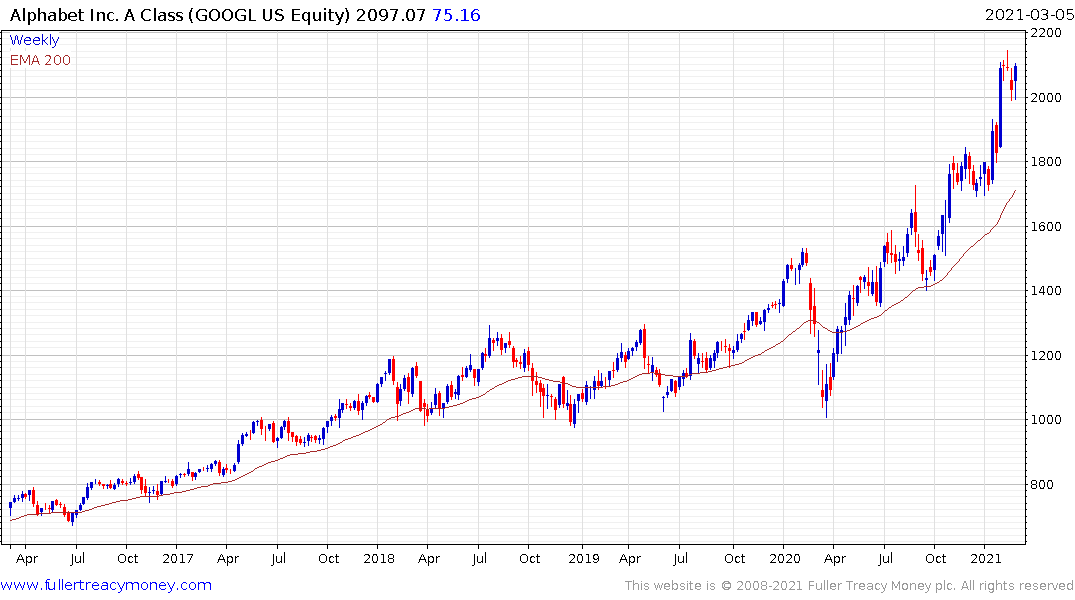

The way the market tests a central bank’s resolve is with a pullback in asset prices. That’s is what we are seeing right now. Technology stocks have been the leaders in the bull market up from the lows in 2008/09. They are now leading the market lower.

Leaders tend to lead in both directions and they lead for a reason. Growth oriented shares perform best when interest rates are low and capital is abundant. That’s exactly what we have had for 13 years and tech companies have become the largest in the world by a wide margin.

As a result of reliance on cheap financing they are very interest rate sensitive. The reintroduction of a discount rate brings ambitious forecasts for future growth back to reality. That’s an issue for the mega-caps but they have earnings and many pay dividends which act as a cushion.

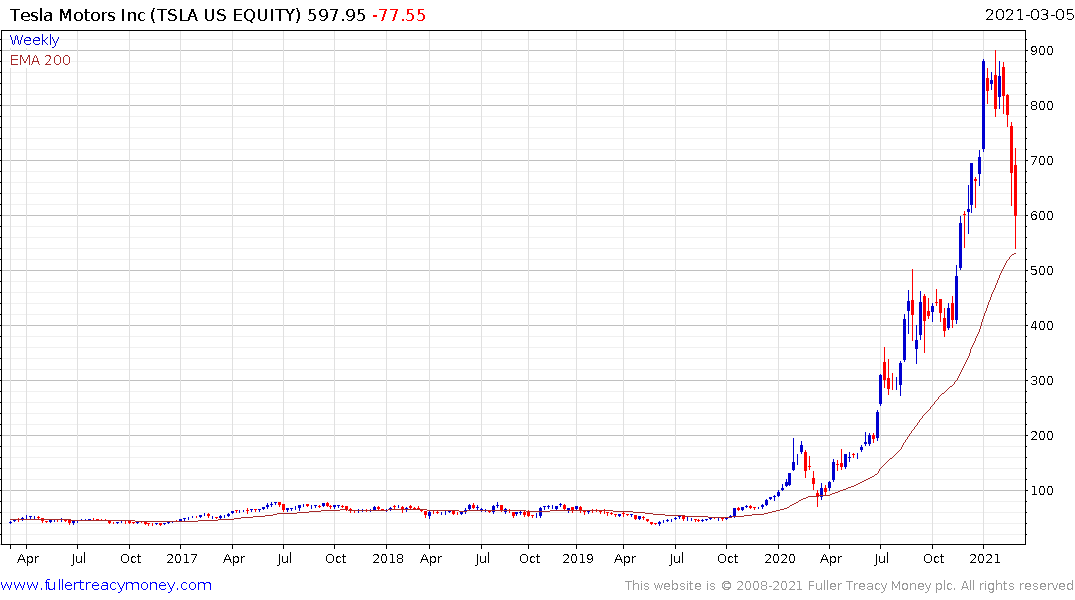

Contrast the recent performance of Alphabet with Tesla for example.

The greater risk resides in the slew of new companies with no profits and ongoing funding requirements which have recently listed. The “innovation” sector which has been selling promises is now pulling back sharply. Running persistent losses only works if there is a queue of people willing to buy because they believe they can sell the stock for more later.

The continued success of companies with no profits is entirely dependent on the willingness of the monetary and fiscal authorities to continue to bail them out with subsidies, low interest rates and abundant credit.

![]()

Weakness is not limited to zombie companies. Cloud computing and semiconductors have both at least partially completed reversions towards the mean.

Interest rates are only part of the story. The other rationale is they pulled forward earnings from the future into 2020 and have no hope for repeating that feat this year. The pace of reopening will further impact that trend while simultaneously burnishing the outlook for recovery stocks.

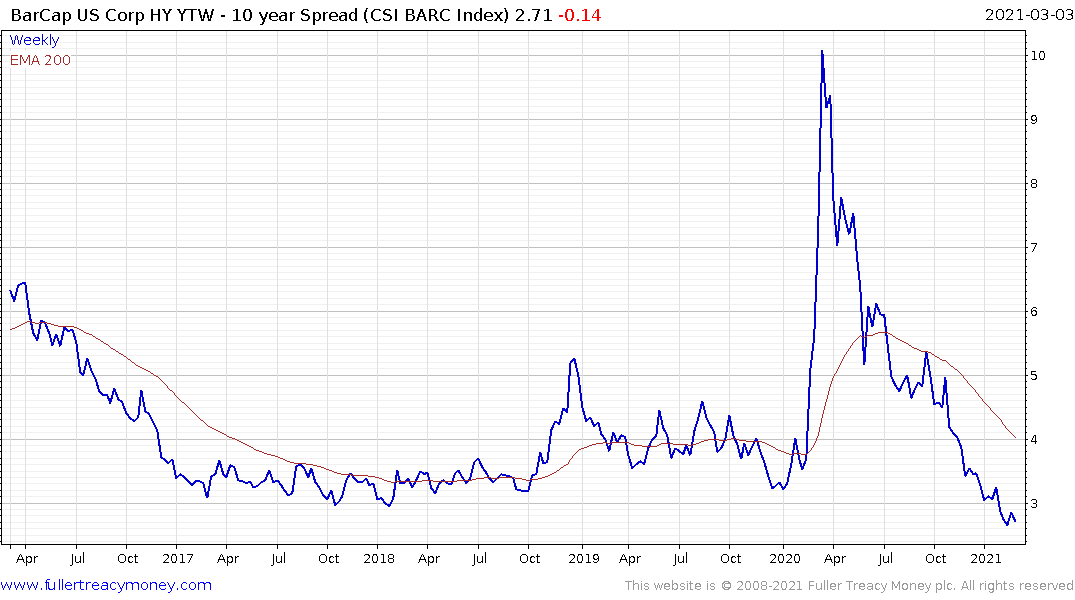

The fact the high yield spread remains at record low levels and financial conditions remain highly accommodative suggests any serious risk of a major market top is relatively well contained. Instead, what we are seeing at present is a consolidation of very powerful gains.

Japan intervened today to maintain the cap on 10-year yields and the Yen continues to pull back.

European yields are still negative but the rate has tightened over the last month.

Swiss yields continue to test the upper side of the yearlong base formation.

.png)

US, UK, Australian and Canadian yields have all broken out in a very dynamic manner over the last month. It is these four countries where bond investors are betting an inflationary bias will appear first.

Nevertheless, bonds are very oversold at present. There is an increasing argument for investors to buy the dip if they have any incentive to believe central banks will act to avoid a rout.

How willing central banks will be to further inflate asset prices, in order to cement economic recovery, is the big question for investors over the coming months. Mean reversion is looking increasingly likely for many of 2020’s favourites and that represents pull backs in the order of 20% or more from their peaks. It’s at that point faith in the recovery will wobble and central banks will be encouraged to act. We are unlikely to see any form of assistance before then.

Illiquidity in the repo market represents an additional potential catalyst for central bank action. The piercing of the fail rate on Treasuries this week was a warning shot that underlying stress in the money markets should not be ignored.

That suggests the Dollar will continue to rebound because the imminent risk of supply increases is at least delayed. As the Dollar rallies it puts pressure on any asset reliant on cheap funding. That’s particularly relevant for emerging markets with large Dollar funding liabilities.

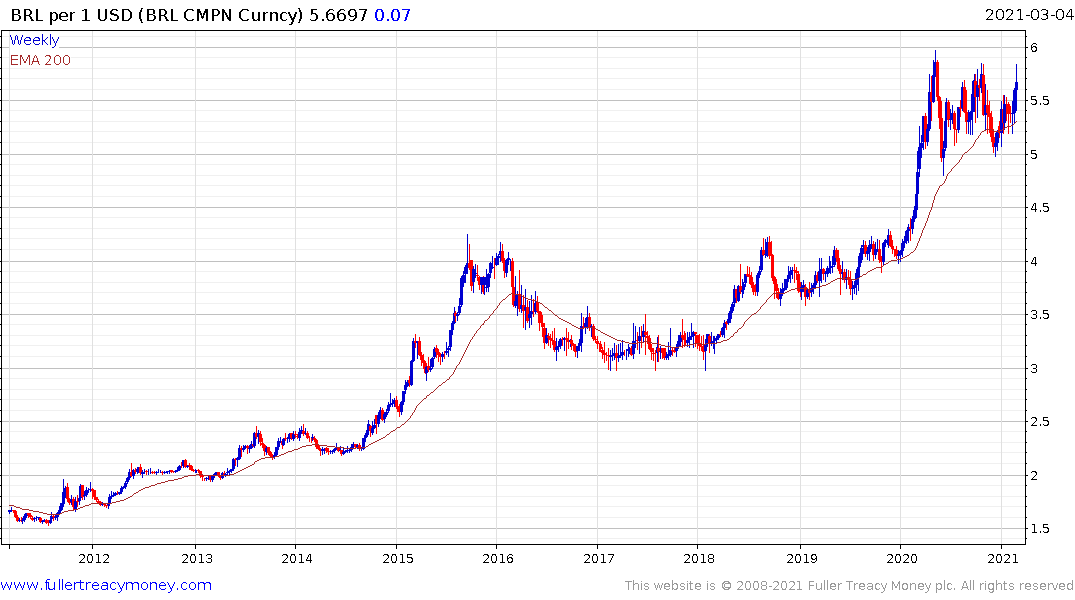

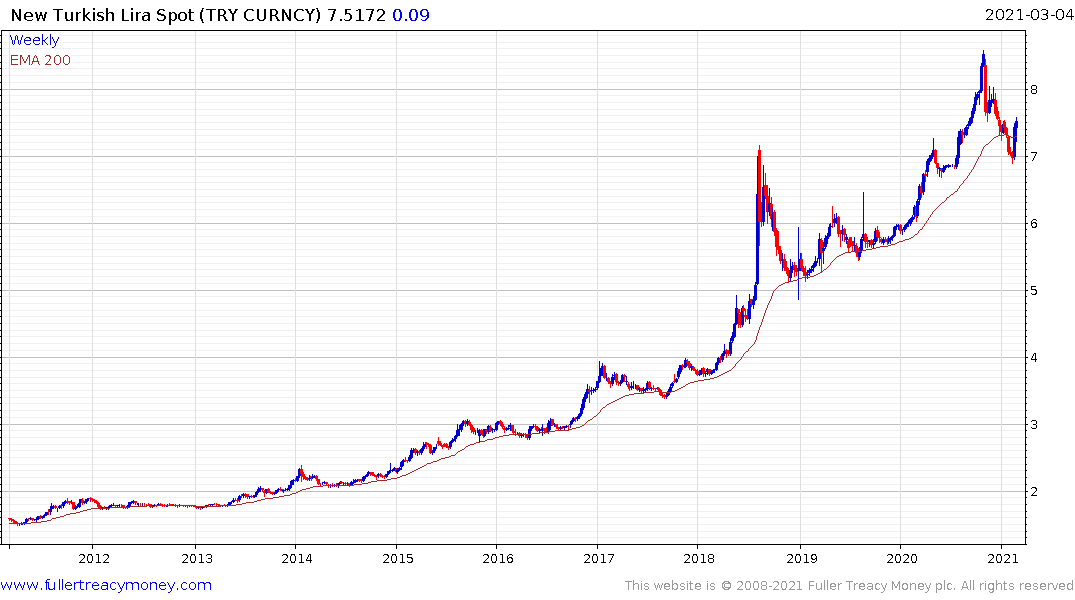

The Brazilian Real is back testing its lows and the Turkish Lira has broken its sequence of higher reaction lows. These markets are as reliant on cheap Dollars as any SPAC.

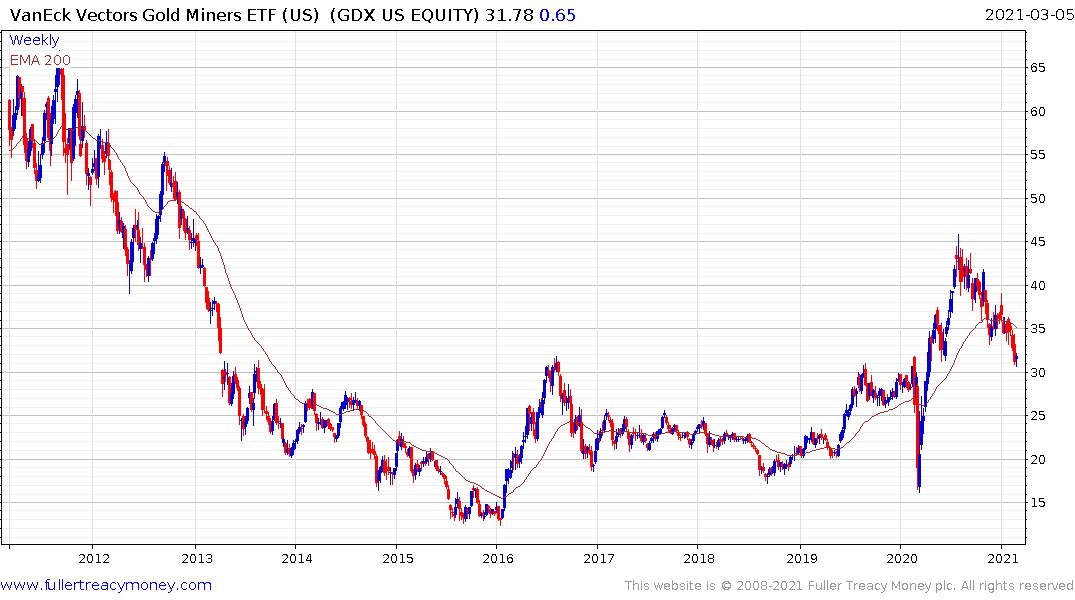

Gold and gold shares have been under pressure as the reflation trade has gathered pace. The next leg of their secular bull market is likely to be fuelled by concerns for what the pandemic public debt hangover will do to the purchasing power of currencies.

At the other end of the spectrum the prospect of a return to global growth is boosting the outlook for value and recovery strategies. They are likely to continue to outperform at least until there is a clear message that interest rates will be controlled.

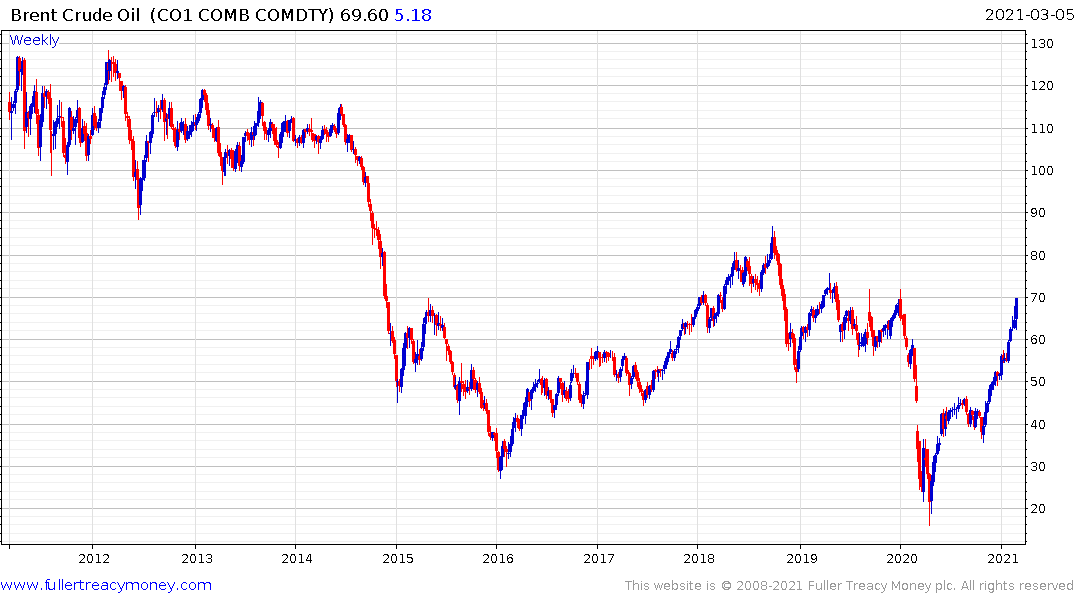

Oil’s continued impressive rebound is being driven by newfound supply restraint at OPEC and recovering demand. It’s advance, against a background of doubt at the sustainability of the fossil fuel sector, highlights how out of touch with reality some of the most bullish renewable energy forecasts are. It will still be a long time before we stop using oil.

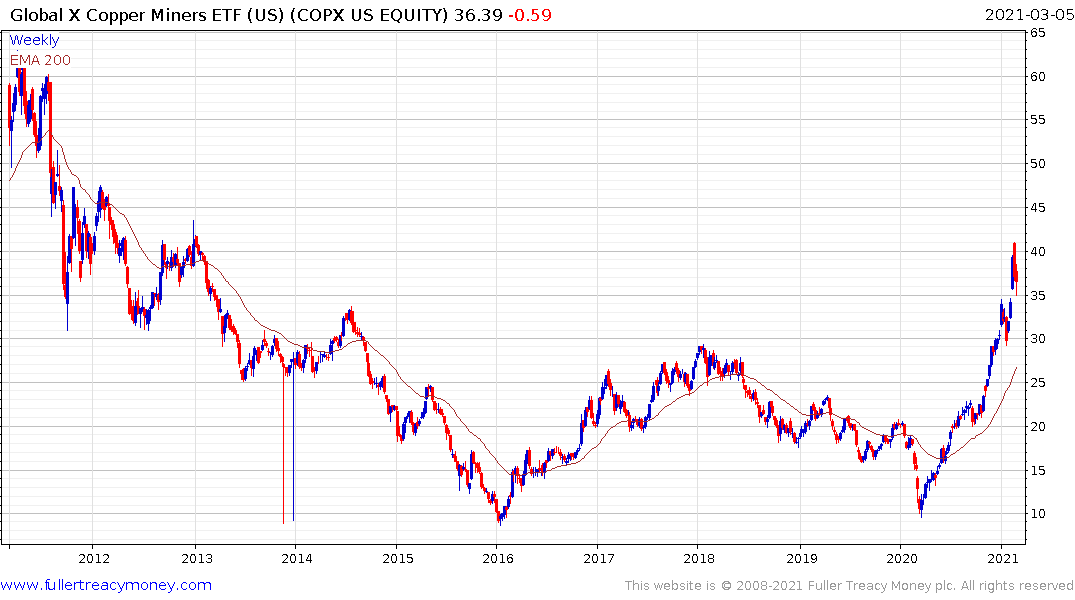

Copper demand is on a secular bull market trajectory because of the anticipated evolution of demand for electric vehicles, batteries, wind turbines, electric motors and charging stations. All of these sectors are growing quickly but from low bases so there is ample scope for copper demand to multiply over the coming decade. Between now and then there will still be great need for oil because all of that infrastructure is still waiting to be built.

The Global X Copper Miners ETF is currently consolidating but a sustained move below the trend mean would be required to begin to question recovery potential.

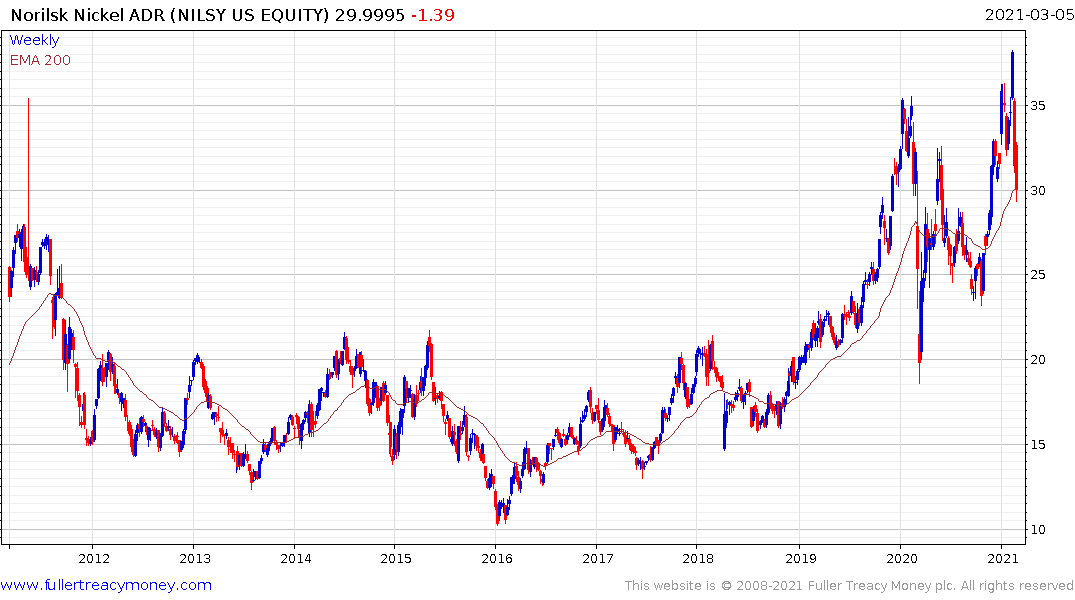

In the nickel sector, Norilsk Nickel is back in the region of the trend mean which may offer an area of support.

Lithium producers like Orocobre and Livent are back testing the upper side of their respective base formations.

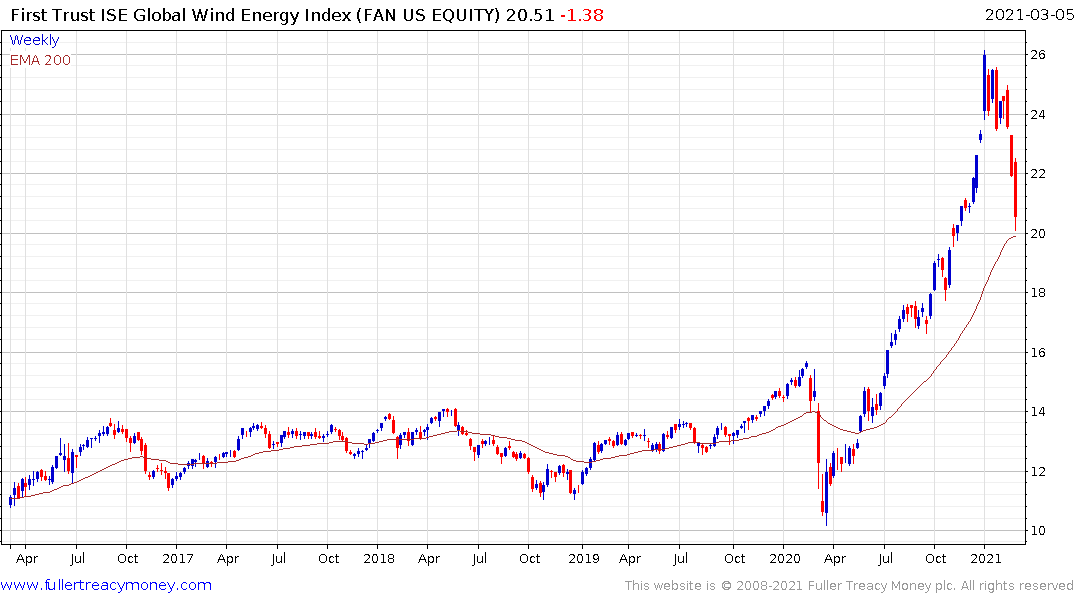

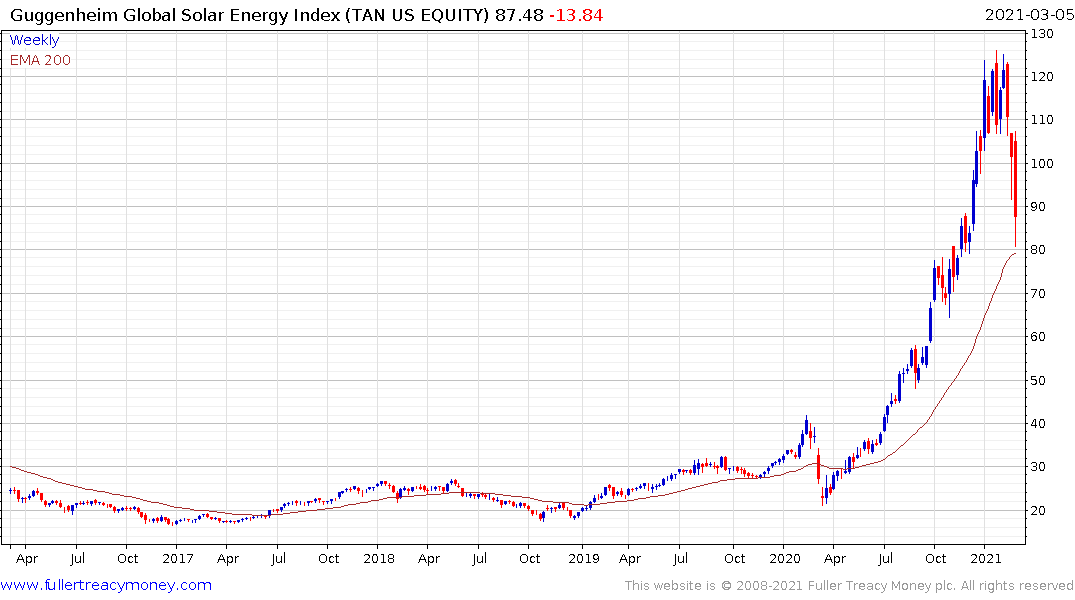

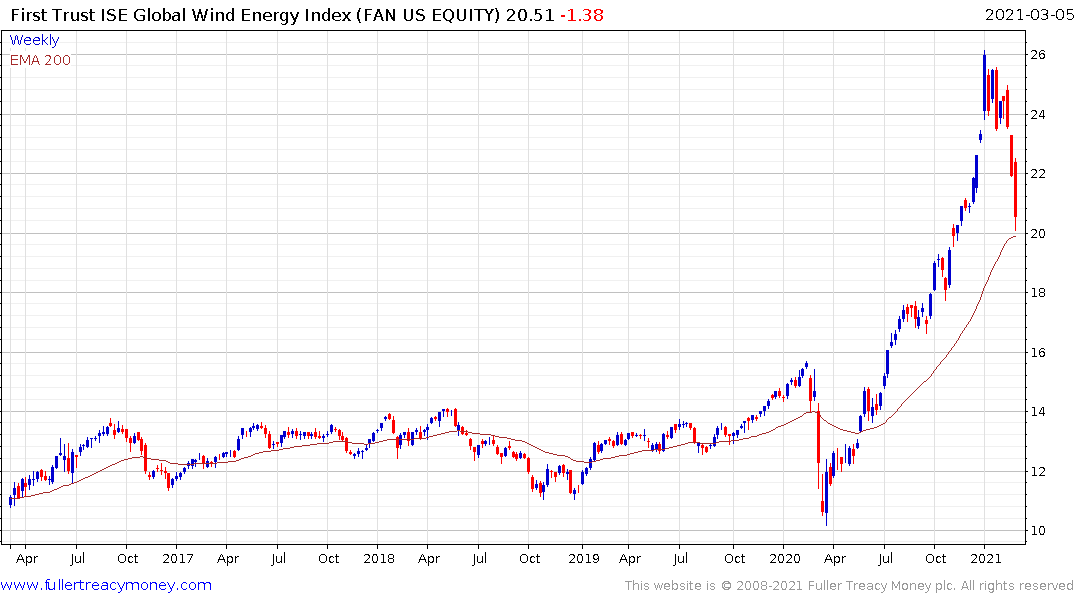

The Solar and Wind sectors are both interest rate sensitive but they also enjoy public policy support and a runway for further growth. That suggests significant drawdowns, like we have just seen, provide entry opportunities.

The drive to deliver vaccines created the opportunity for a mass market proof of concept for the genetic sector. To date, the speed of solution deliver is unparalleled. That opens up whole new areas for exploration. Genetic solutions have been gaining traction since the human genome was first sequenced less than twenty years ago. The pandemic has accelerated the path to commercial reality.

.png)

The iShares Biotechnology ETF steadied today from the region of the trend mean.

The next big innovation in the sector is in liquid biopsies and synthetic biology. Illumina’s purchase of Grail puts it in the pole position for liquid biopsies.

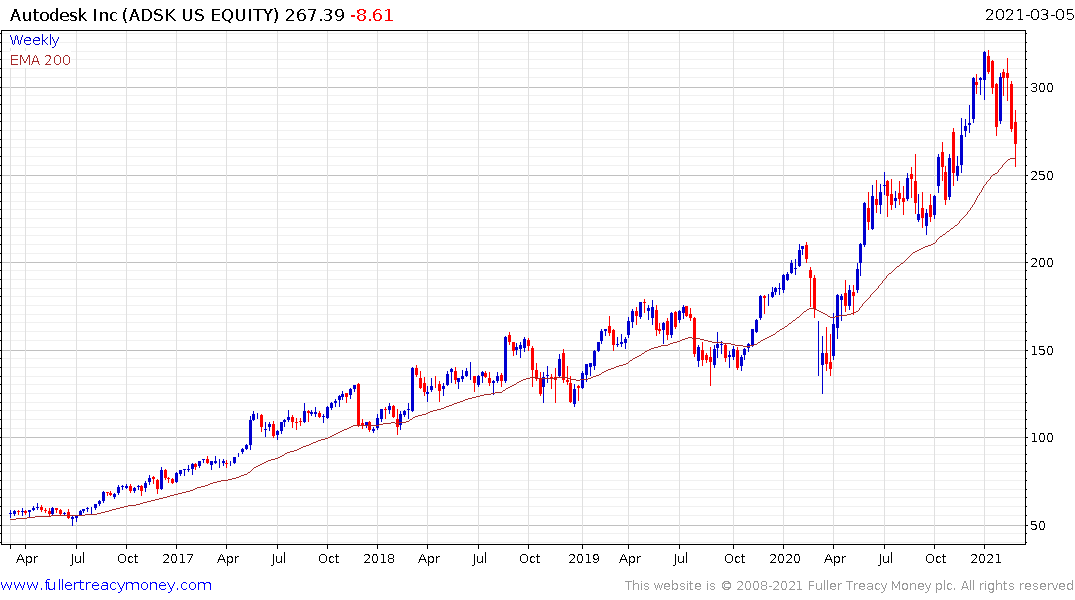

Interestingly synthetic biology, where custom genetic strings are programmed like computers, is being pioneered by companies like Autodesk.

This also highlights that there are plenty of technological and innovation plays that are not completely dependent on the bigger fool theory.

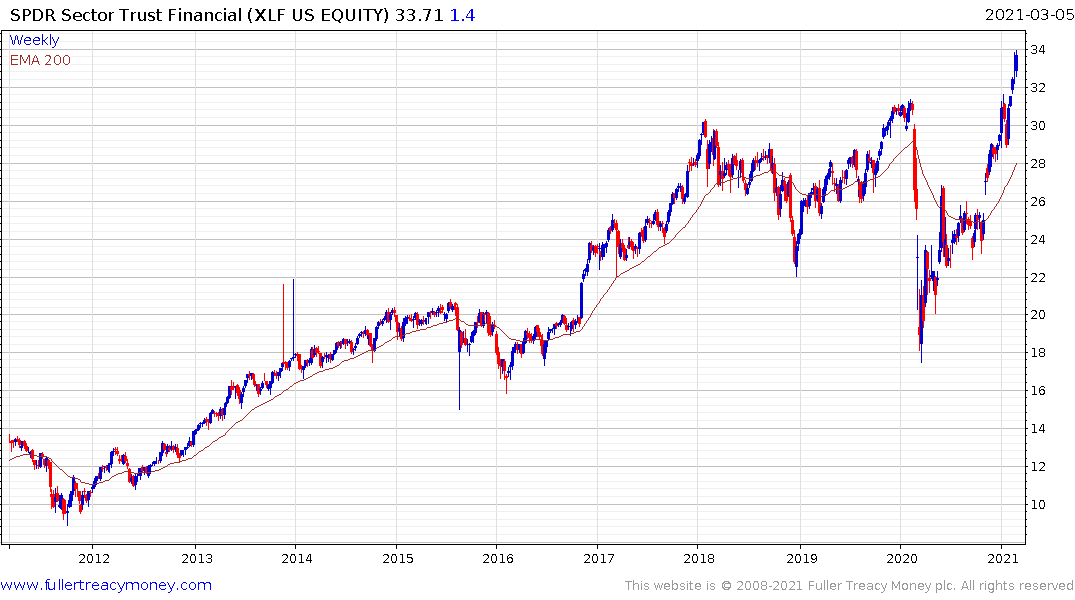

The value segment of the market is dominated by energy, banks and pharmaceuticals. They tend to do better when inflationary fears mount. That’s particularly true of banks because their business model is leveraged to a steepening yield curve.

The Financial sector SPDR fund has broken out of a 3-year range and continues to improve on its performance.

Meanwhile at the more speculative edge of the financial system the Ark Fintech Innovation ETF has become to steady in the region of the trend mean.

Bitcoin remains in a reasonably consistent uptrend with a series of ranges one above another. A sustained move below $40,000 will be required to question the consistency of the move.

The Amundi Europe 600 Banks ETF is rebounding from the lower side of a decade-long range.

Small caps are also a strong play on the global reflation trend.

The MSCI Emerging Markets ETF is also susceptible to further mean reversion.

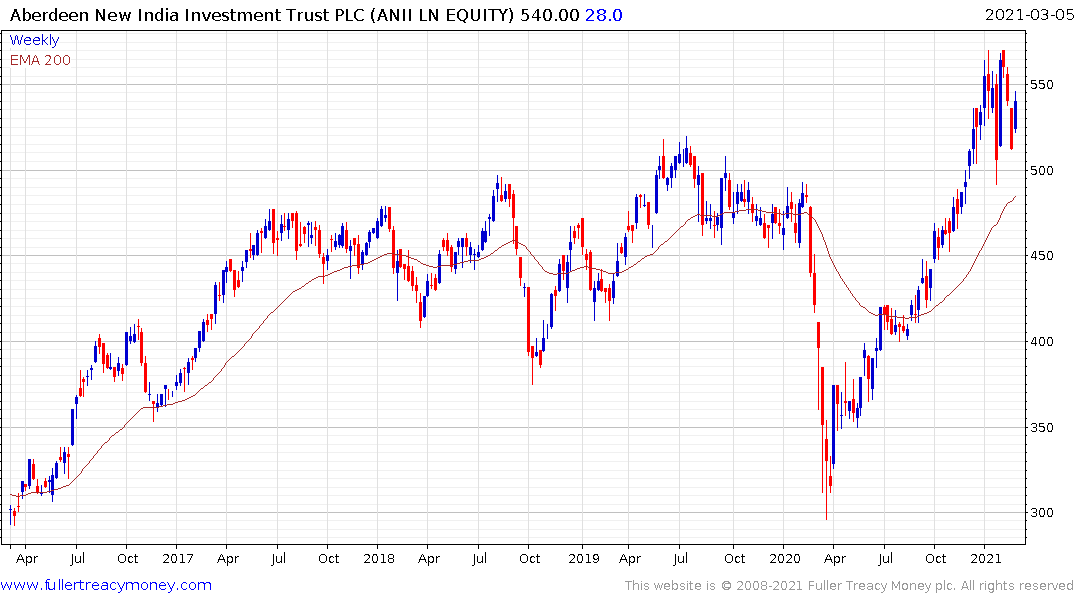

The Aberdeen New India Investment Trust continues to consolidate above the four-year range.

Japan has been through a debt deflation for decades and it is likely to be the biggest beneficiary of a return to a global inflationary bias. The Nikkei-225 Average has paused in the region of the psychological 30,000 and may experience some additional risk of mean reversion.

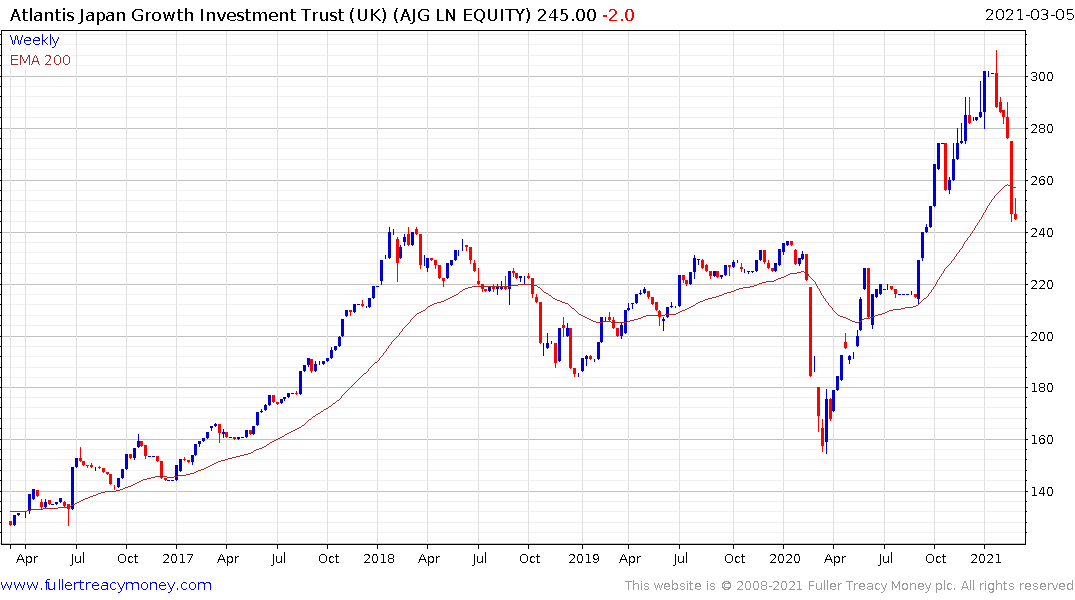

The Atlantis Japan Growth Fund pulled back extremely violently over the last week and is now testing the region of the trend. It will need to find support soon if the uptrend is to be given the benefit of the doubt.

The other big speculative asset which has endured a significant retracement this month is cannabis. The Alternative Harvest ETF is now back testing the $20 area beginning to demonstrate support.

The rebound in bond yields is hastening a rotation out of the most speculative areas of the market and into reflation trades. That is benefitting real world plays like commodities and banks. It is also beneficial to the travel and leisure sector as well as for retailers. The short-term oversold condition in bonds suggests we are liable to see at least some steadying and that may already be starting.

I remain very much of the view that we are about to see a swift return to normal. People will surge back into social activities as lockdowns end. That will create demand for everything and stir fears of inflation and higher bond yields. There are already clear winners and losers from this trend.

In a bull market buying the dips always works. That is true of any asset class. Any time bonds stop falling equity investors wade in to buy stocks. We have seen a sufficiently large pullback to encourage dip buying in a range of assets. The test of whether the trend in bond yield expansion has ended will be in how far a rebound goes before it encounters resistance. We’re likely to have at least a partial answer to that question by this time next month.

Back to top