Rio Tinto joins race for stake in world's largest lithium miner

Rio Tinto joins race for stake in world’s largest lithium miner – This article by Cecilia Jamasmie for Mining.com may be of interest to subscribers. Here is a section:

El Mostrador suggested Tinto Rio had already made a bid, potentially trumping Chinese companies Sinochem, Tianqi and GSR Capital, all of which had also expressed interest in SQM.

The news came on the heels of PotashCorp and Agrium announcing Tuesday that China’s ministry of commerce had approved the merger, but required the sale of PotashCorp’s minority holdings in Arab Potash Company and SQM within 18 months of closing, and Israel Chemicals Ltd. within nine months.

SQM, which has a market value at just over $15 billion, produced roughly 44 million tonnes of lithium carbonate last year and is developing new projects in Chile and Australia.

Rio's current incursion in the lithium market is mostly limited to its 100%-owned lithium and borates mineral project in Jadar, Serbia, which is still in the early stages of development.

Rio Tinto generates 68% of its revenue from iron-ore and aluminium. Diamonds and minerals, copper and energy make up the balance of its operations in that order. Despite enthusiasm about lithium SQM generate about 26.5% of its revenue from the metal, with plant nutrition (32.2%) and potassium (20.8%) also representing major businesses for the company.

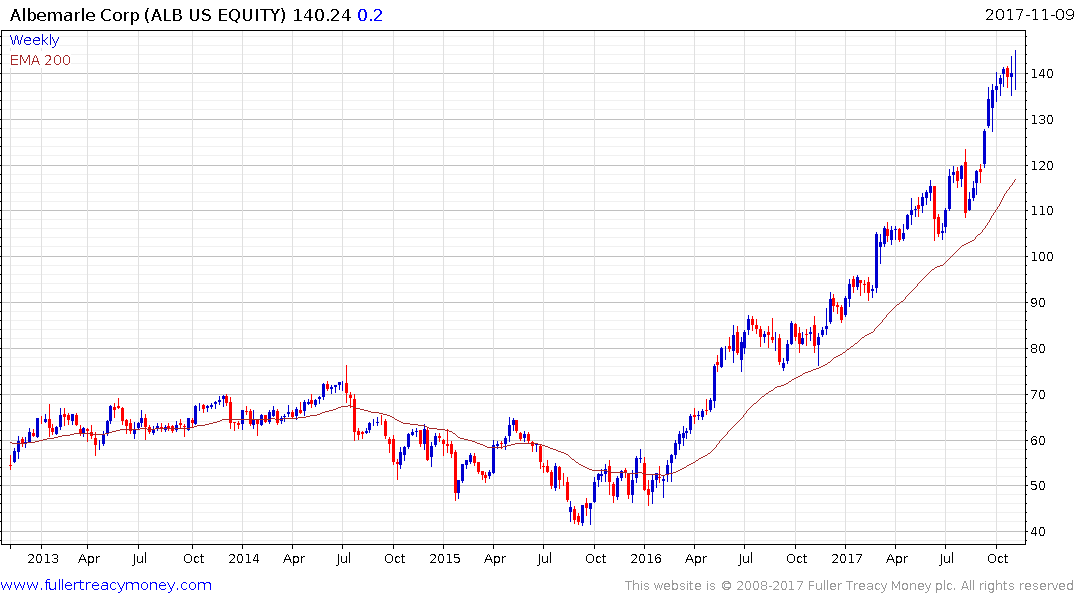

The dearth of pureplays on the supply inelasticity meets rising demand bull market for lithium has lend to any company with significant lithium capacity rallying; regardless of how significant the business is to the company’s overall cashflow. Albemarle for example is the world’s largest producer but lithium accounts for only 26.8% of revenue.

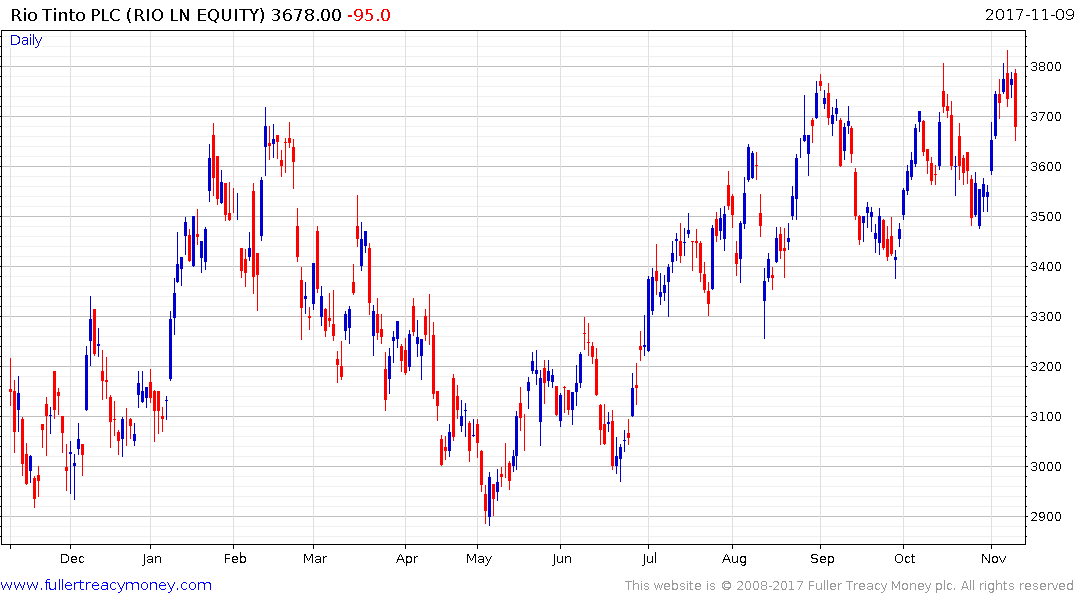

If Rio Tinto succeeds in acquiring Potash Corp’s position in SQM it will add negligible revenue to the company relative its other operations, but it would likely burnish the company’s credentials in the evolving battery materials sector. The share has been ranging with an upward bias for the six months and is now testing its six-year highs. A sustained move back below the trend mean would be required to question medium-term scope for continued higher to lateral ranging.

Australia listed Orocobre is developing a lithium brine operation in Argentina and expects that business to represent the majority of its revenues over the coming years as its focus on borax declines. The share completed a 17-month range last week with clear move above A$5 and a sustained move below that level would be required to question potential for additional upside.