Ride of the 'Volkyries'

Thanks to a subscriber for this report by Zoltan Pozsar for Credit Suisse. Here is a section:

As I see it, the risk of recession, whether it is real or merely implied by an inversion of the yield curve, won’t deter the Fed from hiking rates higher faster or from injecting more volatility to build up negative wealth effects, and signs of a recession might not mean immediate rate cuts to ramp demand back up …

…cuts may have to wait until the Fed is certain that inflation is surely dead.

Back to the level of the stock market under the Fed call.

According to President Daly’s comments, the recent stock market correction and the rise in mortgage rates is “great”, but not enough (“want to see more”). Chair Powell also noted in his press conference that he wants to see further tightening in financial conditions still. At face value, that implies that the Fed won’t stop shaping expectations until we see more damage to stocks and bonds.

Rallies could beget more forceful pushback from the Fed – the new game…

Here is a link to the full report.

This is a welcome elucidation of the “chicken and egg” argument I have been talking about the audio/video commentary.

If the stock market and other financial assets sell off, the Fed will believe their policies are working which reduces the need for further tightening. However, if investors believe tightening is less likely they will buy the dip which will convince the Fed their policies are not sufficiently tight.

This is a clear circular argument and will not be broken until there is clear visibility on the trajectory of inflation data. The “inflation is close to peaking” argument has been reasonably convincing for the last year, but new difficulties arise to push the peak further into the future.

.png)

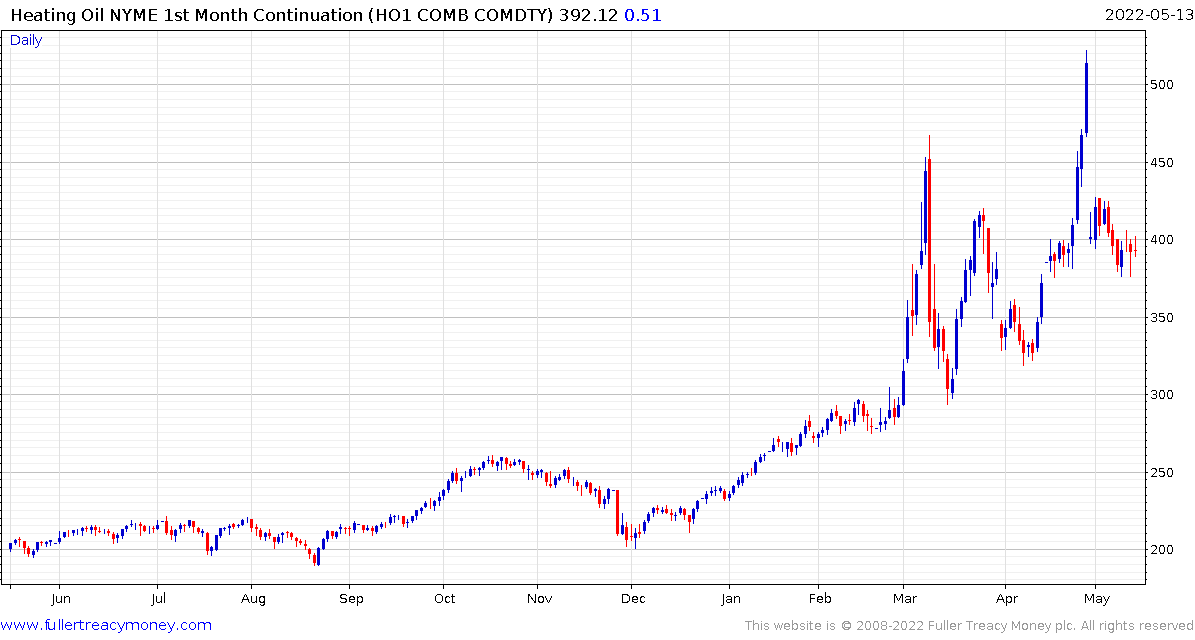

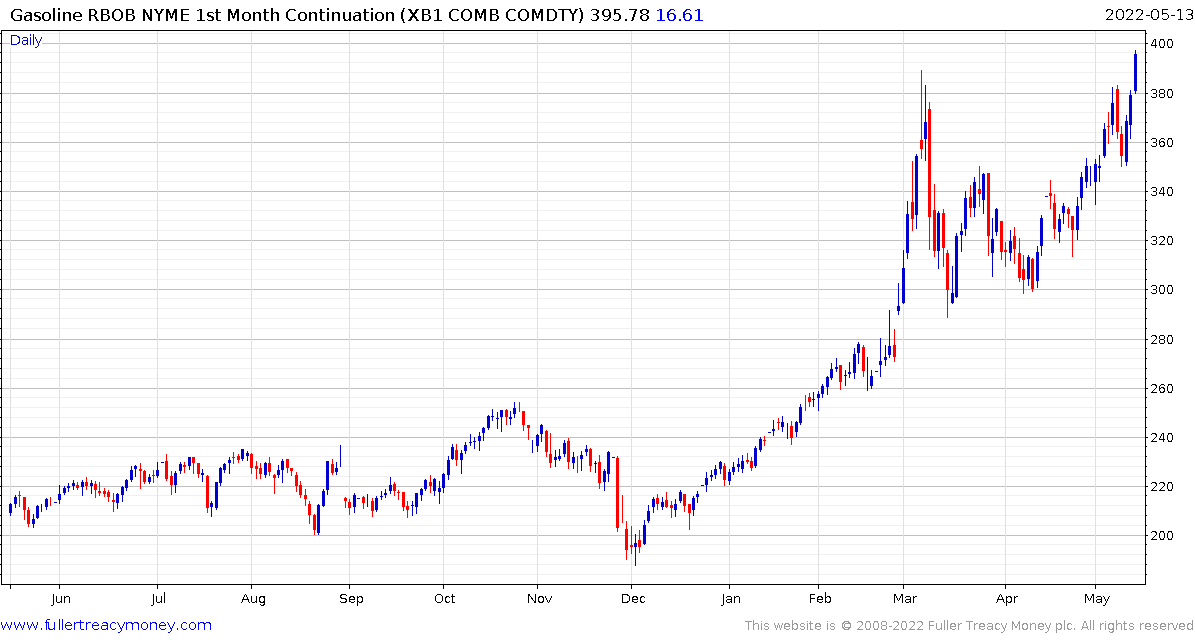

At present oil, natural gas, heating oil and gasoline are all strong. As if the war in Ukraine were not enough, it is likely that the disruptions predicted from the introduction of the IMO2020 shipping emission rules are now relevant. They were delayed by the pandemic but not eliminated.

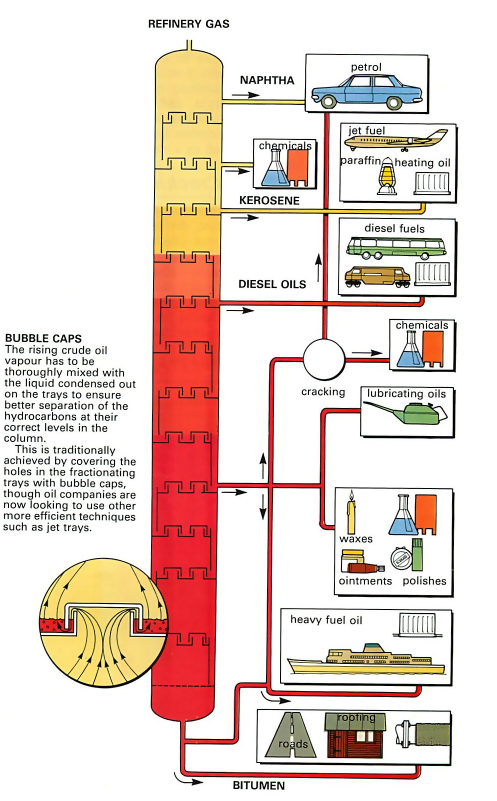

Moving over three million barrels of fuel demand from the bottom to the same level as diesel in the above column is problematic. The refining sector suddenly has much more demand for middle distillates and will need to build more plants to cater to it.

Valero is somewhat overextended in the short term but still trending higher.

Marathon Petroleum has a similar pattern.

Phillips 66 broke out to a new recovery high today.