China's #1 oil company says peak gasoline demand has already passed

This article from NewAtlas may be of interest. Here is a section:

So China's largest oil company Sinopec is already seeing a drop in demand, from which it doesn't expect to recover. Previous predictions placed peak demand somewhere in 2025, but at a conference in Zhengzhou in August, Bloomberg reported that one Zhou Yan, from Sinopec’s retail sales division, said EVs were already displacing some 15 million tons of Chinese oil product sales in 2023, and that the company is forecasting that 2024 and subsequent years will see declining demand.

According to the International Energy Agency, Chinese demand accounted for more than 70% of global oil market growth in 2023, so while global oil product sales are at record highs of around 102.2 million barrels per day in 2023 (up around 2.2 million barrels per day over figures from 2022), and gasoline for passenger cars is only a percentage of total oil product demand, it'll be interesting to see how China's rapid EV uptake affects predictions for global peak oil demand.

The IEA released its forecast in June, estimating that peak global oil use for transport will arrive around 2026, but strong demand from the petrochemical and aviation sectors would continue to support overall market growth, albeit at slower rates, at least as far out as 2028.

Saudi Arabia and Russia remain eager to extend their supply cuts for good reason. They both need high prices to supplement their budgets. They also face the uncertain prospect of demand growth tapering to a standstill in some of their largest export markets, sooner than expected.

That also helps to explain why Saudi Arabia is exploring the sale of an additional $50 billion stake in Saudi Aramco. They would sell at a high price when demand is still strong rather than wait and risk battery technology makes a major leap forward at some point in the next decade.

Brent crude oil testing the $90 area today. A clear downward dynamic will be required to question recovery potential.

Brent crude oil testing the $90 area today. A clear downward dynamic will be required to question recovery potential.

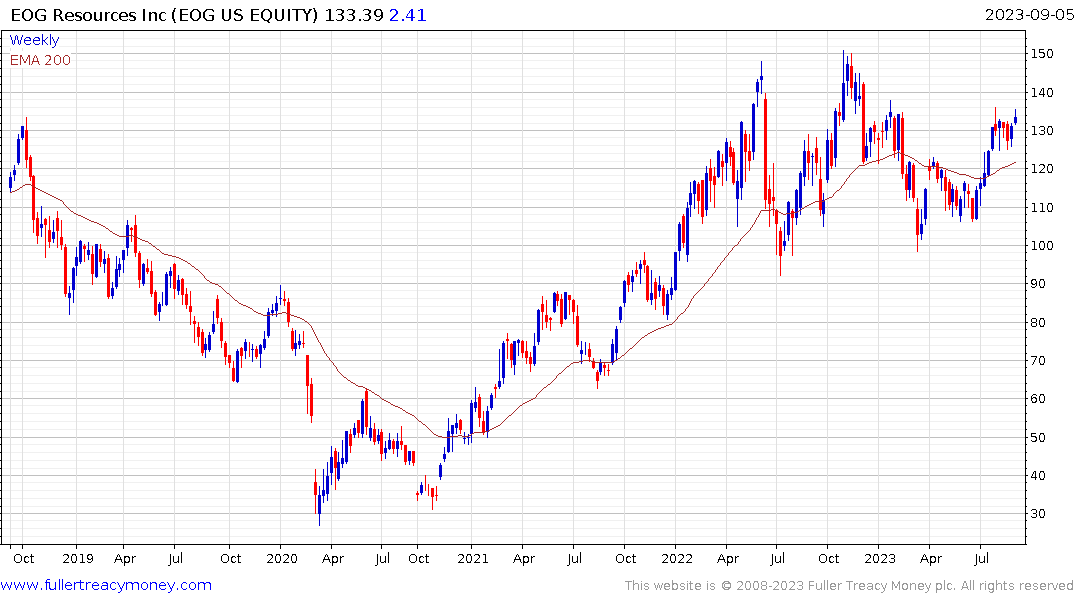

There was a mixed performance among related shares. EOG Resources popped on the upside while Exxon Mobil failed to hold the intraday rally. The main challenge for oil shares is high prices erode demand and high profits invite windfall taxes.