The Great Progression 2025-2050

This lengthy article by Peter Leyden for Wired’s bigthink.com may be of interest to subscribers. Here is a section:

We’re living through an extraordinary time in American history, and really in all human history. Once you take that big-picture historical perspective, once you look at the whole forest rather than the individual trees, the real story of our times starts to make more sense. We happen to have arrived at a juncture between two very different historical eras and that makes everything on the ground very confusing, and very traumatic.

One way to understand this is that for the last 40 years America and the world have been operating within a series of interconnected systems that add up to one mega-system. Our energy system was rooted in carbon, and our transportation system was based on the internal combustion engine. Our culture was dominated by the huge Baby Boom generation and our politics tended to be more conservative. Our economics was all about unleashing the private sector and maximizing shareholder capitalism. Work was done in physical places and production was primarily industrial. Our uber-challenge was terrorism, and our geopolitical focus was the Middle East, which made sense because we needed to keep the carbon energy flowing to keep the whole flywheel of this mega-system spinning.

That whole mega-system, and all the subsystems, arguably are now breaking down and often causing more problems than they are solving. This world that older people spent their entire careers and lives mastering is coming to an end. This world that younger people were taught is “just the way things are” increasingly does not make sense. This world that politicians proudly had policies for, and that the media confidently analyzed and explained, is soon going to be over.

Every one of those systems arguably is being superseded by new systems much better suited for the 21st century. Our uber-challenge is now climate change and so our energy system must shift to clean power and our transportation system to electric. Our culture now is dominated by the huge Millennial generation and our politics are becoming more progressive. Our economics is raising the role of the public sector and capitalism being pushed to include all stakeholders. Work is now taking place much more virtually, and production is on the cusp of becoming biological. And our geopolitics is recentering on Asia, and in particular on the new superpower, China.

There are two important cycles investors need to be aware of. First you have the technology cycle. Time marches to a different beat inside universities and labs all over the world. The market may go up and down but smart people, beavering away on their pet idea, will eventually lead to technological innovations that take everyone by surprise.

Then you have the money cycle. It’s easier to get your idea funded and commercialised when interest rates are low and credit is abundant. When interest rates are high and credit is not available, the hurdle new technologies face is higher. Moreover, when energy prices are high, they inhibit consumer demand which raises the hurdle rate even higher.

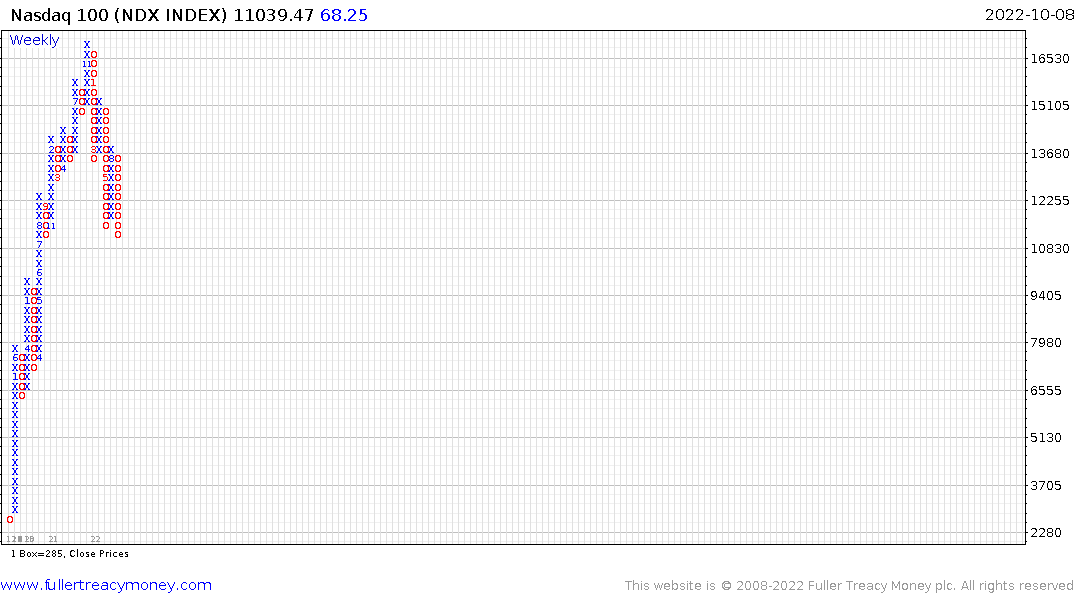

The stock market is a discounting mechanism. As a bull market progresses investors are willing to price in cashflows from further and further into the future. By the time the future of technological utopia is clearly visible out to 2050, it is reasonable to conclude it is fully priced in. For example, this article highlights the fact vehicle autonomy is likely to be a 10-year project not a 2023 delivery.

![]()

Major bull markets make big promises and ultimately deliver on them. The promise of artificial intelligence, autonomy, renewable energy and synthetic biology are well understood and are likely to be delivered upon. Prices will go down and up a lot in between.

Secular bear markets plant the seeds for secular bull markets. In the 1990s, the massive infrastructure build for the internet, and subsequent crash, laid the foundation for companies to make use of cheap chips and a growing network to build global businesses.

The shale revolution kept natural gas prices low for a decade. That created new demand. Substitution for coal suddenly became viable and global trading via LNG tankers continues to grow.

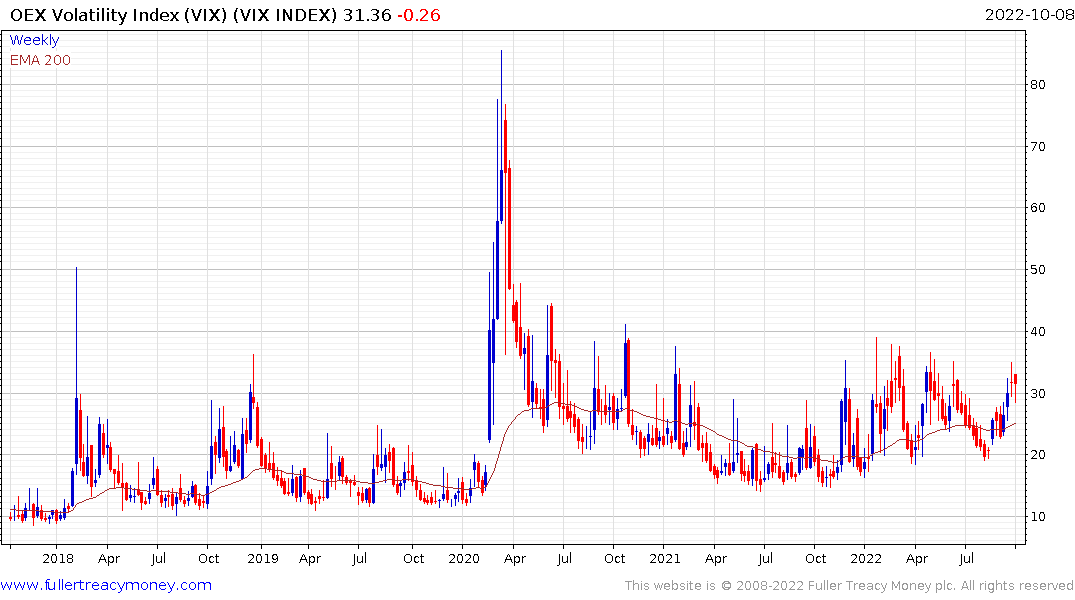

Today the price of both chips and energy is high. At the same time interest rates are rising and money supply growth is negative on a global basis. That’s not a recipe for a happy outcome in markets.

The VIX Index has clear triangular wedge characteristics that typically presage a major breakout. That suggests scope for a downside surprise.

Nevertheless, over the coming two decades, there will be significant buying opportunities in the biotech and technology sectors. Patience in initiating positions will be rewarded.

Back to top