Oil Traders Empty Key Crude Storage Hub as Demand Booms

This article by Rupert Rowling and Javier Blas for Bloomberg may be of interest to subscribers. Here is a section:

Oil traders are emptying one of the world’s largest crude storage facilities, located near the southernmost tip of Africa, as the physical market tightens amid booming demand and OPEC production cuts.

Total SA, Vitol Group and Mercuria Energy Group Ltd. are selling crude they hoarded in Saldanha Bay, South Africa, during the 2015-2016 glut when the market effectively paid traders to store oil, according to people familiar with the matter, who asked not to be named discussing private operations.

Crude demand is now seasonally outstripping supply, tightening the physical market for some crude varieties to levels not seen in the last two years and encouraging traders to sell their stored oil.

“The market is selling inventories from everywhere,” Mercuria Chief Executive Officer Marco Dunand said in an interview in Geneva.

Although largely unknown outside the oil trading industry, Saldanha Bay is one of the world’s largest crude storage facilities, with the capacity to hold 45 million barrels in just six gigantic, partially-buried concrete tanks. By comparison, Cushing, the better-known U.S. oil storage center in Oklahoma that serves as the pricing point for the West Texas Intermediate oil benchmark, can hold about 75 million barrels in more than 125 tanks.

We are in a period of synchronized global economic expansion so that should be generally positive for commodity demand, all other factors being equal. The hurricanes which hit the US and meant that the strategic reserve was tapped means it will need to be refilled while refineries will be running at capacity once they get back on line to make up for lost time.

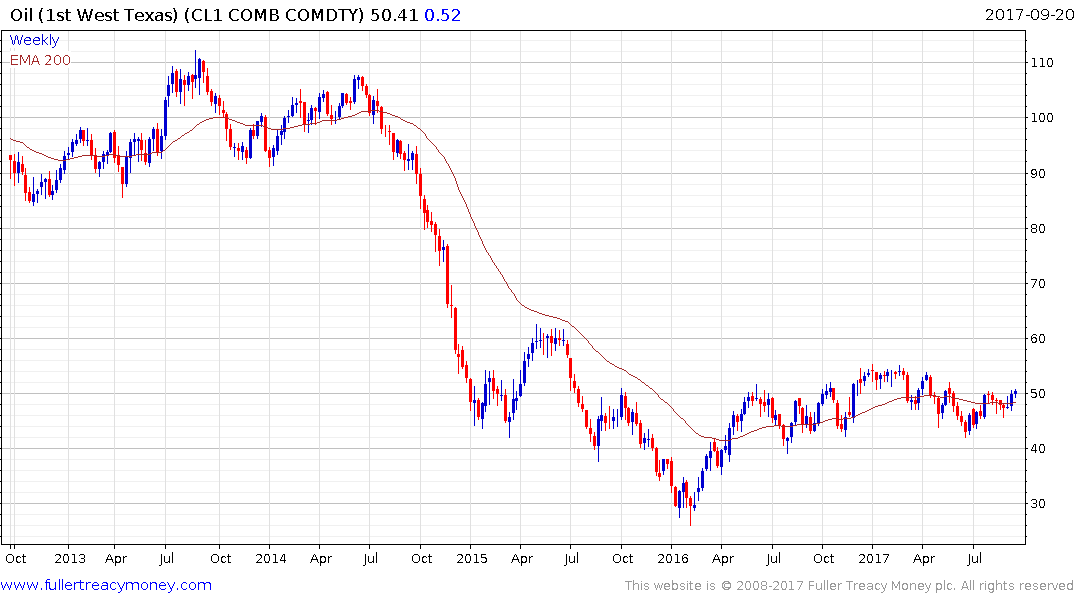

West Texas Intermediate broke above $50 today and held the move to break this year’s progression of lower rally highs.

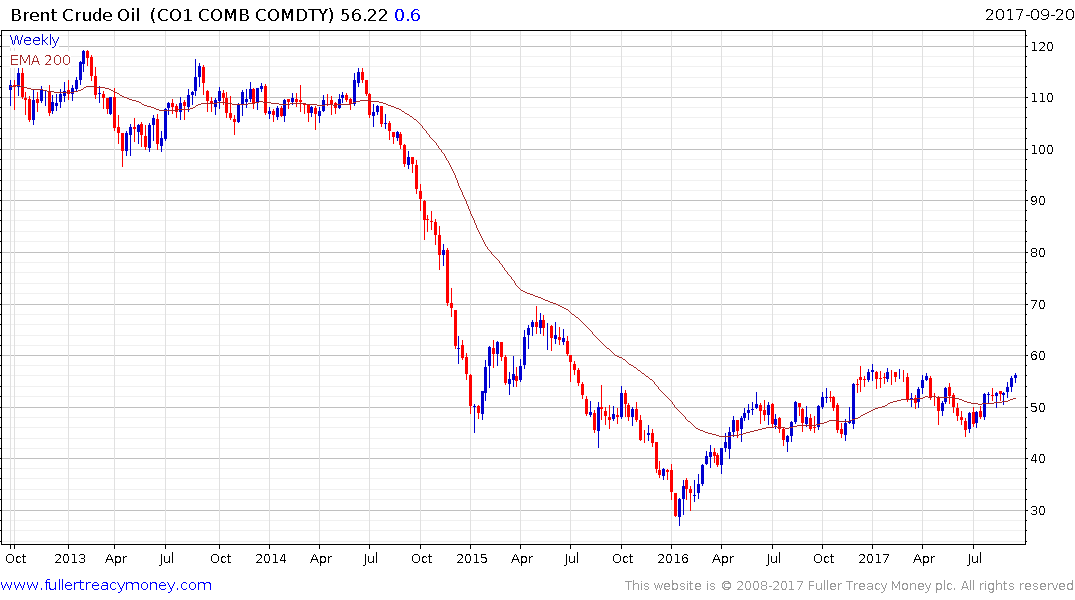

Brent Crude has been leading not least because it was not impacted by the hurricanes. This action suggests the downward bias to trading, so far this year, may be reversing and a rally back up towards the January highs near $60 is increasingly likely.

We know that unconventional supply becomes much more economic in the $60 area so it may be more difficult to sustain a move above that level.

Back to top