OPEC Sees Lowest Demand for Its Crude Since 2009 Amid U.S. Boom

This article by Grant Smith for Bloomberg may be of interest to subscribers. Here is a section:

OPEC predicted that demand for its crude will decline in 2015 to the lowest in six years as supplies from other producers, led by the U.S., are more than enough to cover the increase in global consumption.

The need for crude from the Organization of Petroleum Exporting Countries will slide to 29.4 million barrels a day next year even as growth in world oil consumption accelerates, the group said in its first assessment of 2015. That’s 300,000 a day less than OPEC’s 12 members pumped in June. It would be the third consecutive annual drop in demand for OPEC crude and the lowest since 2009. The U.S. will provide about two-thirds of next year’s supply growth, OPEC said, amid a shale-oil surge that has made the U.S. the world’s biggest producer.

“Even if next year’s world economic growth turns out to be better than expected and crude oil demand outperforms expectations, OPEC will have sufficient supply to provide to the market,” the group’s Vienna-based secretariat said in the report.

The U.S. has overtaken Saudi Arabia and Russia as the world’s biggest oil producer as it taps shale formations in Texas and North Dakota by splitting apart rocks with high- pressure liquid, a process known as known as hydraulic fracturing, or fracking. Oil prices have remained supported by threats to supplies in OPEC members such as Iraq and Libya, with the Brent benchmark’s loss this year limited to 2.3 percent.

We have referred to the evolution of unconventional oil and gas as a game changer for the energy sector since at least 2008 and the fact that OPEC’s dominance of the energy sector is decreasing is testament to that transformation.

There are two ways to look at this development. On the one hand, new US and Russian production might be at a higher marginal cost than that of many OPEC members but at today’s prices it is helping to contain the risk of price spikes since there is ample supply.

Another way of looking at this evolution is that less demand for OPEC supply is resulting in lower revenues for the group’s government’s; many of whom have large young, unemployed, under-educated populations. This may at least partially help to explain why unrest in the Middle East has increased now rather than at any other time. I wonder could the USA have been so quick to remove its troops from Afghanistan and Iraq without the shale oil and gas boom at home?

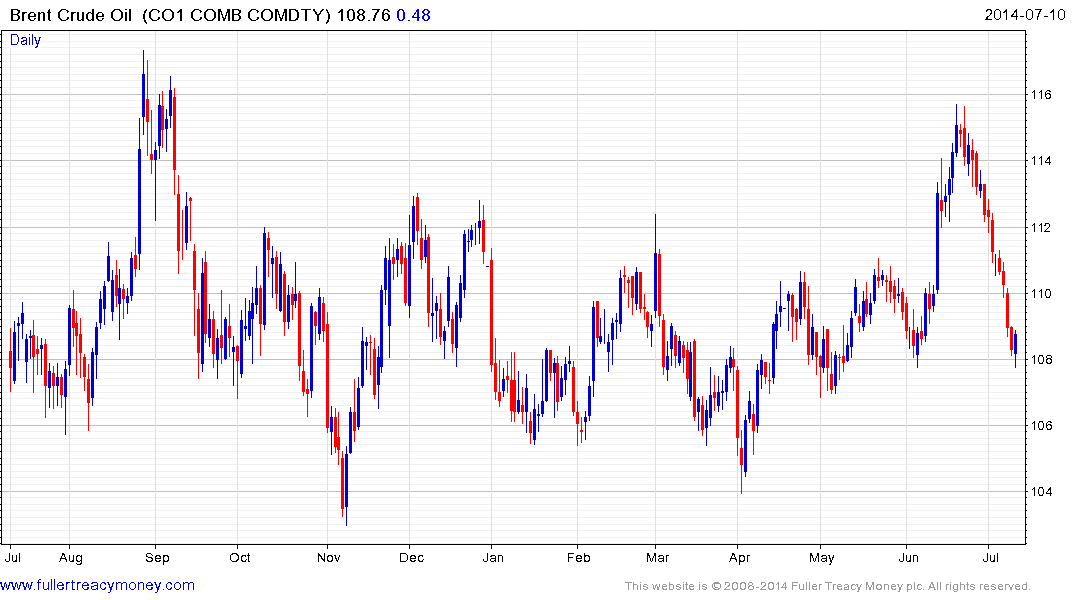

Brent Crude failed to hold the break above $110 and pulled back sharply over the last three weeks to retest the $108 area. It paused today but a clear upward dynamic will be required to pressure the shorts and suggest demand has returned beyond some short-term steadying.

Generally speaking the oil price has been relatively inert over the last three years. A great deal of additional unconventional supply is economic above $100. Therefore a significant geopolitical threat to supply and refining infrastructure would be required to sustain a rally above $120.

Back to top